Tulsa Sales Tax

Sales tax is an essential component of the revenue system in the United States, with each state and, in some cases, local jurisdictions, implementing their own sales tax regulations. In the city of Tulsa, Oklahoma, sales tax is a crucial aspect of the city's economic landscape, impacting both businesses and consumers. This article delves into the intricacies of Tulsa's sales tax system, exploring its rates, applicability, and the unique features that make it distinct from other sales tax structures across the nation.

Understanding Tulsa’s Sales Tax Structure

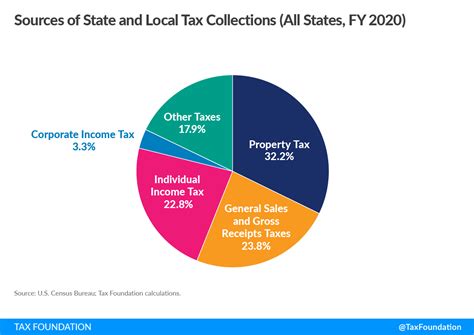

Tulsa, like many other cities in Oklahoma, operates under a complex sales tax system that consists of several layers of taxation. The sales tax rate in Tulsa is influenced by a combination of state, county, and city taxes, each with its own unique purpose and rate.

At the state level, Oklahoma imposes a uniform sales tax rate across the state. This rate is applied to most retail sales and is a significant contributor to the state's overall revenue. In Tulsa, this state sales tax is combined with additional taxes levied by Tulsa County and the city of Tulsa itself.

Tulsa County adds its own sales tax to the state rate, creating a cumulative tax burden on consumers. This county-level tax is often used to fund specific initiatives or infrastructure projects within the county.

The city of Tulsa also imposes its own sales tax, which is dedicated to supporting city operations and development projects. This city-level tax is an essential source of revenue for the city's budget, covering a range of services and amenities enjoyed by Tulsa residents and businesses.

Rates and Applicability

As of [most recent update date], the combined sales tax rate in Tulsa stands at [percentage]%. This rate is broken down as follows:

| Taxing Authority | Sales Tax Rate |

|---|---|

| State of Oklahoma | [State rate]% |

| Tulsa County | [County rate]% |

| City of Tulsa | [City rate]% |

| Total | [Total rate]% |

It's important to note that these rates are subject to change, and it is the responsibility of businesses and consumers to stay informed about the most current tax rates. Changes in tax rates can occur due to various factors, including legislative decisions and budgetary needs.

Exemptions and Special Considerations

While most retail sales in Tulsa are subject to the combined sales tax rate, there are certain exemptions and special considerations to be aware of. Some common examples include:

- Food for home consumption is generally exempt from sales tax in Oklahoma, but prepared food and restaurant meals are taxable.

- Prescription drugs and certain medical devices are exempt from sales tax.

- Textbooks and educational materials are often exempt, promoting accessibility to education.

- Certain manufacturing and agricultural sales may be subject to different tax rates or exemptions.

Businesses operating in Tulsa must navigate these exemptions carefully to ensure compliance with the law and avoid penalties.

Impact on Businesses and Consumers

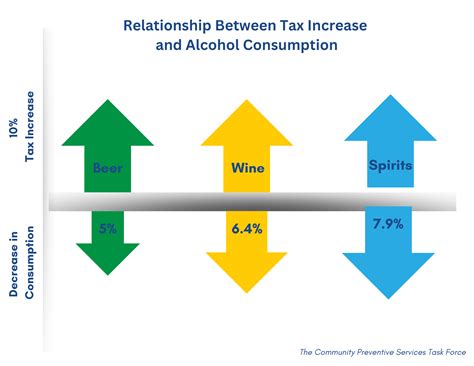

The sales tax structure in Tulsa has a profound impact on both businesses and consumers. For businesses, the sales tax is a significant factor in their pricing strategies and overall profitability. Businesses must factor in the sales tax when setting retail prices, ensuring that they remain competitive while also covering their costs and generating a profit.

From a consumer perspective, the sales tax adds to the overall cost of goods and services. Consumers in Tulsa must consider the sales tax rate when making purchasing decisions, especially for big-ticket items. The cumulative effect of state, county, and city taxes can significantly impact the final price paid by consumers.

Compliance and Collection

Compliance with sales tax regulations is a critical aspect of doing business in Tulsa. Businesses are responsible for collecting and remitting sales tax to the appropriate taxing authorities. This process involves accurate record-keeping, proper tax calculation, and timely submission of tax returns.

Failure to comply with sales tax regulations can result in significant penalties and legal consequences for businesses. The Oklahoma Tax Commission and local authorities take a proactive approach to ensuring tax compliance, conducting audits and investigations when necessary.

E-Commerce and Remote Sales

With the rise of e-commerce, the sales tax landscape has become increasingly complex. Tulsa, like many other jurisdictions, has had to adapt its sales tax regulations to accommodate remote sales and online businesses. This includes the implementation of rules governing the collection of sales tax on online transactions and the determination of nexus, which establishes a business’s obligation to collect and remit sales tax.

Businesses engaged in e-commerce must navigate these complexities to ensure they are in compliance with Tulsa's sales tax regulations, even if they do not have a physical presence in the city.

The Future of Tulsa’s Sales Tax

As Tulsa continues to grow and evolve, its sales tax structure is likely to undergo changes and adaptations. Economic trends, legislative decisions, and budgetary needs can all influence the future of Tulsa’s sales tax.

One potential area of development is the exploration of tax incentives and credits to promote economic growth and attract businesses. Tulsa may also consider implementing tax reforms to simplify the sales tax system, making it more efficient and easier for businesses and consumers to understand.

Additionally, the continued growth of e-commerce and the digital economy will likely shape the future of Tulsa's sales tax regulations, with a focus on ensuring fair and equitable taxation for online businesses and consumers alike.

Frequently Asked Questions

How often do sales tax rates change in Tulsa?

+Sales tax rates in Tulsa can change periodically, often as a result of legislative decisions or budgetary needs. It is advisable to check for updates regularly, as changes can occur annually or even more frequently.

Are there any special tax holidays in Tulsa?

+Yes, Tulsa, like some other cities, may observe special tax holidays where certain types of purchases are exempt from sales tax for a limited time. These holidays are often tied to specific events or seasons and can provide an opportunity for consumers to save on taxes.

How do I know if my business is required to collect sales tax in Tulsa?

+Businesses are generally required to collect sales tax if they have a physical presence in Tulsa or if they meet certain economic nexus thresholds. It is recommended to consult with a tax professional or refer to the guidelines provided by the Oklahoma Tax Commission to determine your business’s specific obligations.