Madison County Tax

Madison County, nestled in the heart of Iowa, is renowned for its vibrant communities, rich history, and thriving agricultural industry. However, one aspect that often sparks curiosity and prompts questions among residents and business owners alike is the matter of taxation. Understanding the intricacies of Madison County's tax system is crucial for making informed financial decisions and contributing to the local economy effectively.

Demystifying Madison County Taxes: A Comprehensive Guide

Madison County’s tax system is designed to support the county’s infrastructure, public services, and overall development. It encompasses various tax categories, each serving a specific purpose and impacting different aspects of the community. This guide aims to provide a comprehensive overview, shedding light on the different tax types, their applications, and how they shape the financial landscape of Madison County.

Property Taxes: A Cornerstone of Local Funding

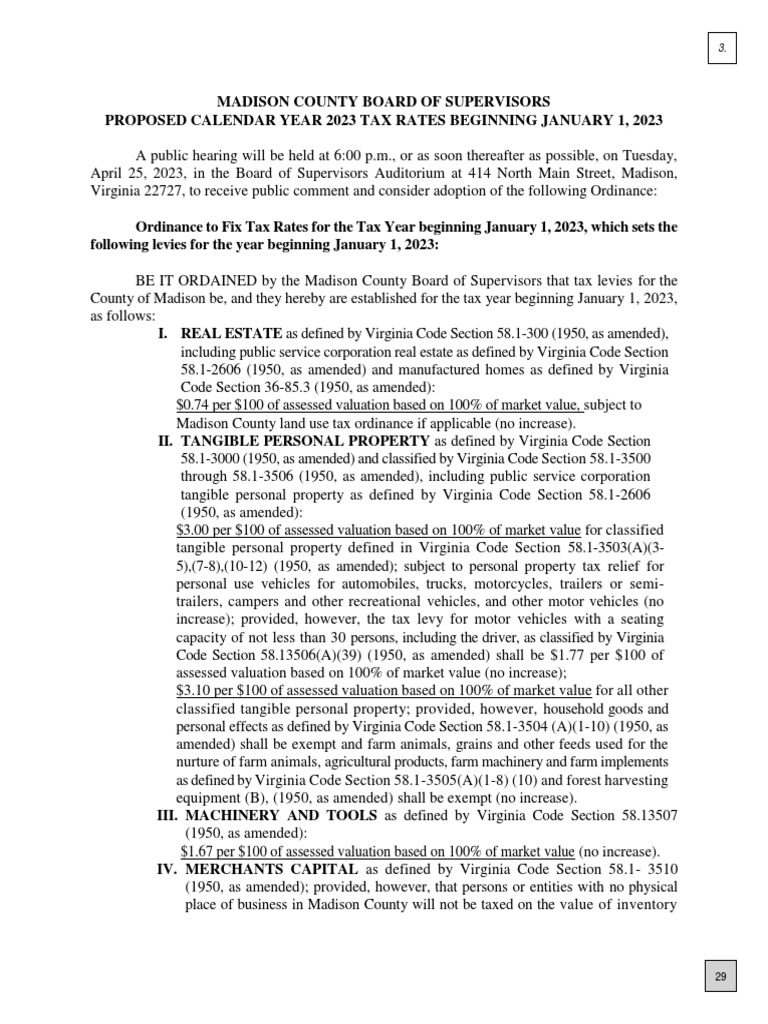

Property taxes form the backbone of Madison County’s revenue stream. These taxes are levied on real estate properties within the county, including residential homes, commercial buildings, and agricultural lands. The assessment process involves evaluating the property’s value, taking into account factors such as location, size, and improvements.

The assessed value of a property is then multiplied by the tax rate, which is determined by the local taxing authorities. This rate varies across different districts within Madison County, reflecting the unique needs and priorities of each community. The resulting tax amount is a vital contribution to the county’s budget, funding essential services like education, public safety, and road maintenance.

| Taxing District | Tax Rate |

|---|---|

| Madison County | 1.25% |

| Winter Set School District | 1.4% |

| Madison Community School District | 1.35% |

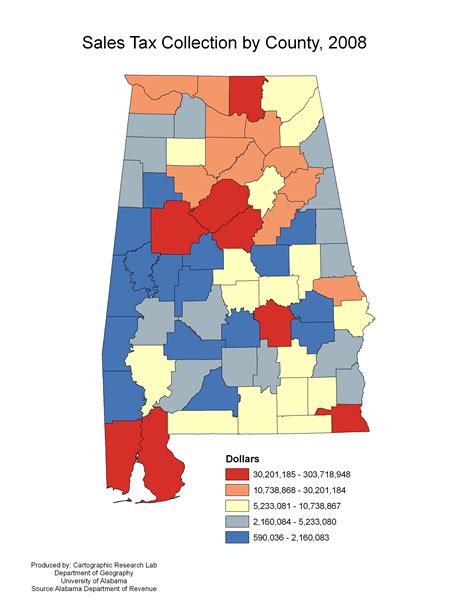

Sales and Use Taxes: Supporting Economic Activities

Sales and use taxes are another significant revenue generator for Madison County. These taxes are applied to the purchase of goods and services within the county, with the responsibility of collection and remittance falling on businesses. The sales tax rate in Madison County is 6%, which is added to the purchase price of most tangible items, including groceries, clothing, and electronics.

Additionally, Madison County imposes a use tax on items purchased outside the county and brought into its jurisdiction. This tax ensures fairness and prevents businesses and individuals from avoiding sales taxes by making purchases elsewhere. The use tax rate mirrors the sales tax rate, ensuring consistency in taxation practices.

| Tax Type | Rate |

|---|---|

| Sales Tax | 6% |

| Use Tax | 6% |

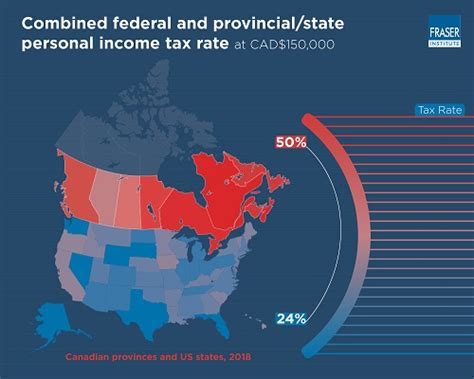

Income Taxes: Individual and Business Contributions

Madison County residents and businesses also contribute through income taxes. Individual income taxes are levied on personal earnings, with rates varying based on income brackets and filing status. These taxes support state and local programs, including education, healthcare, and social services.

For businesses, Madison County offers a range of incentives and tax credits to encourage economic growth and investment. These measures aim to attract new businesses and support existing ones, fostering a vibrant business ecosystem. The specific tax rates and incentives vary depending on the type of business and its location within the county.

| Income Bracket | Tax Rate |

|---|---|

| 0 - 10,000 | 2% |

| 10,001 - 25,000 | 3% |

| 25,001 - 50,000 | 4% |

| Over $50,000 | 5% |

Special Taxes and Assessments: Targeted Funding

In addition to the standard tax categories, Madison County utilizes special taxes and assessments to fund specific projects and initiatives. These targeted taxes are often implemented to address unique community needs or to support infrastructure development in specific areas.

For instance, the county may levy a special assessment on properties within a designated improvement district to fund infrastructure upgrades like street repairs or utility enhancements. These assessments are based on the benefits received by the properties and are calculated accordingly.

| Special Assessment District | Assessment Rate |

|---|---|

| Downtown Revitalization District | 0.5% |

| Riverfront Development District | 0.75% |

Tax Incentives and Exemptions: Encouraging Growth

Madison County recognizes the importance of attracting and retaining businesses, and thus offers a range of tax incentives and exemptions to promote economic growth. These incentives can take various forms, such as tax credits, abatements, or deferrals, depending on the nature of the business and its contribution to the local economy.

For example, businesses that create a significant number of jobs or invest in environmentally sustainable practices may be eligible for tax credits. Similarly, certain industries, such as manufacturing or renewable energy, may benefit from tax abatements or exemptions to encourage their presence in the county.

| Incentive Program | Eligibility Criteria |

|---|---|

| Job Creation Tax Credit | Creating 20+ new full-time jobs |

| Renewable Energy Tax Abatement | Investing in renewable energy infrastructure |

| Manufacturing Property Tax Exemption | Manufacturing businesses with a significant local presence |

Tax Payment and Compliance: A Shared Responsibility

Ensuring tax compliance is a shared responsibility between taxpayers and the Madison County tax authorities. Property owners, businesses, and individuals are expected to accurately report their taxable activities and pay their respective taxes on time. The county provides clear guidelines and resources to assist taxpayers in understanding their obligations and meeting compliance requirements.

Late payments or non-compliance can result in penalties and interest charges, which further impact the taxpayer’s financial well-being. Therefore, staying informed about tax due dates, understanding the tax payment process, and seeking professional advice when needed are essential steps toward maintaining compliance and avoiding unnecessary financial burdens.

Conclusion: Navigating Madison County’s Tax Landscape

Madison County’s tax system is a complex yet essential component of its financial framework, supporting the county’s growth, development, and community well-being. By understanding the various tax types, their applications, and the benefits they bring, residents and businesses can actively contribute to the local economy and ensure the continued prosperity of Madison County.

Stay informed, seek professional guidance when needed, and embrace your role as a responsible taxpayer. Together, we can navigate the tax landscape with confidence, fostering a vibrant and thriving community for all.

What is the tax rate for property taxes in Madison County, Iowa?

+

The tax rate for property taxes in Madison County, Iowa, varies depending on the taxing district. The county itself has a tax rate of 1.25%, while school districts like Winter Set and Madison Community School District have rates of 1.4% and 1.35%, respectively. These rates are applied to the assessed value of properties within the respective districts.

Are there any sales tax exemptions in Madison County, Iowa?

+

Yes, there are certain sales tax exemptions in Madison County, Iowa. These exemptions typically apply to specific items or services, such as groceries, prescription medications, and some agricultural purchases. It’s important to consult the Iowa Department of Revenue for a comprehensive list of exempt items and to stay updated on any changes in sales tax regulations.

How can I estimate my property taxes in Madison County, Iowa?

+

To estimate your property taxes in Madison County, Iowa, you can use the county’s online property tax estimator. This tool allows you to input your property’s assessed value and applicable tax rates to get an estimate of your annual property tax liability. Alternatively, you can contact the Madison County Assessor’s Office for assistance in calculating your property taxes.

Are there any tax incentives for renewable energy projects in Madison County, Iowa?

+

Yes, Madison County, Iowa, offers tax incentives for renewable energy projects. These incentives aim to promote the development and adoption of clean energy technologies. The specific incentives may include tax credits, abatements, or exemptions, and they typically apply to projects such as solar panel installations, wind turbines, and other renewable energy systems. It’s advisable to consult with the Madison County Assessor’s Office or the Iowa Economic Development Authority for more detailed information on these incentives.

What is the due date for property tax payments in Madison County, Iowa?

+

The due date for property tax payments in Madison County, Iowa, typically falls in the late summer or early fall. It’s essential to check with the Madison County Treasurer’s Office for the exact due date, as it may vary slightly from year to year. Timely payment of property taxes is crucial to avoid penalties and interest charges.