Lowest Sales Tax In California

California, known for its diverse landscapes, vibrant cities, and bustling economy, is a state that attracts millions of residents and visitors alike. However, when it comes to sales tax, it's essential to understand the landscape to make informed decisions about purchases and financial planning.

Sales tax in California can vary across different counties and cities, making it a complex system to navigate. While some regions may have higher tax rates to support specific initiatives or infrastructure projects, others aim to attract businesses and residents by keeping their sales tax rates competitive. In this article, we will explore the intricacies of sales tax in California, with a focus on uncovering the counties and cities with the lowest sales tax rates.

Understanding California’s Sales Tax Structure

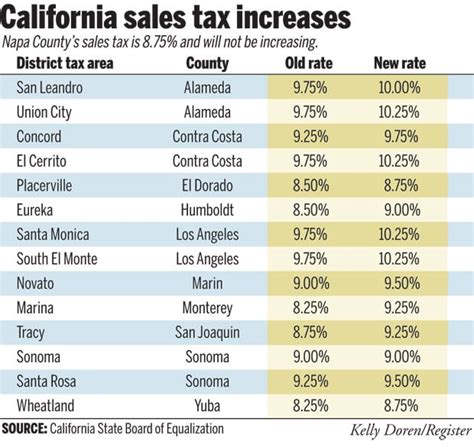

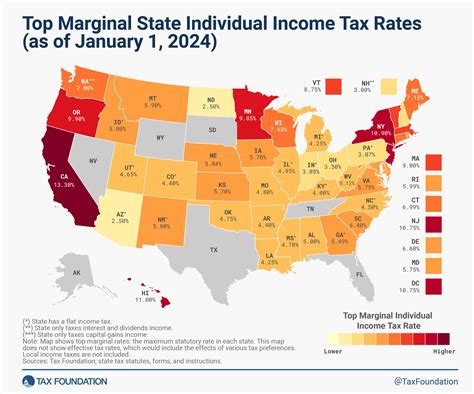

California imposes a statewide sales and use tax, which applies to the retail sale, lease, or rental of most goods, as well as certain services. The state’s sales tax rate is set at 7.25%, which serves as the base rate for all counties. However, it’s important to note that local jurisdictions, such as counties and cities, have the authority to add their own local sales taxes on top of the state rate.

These local additions can significantly impact the overall sales tax rate. For instance, a county or city with a local sales tax of 0.25% would result in a combined rate of 7.50%, while a locality with a 1.00% addition would lead to a 8.25% rate. These variations can make a substantial difference in the total cost of purchases, especially for high-value items.

Additionally, certain cities within California have formed special tax districts, often known as "enterprise zones" or "community redevelopment areas." These districts are designated to encourage economic development and may offer reduced sales tax rates to attract businesses and stimulate growth. Understanding these unique tax structures is crucial for businesses and individuals alike.

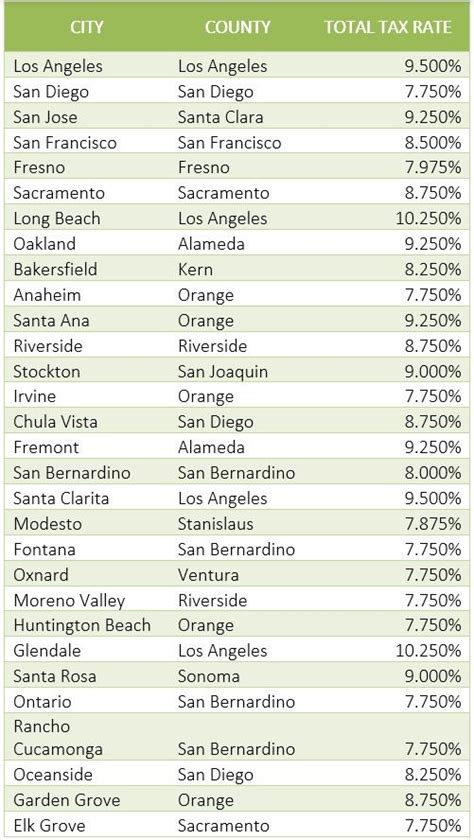

The Counties with the Lowest Sales Tax Rates

When it comes to identifying the counties with the lowest sales tax rates in California, several stand out due to their minimal local additions to the state’s base rate.

Orange County

Orange County, located in Southern California, boasts one of the lowest sales tax rates in the state. With a local addition of just 0.25%, the total sales tax rate in Orange County is 7.50%. This makes it an attractive destination for shoppers seeking to minimize their sales tax burden.

Orange County's vibrant economy and diverse attractions, ranging from world-class theme parks to stunning coastal communities, make it a popular choice for residents and tourists alike. The low sales tax rate further enhances its appeal, especially for those making significant purchases.

San Diego County

San Diego County, known for its beautiful beaches and mild climate, also boasts a favorable sales tax rate. With a local addition of 0.50%, the total sales tax rate in San Diego County is 7.75%. This rate is particularly attractive when compared to other major metropolitan areas in California.

San Diego's vibrant culture, diverse neighborhoods, and thriving tourism industry make it a sought-after destination. The relatively low sales tax rate contributes to the overall appeal of the region, making it an ideal place for businesses and individuals to thrive.

Imperial County

Imperial County, situated in the southeastern corner of California, shares a border with Arizona and Mexico. With a local sales tax addition of 0.25%, the total sales tax rate in Imperial County is 7.50%, on par with Orange County.

While Imperial County may be less populous than some of its neighboring counties, it offers a unique blend of desert landscapes and agricultural prosperity. The low sales tax rate, combined with its strategic location, makes it an attractive option for businesses and residents seeking a more affordable cost of living.

Counties with No Local Sales Tax Additions

It’s worth noting that a few counties in California do not impose any local sales tax additions on top of the state’s base rate of 7.25%. These counties include:

- Alpine County

- Amador County

- Calaveras County

- Mariposa County

- Sierra County

While these counties may have smaller populations and less developed economies, their absence of local sales tax additions can make them attractive destinations for certain businesses and individuals seeking to minimize their tax obligations.

Cities with Reduced Sales Tax Rates

In addition to counties, certain cities within California have taken steps to reduce their sales tax rates through special tax districts or other initiatives. These cities offer reduced rates to encourage economic development and attract businesses and residents.

Palmdale and Lancaster

Palmdale and Lancaster, located in Los Angeles County, are part of the Antelope Valley Enterprise Zone. This zone offers a reduced sales tax rate of 6.75%, which is significantly lower than the surrounding areas. This incentive has attracted numerous businesses and contributed to the economic growth of the region.

Bakersfield

Bakersfield, situated in Kern County, is another city with a reduced sales tax rate. As part of the Bakersfield Community Redevelopment Agency, the city offers a sales tax rate of 7.50%, which is 0.75% lower than the state’s base rate. This initiative aims to stimulate economic growth and investment in the area.

Chico

Chico, a city in Butte County, has implemented a unique sales tax structure. Through the Chico Community Development Agency, the city offers a reduced sales tax rate of 6.75% for certain types of businesses, such as restaurants and retail stores. This incentive has made Chico an appealing location for entrepreneurs and small business owners.

The Impact of Low Sales Tax Rates

The presence of counties and cities with low sales tax rates in California can have significant economic implications. These regions often become destinations for shoppers seeking to save on sales tax, which can boost local economies and support small businesses.

For businesses, operating in areas with reduced sales tax rates can provide a competitive advantage. It can attract customers who are price-conscious and seeking to minimize their tax obligations. Additionally, lower sales tax rates can reduce the overall cost of doing business, making these regions more attractive for business expansion and investment.

Furthermore, low sales tax rates can contribute to a higher quality of life for residents. With more disposable income, individuals can allocate their funds towards other essential expenses or savings, ultimately improving their financial well-being.

| County | Sales Tax Rate |

|---|---|

| Orange County | 7.50% |

| San Diego County | 7.75% |

| Imperial County | 7.50% |

Conclusion

California’s sales tax structure is diverse and complex, with variations across counties and cities. While the state’s base rate is 7.25%, local additions can significantly impact the total sales tax burden. Counties like Orange, San Diego, and Imperial stand out for their low sales tax rates, offering a competitive advantage to businesses and shoppers.

Additionally, cities such as Palmdale, Lancaster, Bakersfield, and Chico have implemented reduced sales tax rates through special initiatives, further enhancing their economic appeal. These tax incentives play a crucial role in attracting businesses, stimulating economic growth, and creating vibrant communities.

Whether you're a business owner seeking to minimize tax obligations or an individual looking to make informed purchasing decisions, understanding the lowest sales tax rates in California is essential. By leveraging this knowledge, you can make strategic choices that align with your financial goals and contribute to the overall economic vitality of the state.

What is the average sales tax rate in California?

+The average sales tax rate in California is around 8.25%, including the state’s base rate of 7.25% and local additions. However, certain counties and cities have lower rates, making them more attractive for businesses and shoppers.

How do sales tax rates impact businesses?

+Sales tax rates can significantly impact businesses, as they directly affect the cost of goods and services. Lower sales tax rates can make a region more attractive for businesses, as it reduces their tax obligations and can attract more customers seeking to save on sales tax.

Can individuals save money by shopping in counties with lower sales tax rates?

+Absolutely! Shopping in counties with lower sales tax rates can save individuals money on their purchases. By understanding the sales tax landscape and choosing to shop in these areas, individuals can minimize their tax obligations and potentially make significant savings, especially on large-ticket items.