Maryland Tax Rate

Welcome to this in-depth exploration of the tax landscape in Maryland, a state rich in history and economic diversity. In this article, we will delve into the intricacies of Maryland's tax system, providing you with a comprehensive understanding of the rates, structures, and unique features that define this state's fiscal policies. From income taxes to sales taxes and property taxes, we will uncover the specifics that impact both individuals and businesses residing in or doing business within the Old Line State.

Understanding Maryland’s Tax Structure

Maryland’s tax system is a complex yet well-defined structure, designed to support the state’s diverse economy and diverse population. The state levies taxes on various income sources, sales, and property ownership, each with its own set of rules and rates.

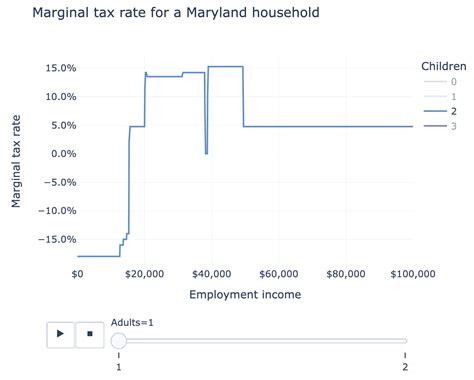

Income Tax: A Progressive Approach

Maryland employs a progressive income tax system, meaning that higher incomes are taxed at progressively higher rates. This approach ensures that individuals and businesses with greater financial means contribute a larger share of their income to the state’s revenue. The income tax rates in Maryland are structured as follows:

- 0%: The lowest tax bracket, applicable to the first 1,000 of taxable income.</li> <li><strong>2%:</strong> For taxable income between 1,001 and 2,000.</li> <li><strong>3%:</strong> For income between 2,001 and 3,000.</li> <li>And so on, with the highest rate of <strong>6.25%</strong> applying to taxable income over 250,000.

It’s worth noting that Maryland’s income tax brackets are adjusted annually to account for inflation, ensuring that taxpayers are not pushed into higher tax brackets solely due to rising costs of living.

Sales and Use Tax: A Standard Rate, with Exceptions

Maryland imposes a standard sales and use tax of 6% on most tangible personal property and services. This tax is applied at the point of sale, with certain exemptions and special rates applying to specific items. For instance, certain foods, prescription drugs, and clothing items are exempt from sales tax, while alcoholic beverages and gasoline have dedicated tax rates.

In addition to the standard sales tax, Maryland also imposes a 9% tax on prepared food and beverages, commonly known as the “meal tax.” This tax is typically included in the displayed price of meals in restaurants and other food establishments.

Property Tax: A Local Affair

Property taxes in Maryland are primarily a local responsibility, with rates and assessment practices varying widely across the state’s 24 jurisdictions. While the state does not impose a uniform property tax, it does provide guidelines and oversight to ensure fairness and consistency.

The average effective property tax rate in Maryland is 1.06%, but this can range from as low as 0.55% in certain areas to over 2% in others. Property taxes are assessed based on the value of the property, with reassessments typically occurring every three years. Homeowners may also benefit from various exemptions and credits, such as the Homestead Tax Credit, which provides a tax credit for owner-occupied residential properties.

Tax Incentives and Programs

Maryland is known for its proactive approach to attracting businesses and encouraging economic development. The state offers a range of tax incentives and programs to support businesses, particularly those in emerging industries or those that create jobs and contribute to the local economy.

Enterprise Zones

Maryland’s Enterprise Zone program provides a variety of tax credits and incentives to businesses that locate or expand in designated economically distressed areas. These incentives can include income tax credits, property tax credits, and sales and use tax exemptions. The program aims to stimulate economic growth and job creation in targeted communities.

Research and Development Tax Credit

The state’s Research and Development Tax Credit is designed to encourage innovation and technological advancement. Eligible businesses can receive a credit against their income tax liability for qualified research expenses. This credit is particularly beneficial for high-tech industries and startups, promoting Maryland as a hub for research and development.

Film Production Tax Credit

To attract film and television productions to the state, Maryland offers a generous Film Production Tax Credit. Productions that meet certain requirements can receive a refundable tax credit of up to 30% of qualified production expenses incurred in Maryland. This incentive has successfully boosted the state’s film industry and created a vibrant media presence.

The Impact of Maryland’s Tax Policies

Maryland’s tax policies have a significant impact on the state’s economy and the daily lives of its residents. The progressive income tax structure ensures that higher-income earners contribute a larger share, providing a stable revenue stream for the state. This revenue is crucial for funding essential services such as education, healthcare, and infrastructure development.

Education Funding

A substantial portion of Maryland’s tax revenue is dedicated to education. The state’s commitment to providing quality education is evident in its investment in schools, with a focus on early childhood education, college affordability, and support for students with special needs. This investment helps foster a skilled workforce and contributes to the state’s economic growth.

Healthcare Initiatives

Maryland’s tax revenue also plays a vital role in funding healthcare initiatives. The state has implemented programs to improve access to healthcare, reduce healthcare disparities, and promote wellness. These initiatives include expanding Medicaid coverage, investing in mental health services, and supporting community health centers.

Infrastructure Development

Tax revenue is a key driver of Maryland’s infrastructure development plans. The state’s investments in transportation, housing, and environmental initiatives create jobs, enhance the quality of life for residents, and attract businesses. Projects such as the Purple Line transit system, affordable housing initiatives, and the Chesapeake Bay restoration efforts are all funded, in part, by Maryland’s tax revenue.

Conclusion: Navigating Maryland’s Tax Landscape

Maryland’s tax system is a carefully crafted framework designed to support the state’s diverse economy and its residents. From progressive income taxes to targeted incentives for businesses, Maryland’s fiscal policies aim to create a balanced and prosperous environment. As we’ve explored, these taxes and incentives have a direct impact on the state’s ability to invest in essential services, promote economic growth, and enhance the overall quality of life for its citizens.

Understanding Maryland’s tax landscape is crucial for individuals and businesses alike. For residents, it means making informed decisions about financial planning and taking advantage of available credits and exemptions. For businesses, it means considering the state’s tax environment when making strategic decisions about location, expansion, and growth. Whether you’re a long-time Marylander or considering a move to the state, a thorough understanding of Maryland’s tax structure is essential to navigating this dynamic and prosperous state.

What is the average property tax rate in Maryland?

+The average effective property tax rate in Maryland is 1.06%, but rates can vary widely across the state’s 24 jurisdictions, ranging from 0.55% to over 2%.

Are there any tax incentives for renewable energy projects in Maryland?

+Yes, Maryland offers a Renewable Energy Production Tax Credit for eligible renewable energy projects. This credit provides an incentive for the development of clean energy sources and promotes the state’s commitment to sustainability.

How often are property assessments conducted in Maryland?

+Property assessments in Maryland are typically conducted every three years. However, certain jurisdictions may conduct reassessments more frequently to ensure accurate and up-to-date property values.

Are there any tax exemptions for senior citizens in Maryland?

+Yes, Maryland offers a variety of tax exemptions and credits for senior citizens. These include the Senior Citizen Property Tax Credit, which provides a credit against property taxes for eligible seniors, and the Senior Citizen Income Tax Credit, which reduces income tax liability for those over 65.

How does Maryland’s tax system compare to other states in the region?

+Maryland’s tax system is often compared to its neighboring states, such as Virginia and Pennsylvania. While each state has its unique features, Maryland’s progressive income tax structure and targeted business incentives set it apart, offering a balanced approach to taxation.