City Of New Orleans Sales Tax

Welcome to the vibrant city of New Orleans, Louisiana, where the lively streets, rich cultural heritage, and unique culinary delights captivate visitors from around the world. Beyond its renowned attractions, the city's economic landscape is influenced by a range of factors, including its sales tax structure. In this article, we will delve into the intricacies of the City of New Orleans sales tax, exploring its rates, applicability, and the impact it has on businesses and consumers alike.

Understanding the New Orleans Sales Tax Structure

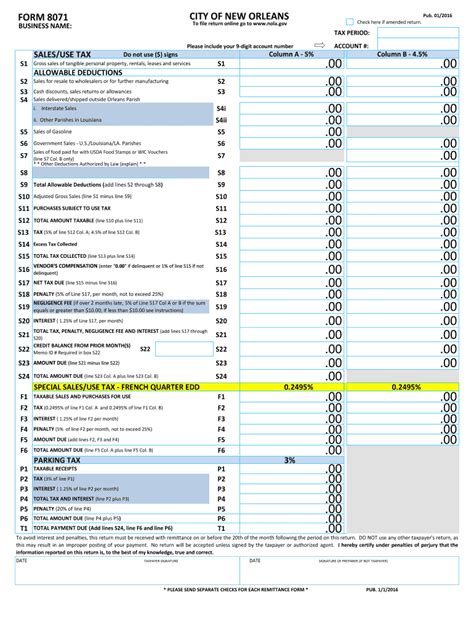

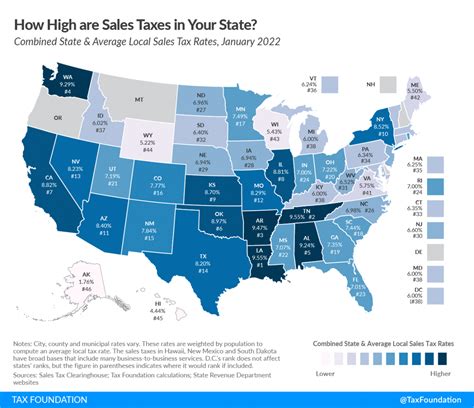

The sales tax in New Orleans, like in many other U.S. cities, is a consumption tax levied on the sale of goods and certain services. It is a critical revenue source for the city, funding essential public services and infrastructure projects. The sales tax rate in New Orleans is composed of several layers, including state, local, and potentially additional taxes.

The state of Louisiana imposes a sales tax rate of 4.45%, which serves as the foundation for the city's tax structure. On top of this state tax, New Orleans implements its own local sales tax, currently set at 5%. This local tax is dedicated to supporting specific initiatives and programs within the city, such as public transportation and cultural events.

In addition to the state and local taxes, there may be other applicable taxes, depending on the nature of the transaction and the specific location within the city. For instance, the New Orleans Aviation Board levies a 2% sales tax on certain transactions, particularly those related to aviation and tourism. These additional taxes contribute to the overall sales tax burden in New Orleans.

Sales Tax Exemptions and Special Considerations

While the sales tax is generally applicable to most goods and services, there are certain exemptions and special considerations in New Orleans. For instance, many essential food items, such as unprocessed groceries, are exempt from sales tax. This exemption aims to reduce the tax burden on residents’ basic necessities.

Additionally, certain industries and sectors may be subject to specific tax regulations. For example, the hospitality industry in New Orleans is often subject to additional taxes, such as the Transient Rental Tax, which is imposed on short-term rentals and accommodations. These industry-specific taxes contribute to the diverse tax landscape in the city.

| Tax Category | Rate |

|---|---|

| Louisiana State Sales Tax | 4.45% |

| New Orleans Local Sales Tax | 5% |

| New Orleans Aviation Board Tax | 2% |

| Transient Rental Tax (Accommodations) | Varies |

Impact on Businesses and Consumers

The sales tax in New Orleans has a significant impact on both businesses and consumers. For businesses, especially those engaged in retail and service industries, the sales tax can influence pricing strategies and operational costs. Businesses must factor in the sales tax when setting their prices, ensuring that they remain competitive while also meeting their tax obligations.

From a consumer perspective, the sales tax adds to the overall cost of goods and services. While it may not be a deciding factor in purchasing decisions, it can influence consumers' spending habits, particularly when considering large purchases. The sales tax is often visible to consumers at the point of sale, providing transparency about the tax burden.

Sales Tax Compliance and Challenges

Compliance with sales tax regulations is a critical aspect for businesses operating in New Orleans. The complexity of the tax structure, with multiple layers and potential exemptions, requires businesses to have robust tax management systems in place. This includes accurate tax calculation, proper record-keeping, and timely tax filings.

One of the challenges businesses face is keeping up with the evolving tax landscape. Tax rates and regulations can change over time, and businesses must stay informed to avoid penalties and ensure compliance. Additionally, the diverse nature of sales tax regulations across different industries and locations within the city adds to the complexity of tax management.

Sales Tax and Economic Development

The sales tax in New Orleans plays a pivotal role in the city’s economic development. The revenue generated from sales tax contributes to various public initiatives, including infrastructure projects, education, and social services. It helps fund critical programs that support the city’s growth and sustainability.

Moreover, the sales tax revenue is often utilized to attract and retain businesses. By investing in infrastructure and providing a conducive business environment, the city can encourage economic growth and create job opportunities. This, in turn, can lead to increased sales tax revenue, creating a positive feedback loop for the local economy.

Future Implications and Potential Reforms

As with any tax system, there are ongoing discussions and potential reforms surrounding the New Orleans sales tax. Some proponents argue for simplifying the tax structure to reduce administrative burdens on businesses and enhance transparency. This could involve consolidating multiple tax rates or exploring alternative tax mechanisms.

Additionally, there may be considerations for tax incentives and incentives to promote specific industries or attract investments. These initiatives could include tax holidays, reduced tax rates for certain sectors, or targeted tax credits. Such reforms aim to balance the need for revenue generation with the goal of fostering economic growth and competitiveness.

Conclusion: Navigating the New Orleans Sales Tax Landscape

The sales tax in New Orleans is a multifaceted aspect of the city’s economic fabric. It influences businesses, consumers, and the overall economic development of the region. Understanding the intricacies of the sales tax structure is essential for businesses to navigate the tax landscape effectively and ensure compliance.

As New Orleans continues to thrive and evolve, the sales tax will remain a critical component of its economic strategy. By staying informed about tax regulations, businesses can make informed decisions, contribute to the local economy, and continue to thrive in this vibrant city.

What is the current sales tax rate in New Orleans, Louisiana?

+The current sales tax rate in New Orleans consists of a 4.45% state tax and a 5% local tax, resulting in a combined rate of 9.45%. Additional taxes may apply depending on the nature of the transaction.

Are there any sales tax exemptions in New Orleans?

+Yes, certain items, such as essential groceries, are exempt from sales tax. Additionally, there are industry-specific exemptions and special considerations, such as the Transient Rental Tax for accommodations.

How does the sales tax impact businesses in New Orleans?

+Businesses must factor in the sales tax when setting prices and managing their operations. It influences pricing strategies and operational costs, and businesses need robust tax management systems to ensure compliance.

What are the potential future reforms for the New Orleans sales tax?

+Potential reforms include simplifying the tax structure, exploring alternative tax mechanisms, and implementing tax incentives to promote economic growth and competitiveness. These initiatives aim to balance revenue generation with fostering a business-friendly environment.