Alaska Taxes

Welcome to a comprehensive guide on Alaska's unique tax system, a topic that often sparks curiosity and offers a glimpse into the fascinating fiscal landscape of the Last Frontier. As one of the few states in the U.S. without a sales tax, Alaska has developed a distinctive approach to taxation, which we will explore in detail. This article aims to provide an in-depth analysis, ensuring you gain a thorough understanding of Alaska's tax structure and its implications.

Understanding Alaska’s Tax System: A State of No Sales Tax

Alaska is renowned for its distinct tax policies, particularly the absence of a sales tax, which sets it apart from the majority of U.S. states. This unique approach to taxation has significant implications for residents, businesses, and visitors alike, creating a fiscal environment that is both advantageous and challenging.

No Sales Tax: A Boon for Consumers

The absence of a sales tax in Alaska is a notable advantage for consumers. It means that everyday purchases, from groceries to electronics, are not subject to the additional tax burden that is common in most other states. This can result in significant savings over time, especially for those with high consumption levels.

For example, a resident of a state with a 7% sales tax who spends 50,000 annually on taxable goods would save 3,500 in taxes by living in Alaska. This savings can make a substantial difference in an individual’s or family’s budget.

The State Income Tax: A Key Revenue Source

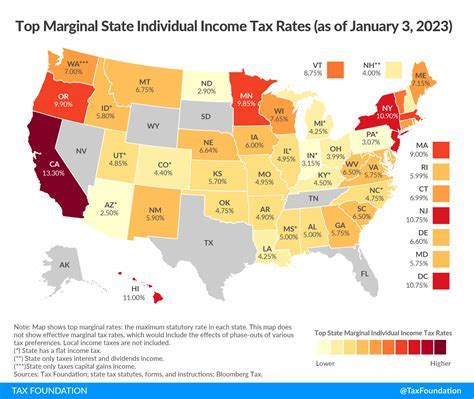

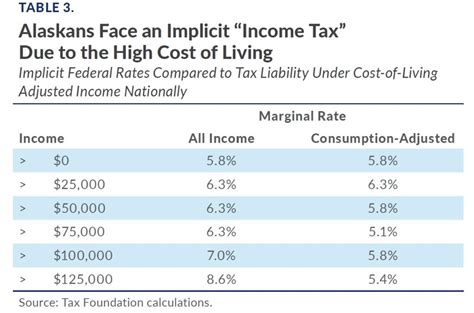

While Alaska does not impose a sales tax, it does have a progressive income tax system. This means that residents’ earnings are taxed at varying rates depending on income levels. The state’s income tax brackets range from 0% to 9.4%, with the highest rate applicable to income over 250,000 for single filers and 500,000 for joint filers.

For instance, a resident earning 50,000 annually would fall into the 4.25% tax bracket, resulting in an annual tax liability of 2,125. On the other hand, a high-income earner with an annual income of 500,000 would be taxed at the highest rate of 9.4%, leading to a tax bill of 47,000.

| Income Bracket | Tax Rate |

|---|---|

| Up to $25,000 | 0% |

| $25,001 - $35,000 | 2.5% |

| $35,001 - $75,000 | 3.5% |

| $75,001 - $125,000 | 5% |

| $125,001 - $250,000 | 7% |

| Over $250,000 | 9.4% |

Property Taxes: A Localized Approach

Alaska’s property tax system is another key component of its fiscal landscape. Property taxes are primarily levied by local governments, including cities, boroughs, and school districts, resulting in significant variations across the state.

For instance, the median effective property tax rate in Juneau, Alaska’s capital, is 1.35%, while in Anchorage, the state’s largest city, it stands at 1.09%. These rates are calculated based on the assessed value of the property and can vary significantly depending on the location and the specific tax assessments made by local authorities.

| Location | Effective Property Tax Rate |

|---|---|

| Juneau | 1.35% |

| Anchorage | 1.09% |

| Fairbanks | 1.19% |

| Kodiak | 1.02% |

| Sitka | 1.48% |

Business Taxes: A Competitive Environment

Alaska offers a competitive environment for businesses with a range of tax incentives and a relatively simple tax structure. The state does not impose a corporate income tax, which can be a significant advantage for businesses looking to minimize their tax liabilities.

Additionally, Alaska has a limited sales tax in the form of a 3% sales tax on prepared food and beverages sold by restaurants and other food service establishments. This tax is often referred to as the “bed and breakfast tax” and is one of the state’s few direct taxes on consumer spending.

The Permanent Fund Dividend: A Unique Feature

One of the most distinctive aspects of Alaska’s tax system is the Permanent Fund Dividend (PFD). Every year, eligible Alaskans receive a dividend check from the Alaska Permanent Fund, which is funded by a portion of the state’s mineral royalties, primarily from oil revenues. This dividend can range from a few hundred to a few thousand dollars per person, providing a unique form of income for residents.

For instance, in 2022, the PFD amount was 1,606 per eligible individual. This means a family of four, all eligible for the dividend, could receive a total of 6,424, which can significantly boost their household income.

Implications and Insights

Alaska’s unique tax system offers a range of advantages and challenges. The absence of a sales tax is a significant benefit for consumers, while the state’s income tax structure ensures a steady revenue stream for the government. The Permanent Fund Dividend provides a unique source of income for residents, further differentiating Alaska’s fiscal landscape.

However, the reliance on volatile sources of revenue, such as oil royalties, can make Alaska’s fiscal health susceptible to fluctuations in the energy market. Additionally, the localized nature of property taxes can result in significant variations across the state, impacting the affordability of homeownership and rental markets.

For businesses, Alaska’s tax system can be both an opportunity and a challenge. While the absence of a corporate income tax is a significant advantage, the state’s relatively high property taxes and limited sales tax can impact business operations and profitability.

FAQs

How does Alaska’s lack of sales tax impact the state’s economy?

+Alaska’s lack of sales tax encourages consumer spending, boosts tourism, and makes the state more attractive for businesses to operate in. However, it also means the state relies more heavily on other forms of taxation, such as income and property taxes, for revenue.

What is the purpose of the Permanent Fund Dividend?

+The Permanent Fund Dividend is a way to distribute Alaska’s natural resource wealth to its residents. It’s seen as a way to share the benefits of the state’s oil revenue with its citizens and has become a key part of Alaska’s economy and culture.

How do property taxes vary across Alaska’s boroughs and cities?

+Property taxes in Alaska can vary significantly between different boroughs and cities due to the localized nature of the tax. Each borough or city sets its own tax rate, which can lead to wide variations in property tax liabilities for similar properties across the state.

Are there any other unique tax features in Alaska?

+Yes, Alaska has a few other unique tax features. For instance, it has a limited sales tax on prepared food and beverages, often called the “bed and breakfast tax.” Additionally, the state has a system of tax credits and incentives to encourage certain economic activities, like film production and renewable energy development.