Tax Puerto Rico Income

The process of filing taxes in Puerto Rico can be a complex journey for both residents and businesses, with unique considerations stemming from its status as a U.S. territory with its own set of tax laws and regulations. Navigating these waters requires a deep understanding of the tax system, from knowing which forms to use to calculating deductions and credits accurately. In this comprehensive guide, we'll delve into the intricacies of tax filing in Puerto Rico, offering a step-by-step breakdown and expert insights to ensure a seamless and compliant tax experience.

Understanding the Puerto Rico Tax System

The tax system in Puerto Rico operates under a unique set of rules and regulations, distinct from those in the continental United States. This is primarily due to the island’s unique political status as a commonwealth of the U.S., which grants it a degree of autonomy in tax matters. As a result, Puerto Rico has its own set of tax laws, administered by the Puerto Rico Department of the Treasury.

One of the most notable differences is the income tax structure. Puerto Rico has its own income tax rates and brackets, which can vary from those in the U.S. mainland. Additionally, certain types of income may be taxed differently, or even exempt from taxation, under Puerto Rico's laws.

Another key aspect is the availability of tax incentives and credits. The Puerto Rico government often offers incentives to attract businesses and promote economic development. These can include tax credits for research and development, job creation, or investments in certain sectors. Understanding and leveraging these incentives can significantly impact a business's or individual's tax liability.

Key Tax Forms and Requirements

When it comes to filing taxes in Puerto Rico, individuals and businesses must use specific forms designated by the Puerto Rico Department of the Treasury. For individuals, the primary form is the PUERTO RICO INDIVIDUAL INCOME TAX RETURN (Form 482.0). This form is used to report income, claim deductions and credits, and calculate the tax liability. It’s important to note that the filing requirements and due dates may differ from those in the U.S. mainland.

For businesses, the tax forms vary depending on the entity type. Corporations typically use the CORPORATION INCOME TAX RETURN (Form 480.9), while partnerships and limited liability companies (LLCs) may use the PARTNERSHIP AND LIMITED LIABILITY COMPANY INCOME TAX RETURN (Form 480.5). Sole proprietors often report their business income on their individual tax return.

| Entity Type | Common Tax Forms |

|---|---|

| Individuals | Form 482.0 |

| Corporations | Form 480.9 |

| Partnerships & LLCs | Form 480.5 |

In addition to these primary forms, there may be additional schedules and attachments required, depending on the complexity of the tax situation. For instance, businesses may need to file schedules for depreciation, amortization, or specific industry-related expenses.

Calculating Tax Liability and Deductions

Determining your tax liability in Puerto Rico involves a careful calculation of your taxable income and the application of the appropriate tax rates. The first step is to identify all sources of income, including wages, business profits, investments, and any other taxable earnings. It’s crucial to distinguish between taxable and non-taxable income, as certain types of income may be exempt from taxation in Puerto Rico.

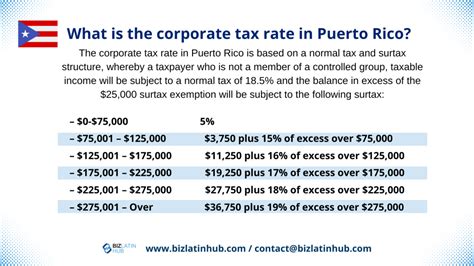

Once you've determined your taxable income, you can apply the relevant tax rates. Puerto Rico has a progressive tax system, meaning the tax rate increases as your income rises. The exact tax brackets and rates can be found in the official tax guidelines published by the Puerto Rico Department of the Treasury. It's important to note that these rates may change from year to year, so it's essential to refer to the most recent guidelines when filing your taxes.

After calculating your tax liability, you can explore various deductions and credits to reduce your taxable income. These can include deductions for medical expenses, charitable contributions, and certain business-related expenses. Additionally, Puerto Rico offers a range of tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, which can further reduce your tax burden.

Common Deductions and Credits in Puerto Rico

- Standard Deduction: Most taxpayers can choose to take a standard deduction, which is a set amount that reduces taxable income. The standard deduction amount varies based on filing status.

- Itemized Deductions: Taxpayers can opt to itemize their deductions, which involves listing specific expenses such as mortgage interest, state and local taxes, medical expenses, and charitable contributions.

- Child Tax Credit: This credit is available for qualifying children under the age of 17. It can significantly reduce tax liability and may even result in a refund.

- Education Credits: Puerto Rico offers education credits for eligible higher education expenses, such as tuition and fees.

- Savings and Investment Credits: Taxpayers can benefit from credits for contributions to retirement accounts, such as IRAs or 401(k)s.

It's important to note that the availability and requirements for these deductions and credits may change from year to year, so it's crucial to stay updated with the latest tax guidelines.

Filing and Payment Options

Once you’ve calculated your tax liability and determined your deductions and credits, it’s time to file your tax return and make any necessary payments. The Puerto Rico Department of the Treasury offers various filing and payment options to accommodate different preferences and needs.

Online Filing

The most convenient and efficient way to file your tax return is through the Department’s online filing system. This system is secure and allows you to file your return electronically, ensuring a faster processing time. You’ll need to create an account and provide the necessary information, including your personal details, income sources, and deductions.

Paper Filing

If you prefer a more traditional approach, you can file your tax return using paper forms. You can download the relevant forms from the Department’s website or pick them up at a local tax office. Make sure to fill out the forms accurately and completely, providing all necessary supporting documents.

Payment Methods

The Department of the Treasury accepts various payment methods, including credit cards, debit cards, and electronic fund transfers. You can also pay by check or money order, but make sure to include the correct payment voucher with your return.

If you're unable to pay your tax liability in full, you may be eligible for a payment plan or installment agreement. Contact the Department's taxpayer services division to discuss your options and ensure you understand the terms and conditions.

Common Tax Scenarios and Considerations

Tax filing in Puerto Rico can present unique scenarios and considerations, especially for individuals and businesses with complex financial situations. Understanding these scenarios and their implications is crucial for accurate tax reporting and compliance.

Business Tax Considerations

Businesses operating in Puerto Rico must navigate a range of tax considerations, from corporate income tax to payroll taxes and sales tax. Corporate income tax rates and brackets can vary based on the type of business entity and its revenue. Additionally, businesses must comply with payroll tax regulations, including withholding and remitting taxes for employees.

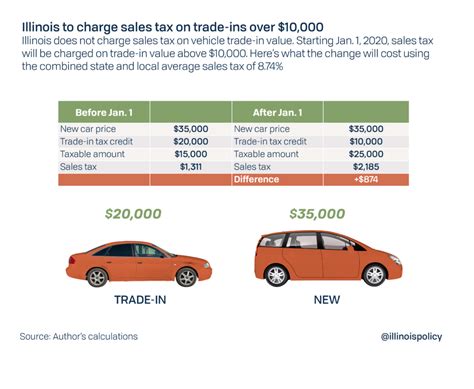

Sales tax, known as Impuesto sobre Ventas y Uso (IVU) in Puerto Rico, is another critical consideration. Businesses must collect and remit IVU on taxable goods and services sold within the island. The rate can vary based on the type of item and the location of the sale.

Residency Status and Tax Liability

Determining your residency status is crucial when it comes to tax liability in Puerto Rico. Generally, individuals who reside in Puerto Rico for more than 183 days in a calendar year are considered residents for tax purposes. Resident taxpayers are subject to Puerto Rico income tax on their worldwide income, while non-residents are taxed only on income sourced within Puerto Rico.

It's important to note that residency status can have a significant impact on tax liability. Resident taxpayers may be eligible for certain deductions and credits that are not available to non-residents. Additionally, resident taxpayers may be subject to different tax rates and brackets.

Tax Treaties and International Considerations

Puerto Rico has entered into tax treaties with various countries to prevent double taxation and promote international trade. These treaties can have significant implications for individuals and businesses with cross-border transactions. It’s crucial to understand the terms of these treaties and how they apply to your specific situation.

For instance, if you're a resident of a country with a tax treaty with Puerto Rico, you may be eligible for reduced tax rates or exemptions on certain types of income. However, it's essential to consult with a tax professional to ensure you're complying with the terms of the treaty and avoiding any potential penalties.

Future Tax Implications and Planning

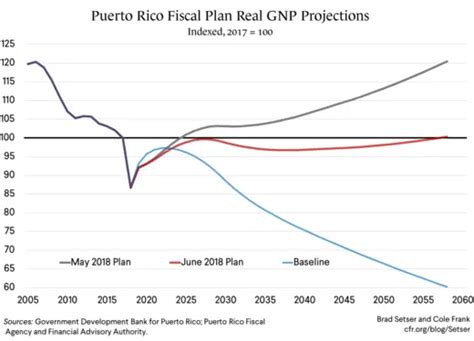

As the tax landscape in Puerto Rico is subject to change, it’s crucial for individuals and businesses to stay informed about upcoming tax reforms and their potential impact. Being proactive in tax planning can help minimize surprises and ensure compliance with any new regulations.

Upcoming Tax Reforms and Changes

The Puerto Rico government periodically introduces tax reforms and amendments to its tax laws. These changes can include adjustments to tax rates, new deductions or credits, or modifications to filing requirements. Staying updated on these reforms is essential to ensure accurate tax planning and filing.

For instance, in recent years, Puerto Rico has implemented various tax incentives and reforms to attract businesses and stimulate economic growth. These include the Puerto Rico Incentives Code, which offers a range of tax benefits to qualifying businesses, and the Individual Investors Act, which provides tax incentives for high-net-worth individuals investing in Puerto Rico.

Tax Planning Strategies for the Future

Tax planning is an essential aspect of financial management, and it’s crucial to adopt a proactive approach to minimize tax liability and maximize deductions and credits. Here are some strategies to consider for future tax planning:

- Review and understand the latest tax guidelines and regulations issued by the Puerto Rico Department of the Treasury.

- Consult with a tax professional or accountant who specializes in Puerto Rico tax laws to ensure you're taking advantage of all available deductions and credits.

- Consider tax-efficient investment strategies, such as contributing to tax-advantaged retirement accounts or investing in qualified business entities that offer tax benefits.

- Stay informed about any changes to tax treaties and their implications for your specific situation.

- Explore the potential benefits of Puerto Rico's tax incentives, such as the Individual Investors Act or the Puerto Rico Incentives Code, if you meet the eligibility criteria.

By staying informed and proactive, you can navigate the complexities of the Puerto Rico tax system with confidence and ensure compliance with the latest regulations.

How do I determine my residency status for tax purposes in Puerto Rico?

+To determine your residency status for tax purposes in Puerto Rico, you need to assess the number of days you’ve spent on the island during the calendar year. Generally, if you’ve resided in Puerto Rico for more than 183 days, you’re considered a resident for tax purposes. This means you’ll be subject to Puerto Rico income tax on your worldwide income. However, it’s important to consult with a tax professional to understand the specific criteria and any potential exceptions.

What are the tax rates for corporations in Puerto Rico?

+The tax rates for corporations in Puerto Rico can vary based on the type of business entity and its revenue. Generally, corporations are subject to a corporate income tax, with rates ranging from 10% to 30%, depending on the income level. However, it’s important to note that these rates are subject to change, and it’s crucial to refer to the most recent tax guidelines issued by the Puerto Rico Department of the Treasury for accurate information.

Are there any tax incentives available for businesses in Puerto Rico?

+Yes, Puerto Rico offers a range of tax incentives to attract businesses and promote economic development. These incentives can include tax credits for research and development, job creation, or investments in certain sectors. One notable incentive is the Puerto Rico Incentives Code, which offers a range of benefits to qualifying businesses. It’s important to consult with a tax professional to understand the eligibility criteria and how these incentives can benefit your business.

How can I stay updated on tax reforms and changes in Puerto Rico?

+To stay updated on tax reforms and changes in Puerto Rico, it’s crucial to regularly check the official website of the Puerto Rico Department of the Treasury. They publish the latest tax guidelines, amendments, and reforms. Additionally, consider subscribing to tax newsletters or following reputable tax blogs and websites that provide updates on Puerto Rico tax laws. Consulting with a tax professional or accountant who specializes in Puerto Rico taxes can also ensure you receive timely and accurate information.