Tax Form 5695

Welcome to our comprehensive guide on Tax Form 5695, an essential tool for claiming tax credits related to residential energy-efficient improvements. In this article, we'll delve into the details of this form, exploring its purpose, significance, and the steps involved in completing it accurately. Whether you're a homeowner looking to maximize your tax benefits or a tax professional seeking a deeper understanding, this guide will provide you with the insights you need to navigate the world of energy-efficient tax credits.

Understanding the Purpose of Tax Form 5695

Tax Form 5695, officially known as the Residential Energy Credits form, plays a crucial role in the tax landscape, particularly for homeowners who have invested in making their residences more energy-efficient. This form is designed to facilitate the claiming of tax credits for qualified energy-efficient improvements made to existing homes, offering a financial incentive to promote environmentally conscious practices.

The Internal Revenue Service (IRS) introduced this form to encourage homeowners to adopt energy-saving measures, thereby reducing the nation's carbon footprint and promoting sustainable living. By offering tax credits, the government aims to make these improvements more affordable and accessible, ultimately contributing to a greener future.

Key Eligibility Criteria for Form 5695

Not all energy-related home improvements qualify for tax credits. The IRS has established specific criteria to determine which improvements are eligible. Here’s an overview of the key eligibility factors:

- Improvement Type: The IRS maintains a list of approved energy-efficient improvements. These typically include items like insulation, energy-efficient windows, doors, roofs, and certain types of heating and cooling systems.

- Cost and Timing: The cost of the improvement is a critical factor. The IRS sets a minimum expenditure threshold, and the improvement must have been installed during the tax year for which you’re claiming the credit.

- Documentation: Proper documentation is essential. You’ll need to provide receipts, invoices, or other proof of purchase and installation for the qualified improvements.

- Taxpayer Status: Only taxpayers who own and occupy the home as their primary residence can claim the credit. Rental properties and second homes do not qualify.

Completing Tax Form 5695: A Step-by-Step Guide

Now that we understand the purpose and eligibility criteria, let’s dive into the process of completing Tax Form 5695. This section will provide a detailed, step-by-step guide to ensure accuracy and maximize your tax benefits.

Step 1: Gather the Necessary Documentation

Before you begin filling out the form, it’s crucial to have all the required documentation at hand. This includes receipts, invoices, and any other proof of purchase and installation for the qualified energy-efficient improvements. Ensure that these documents are organized and easily accessible to streamline the process.

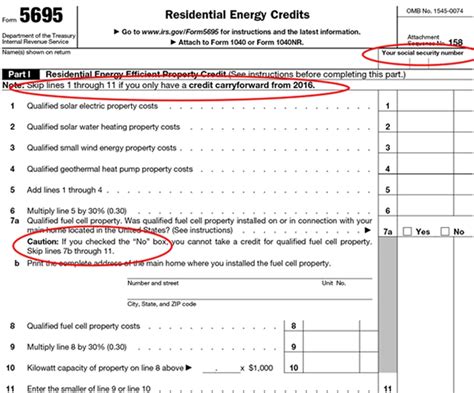

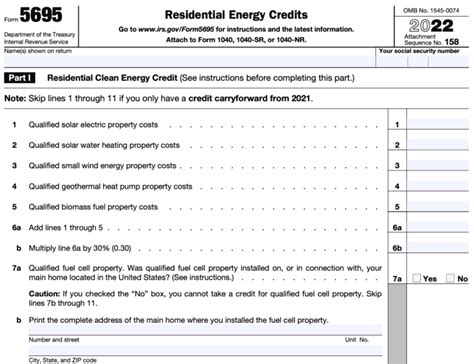

Step 2: Understanding the Form Sections

Tax Form 5695 is divided into several sections, each serving a specific purpose. Here’s a breakdown of the key sections and their significance:

- Identification Information: This section requires basic personal information, including your name, address, and taxpayer identification number. Ensure that this information matches the details on your tax return.

- Energy-Efficient Improvements: Here, you’ll list the qualified energy-efficient improvements made to your home. Provide details such as the type of improvement, the date of installation, and the cost incurred. Ensure accuracy, as this information will be cross-referenced with your documentation.

- Calculating the Credit: This section involves a series of calculations to determine the tax credit amount. The IRS provides specific instructions and formulas to guide you through this process. It’s essential to follow these instructions meticulously to avoid errors.

- Transferring the Credit: Once you’ve calculated the credit, you’ll need to transfer the amount to the appropriate line on your tax return. This step ensures that the credit is correctly applied to your overall tax liability.

Step 3: Calculating the Tax Credit

Calculating the tax credit accurately is a critical aspect of completing Form 5695. The IRS provides a detailed set of instructions and formulas to guide you through this process. Here’s a simplified overview of the calculation process:

- Base Credit Amount: Start by determining the base credit amount for each qualified improvement. This amount is typically a percentage of the cost incurred for the improvement.

- Adjusted Gross Income (AGI) Threshold: The IRS sets an AGI threshold. If your AGI exceeds this threshold, your credit amount may be reduced or phased out. Ensure you understand your AGI and how it affects your credit eligibility.

- Credit Limitations: There are limits to the amount of credit you can claim. The IRS sets an annual maximum credit amount, and you cannot exceed this limit. Additionally, there may be lifetime limits for certain improvements.

- Carryover Credits: If your credit amount exceeds the limitations for the current tax year, you may be able to carry over the remaining credit to future years. Understanding the carryover rules is essential for maximizing your benefits.

Step 4: Filing and Document Retention

Once you’ve completed Form 5695, it’s time to file it with your tax return. Ensure that you attach all supporting documentation, such as receipts and invoices, to your tax package. Retain copies of these documents for your records, as they may be required during an IRS audit.

Maximizing Your Tax Benefits with Form 5695

Tax Form 5695 offers a valuable opportunity to reduce your tax liability and promote sustainable living. To maximize your benefits, consider the following strategies:

Strategic Timing of Improvements

Plan your energy-efficient improvements strategically. The IRS sets specific timelines for claiming credits. Ensure that the improvements are installed within the eligible tax year to qualify for the credit.

Bundle Eligible Improvements

Consider bundling multiple eligible improvements into a single project. This can increase the overall cost and potentially result in a higher tax credit. However, ensure that each improvement meets the eligibility criteria.

Seek Professional Guidance

If you’re unsure about the eligibility of certain improvements or have complex tax situations, consider consulting a tax professional. They can provide tailored advice to maximize your tax benefits while ensuring compliance with IRS regulations.

Future Implications and Policy Considerations

The introduction of Tax Form 5695 and the associated energy-efficient tax credits have had a significant impact on the residential energy sector. These incentives have encouraged homeowners to invest in sustainable practices, leading to a noticeable shift towards energy-efficient homes. As a result, the market for energy-efficient products and services has grown, creating new economic opportunities and contributing to a greener economy.

Looking ahead, the future of energy-efficient tax credits remains a topic of interest and debate. While the current incentives have proven effective, policymakers and environmental advocates continue to discuss potential expansions and modifications to these programs. Some proposed changes include extending the credit timelines, increasing the credit amounts, and broadening the range of eligible improvements.

Furthermore, the integration of emerging technologies, such as smart home systems and renewable energy solutions, presents new opportunities for energy efficiency. As these technologies become more accessible and affordable, they could become integral components of energy-efficient homes, further reducing carbon footprints and driving the transition to a sustainable future.

| Form 5695 Key Details | Information |

|---|---|

| Form Name | Residential Energy Credits |

| Purpose | Claim tax credits for qualified energy-efficient home improvements |

| Eligibility Criteria | Approved improvements, cost thresholds, documentation, primary residence ownership |

| Key Sections | Identification, improvements, credit calculation, transfer to tax return |

| Credit Calculation | Base credit, AGI threshold, credit limitations, carryover rules |

What is the purpose of Tax Form 5695?

+Tax Form 5695, also known as the Residential Energy Credits form, allows taxpayers to claim tax credits for qualified energy-efficient improvements made to their primary residence. It encourages homeowners to invest in sustainable practices and reduces their tax liability.

How do I know if my home improvement qualifies for the credit?

+To qualify, the improvement must be on the IRS’s list of approved energy-efficient items. These include insulation, energy-efficient windows, doors, roofs, and certain heating/cooling systems. The improvement must also meet cost and installation criteria.

Can I claim the credit for a rental property or second home?

+No, the credit is only available for improvements made to a taxpayer’s primary residence. Rental properties and second homes are not eligible for this tax credit.

How do I calculate the tax credit on Form 5695?

+The credit calculation involves determining the base credit amount for each improvement, considering AGI thresholds, credit limitations, and potential carryover credits. The IRS provides detailed instructions for each step.