Nyc Paycheck Tax Calculator

Welcome to our comprehensive guide on the NYC Paycheck Tax Calculator, a vital tool for both employers and employees navigating the complex tax landscape of New York City. In this article, we will delve into the intricacies of this calculator, exploring its features, benefits, and real-world applications. As the financial hub of the world, NYC presents unique tax challenges, and understanding these nuances is crucial for accurate payroll management.

Unraveling the Complexity: NYC Paycheck Tax Calculator

The NYC Paycheck Tax Calculator is an innovative solution designed to simplify the process of calculating payroll taxes for businesses operating in the Big Apple. Developed by leading tax experts, this calculator takes into account the city's diverse tax landscape, which includes not only federal and state taxes but also a myriad of local taxes and deductions.

For businesses, especially those new to the NYC market, navigating these complexities can be daunting. The calculator provides a user-friendly interface, allowing employers to input key employee details and receive a precise breakdown of the tax obligations associated with each paycheck. This not only ensures compliance with the city's tax regulations but also streamlines the payroll process, saving time and reducing the risk of errors.

Key Features of the NYC Paycheck Tax Calculator

The NYC Paycheck Tax Calculator offers a range of features that make it an indispensable tool for any business operating in the city:

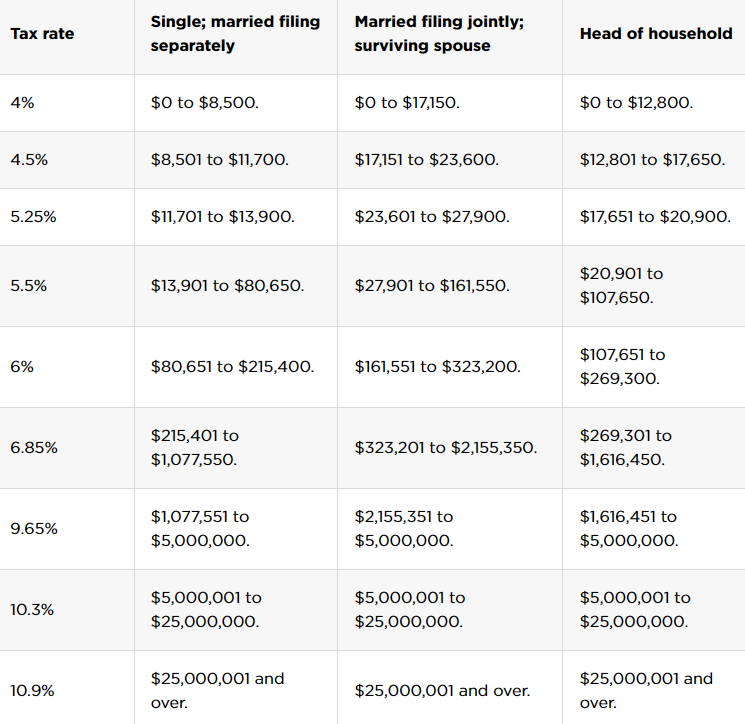

- Accurate Tax Calculations: The calculator considers all applicable taxes, including federal, state, and local income taxes, as well as Social Security and Medicare contributions. It also accounts for various deductions, such as health insurance premiums and retirement plan contributions.

- User-Friendly Interface: With a simple and intuitive design, the calculator guides users through the tax calculation process step by step. It accepts basic employee information, such as salary, filing status, and number of dependents, to provide an accurate tax estimate.

- Real-Time Updates: Tax laws and regulations are subject to change, and the calculator stays up-to-date with the latest modifications. This ensures that businesses receive accurate tax calculations based on the most current tax rates and rules.

- Detailed Reports: After inputting employee data, the calculator generates comprehensive reports. These reports provide a breakdown of the calculated taxes, deductions, and net pay, offering employers a clear understanding of their payroll obligations.

- Compliance Assurance: By using the NYC Paycheck Tax Calculator, businesses can rest assured that they are meeting their tax compliance requirements. This reduces the risk of penalties and ensures a smooth relationship with tax authorities.

Case Study: Streamlining Payroll for a Growing NYC Startup

Consider the example of InnovateNow, a tech startup based in Manhattan. As the company expanded rapidly, its payroll management became increasingly complex. With a diverse workforce, including remote employees across the country, accurately calculating taxes for each employee was a challenge.

The NYC Paycheck Tax Calculator proved to be a game-changer for InnovateNow. By inputting employee details into the calculator, the startup's HR team could quickly generate accurate tax calculations for each employee, regardless of their location. This not only saved time but also reduced the risk of errors, ensuring that InnovateNow remained compliant with NYC's tax regulations.

Furthermore, the calculator's detailed reports allowed the startup to provide transparent and clear payroll information to its employees. This boosted employee satisfaction and trust in the company's payroll processes.

| Feature | Benefit |

|---|---|

| Accurate Tax Calculations | Ensures compliance and prevents penalties |

| User-Friendly Interface | Simplifies tax calculation process for employers |

| Real-Time Updates | Provides up-to-date tax rates and regulations |

| Detailed Reports | Offers transparency and clarity for employees |

Future Implications and Conclusion

As NYC continues to be a global leader in finance and innovation, the importance of tools like the NYC Paycheck Tax Calculator will only grow. With an ever-evolving tax landscape, businesses must stay informed and adapt to changing regulations. The calculator provides a solid foundation for accurate tax calculations, allowing businesses to focus on their core operations while ensuring tax compliance.

In conclusion, the NYC Paycheck Tax Calculator is a powerful resource for employers navigating the complex tax environment of New York City. Its accuracy, ease of use, and real-time updates make it an essential tool for any business, large or small, looking to streamline their payroll processes and maintain compliance with the city's tax regulations.

How often are the tax rates and regulations updated in the calculator?

+

The NYC Paycheck Tax Calculator is updated on a quarterly basis to reflect any changes in tax rates and regulations. However, in the event of significant legislative changes, updates are made immediately to ensure accuracy.

Can the calculator handle complex scenarios, such as multiple jobs or varying pay frequencies?

+

Absolutely! The calculator is designed to accommodate various employment scenarios. It can calculate taxes for employees with multiple jobs, different pay frequencies (weekly, biweekly, monthly), and even handle unique situations like bonus payments or commission-based earnings.

Is the calculator suitable for both small businesses and large enterprises?

+

Yes, the NYC Paycheck Tax Calculator is scalable and suitable for businesses of all sizes. Whether you’re a startup with a handful of employees or a large corporation with thousands of workers, the calculator provides accurate tax calculations tailored to your specific needs.

Can the calculator integrate with existing payroll software?

+

Absolutely! The calculator is designed to integrate seamlessly with popular payroll software solutions. This integration streamlines the payroll process, allowing for a smooth flow of data between the calculator and your payroll system.