Figuring Sales Tax On A Car

Calculating sales tax on a car purchase can be a complex process, especially when navigating the unique tax regulations of different states and jurisdictions. This article aims to provide a comprehensive guide on understanding and computing sales tax for car purchases, offering insights into the factors that influence these calculations and the potential implications for buyers.

Understanding Sales Tax for Car Purchases

Sales tax is a consumption tax levied on the purchase of goods and services. In the context of car buying, it is an additional cost that buyers must consider when finalizing their purchase. The sales tax rate can vary significantly depending on the state, county, and even city where the purchase is made. This variability is primarily due to the different tax laws and revenue requirements of each jurisdiction.

For instance, let's consider the state of California. The state sales tax rate is set at 7.25%, but this is just the base rate. Many counties in California add their own local sales tax on top of this, which can increase the total sales tax rate to as high as 10.25%. This means that a $30,000 car purchase in a county with a 10.25% sales tax rate would incur an additional $3,075 in sales tax, bringing the total cost of the car to $33,075.

Furthermore, it's important to note that sales tax is typically calculated on the total purchase price of the vehicle, which includes not just the car's sticker price but also any additional fees, such as dealer preparation fees, destination charges, and other add-ons. However, certain fees, like documentation fees and registration fees, are often excluded from sales tax calculations.

Factors Influencing Sales Tax Calculations

Several factors can impact the sales tax calculation for a car purchase. These include:

- Vehicle Price: The higher the vehicle’s price, the more sales tax you’ll pay.

- Location of Purchase: Sales tax rates can vary significantly by state, county, and city.

- Taxable Items: Sales tax is typically applied to the total purchase price, including the vehicle’s cost and certain additional fees.

- Exemptions and Incentives: Some states or localities offer tax exemptions or incentives for certain types of vehicles, such as electric or hybrid cars.

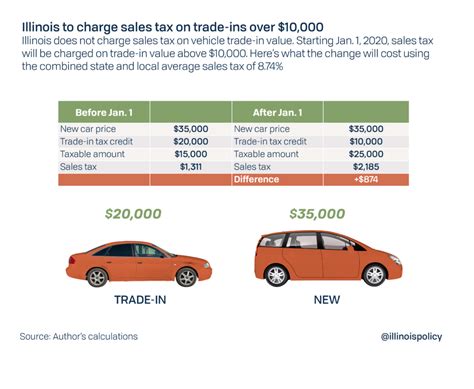

- Trade-In Value: If you’re trading in an old car, the trade-in value may affect the sales tax calculation.

To illustrate, consider the purchase of a $40,000 vehicle in a state with a 6% sales tax rate. The total sales tax would be $2,400, bringing the total cost of the vehicle to $42,400. However, if the buyer is trading in a vehicle with a $5,000 trade-in value, the sales tax calculation would be based on the $35,000 difference between the new and old vehicles, resulting in a sales tax of $2,100 and a total cost of $42,100.

Calculating Sales Tax: A Step-by-Step Guide

Calculating sales tax for a car purchase involves a straightforward process. Here’s a step-by-step guide:

- Determine the Purchase Price: Start by identifying the total purchase price of the vehicle, including any additional fees that are subject to sales tax.

- Find the Sales Tax Rate: Research the applicable sales tax rate for the location where the purchase is being made. This can be found on the official government websites of the state, county, or city.

- Calculate Sales Tax: Multiply the purchase price by the sales tax rate. For example, if the purchase price is 25,000 and the sales tax rate is 8%, the sales tax amount would be 2,000.

- Add Sales Tax to the Purchase Price: Finally, add the calculated sales tax to the purchase price to determine the total cost of the vehicle.

It's important to note that while this guide provides a general framework, specific tax laws and regulations can vary significantly, so it's always advisable to consult with a tax professional or the relevant tax authority for accurate and up-to-date information.

Implications and Strategies for Car Buyers

Understanding the sales tax implications of a car purchase is crucial for buyers, as it can significantly impact the overall cost of ownership. Here are some key considerations and strategies for car buyers:

- Research Local Sales Tax Rates: Before making a purchase, thoroughly research the sales tax rates in the area where you plan to buy the car. This can help you budget accurately and potentially identify more affordable locations.

- Explore Tax Incentives: Some states or localities offer tax incentives or rebates for certain types of vehicles, such as electric or fuel-efficient cars. These incentives can significantly reduce the sales tax burden.

- Consider Trade-Ins Strategically: While trading in a vehicle can reduce the sales tax calculation, it’s important to ensure that the trade-in value is fair and that it makes financial sense in the context of the overall purchase.

- Negotiate the Deal: Don’t be afraid to negotiate the purchase price of the vehicle. Every dollar saved on the sticker price can result in significant savings on sales tax.

- Utilize Online Calculators: Various online tools and calculators can assist in estimating sales tax based on the vehicle’s price and location. These can provide a quick and convenient way to understand the potential sales tax cost.

By understanding the factors that influence sales tax calculations and implementing strategic approaches, car buyers can make more informed decisions and potentially save significant amounts on their purchases.

Future Outlook and Potential Changes

The landscape of sales tax regulations is constantly evolving, and car buyers should stay informed about potential changes that could impact their purchases. For instance, some states are considering the implementation of road usage charges or mileage-based taxes as an alternative to traditional sales tax. These changes, if enacted, could significantly alter the way sales tax is calculated for car purchases.

Additionally, the growing popularity of electric and hybrid vehicles has led to increased discussions around tax incentives and rebates for these environmentally friendly options. Such incentives could further reduce the financial burden of purchasing these vehicles, making them more accessible to a wider range of buyers.

Staying updated on these potential changes and their implications is crucial for car buyers, as it can help them make more strategic decisions and potentially benefit from emerging tax incentives and regulations.

Conclusion

Calculating sales tax on a car purchase is a critical aspect of the buying process, and understanding the intricacies of these calculations can empower car buyers to make more informed decisions. By researching local tax rates, exploring incentives, negotiating deals, and staying informed about potential regulatory changes, buyers can navigate the sales tax landscape effectively and potentially save significant amounts on their purchases.

Remember, while this article provides a comprehensive guide, it's always advisable to consult with tax professionals or the relevant tax authorities for specific and up-to-date information tailored to your unique circumstances.

How often do sales tax rates change?

+

Sales tax rates can change annually or even more frequently, depending on the jurisdiction. It’s important to check the latest rates before finalizing a car purchase.

Are there any ways to avoid paying sales tax on a car purchase?

+

In some cases, certain types of purchases, such as those made by government entities or non-profit organizations, may be exempt from sales tax. Additionally, some states offer tax-free holidays for specific items, including cars, during certain periods.

Can I deduct sales tax from my taxes?

+

Whether or not you can deduct sales tax from your taxes depends on your specific circumstances and the tax laws in your jurisdiction. It’s recommended to consult with a tax professional for personalized advice.