Randolph County Tax Department

Welcome to the Randolph County Tax Department's guide, where we aim to provide you with a comprehensive understanding of the tax landscape in this region. Randolph County, nestled in the heart of North Carolina, boasts a vibrant community and a unique tax system. In this article, we will delve into the intricacies of local taxes, exploring the key areas that affect residents, businesses, and property owners. By the end, you'll have a clearer picture of your tax obligations and the resources available to navigate the tax landscape with confidence.

Understanding Randolph County’s Tax Structure

Randolph County’s tax system is designed to support the local government’s operations, infrastructure development, and community initiatives. The tax structure comprises several components, each playing a vital role in funding essential services and maintaining the county’s economic vitality.

Property Taxes: A Key Revenue Source

Property taxes are a significant contributor to Randolph County’s tax revenue. Every property owner within the county is subject to these taxes, which are calculated based on the assessed value of their property. The assessed value is determined by the Randolph County Tax Assessor’s Office, which conducts regular evaluations to ensure fairness and accuracy.

The property tax rate in Randolph County is set annually by the Randolph County Board of Commissioners. This rate is applied to the assessed value of each property to determine the tax liability. The board carefully considers the county's budgetary needs and strives to maintain a balanced approach, ensuring that property taxes remain reasonable while providing adequate funding for essential services.

| Property Type | Average Assessed Value | 2023 Tax Rate |

|---|---|---|

| Residential | $150,000 | 0.76% |

| Commercial | $250,000 | 0.82% |

| Agricultural | $100,000 | 0.68% |

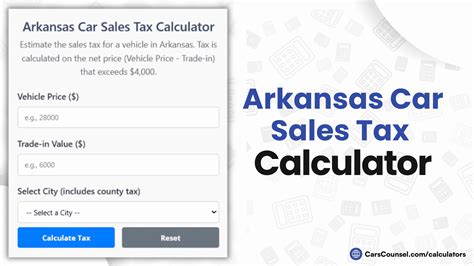

Sales and Use Taxes: Funding Local Projects

In addition to property taxes, Randolph County also levies sales and use taxes on various goods and services. These taxes are collected at the point of sale and contribute to the county’s revenue stream, supporting vital projects and initiatives.

The sales tax rate in Randolph County is currently set at 6.75%, which includes both the state and local sales tax. This rate applies to most tangible personal property and certain services. However, certain items, such as groceries and prescription drugs, are exempt from sales tax to ease the financial burden on residents.

The use tax, on the other hand, is imposed on the storage, use, or consumption of tangible personal property purchased outside Randolph County but used or stored within its borders. This ensures fairness and prevents tax evasion. The use tax rate mirrors the sales tax rate, ensuring consistency.

Tax Resources and Support for Residents and Businesses

Navigating the tax landscape can be complex, but Randolph County offers a range of resources and support to assist residents and businesses in understanding and fulfilling their tax obligations.

The Randolph County Tax Office: Your Local Expert

The Randolph County Tax Office is your go-to resource for all tax-related matters. Located in the heart of Asheboro, the tax office is staffed by experienced professionals dedicated to providing accurate information and personalized assistance.

Their services include:

- Tax Assessment and Valuation: The tax office assesses the value of properties and provides detailed valuation reports, ensuring transparency and fairness.

- Tax Payment Options: They offer various payment methods, including online payments, mail-in payments, and in-person transactions, making it convenient for taxpayers to fulfill their obligations.

- Tax Exemption Applications: Residents and businesses can apply for tax exemptions and credits through the tax office. Staff members guide applicants through the process, ensuring a smooth and efficient experience.

- Tax Appeals and Disputes: If you have concerns about your tax assessment or believe an error has occurred, the tax office provides a fair and impartial appeals process, allowing taxpayers to voice their concerns and seek resolution.

Online Resources: Accessing Information Anytime

In today's digital age, Randolph County recognizes the importance of providing online resources to meet the needs of its tech-savvy residents and businesses. The Randolph County Tax Department's website serves as a comprehensive hub for tax-related information.

Key features of the website include:

- Tax Lookup Tools: Easily search for property tax information, including assessment details, tax rates, and payment due dates, using your property's address or parcel number.

- Online Payment Portal: Make secure tax payments online, anytime, with various payment methods accepted. This convenient option saves time and eliminates the need for physical visits.

- Tax Calendar and Deadlines: Stay organized with a centralized calendar featuring important tax deadlines, ensuring you never miss a payment or filing.

- Tax Forms and Publications: Access a wealth of tax-related forms, guides, and publications, covering various scenarios and providing valuable insights for taxpayers.

Exploring Tax Incentives and Benefits

Randolph County is committed to fostering economic growth and attracting businesses and investors. As such, the county offers a range of tax incentives and benefits to encourage economic development and support local enterprises.

Business Tax Incentives: Supporting Economic Growth

The Randolph County Economic Development Commission plays a pivotal role in attracting new businesses and retaining existing ones. One of their key strategies is offering tax incentives to make Randolph County an attractive destination for entrepreneurs and investors.

These incentives may include:

- Job Creation Tax Credits: Businesses that create a significant number of new jobs in the county may be eligible for tax credits, reducing their tax liability and providing a financial boost.

- Investment Tax Credits: Companies investing in capital improvements or new equipment may qualify for tax credits, encouraging investment and modernization.

- Enterprise Zones: Certain areas within the county are designated as Enterprise Zones, offering reduced tax rates and other benefits to businesses operating within these zones.

Residential Tax Benefits: Encouraging Homeownership

Randolph County also recognizes the importance of homeownership and its impact on the local economy and community. As such, the county provides a range of tax benefits to make owning a home more affordable and attractive.

These benefits include:

- Homestead Exemption: Eligible homeowners can apply for the Homestead Exemption, which reduces the assessed value of their primary residence, resulting in lower property taxes. This incentive aims to make homeownership more financially viable.

- Senior Citizen Tax Deferral: Randolph County offers a unique program allowing senior citizens to defer a portion of their property taxes. This program provides financial relief to older residents, ensuring they can remain in their homes without the burden of rising property taxes.

- Veterans Tax Benefits: Military veterans are entitled to a range of tax benefits, including the Veterans Exemption, which reduces the assessed value of their property. These benefits recognize the service and sacrifices made by veterans.

Future Outlook: A Balanced Approach to Taxation

As Randolph County continues to grow and evolve, its tax system will play a crucial role in shaping the future. The county aims to strike a delicate balance between generating sufficient revenue to support essential services and maintaining a competitive tax environment that attracts residents and businesses.

Looking ahead, key considerations include:

- Sustainable Revenue Sources: The county will explore innovative ways to diversify its revenue streams, ensuring long-term financial stability without overburdening taxpayers.

- Equitable Taxation: Randolph County is committed to maintaining a fair and equitable tax system, ensuring that all taxpayers contribute their fair share based on their ability to pay.

- Economic Development Initiatives: The county will continue to prioritize economic growth, offering incentives and support to businesses, fostering job creation, and driving economic prosperity.

By maintaining a balanced and thoughtful approach to taxation, Randolph County aims to create a vibrant and thriving community, where residents and businesses can prosper and contribute to the county's overall success.

What is the deadline for paying property taxes in Randolph County?

+

Property taxes in Randolph County are due by January 5th each year. However, taxpayers have the option to pay in installments, with the first installment due by January 5th and the second by July 1st.

How can I apply for tax exemptions or credits in Randolph County?

+

To apply for tax exemptions or credits, you can visit the Randolph County Tax Office or access the online application portal on their website. The tax office provides guidance and assistance throughout the application process.

Are there any tax relief programs for low-income residents in Randolph County?

+

Yes, Randolph County offers a Low-Income Tax Relief Program for qualifying residents. This program provides a reduction in property taxes for eligible individuals, making homeownership more affordable. To learn more, contact the Randolph County Tax Office.

How can businesses stay informed about tax incentives and changes in Randolph County?

+

Businesses can stay informed by subscribing to the Randolph County Tax Department’s newsletter, which provides regular updates on tax-related matters. Additionally, attending local business forums and workshops can offer valuable insights into tax incentives and changes.

Is there a tax credit for energy-efficient improvements to my home in Randolph County?

+

Yes, Randolph County offers a Residential Energy Efficiency Tax Credit to encourage homeowners to make energy-efficient upgrades. This credit reduces the assessed value of your property, resulting in lower property taxes. Consult the Randolph County Tax Office for more details.