Sales Tax La County

Sales tax in Los Angeles County is an essential topic for both businesses and consumers alike. Understanding the sales tax structure, rates, and regulations is crucial for accurate pricing, budgeting, and compliance with local laws. In this comprehensive guide, we will delve into the intricacies of sales tax in LA County, exploring its impact on various industries, providing practical tips for businesses, and shedding light on the revenue implications for the county.

The Sales Tax Landscape in LA County

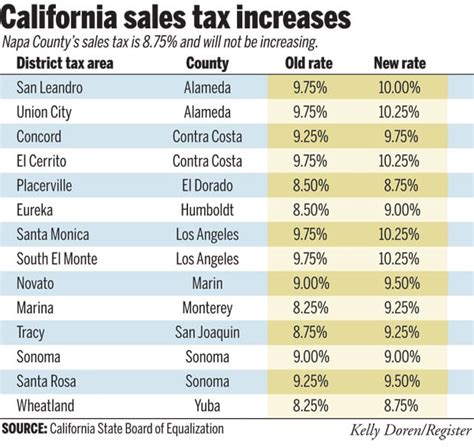

Sales tax in Los Angeles County is a complex system, influenced by a combination of state, county, and city-specific regulations. As one of the largest counties in the United States, LA County boasts a diverse economy, ranging from entertainment and tourism to manufacturing and technology. This diversity translates to varying sales tax rates and requirements across different sectors.

State Sales Tax

The foundation of sales tax in California is established at the state level. As of [insert current date], the statewide sales and use tax rate stands at 7.25%. This rate is applied uniformly across the state, serving as a baseline for local jurisdictions to build upon.

County Sales Tax

Los Angeles County imposes an additional sales tax on top of the state rate. The LA County Sales Tax is currently set at 0.25%, bringing the total sales tax rate for most goods and services within the county to 7.50%. This supplemental tax contributes to the county’s revenue and supports essential services and infrastructure.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 7.25% |

| LA County Sales Tax | 0.25% |

| Total Sales Tax | 7.50% |

City Sales Tax

Within LA County, individual cities may further augment the sales tax rate to meet their specific revenue needs. These city-specific add-ons can vary significantly, resulting in different sales tax rates across the county. For instance, the city of Los Angeles imposes an additional 0.50% tax, bringing the total sales tax rate within the city limits to 8.00%. On the other hand, smaller cities like Malibu have a lower add-on tax, resulting in a total sales tax rate of 7.75%.

| City | City-Specific Add-On | Total Sales Tax Rate |

|---|---|---|

| Los Angeles | 0.50% | 8.00% |

| Malibu | 0.25% | 7.75% |

| ... (and other cities) | ... | ... |

Sales Tax Impact on Industries

The varying sales tax rates across LA County can significantly impact different industries. Let’s explore some real-world examples to understand how sales tax affects businesses and consumers.

Retail Sector

Retail businesses in LA County face a unique challenge due to the diverse sales tax rates. For instance, a clothing store located in the city of Los Angeles will collect a total sales tax of 8.00% from its customers. However, if the same store were located in Malibu, the sales tax would be 7.75%. This difference can influence consumer behavior, with some shoppers opting to make purchases in areas with lower sales tax rates.

E-commerce and Online Sales

E-commerce businesses operating within LA County must navigate the complex sales tax landscape. When shipping goods to customers within the county, the applicable sales tax rate depends on the customer’s shipping address. This means that an online retailer may need to apply different tax rates for orders destined for various cities within LA County.

Tourism and Hospitality

The tourism and hospitality industry in LA County benefits from the county’s appeal as a popular destination. However, sales tax rates can impact the pricing strategies of hotels, restaurants, and attractions. A higher sales tax rate can affect the overall cost of a vacation, potentially influencing tourists’ spending patterns.

Sales Tax Compliance for Businesses

Ensuring compliance with sales tax regulations is critical for businesses operating in LA County. Here are some practical tips and considerations for businesses to navigate the sales tax landscape effectively:

Sales Tax Registration

All businesses selling tangible goods or certain services in LA County are required to register for a Seller’s Permit with the California Department of Tax and Fee Administration (CDTFA). This permit allows businesses to collect and remit sales tax to the appropriate tax authorities.

Sales Tax Calculation and Remittance

Businesses must accurately calculate the applicable sales tax rate based on the customer’s shipping or billing address. This process can be streamlined using sales tax calculation software or by consulting tax professionals. The collected sales tax must be remitted to the CDTFA on a regular basis, typically quarterly or annually, depending on the business’s sales volume.

Sales Tax Exemptions

Certain goods and services are exempt from sales tax in California. Understanding these exemptions is crucial for businesses to avoid overcharging customers. Exempt items may include groceries, prescription medications, and certain types of manufacturing equipment. Staying informed about these exemptions can help businesses provide accurate pricing and avoid unnecessary tax complications.

Revenue Implications for LA County

The sales tax collected in LA County contributes significantly to the county’s revenue stream. This revenue is vital for funding essential services, infrastructure projects, and social programs. By examining historical data and projections, we can gain insights into the economic impact of sales tax on the county’s financial health.

Historical Sales Tax Revenue

Over the past decade, sales tax revenue in LA County has experienced a steady growth trajectory. According to the LA County Chief Financial Officer’s Office, sales tax revenue has increased by an average of 3.5% annually, with a total collection of $3.2 billion in the fiscal year [insert latest available data]. This growth can be attributed to a combination of factors, including population growth, economic development, and rising consumer spending.

Budget Allocation

The revenue generated from sales tax is allocated across various county departments and programs. A significant portion of the funds is directed towards public safety, including law enforcement and emergency services. Additionally, sales tax revenue supports infrastructure projects, such as road maintenance and public transportation improvements. Other areas of allocation include healthcare, social services, and education.

Economic Development and Tourism

The sales tax revenue also plays a pivotal role in promoting economic development and tourism within LA County. A portion of the funds is invested in marketing campaigns and initiatives aimed at attracting businesses and visitors to the county. These efforts contribute to job creation, increased tax revenue, and a thriving local economy.

Future Outlook and Potential Changes

As we look ahead, several factors could influence the sales tax landscape in LA County. Here are some key considerations for the future:

Economic Trends

The economic health of LA County, influenced by factors such as employment rates, consumer confidence, and business growth, will continue to shape sales tax revenue. A strong economy can lead to increased consumer spending, resulting in higher sales tax collections. Conversely, economic downturns may impact revenue negatively.

Legislative Changes

Sales tax rates and regulations are subject to legislative decisions at the state and county levels. Proposed changes to sales tax laws, such as rate adjustments or the introduction of new tax categories, can have a significant impact on businesses and consumers. Staying informed about any potential legislative actions is crucial for effective planning.

Online Sales and E-commerce

The continued growth of e-commerce and online sales presents both opportunities and challenges for sales tax collection. While online retailers contribute to sales tax revenue, the complex nature of online sales and the need for accurate tax calculations pose unique compliance challenges. As e-commerce evolves, sales tax regulations may need to adapt to ensure fair and effective tax collection.

Conclusion: Navigating the Complex World of Sales Tax

Understanding and navigating the sales tax landscape in Los Angeles County is essential for both businesses and consumers. By staying informed about the varying rates, regulations, and their impact on different industries, stakeholders can make informed decisions. For businesses, compliance with sales tax laws is not only a legal obligation but also a strategic consideration that can impact their pricing, competitiveness, and relationship with customers.

As LA County continues to thrive as a diverse economic hub, the sales tax system will remain a vital component of its financial landscape. By exploring the intricacies of sales tax, we gain a deeper understanding of the economic forces at play and the role they play in shaping the county's future.

How often do sales tax rates change in LA County?

+Sales tax rates in LA County can change periodically, often as a result of budgetary decisions at the state and county levels. While the state sales tax rate is relatively stable, county and city-specific add-ons may be subject to more frequent adjustments. It’s essential for businesses and consumers to stay updated on any changes to ensure compliance and accurate pricing.

Are there any sales tax holidays in LA County?

+LA County, along with the rest of California, does not observe specific sales tax holidays as seen in some other states. However, certain types of purchases, such as back-to-school supplies or energy-efficient appliances, may be eligible for temporary sales tax exemptions or rebates during designated periods. It’s advisable to check with the CDTFA for any such promotions.

How do I register for a Seller’s Permit in LA County?

+To obtain a Seller’s Permit in LA County, you need to register with the California Department of Tax and Fee Administration (CDTFA). The registration process involves completing an online application, providing business details, and obtaining the necessary permits. The CDTFA website provides comprehensive guidance on the registration process, including documentation requirements and deadlines.

What happens if a business fails to remit sales tax?

+Failure to remit sales tax can result in significant penalties and legal consequences for businesses. The CDTFA has the authority to impose fines, interest charges, and even criminal penalties for non-compliance. It’s crucial for businesses to maintain accurate records, calculate sales tax correctly, and remit payments on time to avoid these penalties.