Input Tax Credit

In the intricate landscape of financial planning and tax strategies, the concept of Input Tax Credit (ITC) stands out as a crucial mechanism, particularly in the context of value-added taxes (VAT) or goods and services tax (GST). This mechanism, designed to prevent the cascading effect of taxes, offers businesses an opportunity to optimize their tax liabilities, enhance cash flow, and improve overall financial management. As we delve into the intricacies of Input Tax Credit, we uncover its significance, operational mechanisms, and the strategies businesses employ to maximize its benefits.

Understanding Input Tax Credit: A Strategic Financial Tool

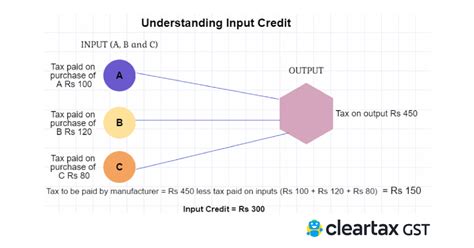

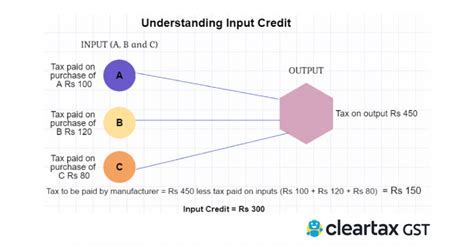

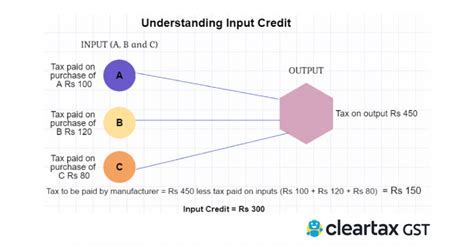

Input Tax Credit, a fundamental component of VAT and GST systems, is a credit given to businesses for the tax they’ve paid on their purchases. It is a strategic financial tool that empowers businesses to claim a credit for the taxes paid on inputs, thereby reducing their overall tax burden. This credit mechanism ensures that the tax burden is shifted to the final consumer, eliminating the cascading effect of taxes at each stage of production and distribution.

For instance, consider a manufacturing company that purchases raw materials from a supplier. The supplier charges the manufacturer a certain amount of tax on the sale. With the Input Tax Credit system, the manufacturer can claim this tax as a credit, reducing the tax liability on its own sales. This credit mechanism not only simplifies tax management but also promotes a more efficient and transparent tax system.

Eligibility and Application of Input Tax Credit

The eligibility for Input Tax Credit is typically defined by the tax laws of a particular jurisdiction. Generally, businesses registered under the VAT or GST system are entitled to claim ITC. The credit is applicable to a range of inputs, including raw materials, capital goods, and services, provided they are used for business purposes. The application process often involves maintaining detailed records of purchases, invoices, and tax payments to substantiate the claim.

| Input Type | ITC Eligibility |

|---|---|

| Raw Materials | Eligible for full credit |

| Capital Goods | Eligible with certain restrictions |

| Services | Eligible for specific services related to business operations |

Maximizing Benefits: Strategies and Considerations

To optimize the benefits of Input Tax Credit, businesses often employ strategic approaches. This includes careful planning of purchases to align with tax periods, ensuring timely payment of taxes to maintain eligibility, and leveraging technology for efficient record-keeping and tax management. Additionally, businesses may consider the optimal use of capital goods and services to maximize the ITC claim while ensuring operational efficiency.

For example, a retail business might strategize its purchases to coincide with quarterly tax periods, ensuring it can claim ITC for a larger volume of goods during these periods. Another strategy could involve negotiating with suppliers to include tax-inclusive pricing, simplifying the tax management process and ensuring a more accurate claim.

Real-World Impact and Case Studies

The impact of Input Tax Credit is significant, especially for businesses operating in industries with high input costs. For instance, consider a construction company that purchases a large volume of materials and services. With a well-managed Input Tax Credit strategy, the company can significantly reduce its tax liability, improving its cash flow and financial health. This, in turn, can lead to more efficient operations, better pricing strategies, and improved competitiveness in the market.

Case Study: Manufacturing Sector

A prominent manufacturing company, ABC Inc., implemented a comprehensive Input Tax Credit strategy, which resulted in substantial savings. By carefully tracking and managing their inputs, they were able to claim a significant ITC, reducing their tax burden by 15% annually. This not only improved their financial position but also allowed them to invest in new technologies and expand their operations.

Case Study: Service Industry

In the service industry, Input Tax Credit can be a game-changer. XYZ Consulting, a leading consulting firm, leveraged ITC to its advantage. By claiming credits for various services, including legal and accounting fees, they reduced their tax liability, freeing up funds for business expansion and employee development initiatives.

Future Outlook and Implications

As tax systems evolve, the role of Input Tax Credit is likely to become even more crucial. With the ongoing digital transformation, tax authorities are moving towards more efficient and transparent tax collection mechanisms. This shift is expected to further simplify the ITC claim process, making it more accessible and beneficial for businesses.

Furthermore, the integration of Input Tax Credit with emerging technologies like blockchain and AI could revolutionize tax management. These technologies can enhance data security, automate record-keeping, and improve the accuracy of ITC claims, leading to a more efficient and fair tax system.

Conclusion

Input Tax Credit is not merely a financial strategy but a powerful tool that shapes the financial landscape for businesses. Its impact on tax liabilities, cash flow, and overall financial health cannot be overstated. By understanding and effectively utilizing Input Tax Credit, businesses can navigate the complex tax environment with confidence, optimizing their financial performance and gaining a competitive edge.

Frequently Asked Questions

Can Input Tax Credit be claimed for all types of inputs?

+

While Input Tax Credit is applicable to a wide range of inputs, certain restrictions may apply to specific items, particularly capital goods. It’s essential to consult the relevant tax laws and regulations to understand the eligibility criteria.

How often can a business claim Input Tax Credit?

+

The frequency of Input Tax Credit claims depends on the tax period and jurisdiction. Typically, businesses can claim ITC on a monthly, quarterly, or annual basis, depending on their registration status and the tax system in their region.

What are the key benefits of Input Tax Credit for businesses?

+

Input Tax Credit offers several benefits, including reduced tax liability, improved cash flow, and enhanced financial flexibility. It also simplifies tax management, promotes transparency, and ensures a more efficient allocation of resources for businesses.

Are there any challenges associated with Input Tax Credit?

+

While Input Tax Credit is a powerful tool, it does come with certain challenges. These include the need for meticulous record-keeping, timely tax compliance, and understanding the complex eligibility criteria. Additionally, businesses must stay updated with changing tax laws and regulations to maximize their ITC claims.

How can businesses ensure they are maximizing their Input Tax Credit benefits?

+

To maximize ITC benefits, businesses should focus on efficient tax planning, timely tax compliance, and meticulous record-keeping. Leveraging technology for tax management and staying informed about tax laws and updates can also help businesses optimize their Input Tax Credit claims.