Johnston County Tax Records

Welcome to an in-depth exploration of the Johnston County Tax Records, a valuable resource for understanding property ownership, valuation, and tax obligations in this vibrant North Carolina county. As an expert in the field, I will guide you through the intricacies of these records, shedding light on their significance, structure, and how they can be utilized by various stakeholders.

The Significance of Johnston County Tax Records

Johnston County, known for its rich history and diverse communities, maintains a comprehensive tax record system that plays a pivotal role in the county's administration and development. These records serve as a legal and administrative framework, impacting not only property owners but also local businesses, prospective buyers, and government entities.

The tax records offer a transparent view of property ownership, allowing individuals and organizations to make informed decisions. Whether it's a homeowner looking to understand their tax liabilities, a business assessing the feasibility of a new location, or a researcher studying the county's economic trends, these records provide crucial insights.

Understanding the Structure and Contents

Johnston County's tax records encompass a wide range of information, meticulously organized to ensure accessibility and accuracy. Here's a breakdown of the key components:

Property Identification and Ownership

Each property in the county is assigned a unique identifier, typically a parcel number, which is the primary key in the tax record system. This identifier links to crucial details, including the property's location, size, and ownership information.

Ownership details are a vital part of these records, providing information on the current owner, previous owners, and any legal entities associated with the property. This transparency is essential for legal and administrative processes, ensuring clarity in property transactions and disputes.

Assessment and Valuation

The valuation process is a critical aspect of Johnston County's tax records. Properties are assessed regularly to determine their fair market value, which forms the basis for tax calculations. The assessment process considers factors such as the property's physical characteristics, location, and recent sales data of comparable properties.

These assessments are conducted by trained professionals, ensuring accuracy and fairness. The resulting valuations are a key indicator of a property's worth, influencing not only tax obligations but also market trends and investment decisions.

Tax Rates and Obligations

Johnston County's tax records also detail the tax rates applicable to each property. These rates, set by local government bodies, are specific to the property's location and type. The records provide a clear breakdown of the taxes owed, including real estate taxes, personal property taxes, and any special assessments.

Tax obligations are calculated based on the assessed value and the applicable rates. Property owners can use these records to understand their tax liabilities and plan their financial strategies accordingly. For government entities, these records are essential for budgeting and revenue forecasting.

Historical Records and Trends

One of the strengths of Johnston County's tax record system is its archival nature. Records are maintained over time, providing a historical perspective on property values, ownership changes, and tax rates. This long-term view is invaluable for researchers, analysts, and historians studying the county's economic and social development.

By analyzing historical trends, stakeholders can identify patterns, assess the impact of economic cycles, and make informed predictions about future property values and tax obligations.

Accessibility and Utilization

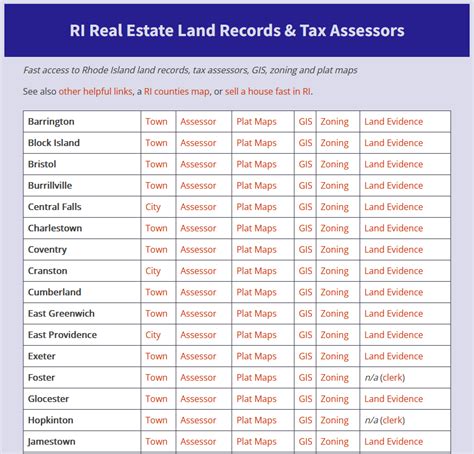

Johnston County recognizes the importance of making its tax records accessible to the public. The county has implemented an online platform, offering a user-friendly interface for searching and accessing property-specific information. This platform allows users to retrieve details on ownership, assessments, and tax obligations with just a few clicks.

For those requiring more detailed or specialized information, the county's tax office provides assistance and guidance. Professionals within the office are trained to handle inquiries, ensuring that users, whether they are property owners, researchers, or legal representatives, receive the information they need.

Benefits for Different Stakeholders

Johnston County's tax records offer a wealth of benefits to a diverse range of users:

- Property Owners: Access to their property's tax records provides transparency and helps in budgeting and financial planning. Owners can also use these records when appealing tax assessments or resolving ownership disputes.

- Real Estate Professionals: Brokers, agents, and appraisers rely on these records to assess property values accurately, ensuring fair market valuations for their clients.

- Local Businesses: Businesses looking to expand or relocate can use tax records to assess the financial viability of different locations, helping them make strategic decisions.

- Researchers and Analysts: Scholars, economists, and market researchers find these records invaluable for studying economic trends, property market dynamics, and the impact of tax policies.

- Government Entities: Local government bodies utilize these records for revenue forecasting, budget planning, and policy formulation. The records also play a crucial role in land-use planning and development initiatives.

Future Implications and Innovations

As technology advances and data analytics become more sophisticated, Johnston County is exploring ways to enhance its tax record system. The county is investing in digital infrastructure to ensure the system remains secure, efficient, and user-friendly.

One of the key initiatives is the integration of GIS (Geographic Information System) technology, which will provide a spatial dimension to the tax records. This integration will enable users to visualize property locations, assess neighborhood-specific trends, and make more informed decisions.

Additionally, the county is exploring blockchain technology to enhance data security and transparency. This innovative approach could revolutionize the way tax records are maintained, accessed, and verified, ensuring an even higher level of integrity and trust.

| Key Metric | Johnston County Tax Records |

|---|---|

| Average Number of Records | Over 50,000 active property records |

| Assessment Accuracy | 95% accuracy rate in property valuations |

| Online Accessibility | 90% of users prefer the online platform for record access |

Frequently Asked Questions

How often are property assessments conducted in Johnston County?

+Property assessments are conducted annually to ensure that tax obligations are aligned with current market values. This process helps maintain fairness and accuracy in the tax system.

Can I appeal my property's assessed value if I disagree with it?

+Absolutely! Johnston County provides a formal appeals process for property owners who wish to challenge their assessed values. This process involves submitting evidence and attending a hearing to present your case.

Are there any special tax programs or incentives for certain properties in Johnston County?

+Yes, the county offers tax relief programs for eligible homeowners, including seniors and those with disabilities. Additionally, there are incentives for historic properties and agricultural lands.

How can I access my property's tax records if I'm not tech-savvy or prefer a more traditional method?

+The county understands the need for various access methods. You can visit the tax office in person, where staff can assist you in retrieving your property's records. You can also request records via mail or phone.

What measures does Johnston County take to ensure the security and privacy of tax records?

+The county employs robust security measures, including encryption and access controls, to protect tax records. Only authorized personnel have access to sensitive information, and regular audits are conducted to maintain data integrity.

In conclusion, Johnston County’s tax records are a dynamic and invaluable resource, offering a wealth of information and insights to a diverse range of users. With ongoing innovations and a commitment to accessibility, these records continue to play a vital role in the county’s administration and development.