How Is Interest Income Taxed

Interest income, derived from various financial instruments and investments, is an important source of revenue for many individuals and businesses. Understanding how interest income is taxed is crucial for effective financial planning and compliance with tax regulations. In this comprehensive guide, we delve into the intricacies of interest income taxation, exploring the different types of interest, applicable tax rates, and strategies to optimize your financial strategies while adhering to tax obligations.

The Nature of Interest Income

Interest income refers to the earnings generated from lending money or investing in interest-bearing assets. It is a key component of personal finance and plays a significant role in wealth accumulation. Interest can be earned from a diverse range of sources, including:

- Savings Accounts: Traditional savings accounts offered by banks often pay interest on deposited funds.

- Certificates of Deposit (CDs): These are time-bound savings accounts that offer higher interest rates in exchange for a fixed term.

- Bonds: When an individual invests in bonds, they essentially lend money to the issuer, receiving interest payments over the bond's life.

- Peer-to-Peer Lending: Platforms that facilitate lending between individuals can generate interest income for investors.

- Dividend-Paying Stocks: While not traditional interest, dividends on stocks can be considered a form of income.

The taxation of interest income varies depending on the source and the tax jurisdiction. Let's explore the key aspects of interest income taxation in greater detail.

Taxation of Interest Income in the United States

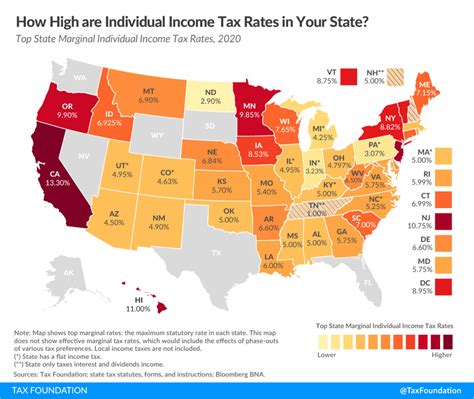

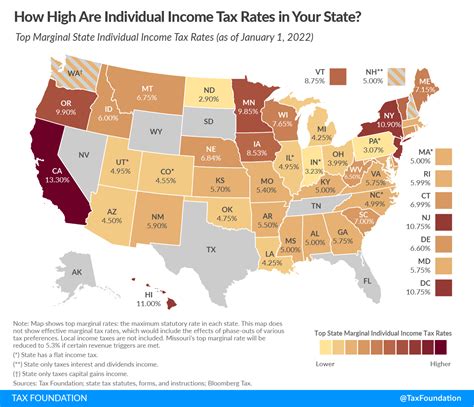

In the United States, interest income is generally subject to federal income tax. However, the tax treatment can differ based on the type of interest and the tax status of the recipient.

Interest from Bank Accounts and CDs

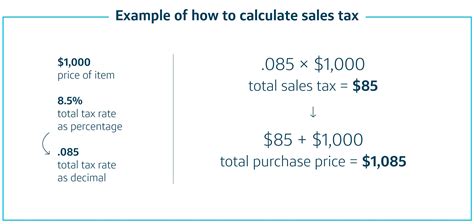

Interest earned from savings accounts and CDs is typically considered ordinary income. This means it is taxed at the recipient’s regular income tax rate, which can vary based on their overall taxable income and filing status.

| Tax Bracket | Tax Rate |

|---|---|

| 10% | 10% |

| 12% | 12% |

| 22% | 22% |

| 24% | 24% |

| ... | ... |

| 37% | 37% |

For example, if an individual falls into the 22% tax bracket, any interest income from their savings account would be taxed at 22%.

Interest from Municipal Bonds

Interest earned from municipal bonds, also known as “muni bonds,” is often exempt from federal income tax. This is because the interest is considered a return of capital, and thus, not subject to taxation. However, it’s important to note that interest from municipal bonds may still be subject to state and local taxes.

Interest from Corporate Bonds

Interest from corporate bonds is generally taxed as ordinary income at the recipient’s regular income tax rate. However, the specific tax treatment can depend on various factors, such as the bond’s maturity, the issuer’s financial health, and the tax status of the bondholder.

Interest from Peer-to-Peer Lending

Interest earned through peer-to-peer lending platforms is typically treated as ordinary income and taxed accordingly. Lenders should report this income on their tax returns and ensure they comply with relevant tax laws.

Dividends from Stocks

Dividends from stocks are not considered interest income in the traditional sense, but they are a form of investment income. The tax treatment of dividends can vary based on the holding period of the stock and the type of dividend. Qualified dividends, held for a minimum period, are taxed at lower capital gains rates, while ordinary dividends are taxed as ordinary income.

Strategies for Optimizing Interest Income Taxation

Understanding the tax implications of interest income can help individuals and businesses optimize their financial strategies. Here are some strategies to consider:

- Tax-Efficient Investing: Explore tax-exempt investments, such as municipal bonds, to reduce your overall tax liability.

- Tax-Advantaged Accounts: Consider utilizing tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k) plans, which offer tax benefits for certain types of investments.

- Diversification: Diversifying your investment portfolio can help spread out your tax liability and potentially reduce the impact of taxation on your overall returns.

- Tax Loss Harvesting: If you have losses from certain investments, you can use them to offset gains and reduce your tax liability. This strategy can be particularly effective when combined with a well-diversified portfolio.

Tax Treatment of Interest Income Abroad

The taxation of interest income can vary significantly across different countries. Some key considerations when dealing with international interest income include:

- Withholding Taxes: Many countries impose withholding taxes on interest payments made to non-residents. This means a portion of the interest income is withheld by the payer and remitted to the tax authority.

- Tax Treaties: Tax treaties between countries can provide relief from double taxation, ensuring that interest income is not taxed twice.

- Foreign Tax Credits: If you pay taxes on your interest income in a foreign country, you may be eligible for foreign tax credits, which can reduce your tax liability in your home country.

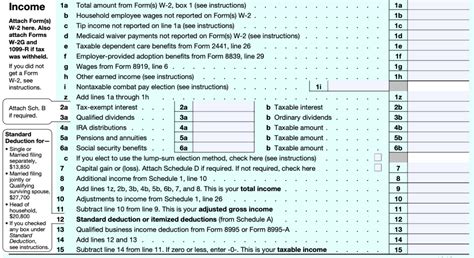

Reporting Interest Income on Tax Returns

Properly reporting interest income on your tax returns is essential to avoid penalties and ensure compliance with tax laws. Here are some key points to consider:

- Banks and financial institutions are required to report interest income over a certain threshold to the Internal Revenue Service (IRS) and issue Form 1099-INT to the account holder.

- You must include all interest income, regardless of amount, on your tax return. Failure to report interest income can result in penalties and interest charges.

- Use the appropriate tax forms, such as Form 1040 or Schedule B (for interest and dividend income), to report your interest income accurately.

Future Implications and Tax Reform

The taxation of interest income is subject to change as tax laws evolve. Recent tax reforms, such as the Tax Cuts and Jobs Act (TCJA) in the United States, have brought about significant changes to tax rates and brackets. It’s essential to stay updated with the latest tax legislation to ensure you are optimizing your financial strategies effectively.

Additionally, the ongoing debate surrounding tax policy and the potential for further reforms can impact the taxation of interest income. Keeping a close eye on legislative developments is crucial for long-term financial planning.

Conclusion

Interest income is an integral part of personal finance and wealth management. By understanding the tax implications associated with different types of interest, individuals and businesses can make informed decisions to optimize their financial strategies while remaining compliant with tax regulations. Remember, tax laws can be complex, so consulting with a tax professional is always recommended to ensure you are navigating the tax landscape effectively.

Is all interest income taxed the same way?

+No, the tax treatment of interest income can vary based on the source and the tax jurisdiction. For example, interest from municipal bonds is often tax-exempt at the federal level, while interest from savings accounts is taxed as ordinary income.

How do I report interest income on my tax return?

+You must report all interest income on your tax return, regardless of amount. Use the appropriate tax forms, such as Form 1040 or Schedule B, to accurately report your interest income. Banks and financial institutions will provide you with Form 1099-INT, which details your interest income for the tax year.

Are there any tax advantages to investing in municipal bonds?

+Yes, investing in municipal bonds can offer tax advantages. Interest earned from municipal bonds is often exempt from federal income tax, and in some cases, it may also be exempt from state and local taxes. This makes municipal bonds an attractive option for tax-efficient investing.