Mississippi Property Tax

Welcome to this in-depth exploration of the Mississippi Property Tax system. Understanding how property taxes work is crucial for homeowners, investors, and anyone interested in real estate within the state. This guide aims to demystify the process, shedding light on the specifics of Mississippi's tax landscape.

Understanding Mississippi’s Property Tax Framework

Mississippi’s property tax system is a critical component of its revenue generation, contributing significantly to the state’s overall financial stability. Unlike some states that employ a flat tax rate, Mississippi operates on a more nuanced system, taking into account various factors to determine the property tax liability of each homeowner.

Assessment Process

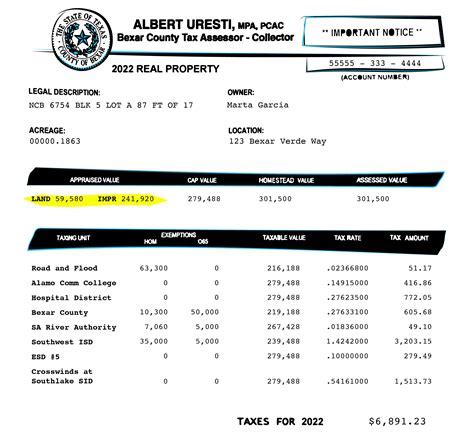

The first step in understanding Mississippi’s property tax is to delve into the assessment process. Every four years, the Mississippi State Tax Commission conducts a comprehensive reassessment of all property values within the state. This reassessment is a crucial phase, as it determines the taxable value of each property, which forms the basis for calculating the property tax.

During the reassessment, the Tax Commission employs a variety of methods to estimate the fair market value of properties. These methods include sales comparison, cost approach, and income approach, ensuring an accurate valuation. The taxable value is then calculated as a percentage of this fair market value, with the specific percentage varying based on the property’s location and classification.

Tax Rates and Classification

Mississippi utilizes a system of tax rates that are specific to each county. These rates are determined by the local governing bodies, taking into account the needs and requirements of the county. While the state sets a minimum rate, counties have the autonomy to set higher rates, which can significantly impact the property tax bill.

Additionally, Mississippi classifies properties into different categories, such as homestead, agricultural, commercial, and industrial. Each category has its own assessment ratio, which is the percentage of the property’s value that is subject to taxation. For instance, a homestead property might have a lower assessment ratio compared to a commercial property, resulting in a lower tax bill.

| Property Type | Assessment Ratio |

|---|---|

| Homestead | 10% |

| Agricultural | 12% |

| Commercial | 15% |

| Industrial | 18% |

It's important to note that while these ratios provide a general guideline, individual counties might have slight variations. This classification system ensures that properties are taxed fairly based on their intended use and value.

Exemptions and Deductions

Mississippi offers a range of exemptions and deductions to reduce the property tax burden on certain individuals and properties. For instance, homeowners aged 65 or older with limited incomes may be eligible for a homestead exemption, which reduces the taxable value of their primary residence. Similarly, certain agricultural lands may qualify for agricultural use valuation, where the property is assessed based on its current use rather than its potential highest and best use.

Furthermore, Mississippi provides a Disabled Veterans Homestead Exemption, offering a full exemption from property taxes for disabled veterans who meet specific criteria. These exemptions not only provide financial relief but also serve as a way to support and recognize specific groups within the community.

Calculating Property Taxes in Mississippi

The process of calculating property taxes in Mississippi involves a series of steps, each contributing to the final tax amount. Let’s break it down to understand the process clearly.

Step 1: Determining the Assessed Value

The first step in calculating property taxes is to determine the assessed value of the property. This is done by multiplying the fair market value of the property by the assessment ratio specific to its classification. For instance, if a commercial property has a fair market value of 500,000 and a 15% assessment ratio, the assessed value would be 75,000.

Step 2: Applying the Tax Rate

Once the assessed value is determined, the next step is to apply the tax rate. As mentioned earlier, tax rates vary across counties and are set by local authorities. For example, if the tax rate in a particular county is 3%, the tax liability for the commercial property with an assessed value of 75,000 would be 2,250.

Step 3: Adjustments and Deductions

The calculated tax amount may then be subject to adjustments and deductions. This step takes into account any applicable exemptions, such as the homestead exemption or the disabled veterans exemption. These adjustments can significantly reduce the final tax bill, making property ownership more affordable for eligible individuals.

Additionally, Mississippi allows for certain deductions, such as the School Tax Credit, which provides a credit against the property tax for homeowners with children enrolled in public schools. This credit aims to alleviate the tax burden on families with school-aged children.

Step 4: Final Tax Bill

After all the calculations, adjustments, and deductions, the final tax bill is determined. This is the amount that homeowners are required to pay to the local government. In Mississippi, property taxes are typically due in two installments, with the first installment due by February 1st and the second by August 31st. Failure to pay on time can result in penalties and interest charges.

It's important for homeowners to understand their tax bills and the factors that contribute to them. By being informed, homeowners can make more effective financial decisions and potentially take advantage of available exemptions and deductions.

Impact and Implications of Mississippi’s Property Tax

Mississippi’s property tax system has wide-ranging implications, impacting not just individual homeowners but also the state’s economy and community development. Let’s explore some of these impacts and their significance.

Revenue Generation and Government Spending

Property taxes are a significant source of revenue for local governments in Mississippi. This revenue is crucial for funding essential services such as education, infrastructure development, and public safety. By setting tax rates and classifications, local governments can determine the level of services they can provide and the quality of life for their residents.

For instance, higher tax rates can lead to improved schools, better roads, and enhanced public facilities. On the other hand, lower tax rates might result in limited funding for these services, impacting the overall development and attractiveness of the community.

Impact on Real Estate Market

The property tax system also plays a vital role in shaping the real estate market within Mississippi. Prospective homebuyers often consider property taxes as a significant factor when deciding on a location. Lower tax rates can make an area more attractive, potentially driving up property values and increasing demand.

Conversely, high property taxes can deter potential buyers, especially those on a tight budget. This can lead to a slowdown in the real estate market and impact the overall economic growth of the region. As such, finding the right balance between tax rates and services is crucial for maintaining a healthy real estate market.

Equity and Fairness Concerns

While Mississippi’s property tax system aims to be fair and equitable, there are concerns about the distribution of the tax burden. Properties with higher values tend to pay more in taxes, which can be seen as a progressive approach. However, this also means that wealthier individuals or businesses may bear a larger share of the tax responsibility.

To address this, Mississippi offers various exemptions and deductions, as mentioned earlier. These measures aim to reduce the tax burden on specific groups, ensuring a more equitable distribution of the tax liability. However, there are ongoing debates about the effectiveness and reach of these exemptions, highlighting the need for continuous evaluation and improvement of the system.

Comparative Analysis: Mississippi vs. Other States

To gain a broader perspective, let’s compare Mississippi’s property tax system with those of other states. By examining these comparisons, we can better understand the unique characteristics and potential areas for improvement within Mississippi’s framework.

Tax Rates and Burden

Mississippi’s property tax rates vary significantly across counties, with some counties having rates as low as 1% and others as high as 5%. This variability allows local governments to tailor their tax rates to their specific needs and the property values within their jurisdiction. However, it also leads to a wide range of tax burdens across the state.

In comparison, states like Hawaii and Alabama have relatively high average property tax rates, while states like Louisiana and Delaware have lower rates. These differences can impact the affordability of homeownership and the attractiveness of a state for real estate investment.

Assessment Methods

Mississippi’s assessment methods, which include sales comparison, cost approach, and income approach, are standard across many states. However, the frequency of reassessments varies. While Mississippi conducts reassessments every four years, other states may reassess annually or biennially. More frequent reassessments can ensure that property values are accurately reflected, but they also require more administrative effort and potentially increase the burden on homeowners.

Exemptions and Deductions

Mississippi’s exemption and deduction system is quite comprehensive, offering relief to various groups, including the elderly, disabled veterans, and agricultural landowners. However, some states provide even more extensive exemptions, such as California’s Proposition 13, which limits property tax increases to 2% per year unless the property changes ownership.

On the other hand, states like Texas and New Hampshire have no state-level property tax, relying solely on local governments for property taxation. This approach provides local control but can lead to significant variations in tax rates and burdens across different regions.

Online Payment and Assessment Tools

In today’s digital age, many states have embraced online tools to enhance the property tax process. Mississippi, like many other states, offers online platforms for property owners to access their assessment information, calculate their tax liability, and even pay their taxes electronically. These tools improve convenience and transparency, allowing homeowners to manage their property taxes efficiently.

Some states, such as Colorado and Utah, have gone a step further by providing advanced property search and valuation tools, allowing residents to compare property values and tax liabilities across different areas. Such initiatives promote transparency and empower homeowners to make more informed decisions.

Future Outlook and Potential Reforms

As we look ahead, it’s essential to consider potential reforms and future directions for Mississippi’s property tax system. By identifying areas for improvement, we can ensure that the system remains fair, efficient, and responsive to the needs of homeowners and the state.

Addressing Equity Concerns

One of the key areas for reform is addressing equity concerns within the system. While Mississippi’s exemptions and deductions aim to provide relief to specific groups, there is a growing recognition of the need for a more holistic approach to ensure fairness. This could involve revisiting assessment ratios and tax rates to create a more balanced distribution of the tax burden.

For instance, considering the income levels of property owners and the value of their properties could lead to a more progressive tax system. This would ensure that those with higher incomes and more valuable properties contribute proportionally more to the tax base, while providing relief to lower-income homeowners.

Enhancing Transparency and Accountability

Transparency is crucial for maintaining public trust in the property tax system. Mississippi can further enhance transparency by providing detailed information on tax rates, assessment methods, and the allocation of tax revenue. This information should be easily accessible to the public, allowing for greater scrutiny and understanding of the tax process.

Additionally, ensuring that the assessment process is consistent and fair across the state is essential. This might involve standardizing assessment methods and providing more training and resources to assessors to ensure uniformity in property valuations.

Embracing Technological Advancements

Technology has the potential to revolutionize the property tax system, making it more efficient and accurate. Mississippi can leverage advancements in data analytics and artificial intelligence to improve property assessments and tax calculations. For instance, using machine learning algorithms to analyze market trends and property values could lead to more accurate assessments, reducing the need for frequent reassessments.

Furthermore, adopting blockchain technology for secure and transparent record-keeping could enhance trust in the system and streamline the payment process. By embracing these technological advancements, Mississippi can stay at the forefront of property tax innovation, providing a more efficient and effective system for its residents.

Conclusion: A Comprehensive Guide to Mississippi’s Property Tax

In conclusion, understanding Mississippi’s property tax system is crucial for anyone involved in the state’s real estate market. From the assessment process to tax calculations and exemptions, each step has a significant impact on homeowners and the state’s economy. By providing a detailed analysis and comparison with other states, this guide aims to offer valuable insights and empower individuals to make informed decisions.

As we've explored, Mississippi's property tax system is a complex yet vital component of the state's financial framework. While it has its strengths and unique features, there are also areas for improvement, such as addressing equity concerns and embracing technological advancements. By staying informed and engaged, homeowners and policymakers can work together to shape a more fair, efficient, and responsive property tax system for the benefit of all Mississippians.

How often are property values reassessed in Mississippi?

+Property values in Mississippi are reassessed every four years by the State Tax Commission. This reassessment process ensures that property values are up-to-date and accurately reflect the current market conditions.

What is the average property tax rate in Mississippi?

+The average property tax rate in Mississippi varies depending on the county. While some counties have rates as low as 1%, others can go up to 5%. These rates are set by local governing bodies and can significantly impact the final tax bill.

Are there any exemptions or deductions available for property taxes in Mississippi?

+Yes, Mississippi offers a range of exemptions and deductions to reduce the property tax burden. These include homestead exemptions for homeowners aged 65 or older with limited incomes, agricultural use valuation for certain agricultural lands, and disabled veterans exemption for qualified veterans. These measures provide financial relief and support to specific groups.

How can I calculate my property taxes in Mississippi?

+To calculate your property taxes in Mississippi, you need to determine the assessed value of your property by multiplying its fair market value by the assessment ratio for your property type. Then, apply the tax rate set by your county to this assessed value. Finally, adjust this amount based on any applicable exemptions or deductions. Remember, Mississippi typically requires property taxes to be paid in two installments, with due dates in February and August.