Sales Tax In Missouri

Sales tax is an essential component of the tax system in the United States, and it plays a significant role in generating revenue for states and local governments. In Missouri, sales tax is a crucial source of funding for various public services and infrastructure projects. Understanding the sales tax system in Missouri is vital for both businesses and consumers, as it directly impacts their financial obligations and the overall economy of the state.

Sales Tax Basics in Missouri

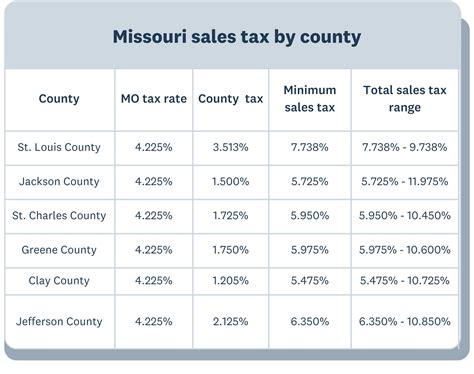

Missouri’s sales tax system is a comprehensive and detailed framework, designed to ensure fair taxation and efficient revenue collection. The state imposes a sales and use tax on the sale or lease of tangible personal property and certain services. This tax is levied on the end consumer, making it a consumption-based tax. The state sales tax rate in Missouri is 4.225%, which is applied uniformly across the state.

However, it's important to note that Missouri also allows local taxing jurisdictions, such as cities and counties, to impose additional sales taxes. These local option sales taxes can significantly vary depending on the location, with rates ranging from 0% to 4.5%, resulting in a combined state and local sales tax rate of up to 8.725% in certain areas. This variability in local sales tax rates makes Missouri's sales tax system one of the most complex in the United States.

The Impact of Local Option Sales Taxes

The local option sales taxes in Missouri have a substantial influence on the overall tax burden for businesses and consumers. While the state sales tax rate remains constant, the addition of local taxes creates a unique tax landscape across the state. For instance, consider the city of St. Louis, which has a local sales tax rate of 3.225%, resulting in a total sales tax rate of 7.45% when combined with the state rate.

| Location | State Sales Tax Rate | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| St. Louis | 4.225% | 3.225% | 7.45% |

| Kansas City | 4.225% | 2.725% | 6.95% |

| Springfield | 4.225% | 1.2% | 5.425% |

These varying rates can have a significant impact on businesses operating in multiple locations within Missouri. For example, a company with stores in both Kansas City and Springfield would face different tax obligations, despite being located in the same state. This complexity necessitates careful tax planning and compliance strategies for businesses to ensure they meet their tax obligations accurately.

Sales Tax Exemptions and Special Rates

While the sales tax in Missouri applies to a wide range of goods and services, there are certain exemptions and special rates that can reduce or eliminate the tax burden for specific items. These exemptions are designed to encourage certain economic activities or support specific industries.

For instance, Missouri offers a reduced sales tax rate of 1.225% for the sale of food for home consumption. This reduced rate aims to make groceries more affordable for Missouri residents. Additionally, certain non-prepared food items, such as produce, dairy, and bread, are entirely exempt from sales tax, further reducing the cost of essential food items for consumers.

Furthermore, Missouri has a sales tax exemption for certain manufacturing and agricultural machinery and equipment. This exemption encourages investment in these industries, fostering economic growth and job creation. It's important for businesses to stay informed about these exemptions to ensure they take advantage of any applicable tax breaks.

Compliance and Enforcement

Ensuring compliance with Missouri’s sales tax laws is crucial for businesses to avoid penalties and maintain a good standing with the state. The Missouri Department of Revenue (DOR) is responsible for enforcing sales tax regulations and collecting the revenue generated. The DOR provides comprehensive resources and guidelines to help businesses understand their sales tax obligations.

Businesses are required to register with the DOR and obtain a sales tax license if they meet certain criteria, such as having a physical presence in the state or making sales to Missouri residents. Once registered, businesses must collect the appropriate sales tax from customers and remit it to the DOR on a regular basis, typically monthly or quarterly.

The DOR conducts audits and investigations to ensure compliance. Businesses found to be non-compliant can face penalties, interest charges, and even criminal charges in severe cases. Therefore, it's essential for businesses to maintain accurate records, properly train their staff, and utilize reliable sales tax software to ensure accurate tax collection and reporting.

The Future of Sales Tax in Missouri

As the economic landscape evolves, so does the sales tax system in Missouri. The state is continuously evaluating its tax policies to ensure they remain fair, efficient, and supportive of economic growth. With the rise of e-commerce and remote sales, the state is focusing on adapting its tax system to accommodate these changes.

One of the key challenges for Missouri, as with many other states, is the collection of sales tax on online sales. The state is working towards implementing measures to ensure that online retailers, especially those with significant economic presence in Missouri, collect and remit sales tax accurately. This includes initiatives like the Wayfair decision, which allows states to require out-of-state sellers to collect and remit sales tax, even if they lack a physical presence in the state.

Furthermore, Missouri is exploring ways to simplify its sales tax system, particularly by reducing the complexity of local option sales taxes. While local taxes provide much-needed revenue for local governments, the variability in rates can create administrative burdens for businesses. The state is considering options to standardize rates or provide clearer guidelines for local taxing jurisdictions to ensure a more consistent tax environment.

Conclusion

Missouri’s sales tax system is a complex but crucial component of the state’s tax framework. It provides significant revenue for state and local governments, supporting essential public services and infrastructure. While the system’s complexity can pose challenges for businesses, staying informed and utilizing the resources provided by the Missouri DOR can help ensure compliance and effective tax management.

As Missouri continues to adapt its sales tax policies, businesses and consumers can expect a more streamlined and efficient tax system, particularly with the increasing focus on online sales and the potential standardization of local sales tax rates. Understanding and navigating Missouri's sales tax landscape is essential for both businesses and consumers to fulfill their tax obligations and contribute to the state's economic growth.

What is the current state sales tax rate in Missouri?

+The current state sales tax rate in Missouri is 4.225%.

Do local jurisdictions in Missouri have the authority to impose additional sales taxes?

+Yes, local taxing jurisdictions, such as cities and counties, have the authority to impose additional sales taxes, known as local option sales taxes.

What is the highest combined state and local sales tax rate in Missouri?

+The highest combined state and local sales tax rate in Missouri can reach up to 8.725% in certain areas.

Are there any sales tax exemptions or special rates in Missouri?

+Yes, Missouri offers exemptions and special rates for certain items, such as a reduced sales tax rate for food for home consumption and exemptions for manufacturing and agricultural machinery.

How can businesses ensure compliance with Missouri’s sales tax laws?

+Businesses can ensure compliance by registering with the Missouri Department of Revenue, collecting the appropriate sales tax from customers, and regularly remitting the tax to the DOR. Staying informed about sales tax regulations and seeking professional tax advice is also crucial.