Nys Income Tax Forms

The New York State (NYS) income tax forms are an essential component of the state's tax system, providing residents and businesses with the necessary tools to fulfill their tax obligations accurately and efficiently. These forms, issued by the New York State Department of Taxation and Finance, vary depending on the taxpayer's status, income sources, and specific circumstances. Understanding which forms to use and how to navigate the filing process is crucial for taxpayers to ensure compliance and avoid potential penalties.

The Importance of NYS Income Tax Forms

New York State, known for its diverse economy and large population, collects income taxes to fund various public services, infrastructure development, and social programs. The income tax system ensures that residents and businesses contribute their fair share to the state’s economy, fostering a sense of shared responsibility and financial stability.

The income tax forms are designed to accommodate the diverse financial situations of New Yorkers. Whether you're a sole proprietor, a corporation, a self-employed individual, or a traditional employee, the state provides tailored forms to ensure accurate reporting and calculation of your tax liabilities.

Key Forms and Their Purposes

The most common NYS income tax forms include:

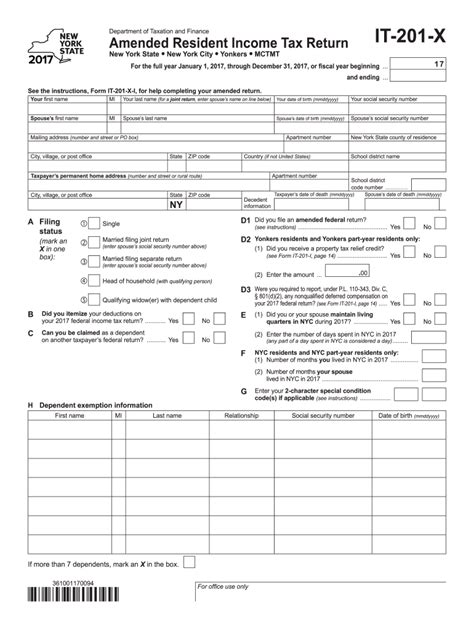

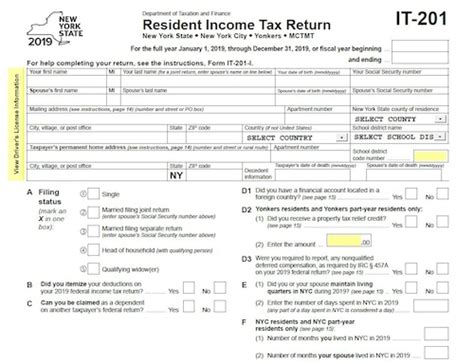

- IT-201: Resident Income Tax Return - This form is for New York residents to report their worldwide income, including wages, salaries, dividends, capital gains, and other sources of income. It also allows taxpayers to claim deductions, credits, and exemptions, reducing their overall tax liability.

- IT-203: Nonresident and Part-Year Resident Income Tax Return - Nonresidents and part-year residents use this form to report income earned within the state, such as wages from a New York employer or income from rental properties located in the state. This form ensures that nonresidents pay taxes only on the income derived from New York sources.

- IT-204: Resident Estimated Income Tax Payment Voucher - Taxpayers who expect to owe more than $1,000 in NYS income tax for the year must make estimated tax payments throughout the year. This form is used to calculate and remit those payments, helping taxpayers avoid penalties for underpayment.

- IT-205: Nonresident and Part-Year Resident Estimated Income Tax Payment Voucher - Similar to IT-204, this form is for nonresidents and part-year residents to make estimated tax payments. It ensures that these taxpayers pay their fair share of taxes on New York-sourced income.

- IT-2105: Individual Income Tax Withholding Certificate - Employers use this form to withhold the correct amount of New York State income tax from their employees' wages. Employees can use this form to claim withholding allowances and ensure their withholdings are accurate.

Other Relevant Forms and Their Uses

Beyond the aforementioned forms, the NYS tax system includes various other forms catering to specific situations, such as:

- IT-209: Extension of Time to File Individual Income Tax Return - This form allows taxpayers to request an extension to file their NYS income tax return beyond the usual deadline.

- IT-210: Corporation Franchise Tax Return - Corporations doing business in New York use this form to report their income and calculate their franchise tax liability.

- IT-211: Partnership Return of Income and Gain - Partnerships operating within the state use this form to report their income and distribute the tax liability among partners.

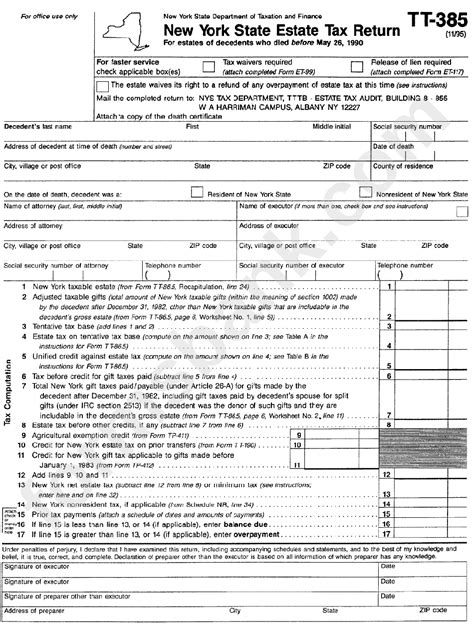

- IT-212: Resident and Nonresident Income Tax Return for Fiduciaries - Fiduciaries, such as trustees and executors, use this form to report income from estates and trusts.

- IT-213: Credit for Tax Paid to Another State - This form allows taxpayers to claim a credit for income taxes paid to another state, reducing their NYS tax liability.

The Filing Process: A Step-by-Step Guide

Filing your NYS income tax forms accurately is crucial to avoid errors and potential audits. Here’s a simplified guide to help you navigate the process:

- Gather Your Documents - Collect all relevant financial documents, such as W-2s, 1099s, bank statements, and records of income and expenses.

- Determine Your Tax Status - Identify whether you are a resident, nonresident, or part-year resident. This status will determine which forms you need to use.

- Calculate Your Income - Sum up all your income sources, including wages, investments, business income, and any other taxable income.

- Choose the Right Form - Based on your tax status and income, select the appropriate NYS income tax form. For most residents, this will be the IT-201.

- Complete the Form - Carefully fill out the form, providing accurate information for all relevant fields. Be sure to claim any deductions, credits, or exemptions you're eligible for.

- Calculate Your Tax Liability - Use the instructions provided with the form to calculate your taxable income and the corresponding tax amount.

- Make Payment (if applicable) - If you owe taxes, you can pay online, by phone, or by mail using the payment voucher provided with your form.

- Submit Your Return - You can file your return electronically or by mail. Electronic filing is faster and often more convenient.

- Keep Records - Retain a copy of your filed return and all supporting documents for at least three years. This is essential in case of an audit.

Special Considerations for Businesses

Businesses operating in New York face unique challenges when it comes to tax compliance. Here are some key considerations:

- Franchise Tax - Corporations doing business in New York are subject to franchise tax, which is calculated based on their net income. They must file the IT-210 form to report their income and calculate their tax liability.

- Sales and Use Tax - Businesses selling goods or providing services in New York are often required to collect and remit sales tax. They must register with the state and file sales tax returns regularly.

- Withholding Requirements - Employers must withhold New York State income tax from their employees' wages. They use the IT-2105 form to ensure accurate withholding and reporting.

The Benefits of Accurate Filing

Filing your NYS income tax forms accurately and on time has several advantages:

- Compliance with the Law - Accurate filing ensures you meet your legal obligations as a taxpayer, avoiding potential penalties and legal issues.

- Reduced Audit Risk - The more accurate your return, the less likely you are to be selected for an audit. Audits can be time-consuming and stressful.

- Maximized Deductions and Credits - Taking advantage of all eligible deductions and credits can significantly reduce your tax liability, leaving more money in your pocket.

- Smooth Tax Refunds - If you overpaid your taxes, accurate filing ensures you receive your refund promptly and without complications.

Common Pitfalls to Avoid

To ensure a smooth filing process, here are some common mistakes to avoid:

- Misreporting Income - Intentionally or unintentionally misreporting your income can lead to serious legal consequences. Always report all income accurately.

- Overlooking Deductions and Credits - Failing to claim all eligible deductions and credits can result in overpaying your taxes. Take the time to review all available options.

- Late Filing - Filing your tax return late can lead to penalties and interest charges. Always aim to file by the deadline, or request an extension if needed.

- Not Keeping Records - Failing to maintain proper records can make it difficult to support your return in case of an audit. Always retain important financial documents.

Seeking Professional Help

The NYS income tax system can be complex, especially for businesses and individuals with unique circumstances. If you’re unsure about which forms to use or how to navigate the filing process, consider seeking professional assistance from a tax advisor or accountant.

Tax professionals can provide tailored advice based on your specific situation, ensuring you comply with all relevant laws and regulations. They can also help you maximize your deductions and credits, potentially saving you significant amounts of money.

Stay Informed, Stay Compliant

The world of taxes is constantly evolving, with new laws and regulations being introduced regularly. It’s crucial to stay informed about any changes that may impact your tax obligations. The NYS Department of Taxation and Finance provides regular updates and resources to help taxpayers stay compliant.

Staying on top of your tax obligations is not only a legal requirement but also a sign of financial responsibility. By understanding the NYS income tax forms and the filing process, you can ensure you're contributing your fair share to the state's economy and avoiding potential issues down the line.

| Form | Purpose |

|---|---|

| IT-201 | Resident Income Tax Return |

| IT-203 | Nonresident and Part-Year Resident Income Tax Return |

| IT-204 | Resident Estimated Income Tax Payment Voucher |

| IT-205 | Nonresident and Part-Year Resident Estimated Income Tax Payment Voucher |

| IT-2105 | Individual Income Tax Withholding Certificate |

How do I know which form to use for my NYS income tax return?

+

Your choice of form depends on your tax status. Residents use IT-201, nonresidents and part-year residents use IT-203, and businesses use forms like IT-210. Always review the instructions for each form to ensure you’re using the correct one.

What if I miss the filing deadline for my NYS income tax return?

+

You can request an extension using form IT-209. However, it’s important to note that an extension only gives you more time to file; it does not extend the deadline for paying any taxes owed.

Can I file my NYS income tax return electronically?

+

Yes, the NYS Department of Taxation and Finance offers electronic filing options. This can be faster and more convenient than traditional paper filing.

How do I calculate my estimated tax payments for NYS income tax?

+

Use form IT-204 or IT-205 to calculate your estimated tax payments. These forms help you determine the amount you need to pay throughout the year to avoid penalties for underpayment.

What happens if I overpay my NYS income taxes?

+

If you overpay your taxes, you’re entitled to a refund. You can claim your refund by filing a return, and the state will process your refund accordingly.