Sales Tax Pennsylvania Cars

In the state of Pennsylvania, sales tax on vehicles is an important consideration for both buyers and sellers, as it can significantly impact the overall cost of purchasing a car. Understanding the ins and outs of sales tax in this context is crucial for making informed decisions when it comes to automotive purchases. This article aims to provide a comprehensive guide to sales tax on cars in Pennsylvania, covering the various aspects and implications for those navigating the state's automotive market.

The Basics of Sales Tax in Pennsylvania

Sales tax in Pennsylvania is a percentage-based tax applied to the purchase price of various goods and services, including vehicles. This tax is collected by the Pennsylvania Department of Revenue and is used to fund various state programs and services. The sales tax rate can vary depending on the type of item being purchased and the location of the sale.

When it comes to cars, the sales tax rate in Pennsylvania is relatively straightforward. The state imposes a 6% sales tax on the purchase price of most vehicles. This applies to both new and used cars, motorcycles, recreational vehicles (RVs), and other types of motorized vehicles.

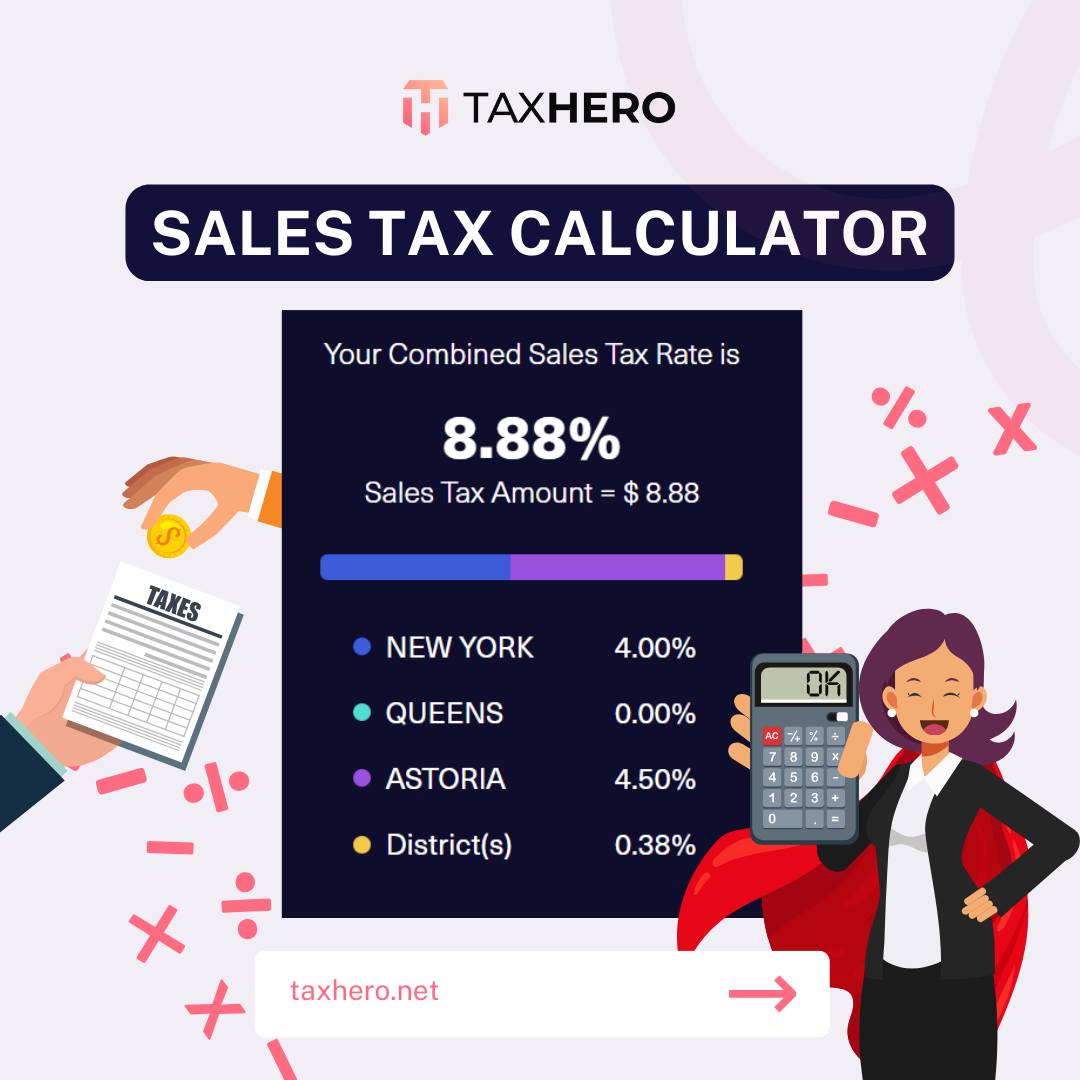

However, it's important to note that there are some exceptions and additional considerations to be aware of. For instance, certain localities in Pennsylvania may impose additional local sales taxes, which can increase the overall tax burden. These local tax rates can vary significantly, so it's crucial for buyers to research the specific sales tax rates in their intended purchase area.

Understanding the Sales Tax Calculation

The sales tax calculation for cars in Pennsylvania is based on the purchase price of the vehicle. This includes the total cost of the car, including any additional fees, options, or accessories. For instance, if you’re purchasing a new car for $30,000, the sales tax would be calculated as follows:

| Vehicle Purchase Price | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $30,000 | 6% | $1,800 |

In this example, the sales tax on the car would amount to $1,800, which is 6% of the $30,000 purchase price. This amount is added to the total cost of the vehicle, so the buyer would need to pay a total of $31,800 to cover both the car's price and the applicable sales tax.

Sales Tax Exemptions and Considerations

While the standard sales tax rate in Pennsylvania is 6% for most vehicles, there are certain scenarios where exemptions or reduced tax rates may apply. Understanding these exemptions is crucial for buyers looking to minimize their tax burden.

Leased Vehicles

For individuals leasing a vehicle in Pennsylvania, the sales tax calculation is different. Instead of paying sales tax upfront, the tax is included in the monthly lease payments. The lease agreement will typically specify the tax rate and how it is calculated. It’s important to note that leasing a car may have other tax implications, such as additional fees or penalties, so it’s advisable to consult with a tax professional for a detailed understanding of these aspects.

Military Personnel and Veterans

Active-duty military personnel and veterans may be eligible for sales tax exemptions on vehicle purchases. Pennsylvania offers a Motor Vehicle Sales and Use Tax Exemption for Military Personnel, which allows qualifying individuals to purchase vehicles tax-free. To claim this exemption, buyers must provide the necessary documentation, such as a valid military ID or a certificate of eligibility.

Trade-Ins and Used Car Sales

When purchasing a used car in Pennsylvania, the sales tax is calculated based on the vehicle’s purchase price, just like with new vehicles. However, if you’re trading in your old car as part of the deal, the trade-in value can reduce the taxable amount. For instance, if you’re buying a used car for 20,000 and your trade-in vehicle is valued at 5,000, the sales tax would be calculated on the $15,000 difference.

| Vehicle Purchase Price | Trade-In Value | Taxable Amount | Sales Tax Rate | Sales Tax Amount |

|---|---|---|---|---|

| $20,000 | $5,000 | $15,000 | 6% | $900 |

Registration and Title Fees

In addition to sales tax, buyers in Pennsylvania need to be aware of other fees associated with vehicle purchases. These fees include registration fees and title transfer fees. Registration fees are typically paid annually and cover the cost of registering the vehicle with the state. Title transfer fees, on the other hand, are one-time fees paid when transferring ownership of a vehicle.

The exact amount of these fees can vary depending on the type of vehicle and its characteristics. For instance, passenger cars typically have lower registration fees than commercial vehicles. Additionally, certain counties in Pennsylvania may impose additional fees for title transfers.

Title Transfer and Registration Process

When purchasing a vehicle in Pennsylvania, buyers must complete the title transfer process within 15 days of the purchase. This involves submitting the necessary paperwork to the Pennsylvania Department of Transportation (PennDOT). The required documents typically include a completed title transfer form, proof of insurance, and the applicable fees.

Once the title transfer is processed, buyers can then register their vehicle with PennDOT. The registration process involves providing additional documentation, such as the vehicle's inspection report and proof of ownership. Buyers should be aware that registration fees are typically due annually and can be paid online or at a local PennDOT office.

Sales Tax Implications for Sellers

While this article primarily focuses on the buyer’s perspective, it’s important to briefly touch on the sales tax implications for sellers as well. In Pennsylvania, sellers are responsible for collecting and remitting sales tax on vehicle sales. This means that sellers must accurately calculate and collect the applicable sales tax from buyers and then remit these funds to the Pennsylvania Department of Revenue.

Sellers should also be aware of their reporting obligations. They are required to file sales tax returns periodically, typically on a monthly or quarterly basis, depending on their sales volume. These returns must accurately report the sales tax collected and ensure timely payment to the state.

Future Implications and Potential Changes

As with any tax-related matter, it’s important to stay updated on potential changes to sales tax laws and regulations in Pennsylvania. While the current sales tax rate for vehicles is 6%, there is always the possibility of future adjustments or the introduction of new exemptions or considerations.

Additionally, with the rise of electric vehicles (EVs) and the potential for increased EV adoption, there may be future discussions around EV-specific tax incentives or exemptions. Keeping an eye on these developments can help buyers and sellers stay informed and make strategic decisions regarding vehicle purchases and sales.

Conclusion

Understanding the intricacies of sales tax on cars in Pennsylvania is essential for making informed automotive purchases. From the standard 6% sales tax rate to the various exemptions and considerations, buyers and sellers alike should be well-versed in the state’s tax regulations. By staying informed and proactive, individuals can navigate the automotive market with confidence and ensure compliance with Pennsylvania’s tax laws.

Frequently Asked Questions

Are there any exceptions to the 6% sales tax rate on vehicles in Pennsylvania?

+

Yes, there are certain exceptions and exemptions to the standard 6% sales tax rate. For instance, active-duty military personnel and veterans may be eligible for a sales tax exemption on vehicle purchases. Additionally, certain localities may have different sales tax rates, so it’s important to research the specific area where the purchase is taking place.

How is sales tax calculated on a leased vehicle in Pennsylvania?

+

For leased vehicles, the sales tax is typically included in the monthly lease payments. The lease agreement will specify the tax rate and how it is calculated. It’s important to carefully review the lease agreement and consult with a tax professional if needed to understand the tax implications of leasing a vehicle.

What documents are required for the title transfer process in Pennsylvania?

+

To complete the title transfer process, buyers typically need to submit a completed title transfer form, proof of insurance, and the applicable fees. It’s important to ensure that all documents are accurate and up-to-date to avoid delays in the transfer process.

Are there any online resources for calculating sales tax on car purchases in Pennsylvania?

+

Yes, there are online calculators and tools available that can help estimate the sales tax on a car purchase in Pennsylvania. These calculators take into account the purchase price, sales tax rate, and any applicable exemptions or discounts. However, it’s always advisable to consult with a tax professional for a precise calculation.