Contra Costa County Property Tax

Understanding property taxes is essential for homeowners and prospective buyers alike, as they significantly impact the overall cost of owning a property. This comprehensive guide delves into the intricacies of Contra Costa County's property tax system, shedding light on its unique features and providing valuable insights for residents and investors.

The Contra Costa County Property Tax Landscape

Nestled in the San Francisco Bay Area, Contra Costa County boasts a vibrant real estate market with diverse neighborhoods and a thriving economy. However, the property tax system in this county differs from many other regions, owing to California’s unique Proposition 13, which has had a profound impact on property tax assessments and rates.

Under Proposition 13, property tax rates in California are generally limited to 1% of a property's assessed value, with increases capped at a maximum of 2% annually. This means that, in most cases, property taxes in Contra Costa County will increase gradually over time, providing a stable and predictable tax burden for homeowners.

Assessed Value and Tax Rates

The assessed value of a property is a critical factor in determining property taxes. In Contra Costa County, the Assessor’s Office is responsible for establishing this value, which is based on the property’s purchase price or its value at the time of its last reassessment.

For instance, if a homeowner purchases a property for $500,000, the initial assessed value will be set at this price. However, due to Proposition 13's limitations on annual increases, the assessed value will only rise by a maximum of 2% each year, even if the market value of the property increases more significantly.

| Property Value | Assessed Value |

|---|---|

| $500,000 (Purchase Price) | $500,000 |

| Market Value Increases to $600,000 | Assessed Value Remains at $500,000 (Max. 2% Increase) |

Reassessments and Prop. 58 Transfers

While Proposition 13 generally limits annual increases in assessed value, there are certain situations where the assessed value can be reassessed, leading to potential increases in property taxes.

One such scenario is when a property is sold. In this case, the new assessed value will be based on the sale price, potentially resulting in a significant increase in property taxes for the new owner.

However, California's Proposition 58 offers a reprieve for homeowners who are passing their property to their children or grandchildren. Under Prop. 58, if a homeowner meets certain criteria and passes their property to a qualifying family member, the property's assessed value can remain the same, avoiding a potentially large tax increase.

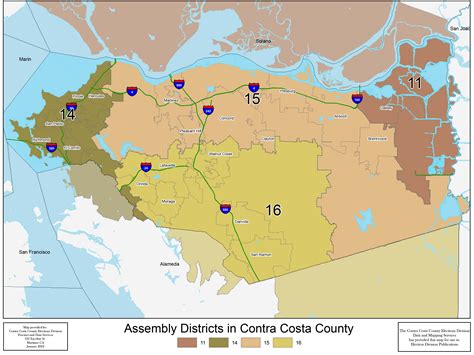

Special Assessment Districts

Contra Costa County, like many other counties in California, has various special assessment districts that provide additional services or improvements to specific areas. These districts may levy additional taxes on properties within their boundaries to fund these services.

For example, a neighborhood with a dedicated fire protection district might have an additional tax assessment to support the district's operations. These special assessments are in addition to the standard property taxes and are based on the benefits received by each property.

Calculating Property Taxes in Contra Costa County

The calculation of property taxes in Contra Costa County involves a few key steps, which we’ll break down to provide a clearer understanding.

Step 1: Determine the Assessed Value

As mentioned earlier, the assessed value of a property is its base value for tax purposes. This value is established by the Assessor’s Office and is subject to the limitations set by Proposition 13.

Step 2: Apply the Tax Rate

The standard property tax rate in California, as set by Proposition 13, is 1% of the assessed value. However, this rate can vary slightly depending on the specific location within Contra Costa County and any additional assessments or special districts.

For instance, let's consider a property with an assessed value of $400,000. The standard property tax rate of 1% would result in an annual tax bill of $4,000.

Step 3: Consider Additional Assessments

As we discussed earlier, there may be additional assessments or special districts that levy taxes on properties within their boundaries. These additional assessments are typically a percentage of the assessed value and are added to the standard property tax bill.

For example, if the property in our previous example is located within a fire protection district that assesses an additional 0.15% of the assessed value, the total property tax bill would be $4,000 (standard tax) + $600 (additional assessment) = $4,600.

Step 4: Annual Increases

Due to Proposition 13’s limitations, the assessed value of a property can only increase by a maximum of 2% each year. This means that property taxes will generally increase by a maximum of 2% annually, providing a stable and predictable tax burden.

Property Tax Due Dates and Payment Options

Understanding when property taxes are due and the available payment options is crucial for homeowners to avoid late fees and potential penalties.

Due Dates

Property taxes in Contra Costa County are due in two installments. The first installment is typically due on November 1st, with a grace period until December 10th. If the first installment is not paid by this date, a 10% penalty is applied.

The second installment is due on February 1st, with a grace period until April 10th. Failure to pay the second installment by this date will result in additional penalties and potential legal action.

Payment Options

Contra Costa County offers several convenient payment options for property taxes, including online payment through the county’s website, payment by phone, or traditional methods like mail or in-person payments at the Treasurer-Tax Collector’s Office.

Additionally, homeowners can choose to set up automatic payments, ensuring that their property taxes are always paid on time and avoiding the risk of late fees.

Impact of Property Taxes on Homeownership

Property taxes are an essential consideration for anyone looking to purchase a home in Contra Costa County. They can significantly impact the overall cost of owning a property and should be factored into financial planning.

Budgeting and Financial Planning

When considering a home purchase, it’s crucial to understand the potential property tax burden. While Proposition 13 provides some stability in terms of annual increases, the initial assessed value can vary widely based on the purchase price or the last reassessment.

For example, a homeowner who purchases a property with a high assessed value may face a significant property tax bill, even with the annual increases capped at 2%. This can impact the overall affordability of the home and should be considered when budgeting for homeownership.

Strategies for Managing Property Taxes

There are several strategies homeowners can employ to manage their property tax burden effectively.

- Proposition 58 Transfers: As we discussed earlier, Proposition 58 offers a way for homeowners to pass their property to their children or grandchildren without a significant increase in property taxes. This can be a valuable strategy for estate planning and ensuring the affordability of the property for future generations.

- Reassessments: If a homeowner believes their property's assessed value is significantly higher than its actual value, they can request a reassessment. This can lead to a reduction in the assessed value and, consequently, a lower property tax bill.

- Special Assessment Districts: Understanding the special assessment districts in your area and the services they provide can help homeowners make informed decisions. If a district's services are not beneficial to a particular property, homeowners may consider moving or advocating for changes to the district's boundaries or assessments.

Conclusion: Navigating Contra Costa County’s Property Tax System

Understanding the intricacies of Contra Costa County’s property tax system is essential for homeowners and prospective buyers alike. While Proposition 13 provides some stability and predictability in terms of annual increases, the initial assessed value and any additional assessments or special districts can significantly impact the overall property tax burden.

By understanding the calculation process, due dates, and payment options, homeowners can effectively manage their property taxes and ensure they are always in compliance. Additionally, strategies like Proposition 58 transfers and reassessments can help mitigate the impact of property taxes on homeownership.

For those considering a home purchase in Contra Costa County, it's crucial to factor in the potential property tax burden and explore strategies to manage it effectively. With the right knowledge and planning, homeowners can navigate the county's unique property tax system with confidence.

How often are property values reassessed in Contra Costa County?

+Property values are typically reassessed when a property is sold or when a significant change occurs that affects the property’s value. This can include renovations, additions, or other improvements. Reassessments are not conducted annually but are triggered by these specific events.

Can homeowners appeal their property’s assessed value?

+Yes, homeowners have the right to appeal their property’s assessed value if they believe it is incorrect or too high. The process involves submitting an appeal to the Assessor’s Office, providing evidence and arguments to support the appeal. It’s important to carefully review the assessed value and consider any recent changes that may have impacted the property’s value.

What happens if property taxes are not paid on time in Contra Costa County?

+If property taxes are not paid by the due date, a 10% penalty is applied to the first installment. Failure to pay the second installment by the due date can result in additional penalties, interest, and potential legal action. It’s important to stay on top of property tax payments to avoid these consequences and maintain good standing with the county.

Are there any exemptions or discounts available for property taxes in Contra Costa County?

+Yes, there are several exemptions and discounts available for property taxes in Contra Costa County. These include the Homeowner’s Exemption, which reduces the assessed value of a property by $7,000, and the Senior Citizen’s Exemption, which provides a reduction in property taxes for homeowners aged 65 or older. Additionally, veterans and disabled persons may qualify for further exemptions or discounts.

How can I estimate my property tax bill before purchasing a home in Contra Costa County?

+To estimate your property tax bill, you can use the county’s online property tax calculator, which takes into account the assessed value of the property and any additional assessments or special districts. This can provide a rough estimate of your potential property tax burden and help you budget accordingly.