Last Day To Do Taxes 2025

It's that time of year again when taxpayers across the United States are scrambling to meet the tax deadline. The Internal Revenue Service (IRS) has set the due date for filing federal income tax returns, and it's crucial to be aware of the deadline to avoid any penalties or missed opportunities.

The Tax Deadline: A Snapshot

For the tax year 2025, the last day to file your taxes falls on April 15, 2026. This date is a key milestone for individuals and businesses alike, marking the end of the tax season and the beginning of a new fiscal year.

However, it's important to note that this deadline applies to most taxpayers. There are certain situations and scenarios that might extend or alter this due date. Let's delve deeper into the specifics to ensure you're fully prepared.

Understanding the Tax Deadline

The tax deadline is a critical date for taxpayers as it signifies the end of the tax filing season and the beginning of the tax payment season. This date is set by the IRS and is generally consistent from year to year, providing taxpayers with a reliable timeline to work with.

The deadline applies to various tax forms and returns, including Form 1040, the primary tax form for individuals, as well as other forms like Form 1065 for partnerships and Form 1120 for corporations.

By understanding the deadline and the applicable forms, taxpayers can ensure they meet their tax obligations in a timely and efficient manner.

Key Considerations for the 2025 Tax Deadline

While the general tax deadline for 2025 is April 15, 2026, there are some important considerations to keep in mind:

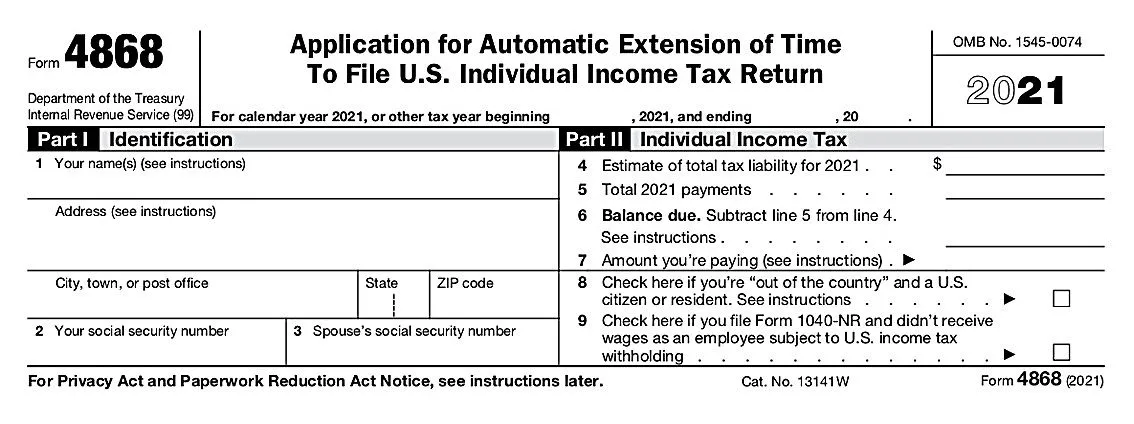

- Extension of Time to File: Taxpayers who are unable to meet the deadline may request an automatic extension of time to file their tax returns. This extension provides an additional six months, pushing the deadline to October 15, 2026. However, it's crucial to note that an extension of time to file does not extend the time to pay any taxes due. Taxpayers must still make estimated tax payments by the original deadline to avoid penalties.

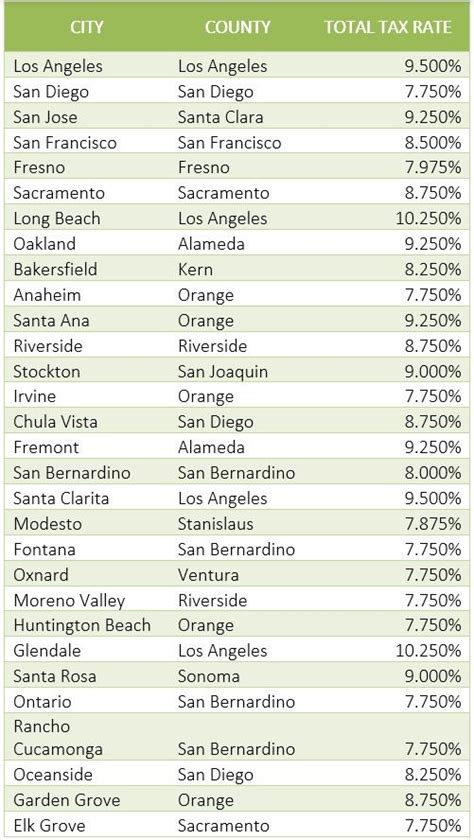

- State Tax Deadlines: It's essential to remember that state tax deadlines may differ from the federal deadline. Taxpayers should be aware of their state's specific tax due date to ensure compliance with local regulations. For instance, some states like California and New York have different deadlines than the federal government.

- Special Circumstances: Certain life events or situations may qualify taxpayers for alternative deadlines. For example, victims of natural disasters or military personnel deployed in combat zones may be eligible for extended filing periods. It's advisable to check with the IRS or consult a tax professional for guidance on these special circumstances.

Preparing for the Tax Deadline

To ensure a smooth and stress-free tax filing process, taxpayers should begin preparing well in advance of the deadline. Here are some key steps to consider:

- Gather Documentation: Collect all relevant tax documents, including W-2 forms, 1099 forms, receipts for deductions, and any other supporting documentation. Ensure that all information is accurate and up-to-date.

- Choose Your Filing Method: Decide whether you prefer to file your taxes manually or use tax preparation software. Tax preparation software can simplify the process and help identify potential deductions and credits you may be eligible for.

- Review Previous Returns: Take the time to review your previous tax returns to identify any areas of improvement or potential issues. This can help you prepare more effectively and avoid common mistakes.

- Seek Professional Help: If you have complex tax situations or are unsure about certain aspects of your taxes, consider consulting a tax professional or accountant. They can provide valuable guidance and ensure your return is accurate and compliant.

- Stay Informed: Keep yourself updated on any changes to tax laws or regulations. The IRS and state tax authorities often make updates and clarifications throughout the year, so staying informed can help you avoid surprises and ensure compliance.

Tips for a Successful Tax Filing

Here are some additional tips to make your tax filing experience smoother and more efficient:

- Start early: Don't wait until the last minute. Beginning the process early gives you ample time to gather documents, seek professional help if needed, and ensure accuracy.

- Organize your records: Create a filing system for your tax-related documents to make it easier to locate specific information when needed.

- Understand deductions and credits: Familiarize yourself with the deductions and credits you may be eligible for. This can help you maximize your tax savings and minimize your tax liability.

- Review and double-check: Before submitting your tax return, carefully review it for errors or omissions. Double-checking can help catch any mistakes and ensure a more accurate filing.

- Stay informed on tax reforms: Keep an eye on any proposed or enacted tax reforms that may impact your tax situation. This will help you plan accordingly and take advantage of any new opportunities.

The Importance of Meeting the Tax Deadline

Meeting the tax deadline is crucial for several reasons:

- Avoid Penalties: Filing your taxes late can result in penalties and interest charges. These penalties can add up quickly and impact your financial situation.

- Timely Refunds: If you're expecting a tax refund, filing on time ensures you receive your refund promptly. Delayed filing can mean a delayed refund, leaving you with less money in your pocket.

- Compliance with the Law: Filing your taxes on time demonstrates your commitment to compliance with the law. It shows your responsibility as a taxpayer and helps maintain a positive relationship with the IRS.

- Peace of Mind: Meeting the deadline provides a sense of accomplishment and peace of mind. It allows you to focus on other aspects of your financial life without the stress of pending tax obligations.

Conclusion: Plan Ahead, File On Time

The tax deadline for the year 2025 is rapidly approaching, and it’s crucial for taxpayers to be prepared. By understanding the deadline, considering any extensions or special circumstances, and taking proactive steps to prepare, taxpayers can ensure a smooth and successful tax filing experience.

Remember, staying organized, seeking professional help when needed, and staying informed are key to a stress-free tax season. Plan ahead, gather your documents, and file your taxes on time to avoid penalties and maximize your tax savings.

For more information on tax deadlines, forms, and guidelines, visit the official IRS website or consult a trusted tax professional.

What happens if I miss the tax deadline?

+

Missing the tax deadline can result in penalties and interest charges. The IRS imposes a failure-to-file penalty, which is typically 5% of the unpaid taxes for each month the return is late, up to a maximum of 25%. Additionally, interest accrues on any unpaid tax balance from the original due date until the tax is paid in full. It’s important to note that requesting an extension of time to file does not extend the time to pay taxes due, so it’s crucial to make estimated tax payments by the original deadline to avoid penalties.

Can I request an extension for filing my taxes?

+

Yes, taxpayers who are unable to meet the tax deadline can request an automatic extension of time to file their tax returns. To do so, you must file Form 4868, “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return,” by the original due date. The extension provides an additional six months, pushing the deadline to October 15, 2026. However, as mentioned earlier, an extension of time to file does not extend the time to pay taxes due.

Are there any exceptions to the tax deadline for certain individuals or situations?

+

Yes, there are certain exceptions and special circumstances that may apply to individuals or situations. For example, victims of natural disasters or military personnel deployed in combat zones may be eligible for extended filing periods. Additionally, taxpayers with complex tax situations, such as those with foreign income or complicated business structures, may require more time to prepare their returns accurately. It’s always advisable to consult with a tax professional or the IRS for guidance on these exceptions.