How Do Illegal Aliens Pay Taxes

In the ongoing discussion surrounding immigration and tax systems, the question of how illegal aliens pay taxes often arises. It's a complex topic that involves various legal, economic, and societal factors. This article aims to provide an in-depth exploration of this issue, offering a comprehensive understanding of the processes and implications involved.

Understanding Illegal Immigration and Tax Obligations

Illegal immigration, often referred to as undocumented immigration, pertains to individuals who enter or reside in a country without the necessary legal permissions or documentation. Despite their legal status, these individuals are subject to certain tax obligations, primarily due to the nature of the US tax system.

The Internal Revenue Service (IRS) operates on a voluntary compliance system, meaning it relies on taxpayers to accurately report and pay their taxes. This principle applies to all individuals, regardless of their immigration status. As a result, illegal aliens, like all taxpayers, are expected to report and pay taxes on their income.

The Use of Individual Taxpayer Identification Numbers (ITINs)

One of the key mechanisms that allows illegal aliens to pay taxes is the Individual Taxpayer Identification Number (ITIN). The ITIN is a processing code issued by the IRS for tax purposes. It allows individuals who are not eligible for a Social Security Number (SSN) to pay taxes and comply with US tax laws.

ITINs are typically issued to non-resident aliens, foreign students, and individuals who are not authorized to work in the US but still have US-sourced income. This includes income from investments, rental properties, or certain business activities. The ITIN application process requires the submission of valid identity documents and a completed tax return.

| ITIN Usage Statistics | Data |

|---|---|

| Number of ITINs issued in 2022 | Approximately 4.3 million |

| Percentage of ITINs held by undocumented immigrants | Estimated at 30-40% |

| Total tax contributions from ITIN holders | Billions of dollars annually |

While ITINs do not grant any legal status or work authorization, they enable undocumented immigrants to pay taxes, file tax returns, and claim tax refunds or credits. This includes the Earned Income Tax Credit (EITC), which provides a financial boost to low- and moderate-income workers and families.

Wage Withholding and Reporting

Many illegal aliens are employed in the informal economy, often working under the table or in cash-based industries. Despite this, a considerable number of undocumented workers are employed in the formal sector, where tax withholding and reporting are standard practices.

When an undocumented worker is employed by a company that follows proper tax procedures, the employer will typically withhold taxes from the employee's wages. This includes federal income tax, Social Security, and Medicare taxes. The employer then reports these withholdings to the IRS and state tax authorities.

While the employee's tax payments may not be directly linked to their Social Security Number, the IRS still receives information about the wages earned and taxes paid. This data is critical for tracking tax compliance and ensuring that individuals pay their fair share.

Economic and Social Implications

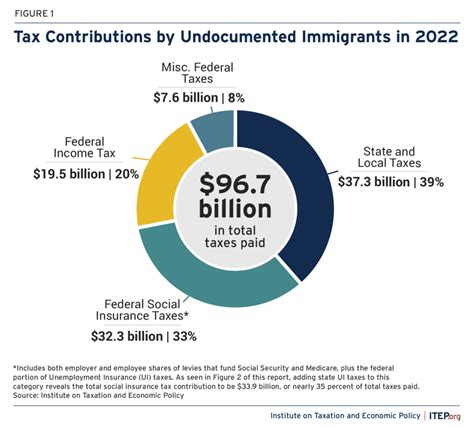

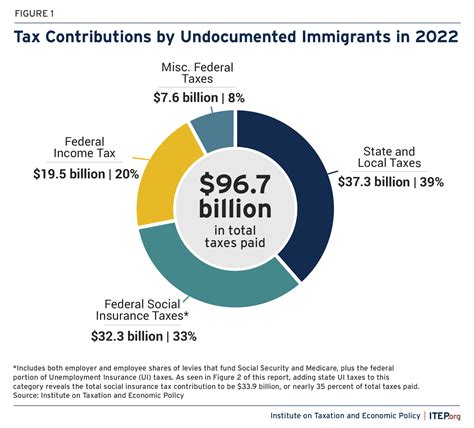

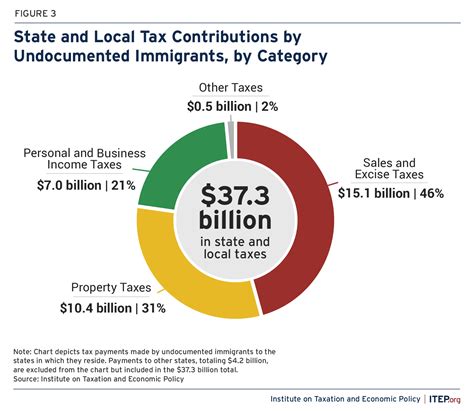

The tax contributions of illegal aliens have significant economic implications. These contributions not only bolster the federal government’s revenue but also support state and local governments through various tax streams.

Federal and State Revenue

Illegal aliens pay a variety of taxes, including income tax, sales tax, property tax (if they own property), and various other levies. These tax payments contribute to the overall revenue of federal, state, and local governments. For instance, undocumented immigrants pay sales taxes on goods and services they purchase, just like any other consumer.

| Tax Revenue from Undocumented Immigrants | Estimation |

|---|---|

| Federal income tax contributions | Over $11.7 billion annually |

| State and local tax contributions | Billions of dollars each year |

The tax contributions of undocumented immigrants help fund critical public services, including education, healthcare, infrastructure, and social safety nets. These funds are especially vital in states with large undocumented populations, where these individuals often access public services and contribute to local economies.

Social and Economic Integration

The ability of illegal aliens to pay taxes and contribute to the economy is a key aspect of their social and economic integration. By paying taxes, they demonstrate a commitment to the community and the country, fostering a sense of responsibility and belonging.

Furthermore, the tax contributions of undocumented immigrants can reduce the tax burden on other taxpayers. Their contributions help support public services and infrastructure, which benefits the entire community. This economic integration can also lead to increased economic opportunities and stability for these individuals and their families.

Legal and Policy Considerations

The topic of illegal aliens paying taxes is intertwined with broader immigration and tax policy debates. While the current system allows for tax payments, there are ongoing discussions and proposed changes that could impact this landscape.

Policy Proposals and Potential Reforms

Some policymakers have proposed reforms that would grant legal status or work permits to undocumented immigrants who have paid taxes consistently over a certain period. These proposals aim to recognize the economic contributions of these individuals and provide a pathway to legalization.

Conversely, there are also discussions about stricter enforcement measures, including proposals to deny tax refunds or credits to individuals who cannot provide valid Social Security Numbers. Such measures could impact the tax compliance and financial well-being of undocumented immigrants.

Legal Challenges and Court Cases

The intersection of immigration and tax laws has led to various legal challenges and court cases. One notable case is the ongoing litigation surrounding the Deferred Action for Childhood Arrivals (DACA) program. DACA recipients, who are eligible to work legally in the US, pay taxes and contribute to the economy, highlighting the complex legal landscape.

The resolution of these legal challenges can have significant implications for the tax obligations and rights of illegal aliens, influencing their ability to pay taxes and access benefits.

Conclusion: The Complex Reality of Illegal Aliens and Taxes

The question of how illegal aliens pay taxes reveals a complex interplay of legal, economic, and social factors. Despite their legal status, undocumented immigrants are subject to tax obligations and contribute significantly to the US economy. Their tax payments support public services, infrastructure, and social programs, benefiting the entire community.

As the debate around immigration and tax policy continues, it's crucial to recognize the economic contributions and social integration of illegal aliens. These individuals play a vital role in the US economy, and their tax payments demonstrate a commitment to the country and its communities.

How do illegal aliens file taxes without a Social Security Number (SSN)?

+Illegal aliens without an SSN can file taxes using an Individual Taxpayer Identification Number (ITIN). The ITIN is a processing code issued by the IRS specifically for tax purposes. To obtain an ITIN, individuals must submit valid identity documents and a completed tax return.

Do illegal aliens pay more or less taxes than legal residents or citizens?

+The tax contributions of illegal aliens can vary widely based on their income, employment status, and other factors. However, on average, they tend to pay less in taxes compared to legal residents or citizens. This is because they often have lower incomes and may not be eligible for certain tax credits or deductions.

Can illegal aliens receive tax refunds or credits?

+Yes, illegal aliens can receive tax refunds or credits if they are eligible. For instance, they can claim the Earned Income Tax Credit (EITC), which is designed to benefit low- and moderate-income workers and families. However, they may face challenges in receiving these refunds if they cannot provide a valid Social Security Number.

What are the potential impacts of stricter tax enforcement measures on illegal aliens?

+Stricter tax enforcement measures, such as denying tax refunds or credits to individuals without valid Social Security Numbers, could have significant impacts on illegal aliens. It may reduce their financial stability, access to social services, and overall well-being. Additionally, it could lead to increased tax evasion and further marginalization of these individuals.