Ohio Income Tax Calculator

Welcome to this comprehensive guide on the Ohio Income Tax Calculator, a vital tool for residents and businesses operating within the Buckeye State. As one of the most populous states in the Midwest, Ohio boasts a diverse economy with a strong focus on manufacturing, healthcare, and education. With a robust tax system, understanding the intricacies of Ohio's income tax landscape is essential for effective financial planning and compliance.

Unveiling the Ohio Income Tax Calculator

The Ohio Income Tax Calculator serves as a sophisticated tool designed to assist individuals and businesses in estimating their tax liabilities accurately. This calculator takes into account various factors such as taxable income, deductions, credits, and applicable tax rates to provide an estimate of the state income tax due. By utilizing this calculator, taxpayers can make informed decisions, plan their finances effectively, and ensure compliance with Ohio's tax regulations.

Ohio's income tax system is structured with a progressive rate schedule, meaning tax rates increase as taxable income rises. This approach ensures that higher-income earners contribute a larger share of their income towards state revenues. Understanding this progressive nature is crucial for taxpayers to assess their potential tax obligations accurately.

Key Features and Benefits

- Tax Rate Calculation: The calculator considers Ohio's tax rates, which vary based on income brackets. By inputting taxable income, users can determine the applicable tax rate and understand how their income is taxed.

- Deduction and Credit Analysis: Ohio allows various deductions and credits that can reduce taxable income. The calculator incorporates these deductions, such as the Standard Deduction, Personal Exemptions, and specific credits like the Ohio Earned Income Credit, to provide an accurate tax estimate.

- Filing Status Considerations: Ohio recognizes different filing statuses, including Single, Married Filing Jointly, Married Filing Separately, and Head of Household. The calculator accounts for these statuses to ensure an accurate tax calculation tailored to the user's specific circumstances.

- Taxable Income Estimation: The tool helps users estimate their taxable income by considering gross income, deductions, and exemptions. This estimation is crucial for understanding the potential tax liability and planning accordingly.

- Tax Planning and Strategy: By using the calculator, taxpayers can explore different scenarios and strategies to optimize their tax positions. Whether it's maximizing deductions, understanding the impact of tax credits, or planning for future tax liabilities, the calculator serves as a valuable tool for financial planning.

Exploring Ohio's Tax Landscape

Ohio's tax system is characterized by a combination of income, sales, and property taxes. While this guide focuses on income taxes, it's essential to recognize the broader tax environment to understand the state's overall fiscal landscape.

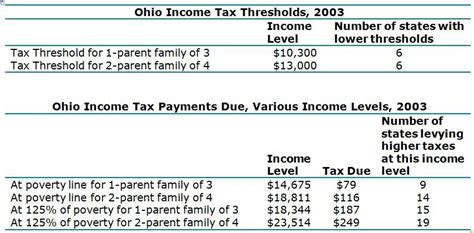

Income Tax Rates and Brackets

Ohio's income tax rates are structured with several brackets, each associated with a specific tax rate. As of [most recent year], the tax rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $5,600 | 0.4797% |

| $5,601 - $11,200 | 1.4697% |

| $11,201 - $16,000 | 2.8297% |

| $16,001 - $21,000 | 3.7997% |

| $21,001 and above | 4.7997% |

These tax rates are applied to taxable income, which is calculated after accounting for deductions and exemptions. The progressive nature of these rates ensures a fair and equitable tax system.

Deductions and Credits

Ohio offers several deductions and credits to reduce taxable income and provide tax relief to residents. Some of the key deductions and credits include:

- Standard Deduction: Ohio provides a standard deduction for taxpayers, allowing them to reduce their taxable income by a predetermined amount. This deduction simplifies the tax filing process and provides a basic level of tax relief.

- Personal Exemptions: Ohio allows personal exemptions for taxpayers and their dependents. These exemptions further reduce taxable income, providing a benefit to families and individuals with dependents.

- Ohio Earned Income Credit: The state offers an Earned Income Credit to eligible low- and moderate-income taxpayers. This credit provides a refundable tax credit, helping offset some of the income tax liability and providing financial support to working families.

- Tax Credits for Seniors and Disabled: Ohio provides specific tax credits for seniors and individuals with disabilities. These credits aim to provide tax relief and support to these vulnerable populations, recognizing their unique financial circumstances.

Maximizing Tax Benefits

Understanding the available deductions and credits is crucial for maximizing tax benefits in Ohio. Here are some strategies to consider:

Strategic Tax Planning

Tax planning is an essential aspect of financial management. By utilizing the Ohio Income Tax Calculator, taxpayers can explore different scenarios and strategies to optimize their tax positions. This may involve adjusting income levels, maximizing deductions, or taking advantage of available tax credits.

For example, taxpayers can consider contributing to retirement accounts, such as 401(k)s or IRAs, to reduce taxable income and potentially qualify for additional tax deductions. Additionally, understanding the impact of deductions and credits on tax liability can help taxpayers make informed decisions about their financial strategies.

Understanding Deduction Limits

While deductions and credits provide valuable tax benefits, it's essential to understand any limitations or restrictions associated with them. Some deductions and credits may have income thresholds or specific eligibility criteria. By being aware of these limits, taxpayers can ensure they qualify for the full extent of the available benefits.

Seeking Professional Guidance

Ohio's tax system can be complex, especially for those with unique financial circumstances or businesses. Seeking guidance from tax professionals or consultants can provide valuable insights and ensure compliance with state tax regulations. Tax experts can help navigate the intricacies of deductions, credits, and filing requirements, ensuring taxpayers make the most of the available benefits.

Frequently Asked Questions (FAQs)

What is the Ohio Income Tax Rate for 2023?

+Ohio's income tax rate for 2023 remains at 4.7997% for all income brackets. This flat rate applies to taxable income, ensuring a straightforward calculation process.

Are there any income tax deductions available in Ohio?

+Yes, Ohio offers several income tax deductions. These include the Standard Deduction, Personal Exemptions, and specific deductions for seniors, military personnel, and individuals with disabilities. Consulting with a tax professional can help identify applicable deductions.

Can I use the Ohio Income Tax Calculator for business taxes?

+The Ohio Income Tax Calculator is primarily designed for individuals and their personal income taxes. However, some aspects, such as understanding tax rates and deductions, can provide insights for business tax planning. For comprehensive business tax guidance, it's advisable to consult with a tax professional or accountant.

When is the deadline for filing Ohio state income taxes?

+The deadline for filing Ohio state income taxes typically aligns with the federal tax filing deadline. For the tax year [most recent year], the deadline is [deadline date]. It's important to note that deadlines may vary for different circumstances, such as extensions or special filing situations.

In conclusion, the Ohio Income Tax Calculator is a valuable tool for residents and businesses to navigate the state’s tax landscape. By understanding tax rates, deductions, and credits, taxpayers can make informed decisions, optimize their tax positions, and ensure compliance with Ohio’s tax regulations. With strategic tax planning and professional guidance, individuals and businesses can effectively manage their tax obligations and maximize the available benefits.