Tax Collector City Of Waterbury

The City of Waterbury, Connecticut, is known for its rich history, diverse culture, and vibrant community. Amidst the city's various administrative functions, the role of the Tax Collector holds significant importance, ensuring the smooth operation of municipal services and infrastructure. In this comprehensive guide, we delve into the responsibilities, processes, and impact of the Tax Collector's office in Waterbury, shedding light on its pivotal role in the city's financial ecosystem.

The Tax Collector’s Office: An Overview

At the heart of Waterbury’s fiscal management lies the Tax Collector’s Office, a dedicated department tasked with the crucial responsibility of collecting property taxes and related fees. This office serves as the financial backbone of the city, facilitating the collection process, managing tax records, and ensuring timely disbursement of funds to various municipal departments and services.

The Tax Collector's role extends beyond mere collection; it involves maintaining accurate records, resolving tax-related inquiries, and implementing strategies to enhance revenue collection. This comprehensive approach ensures the city's financial stability and the efficient allocation of resources to essential services like education, public safety, and infrastructure development.

Key Responsibilities and Functions

The Tax Collector’s Office in Waterbury undertakes a multitude of tasks, each critical to the city’s financial health. These responsibilities include:

- Tax Assessment and Collection: The primary duty involves assessing property values and collecting property taxes. This process ensures that each property owner contributes their fair share towards the city's budget.

- Record Maintenance: Maintaining accurate and up-to-date records of property ownership, tax payments, and assessments is essential for transparency and efficient administration.

- Tax Payment Processing: The office facilitates various payment methods, including online payments, direct deposits, and traditional cash or check transactions, catering to the diverse needs of taxpayers.

- Delinquent Tax Management: Strategies are implemented to manage and collect delinquent taxes, which often involve penalty charges and legal actions to recover unpaid taxes.

- Community Engagement: The Tax Collector's Office actively engages with the community, providing assistance and educating taxpayers on their rights and responsibilities, fostering a culture of financial transparency and accountability.

The Impact on Waterbury’s Financial Ecosystem

The Tax Collector’s Office plays a pivotal role in shaping Waterbury’s financial landscape. By efficiently collecting taxes, the office ensures a steady flow of revenue, enabling the city to:

- Fund essential services such as education, public safety, and healthcare.

- Maintain and develop infrastructure, including roads, parks, and public facilities.

- Support community development initiatives and economic growth.

- Provide financial stability and predictability for long-term planning.

Furthermore, the Tax Collector's Office contributes to the city's overall financial health by implementing efficient collection strategies, reducing the burden of delinquent taxes, and ensuring a fair and transparent tax system.

Navigating the Tax Collection Process

Understanding the tax collection process in Waterbury is essential for property owners and taxpayers. Here’s a simplified breakdown:

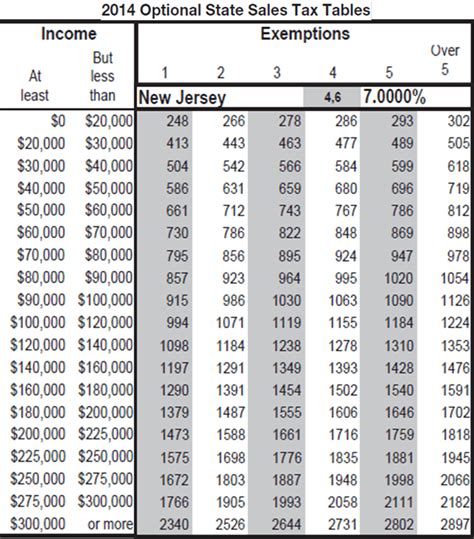

- Assessment: The Tax Assessor's Office determines the value of each property, which forms the basis for tax calculations.

- Billing: Tax bills are issued to property owners, detailing the assessed value and the corresponding tax amount.

- Payment Options: Taxpayers have various payment methods available, including online payments, direct deposits, or traditional cash/check payments.

- Due Dates: Tax bills typically have specific due dates, and late payments may incur penalties and interest charges.

- Delinquent Tax Management: If taxes remain unpaid, the Tax Collector's Office initiates collection actions, which may involve legal proceedings.

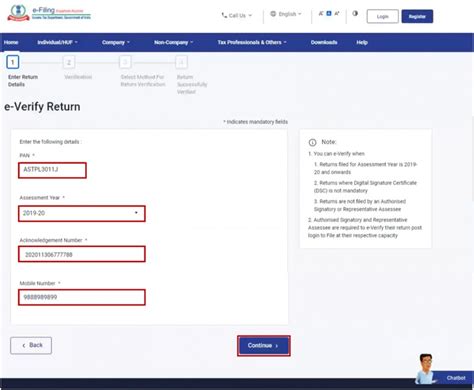

The Tax Collector's Office provides a range of resources to assist taxpayers, including online payment portals, tax payment plans, and detailed tax information on their official website.

The Future of Tax Collection in Waterbury

As technology advances, the Tax Collector’s Office in Waterbury is embracing digital transformation to enhance its services. The adoption of online platforms and mobile applications has simplified tax payment processes, providing taxpayers with convenient and secure options. Additionally, data analytics and AI-powered systems are being leveraged to improve efficiency, reduce errors, and enhance overall tax collection performance.

Furthermore, the Tax Collector's Office is actively exploring innovative strategies to engage with the community, such as hosting educational workshops and utilizing social media platforms to disseminate tax-related information. These initiatives aim to foster a deeper understanding of the tax system, encourage timely payments, and build trust between the city and its taxpayers.

Conclusion

The Tax Collector’s Office in Waterbury stands as a vital pillar of the city’s financial framework, ensuring the smooth operation of municipal services and infrastructure. Through its dedicated efforts, the office collects property taxes, manages records, and engages with the community, fostering a culture of financial responsibility. As Waterbury continues to evolve, the Tax Collector’s Office remains committed to adapting and implementing innovative strategies to enhance its services, ultimately contributing to the city’s long-term prosperity and financial sustainability.

How can I pay my property taxes in Waterbury?

+Property taxes in Waterbury can be paid through various methods, including online payments, direct deposits, or traditional cash/check payments. The Tax Collector’s Office provides a user-friendly online payment portal, making it convenient for taxpayers to make payments from the comfort of their homes.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline may result in penalties and interest charges. The Tax Collector’s Office advises taxpayers to stay informed about due dates and encourages them to utilize the available payment plans to avoid any financial hardships.

How can I dispute my property tax assessment?

+If you believe your property tax assessment is incorrect, you can file an appeal with the Tax Assessor’s Office. The office provides detailed guidelines and assistance for taxpayers wishing to dispute their assessments, ensuring a fair and transparent process.