Unlocking Your Future: A Simple Guide to IRS Tax Lien Search

Facing the weight of unresolved IRS tax liens can feel overwhelming, yet understanding the intricacies of locating and interpreting these liens is a critical step in reclaiming financial independence. Often misunderstood as opaque or inaccessible, the process of IRS tax lien search has evolved with technology, empowering individuals, investors, and legal professionals to access vital information with greater clarity and efficiency. Harnessing this knowledge not only helps in assessing liabilities but also positions users towards strategic financial planning and debt resolution.

Understanding IRS Tax Liens: Myths and Realities

The common misconception that IRS tax lien searches are daunting and only accessible through convoluted bureaucratic channels is widespread. In reality, the advent of digital records and public data repositories has democratized access, rendering the search process straightforward when understood correctly. IRS tax liens are legal claims against properties or assets of delinquent taxpayers, serving as notice of unpaid taxes and securing the government’s interest in recovering debts. These liens can impact credit ratings, property sales, and personal financial opportunities, making accurate detection crucial.

Debunking the Myth: Are IRS Tax Lien Records Confidential?

The notion that IRS tax lien details are confidential or hidden from the public is false. While taxpayer privacy is protected, the IRS makes lien information available through public records, especially after liens become enforceable and are officially recorded. This transparency is designed to alert creditors, potential buyers, and other interested parties. The key is knowing where and how to access these records effectively, which often involves federal and local government databases, online portals, and third-party services.

| Relevant Category | Substantive Data |

|---|---|

| Public Records Access | IRS liens are filed with county recorders and are publicly accessible in most jurisdictions, averaging a processing time of 30-90 days after filing. |

| Search Tools | Official IRS databases, county clerk records, online lien registries, and specialized commercial services. |

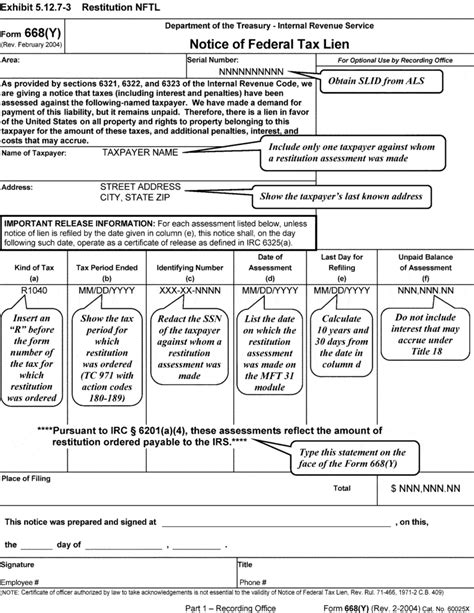

| Information Scope | Liens include debtor name, lien amount, date filed, IRS office involved, and property details if applicable. |

Step-by-Step Guide to Effective IRS Tax Lien Search

Embarking on your IRS lien search necessitates a clear, methodical approach. From initial understanding to final verification, each step builds toward a comprehensive picture of outstanding liabilities and associated risks.

Gathering Essential Information

The first stride involves collecting accurate identifiers such as the full legal name, Social Security Number (SSN) or Employer Identification Number (EIN), and, where possible, the property address. These details streamline the search process, reducing false positives and ensuring precise results.

Utilizing Official IRS Resources

The IRS provides online portals and tools, primarily through the IRS Tax Debt Data service, which offers detailed lien information. Additionally, state and local government websites maintain public records of recorded liens, often accessible via county clerk or recorder offices’ online databases. Advanced search services, sometimes subscription-based, aggregate and streamline these records for more efficient retrieval.

| Relevant Category | Actionable Data |

|---|---|

| Online IRS Tools | Access via the IRS’s Search for Tax Liens portal or similar interfaces. |

| County Record Searches | Visit the county recorder’s website or physical office, utilizing name or property-based searches. |

| Third-Party Services | Leverage commercial lien databases like LexisNexis or Experian for aggregated data. |

Advantages of Systematic Search Strategy

Adopting a systematic approach—such as starting with federal portals, then narrowing down to local records—enhances accuracy and completeness. Keep a detailed log of search parameters, record findings meticulously, and verify discrepancies through multiple sources to ensure data integrity.

Interpreting IRS Lien Data: Myths and Facts

Once the records are gathered, interpreting the results accurately is essential. There exists a misconception that all recorded liens are equally detrimental or relevant; this oversimplification can lead to misinformed decisions. The reality involves nuanced understanding of lien status, amount, and the underlying tax history.

Distinguishing Active from Satisfied Liens

An active lien indicates unresolved debt, while a satisfied lien signifies repayment completion. The date of filing and release are critical data points. Payment histories, often available in detailed records, illuminate the debtor’s current standing and legal obligations.

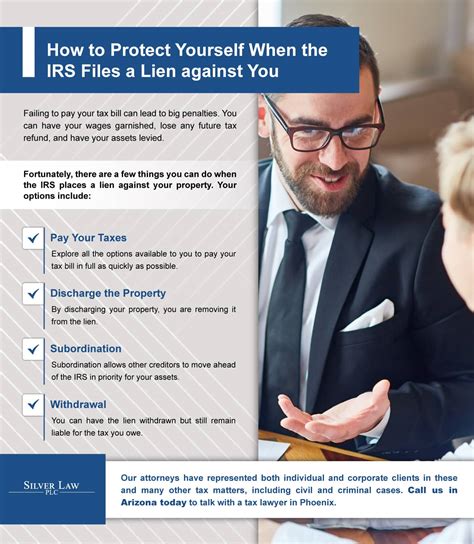

Implications for Property and Credit

Liens attached to real property can cloud titles, hinder refinancing, or facilitate foreclosure proceedings. For credit reports, the presence of a lien can lower credit scores significantly. Understanding the lien’s scope and status informs strategic decisions—whether pursuing debt negotiations, legal actions, or property transfers.

| Relevant Category | Data Insights |

|---|---|

| Liens and Property Title | Active IRS liens can surface during title searches for real estate transactions, necessitating lien release verification. |

| Credit Reporting | IRS liens typically appear on credit reports for up to seven years after release, impacting creditworthiness. |

| Debt Resolution | In some cases, lien withdrawal or release is possible through negotiated settlements or payment plans. |

Legal and Ethical Considerations in IRS Tax Lien Search

While the process is largely accessible, users must navigate legal boundaries carefully. Exploiting public records for malicious purposes, such as identity theft or unauthorized disclosure, violates federal and state laws. Ethical investigation entails using information solely for legitimate purposes like personal due diligence, property transactions, or legal defense.

Privacy and Data Use Regulations

Federal laws restrict the misuse of personal data obtained from public records. For instance, the Fair Credit Reporting Act (FCRA) governs how consumer data, including lien information, can be accessed and used for credit decisions. Users employing third-party services should ensure compliance to avoid legal repercussions and preserve integrity.

Limitations and Risks of DIY Searches

Relying solely on public records without professional guidance may lead to incomplete or outdated information. Professional experts recommend corroborating online data with official records and seeking legal advice when necessary, especially in complex cases involving bankruptcy, disputes, or contested liens.

| Relevant Category | Legal and Ethical Point |

|---|---|

| Data Privacy Laws | Respect laws surrounding the use of personal financial data, including the FCRA and Fair Debt Collection Practices Act (FDCPA). |

| Ethical Use | Use obtained information strictly for legitimate purposes, avoiding malicious or intrusive activities. |

| Professional Guidance | Consult attorneys or certified public accountants for complex or disputed lien issues. |

The Future of IRS Lien Search: Technology and Trends

Emerging technologies are transforming how lien searches are conducted. Blockchain-enabled record-keeping, advanced data analytics, and enhanced online portals aim to boost transparency, accuracy, and speed. Additionally, integrating AI-driven tools can facilitate pattern recognition, flag potential issues proactively, and predict lien release timelines with better precision.

Innovative Tools and Platforms

Innovations include AI-powered search engines that cross-reference multiple databases, providing users with real-time alerts about lien status changes, and cloud-based platforms that streamline document management. These tools are accessible via subscriptions, often tailored for legal and real estate professionals but increasingly available to individual consumers.

| Relevant Category | Trend and Innovation |

|---|---|

| Blockchain | Secure, immutable records reducing errors and forging transparent tracking of lien filings and releases. |

| AI and Machine Learning | Automated pattern detection and predictive analytics improve accuracy and anticipation of legal resolutions. |

| Online Portals | Enhanced user interfaces and integrated services simplify complex searches for both laypersons and professionals. |

Summary: Navigating the Path Forward in IRS Lien Discovery

Demystifying the IRS lien search process underscores its importance in today’s interconnected financial landscape. By dispelling myths, adopting systematic strategies, and leveraging technological advancements responsibly, individuals can turn what once seemed opaque into a clear tool for financial assessment and strategic planning. Maintaining awareness of legal and ethical boundaries ensures that this powerful information is used beneficially and sustainably.