Us Tax Court

The United States Tax Court, often referred to simply as the Tax Court, plays a pivotal role in the American judicial system, offering a specialized forum for taxpayers to resolve disputes with the Internal Revenue Service (IRS) regarding federal taxes. This court is a critical component of the administrative and judicial processes that shape the nation's tax system, providing a vital avenue for taxpayers to challenge IRS determinations and seek fair resolutions.

Understanding the Jurisdiction and Purpose of the U.S. Tax Court

Established by Congress under Article I of the U.S. Constitution, the Tax Court operates as a national, administrative adjudicative body. It possesses exclusive jurisdiction over a range of tax-related matters, including disputes arising from deficiencies in income, estate, and gift taxes, as well as controversies related to the determination of overpayments, the collection of taxes, and the application of the Internal Revenue Code.

The primary objective of the Tax Court is to provide taxpayers with an impartial forum where they can contest IRS determinations without the need to pay the disputed amount upfront and then seek a refund. This pre-payment review mechanism is a unique feature of the Tax Court, offering taxpayers a valuable opportunity to resolve disputes before they incur substantial financial obligations.

Key Features and Benefits of the Tax Court

- The Tax Court offers a streamlined and efficient process for resolving tax disputes, often resulting in quicker resolutions compared to traditional court proceedings.

- It provides a less adversarial environment than regular courts, fostering a collaborative approach to dispute resolution.

- Taxpayers have the right to represent themselves or appoint legal representation, ensuring access to justice regardless of financial means.

- The court’s decisions are often based on a comprehensive understanding of tax laws and regulations, ensuring fair and accurate rulings.

- Its jurisdiction extends nationwide, ensuring consistent and uniform application of tax laws across the country.

The Tax Court’s Impact on Taxpayers and the IRS

For taxpayers, the Tax Court serves as a vital safeguard against potential errors or disagreements with the IRS. It provides a platform for taxpayers to present their cases, defend their tax positions, and seek corrections or adjustments to their tax liabilities. This not only ensures fairness and accuracy in tax assessments but also empowers taxpayers to actively participate in the tax determination process.

From the IRS's perspective, the Tax Court plays a critical role in maintaining the integrity and consistency of tax administration. By offering a structured forum for dispute resolution, the Tax Court allows the IRS to address taxpayer concerns directly, clarify tax regulations, and ensure uniform application of tax laws. This, in turn, enhances the overall efficiency and effectiveness of the tax collection process.

| Statistical Snapshot | 2022 Data |

|---|---|

| Number of Cases Filed | 47,335 |

| Percentage of Cases Decided in Favor of the IRS | 46% |

| Average Time for Case Resolution | 15 months |

Procedural Aspects and Processes in the Tax Court

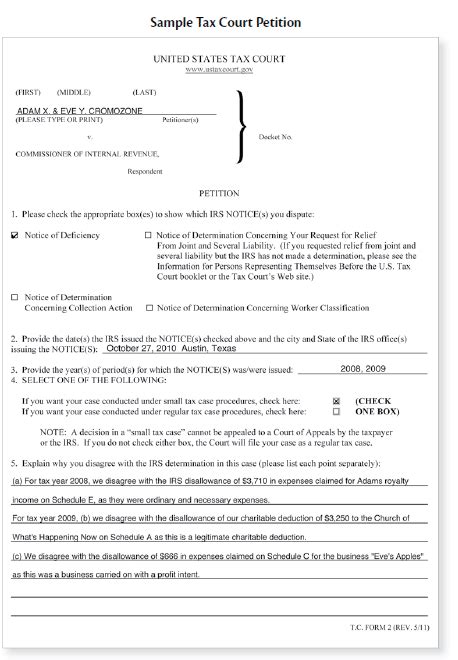

The procedural landscape within the Tax Court is designed to balance efficiency with fairness. Cases typically commence with the filing of a petition, which initiates the court’s jurisdiction. The Tax Court follows a well-defined set of rules and procedures, including rules for evidence, discovery, and trial, to ensure a structured and transparent process.

Key Procedural Milestones

- Petition Filing: Taxpayers must file a petition within a specified timeframe, usually 90 days, after receiving a notice of deficiency from the IRS.

- Pre-Trial Proceedings: This phase involves the exchange of evidence, witness lists, and the submission of pre-trial briefs. It provides an opportunity for both parties to gather and present their cases.

- Trial: The trial phase is a formal hearing where the taxpayer and the IRS present their arguments and evidence before a judge. The court’s decision is typically based on the presented facts and applicable tax laws.

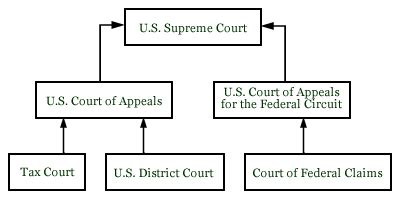

- Post-Trial Proceedings: Following the trial, the court issues a decision, which can be appealed to the U.S. Court of Appeals.

Navigating the Tax Court: A Step-by-Step Guide

- Receipt of IRS Notice: Upon receiving a notice of deficiency or a collection action, taxpayers should carefully review the notice and understand the IRS’s position.

- Petition Preparation: Taxpayers must prepare and file a petition with the Tax Court, outlining the grounds for their dispute. This is a critical step that requires attention to detail.

- Pre-Trial Preparation: During this phase, taxpayers should gather all relevant evidence, consult with tax professionals, and prepare their case. This is an opportunity to strengthen their arguments and ensure a robust presentation.

- Trial: The trial is a formal proceeding where taxpayers present their case before a judge. It is essential to be well-prepared and present a clear and concise argument.

- Post-Trial: After the trial, taxpayers await the court’s decision. If dissatisfied with the outcome, they have the option to appeal to a higher court.

| Tax Court Procedures | Description |

|---|---|

| Petition Filing | A critical step initiating the court's jurisdiction, requiring accuracy and attention to detail. |

| Pre-Trial Briefs | These briefs outline the taxpayer's position and are a key part of the pre-trial preparation. |

| Discovery Process | A phase where both parties exchange information and evidence, crucial for a comprehensive case presentation. |

Recent Developments and Future Prospects in the Tax Court

The Tax Court, like any judicial body, is subject to ongoing evolution and reform. Recent years have seen a focus on streamlining processes, enhancing accessibility, and improving the overall efficiency of the court. The court has been proactive in adopting technological advancements, such as video conferencing and electronic filing, to modernize its operations and cater to the needs of a diverse taxpayer base.

Key Initiatives and Reforms

- Alternative Dispute Resolution (ADR): The Tax Court has been actively promoting ADR methods, including mediation and arbitration, to resolve cases more efficiently and cost-effectively.

- Technology Integration: The court has embraced digital technologies, offering online case management systems and virtual hearing options to enhance accessibility and convenience for taxpayers.

- Continued Education and Training: The Tax Court places a strong emphasis on judge and staff training, ensuring that they remain abreast of evolving tax laws and regulations.

Looking Ahead: The Tax Court’s Role in a Changing Tax Landscape

As the tax landscape continues to evolve, with complex tax reforms and an increasingly globalized economy, the Tax Court’s role becomes even more critical. The court is expected to play a pivotal role in interpreting and applying new tax laws, ensuring fairness and consistency in their implementation. Additionally, the court’s ability to adapt to technological advancements and cater to the diverse needs of taxpayers will be crucial in maintaining its relevance and effectiveness.

In conclusion, the U.S. Tax Court stands as a cornerstone of the American tax system, offering a specialized forum for taxpayers to resolve disputes and seek justice. Its unique jurisdiction, procedural processes, and impact on taxpayers and the IRS underscore its importance in ensuring fairness, efficiency, and consistency in tax administration. As the tax landscape continues to evolve, the Tax Court's adaptability and commitment to innovation will be key to its ongoing success and relevance.

What is the average turnaround time for a case in the Tax Court?

+On average, a case in the Tax Court takes approximately 15 months to reach a resolution. However, this timeline can vary significantly based on the complexity of the case, the court’s caseload, and the parties’ preparedness.

Can taxpayers represent themselves in the Tax Court, or do they need a lawyer?

+Taxpayers have the right to represent themselves in the Tax Court, a practice known as “pro se” representation. However, given the complexity of tax laws and the formal nature of court proceedings, many taxpayers choose to engage the services of a tax professional or attorney to ensure a strong case presentation.

How can taxpayers prepare for a Tax Court trial?

+Preparation is key for a successful Tax Court trial. Taxpayers should gather all relevant documents, consult with tax professionals, and clearly understand the grounds for their dispute. It is beneficial to have a well-organized case presentation and be prepared to address potential questions or challenges from the IRS.