Washington Dc State Tax

State taxes play a significant role in shaping the economic landscape of any region, and Washington, D.C., is no exception. With its unique status as a federal district, Washington, D.C., has a distinct tax system that impacts its residents and businesses. Understanding the intricacies of Washington, D.C.'s state tax structure is crucial for both individuals and entities operating within this dynamic metropolis.

The Washington, D.C. Tax Landscape

Washington, D.C., boasts a comprehensive tax system designed to support its vibrant economy and diverse population. Unlike traditional states, D.C. operates with a singular tax authority, the District of Columbia Office of Tax and Revenue (OTR), which oversees a range of tax types, ensuring a cohesive and streamlined tax collection process.

The OTR's jurisdiction extends across various tax categories, including income tax, property tax, sales and use tax, excise tax, and business taxes. This unified approach simplifies tax compliance for residents and businesses, making it easier to understand and fulfill their tax obligations.

Income Tax: A Dynamic Component

One of the cornerstone taxes in Washington, D.C., is the individual income tax. The OTR imposes a progressive tax rate structure, meaning that higher incomes are subject to higher tax rates. This system aims to promote fairness and balance within the tax landscape.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 2.75% |

| $10,001 - $40,000 | 4% |

| $40,001 - $60,000 | 6% |

| $60,001 and above | 8.5% |

Additionally, Washington, D.C., offers a tax credit for low-income earners, providing relief for individuals with limited means. This credit, known as the Earned Income Tax Credit (EITC), aims to reduce the tax burden on those with lower incomes, fostering economic equity within the district.

Property Tax: A Key Revenue Source

The property tax in Washington, D.C., is a significant revenue generator for the district. This tax is imposed on both real estate and personal property, with rates varying based on property type and location. The OTR assesses properties annually, ensuring an up-to-date valuation for tax purposes.

For residential properties, the tax rate typically hovers around 0.85% of the assessed value. Commercial properties, on the other hand, may face slightly higher rates, depending on their specific use and location within the district.

| Property Type | Tax Rate |

|---|---|

| Residential | 0.85% |

| Commercial (Office Space) | 1.15% |

| Commercial (Retail) | 1.45% |

Washington, D.C., also offers property tax relief programs for eligible homeowners, providing a means to ease the tax burden on certain residents. These programs aim to support those who may face financial challenges, ensuring they can continue to own and reside in their properties.

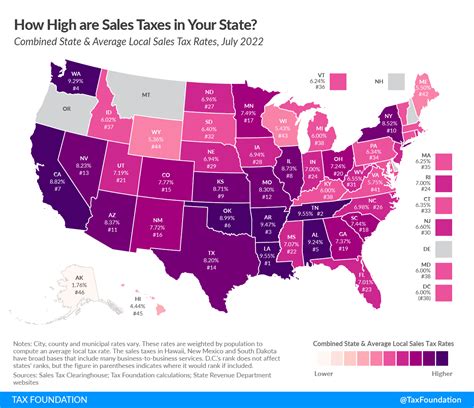

Sales and Use Tax: Impacting Daily Life

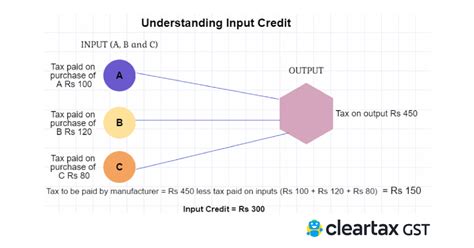

The sales and use tax in Washington, D.C., is a vital component of the district's revenue stream. This tax is applied to most goods and services sold within the district, with a standard rate of 6%. Certain items, such as groceries and prescription drugs, are exempt from this tax, providing essential relief for daily necessities.

For businesses, the use tax comes into play, ensuring that products purchased for business use but not subject to sales tax are still taxed. This measure prevents tax evasion and maintains a level playing field for all businesses operating in the district.

Additionally, Washington, D.C., offers a tax incentive program for businesses that invest in the district's economic development. This program, known as the Business Improvement District Tax Incentive Program, provides tax breaks for businesses that contribute to community improvement projects, fostering a more prosperous and vibrant cityscape.

Tax Compliance and Support

Washington, D.C., recognizes the importance of tax compliance and has implemented various measures to assist residents and businesses. The OTR provides a range of resources, including online filing options, tax guides, and assistance programs, ensuring that taxpayers have the tools they need to navigate the tax landscape with ease.

For those facing financial difficulties, the OTR offers payment plans and tax relief options, providing flexibility and support during challenging times. This approach ensures that taxpayers can maintain compliance even when facing temporary financial hurdles.

Staying Informed: Tax Resources

To stay updated on the latest tax information, Washington, D.C., residents and businesses can utilize the following resources:

- OTR Website: The official website of the District of Columbia Office of Tax and Revenue provides comprehensive information on all tax types, rates, and deadlines.

- Tax Newsletters: The OTR publishes regular newsletters with updates on tax changes, new initiatives, and important deadlines. Subscribing to these newsletters ensures you stay informed.

- Community Workshops: The OTR hosts community workshops and events to educate residents on tax matters. These events provide an opportunity to ask questions and gain personalized guidance.

By leveraging these resources, taxpayers can ensure they remain compliant and take advantage of any available tax benefits or incentives.

Conclusion: A Robust Tax System

Washington, D.C.'s state tax system is a well-structured and comprehensive framework designed to support the district's economy and residents. With a range of tax types and progressive rates, the OTR ensures a fair and balanced approach to taxation. The district's tax system, while unique due to its federal status, provides a model of efficiency and support for its vibrant community.

For those navigating the tax landscape in Washington, D.C., understanding the nuances of each tax type and staying informed is crucial. By leveraging the resources and support offered by the OTR, taxpayers can ensure compliance and take advantage of any available benefits, contributing to the continued growth and prosperity of the district.

What is the current income tax rate for residents of Washington, D.C.?

+The current income tax rate for residents of Washington, D.C., is progressive, ranging from 2.75% to 8.5% based on income brackets. This progressive structure ensures that higher incomes contribute a larger share.

Are there any tax incentives for businesses in Washington, D.C.?

+Yes, Washington, D.C., offers the Business Improvement District Tax Incentive Program, providing tax breaks for businesses that invest in community improvement projects.

How often are property assessments conducted in the district?

+Property assessments in Washington, D.C., are conducted annually, ensuring an up-to-date valuation for tax purposes.