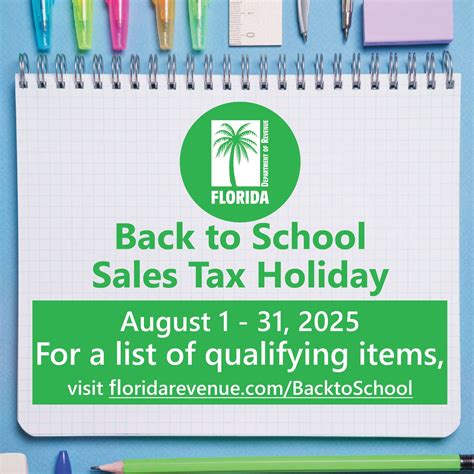

Avoid This Common Mistake When Planning Your Florida Tax Holiday

Each year, anticipating a Florida tax holiday offers consumers the tantalizing prospect of savings on essential purchases, from school supplies to thunderstorms of recreational gear. Yet, despite the allure of temporary exemption from sales tax, many shoppers fall into the trap of a pervasive mistake that undermines their financial advantage: an inadequate understanding of the specific stipulations and limitations that define the holiday. This oversight, often rooted in incomplete or misinterpreted information, can turn what should be a golden opportunity into an avoidable source of frustration—potentially costing consumers hundreds or thousands in unexpected taxes and penalties. The importance of precise, informed planning during Florida’s tax holiday window cannot be overstated, especially as the state’s regulations evolve in response to economic shifts and legislative amendments. To harness the full benefits, shoppers and retailers alike need to grasp the nuances that distinguish a successful tax holiday strategy from a costly misstep.

The No-Excuse Mistake: Overlooking the Specifics of Item Eligibility and Price Limits

The most frequently committed error—one that can sabotage even the most well-intentioned shopping spree—is failing to thoroughly verify whether items qualify under the detailed criteria set forth by Florida’s Department of Revenue. Unlike broad promotional events, a tax holiday imposes explicit restrictions on product types, price points, and sometimes the number of eligible items per transaction. For instance, a common misconception involves assuming all school-related supplies or electronics are exempt, only to discover some products like certain computer software or textbooks do not qualify. Additionally, the law often caps the exempted price per item, leading to a scenario where higher-cost items trigger partial tax exemption rather than full.

Failing to align purchases with these parameters may result in unexpected tax charges at checkout, which negates the intended savings. For example, in the 2023 Florida tax holiday, the limit on clothing and footwear was set at 100 per item. Consumers unaware of this threshold might inadvertently buy items exceeding this limit, thereby incurring sales tax on the entire amount. Retailers, too, can fall prey to this mistake—either by misapplying tax rules or failing to clearly communicate the limits to their customers, leading to compliance errors with subsequent audits.</p> <table> <tr><th>Relevant Category</th><th>Substantive Data</th></tr> <tr><td>Price Cap</td><td>100 per item for clothing and footwear during 2023 tax holiday

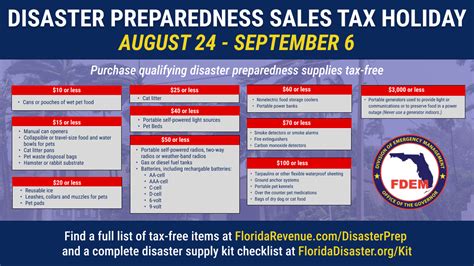

Ignoring the Time-Specific Nature of the Holiday and Its Limitations on Certain Items

Another critical mistake involves neglecting the temporal restrictions that govern the tax holiday. These events are confined to specific dates—such as the first weekend of August or a particular week—as outlined by state legislation. Purchases made outside these timeframes are fully taxable, yet shoppers and vendors sometimes assume a broader window or overlook the exact timing altogether. This oversight leads to miscalculations in budgeting and inadvertently paying taxes on items bought prematurely or afterward.

Moreover, certain categories, like holiday or luxury items, are explicitly excluded despite the festive naming or promotional framing. Retailers might display items prominently as ‘eligible’ due to misclassification or oversight. Therefore, understanding the precise start and end dates, along with item categories not covered, helps shoppers plan purchasing schedules effectively, avoiding costly surprises. Retailers that clearly communicate these constraints—either through storefront signage or online disclaimers—reduce liability and enhance customer satisfaction.

Case Study: The 2023 Florida Back-to-School Tax Holiday Schedule

Following the official calendar, the 2023 Florida tax holiday spanned from August 4-6, with specific stipulations on qualifying items. Any purchase outside this window, even if intended to coincide with the holiday, would swiftly convert non-qualifying items into taxable transactions, plus potential penalties upon audit. Discounting the importance of strict adherence to these deadlines represents a significant planning flaw for both consumers and businesses.

| Relevant Category | Data and Context |

|---|---|

| Holiday Duration | August 4-6, 2023, with precise start/end times and exemption rules |

Discounting Online and Cross-Border Purchases: An Overlooked Pitfall

While in-store shopping aligns relatively straightforwardly with legislative guidelines, online and cross-border transactions introduce considerable complexity. Many buyers mistakenly assume that digital retail platforms automatically apply exemption rules during tax holiday periods. However, online retailers, particularly those outside Florida or with international shipping, might not be mandated to follow the state’s tax holiday provisions, resulting in full tax application regardless of the buyer’s intentions.

Furthermore, consumers often neglect to verify whether their purchase qualifies when ordering from out-of-state vendors, who may not honor the holiday’s exemptions or may only do so for goods shipped within Florida. This oversight can result in paying full sales tax upon delivery, eliminating anticipated savings entirely. Retailers must navigate compliance issues themselves, especially if their e-commerce platforms do not automatically enforce holiday-specific discounts or tax exemptions.

| Relevant Category | Substantive Data |

|---|---|

| E-Commerce Purchases | Varies by retailer; many do not automatically apply Florida tax holiday exemptions outside state borders |

Overlooking the Need for Documentation and Record-Keeping

The final error—yet perhaps the most persistent—is the neglect of proper documentation and record-keeping during tax holiday purchases. Without clear receipts, itemized lists, and transaction records, consumers risk failing audits or tax disputes when questioned about their purchases months or years later. This is particularly vital when claims of exemption are contested, or when items purchased during the holiday are later combined or devalued.

Accurate records, including purchase dates, item descriptions, and prices, not only facilitate compliance but also enable consumers to substantiate their claims if audited by the Florida Department of Revenue. For retailers, maintaining detailed sales records ensures legal compliance and smooth audit processes, especially as legislative oversight tightens and as e-commerce complicates traditional record-keeping procedures.

| Relevant Category | Data and Context |

|---|---|

| Record-Keeping | Essential for audit defense; includes receipts, item descriptions, purchase dates, and exemption documentation |

Key Points

- Deep understanding of item-specific eligibility and price thresholds maximizes holiday savings.

- Exact adherence to declared holiday dates and awareness of category exclusions prevent costly errors.

- Online and cross-border shopping necessitate particular vigilance to prevent inadvertent tax payments.

- Comprehensive record-keeping sustains compliance and supports audits with factual transaction evidence.

- Strategic planning around these elements transforms a transactional event into an optimized financial opportunity.

How can I verify if a product qualifies for Florida’s tax holiday?

+Consult the official Florida Department of Revenue website or the latest legislative guide, which provides detailed lists of eligible products, price limits, and categories for each holiday period. Retailer signage and sales associates can also clarify qualifying items during the event.

What are common pitfalls when shopping online during Florida’s tax holiday?

+Many online retailers outside Florida do not automatically apply exemptions, and purchase timing may not align with the holiday dates. Always verify whether the retailer honors Florida’s tax holiday and consider placing orders within the designated window for maximum savings.

How should I keep records of my tax holiday purchases?

+Save digital or physical receipts showing the purchase date, item description, and price. If possible, take screenshots of online transactions and maintain organized records in a dedicated folder or economy-safe document management system for easy retrieval during audits.