Collin County Property Tax

Property taxes are an essential component of the financial landscape in Collin County, Texas, impacting homeowners, businesses, and the local economy. Understanding the intricacies of Collin County property taxes is crucial for residents and investors alike. This comprehensive guide aims to delve into the specifics of Collin County's property tax system, providing valuable insights and practical information for all stakeholders.

The Fundamentals of Collin County Property Taxes

Collin County, located in the vibrant region of North Texas, is renowned for its thriving economy, diverse communities, and exceptional quality of life. However, alongside these advantages comes the responsibility of property taxes, which play a pivotal role in funding essential services and infrastructure.

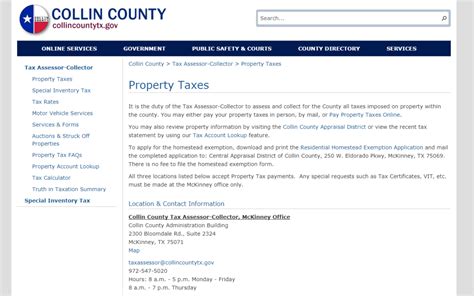

Property taxes in Collin County are primarily determined by the appraised value of the property, which is assessed by the Collin Central Appraisal District (CCAD). The CCAD is responsible for conducting annual appraisals to ensure that property values are accurately reflected in the tax calculations. This process ensures fairness and consistency across the county.

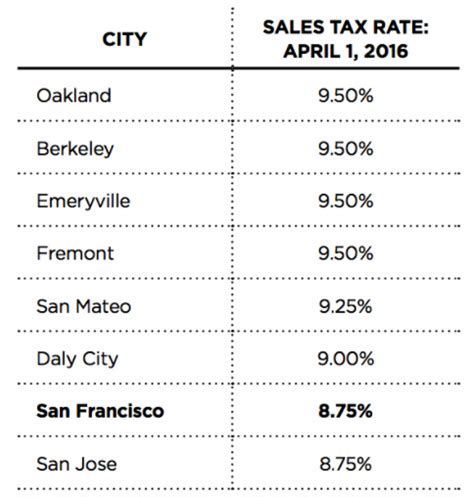

The tax rate, on the other hand, is established by various taxing entities within the county, including the county government, cities, school districts, and special districts. These entities set their respective tax rates to generate revenue for specific purposes, such as education, infrastructure development, and public safety.

To illustrate, let's consider an example property in Plano, one of Collin County's largest cities. Assume this property has an appraised value of $500,000. The tax rate for this property would be the sum of the rates set by the county, the city of Plano, and the Plano Independent School District. This combined tax rate would then be applied to the appraised value to determine the total property tax liability.

| Taxing Entity | Tax Rate (per $100 of appraised value) |

|---|---|

| Collin County | 0.4223 |

| City of Plano | 0.5250 |

| Plano ISD | 1.4499 |

| Total Tax Rate | 2.3972 |

In this scenario, the property owner would owe $2.3972 for every $100 of their property's appraised value. Multiplying this rate by the property's appraised value of $500,000, the total property tax liability would amount to $11,986.

The Property Tax Lifecycle: A Step-by-Step Guide

The property tax process in Collin County follows a well-defined timeline, ensuring transparency and efficiency. Here’s a breakdown of the key stages:

- Appraisal: The CCAD conducts appraisals of all properties within the county annually. Property owners receive a notice of appraised value, allowing them to review and, if necessary, appeal the assessment.

- Protests and Appeals: Property owners have the right to protest their appraised value if they believe it is inaccurate. The CCAD provides a formal process for protests, which can be filed online or in person. Appeals can be made to an independent appraisal review board.

- Tax Rate Adoption: Taxing entities, such as cities and school districts, hold public hearings to propose and adopt their tax rates. These hearings provide an opportunity for community members to voice their opinions and understand the proposed tax rates.

- Tax Bills: Once the appraised values and tax rates are finalized, property owners receive their tax bills. These bills outline the total tax liability, payment due dates, and payment options.

- Payment Options: Collin County offers various payment methods, including online payments, in-person payments at tax offices, and payment by mail. Property owners can choose the most convenient option for them.

- Delinquency and Penalties: Failure to pay property taxes by the due date can result in penalties and interest. It's crucial for property owners to stay informed about payment deadlines to avoid additional costs.

Strategies for Effective Property Tax Management

Navigating the complexities of property taxes in Collin County requires a strategic approach. Here are some key strategies and insights to help property owners and investors:

Stay Informed and Engage with the Community

Property taxes are a public matter, and staying informed about proposed tax rates and community discussions is essential. Attend public hearings, engage with local government representatives, and participate in community forums to understand the tax landscape and voice your concerns.

Understand the Appraisal Process

The appraisal process is a critical component of property tax calculations. Familiarize yourself with the CCAD’s appraisal methods, including market value analysis and income approaches. Understanding how your property’s value is determined can help you identify potential discrepancies and ensure accuracy.

Exercise Your Right to Protest

If you believe your property’s appraised value is inaccurate or unfair, you have the right to protest. The CCAD provides clear guidelines and assistance for filing protests. It’s important to gather supporting evidence, such as recent sales data or expert appraisals, to strengthen your case.

Explore Tax Incentives and Exemptions

Collin County offers various tax incentives and exemptions to eligible property owners. These can include homestead exemptions, which reduce the taxable value of a primary residence, and exemptions for seniors, veterans, and disabled individuals. Understanding these incentives can significantly reduce your tax liability.

Optimize Your Property’s Value

While it’s important to ensure an accurate appraisal, optimizing your property’s value can also impact your tax liability. Investing in improvements, such as energy-efficient upgrades or landscaping enhancements, can increase your property’s market value and potentially offset tax increases.

Consider Alternative Payment Options

Collin County provides flexible payment options, including installment plans and online payment portals. Exploring these options can help manage cash flow and make property tax payments more manageable, especially for large commercial properties or high-value residential properties.

Seek Professional Guidance

Navigating the intricacies of property taxes can be complex, especially for large commercial properties or those with unique circumstances. Engaging the services of a qualified tax professional or accountant can provide valuable insights and ensure compliance with tax regulations.

The Impact of Property Taxes on Collin County’s Economy

Property taxes are a significant revenue stream for Collin County, funding essential services and infrastructure development. The funds generated through property taxes contribute to the county’s overall economic vitality and sustainability.

By investing in high-quality schools, maintaining well-maintained roads and public spaces, and supporting public safety initiatives, Collin County creates an attractive environment for businesses and residents. This, in turn, fosters economic growth, job creation, and a thriving community.

However, it's crucial to strike a balance between tax revenue generation and maintaining a competitive tax environment. Collin County's leaders and community members must work together to ensure that property taxes remain fair, predictable, and aligned with the county's long-term economic goals.

Future Outlook and Potential Reforms

As Collin County continues to grow and evolve, the property tax system may undergo reforms to address emerging challenges and opportunities. Here are some potential areas of focus for future improvements:

Streamlined Appraisal Process

Efforts to streamline the appraisal process, improve data accuracy, and enhance transparency can reduce administrative burdens and ensure a more efficient system. Implementing advanced technology and data analytics can contribute to more precise appraisals and reduced errors.

Enhanced Taxpayer Education

Providing comprehensive education and resources to property owners about their rights, responsibilities, and the tax process can empower taxpayers and reduce confusion. This includes clear communication about tax rates, payment deadlines, and available exemptions.

Equitable Tax Burden Distribution

Ensuring that the tax burden is distributed fairly across different property types and income levels is essential for maintaining a healthy tax environment. Exploring options such as reassessing tax rates or implementing targeted incentives can help achieve a more equitable distribution.

Sustainable Revenue Generation

As Collin County’s population and economy continue to grow, finding sustainable revenue sources beyond property taxes becomes increasingly important. Diversifying the tax base through economic development initiatives and exploring alternative revenue streams can reduce the reliance on property taxes.

Collaborative Community Engagement

Engaging the community in discussions about property taxes and their impact on the local economy fosters a sense of ownership and collaboration. Encouraging open dialogue, hosting town hall meetings, and seeking input from diverse stakeholders can lead to more informed decision-making.

Conclusion

Collin County’s property tax system is a complex yet essential component of the local economy. By understanding the fundamentals, engaging with the community, and implementing strategic tax management practices, property owners and investors can navigate the tax landscape effectively. As the county continues to thrive, ongoing reforms and community involvement will be vital to ensuring a sustainable and equitable tax environment.

What is the role of the Collin Central Appraisal District (CCAD)?

+The CCAD is responsible for conducting annual appraisals of properties within Collin County to determine their market value. This value is then used as the basis for calculating property taxes.

How can I protest my property’s appraised value?

+Property owners can protest their appraised value by following the CCAD’s protest guidelines. This typically involves submitting a written protest with supporting evidence, such as recent sales data or expert appraisals.

What are the payment options for Collin County property taxes?

+Collin County offers various payment options, including online payments through the tax office website, in-person payments at tax offices, and payment by mail. Property owners can choose the most convenient option for them.

Are there any tax incentives or exemptions available in Collin County?

+Yes, Collin County offers several tax incentives and exemptions. These include homestead exemptions, which reduce the taxable value of a primary residence, and exemptions for seniors, veterans, and disabled individuals. It’s important to research and understand the eligibility criteria for these incentives.

How can I stay informed about proposed tax rates and community discussions?

+Staying informed is crucial. Attend public hearings and community forums, follow local news sources, and engage with local government representatives. These channels provide valuable insights into proposed tax rates and community discussions.