Orangeburg County Taxes

Orangeburg County, located in the heart of South Carolina, is a vibrant and diverse region known for its rich history, cultural heritage, and thriving communities. The county, with its scenic landscapes and friendly neighborhoods, attracts residents and businesses alike. As with any locality, understanding the tax system and its implications is essential for both residents and prospective newcomers. This article aims to provide a comprehensive guide to Orangeburg County taxes, covering various aspects such as property taxes, business taxes, and tax incentives, to help readers navigate the tax landscape with ease.

Unraveling the Complexities of Orangeburg County’s Tax System

Taxes play a crucial role in the development and maintenance of any county, and Orangeburg is no exception. The tax system in this region is designed to support the local government’s operations, fund public services, and contribute to the overall economic growth of the area. While the intricacies of tax laws can be daunting, this guide aims to simplify the process, offering a clear understanding of Orangeburg County’s tax structure.

Property Taxes: A Key Component of Orangeburg’s Tax Base

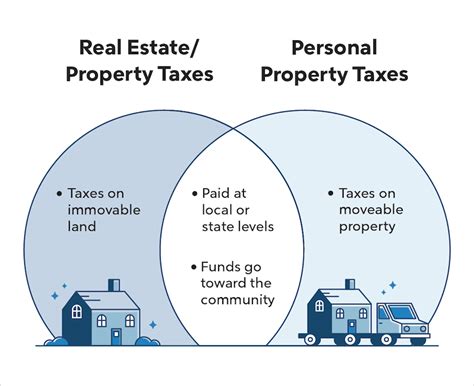

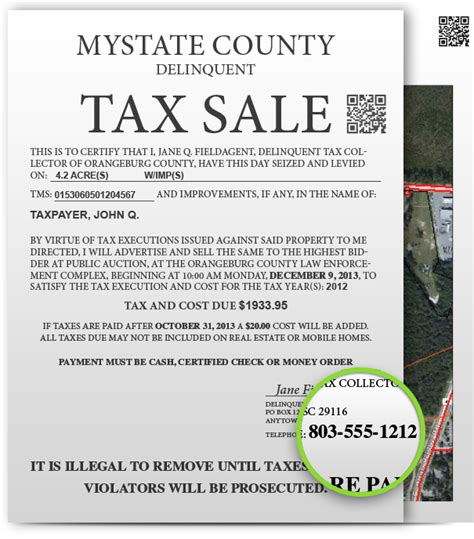

One of the primary sources of revenue for Orangeburg County is property taxes. These taxes are levied on real estate properties, including residential homes, commercial buildings, and vacant land. The property tax rate in Orangeburg County is determined by the millage rate, which is set annually by the county council and varies depending on the location and type of property.

| Property Type | Millage Rate |

|---|---|

| Residential | 100 mills |

| Commercial | 120 mills |

| Agricultural | 70 mills |

For instance, if you own a residential property in Orangeburg County, you can expect to pay 100 mills in property taxes. To calculate the actual tax amount, the assessed value of your property is multiplied by the millage rate and then divided by 1000. Here's an example calculation:

Assessed Value of Property: $200,000

Millage Rate: 100 mills (0.10)

Property Tax Amount: ($200,000 x 0.10) / 1000 = $2,000

Orangeburg County also offers tax exemptions and relief programs to certain eligible homeowners, such as the Homestead Exemption and the Veterans Exemption. These programs can significantly reduce the tax burden for qualifying individuals.

Business Taxes: Supporting Economic Growth in Orangeburg

Orangeburg County is committed to fostering a business-friendly environment, and its tax system reflects this priority. Businesses operating within the county are subject to various taxes, including sales tax, business license tax, and occupational license tax. Understanding these taxes is crucial for any entrepreneur looking to establish or expand their operations in the area.

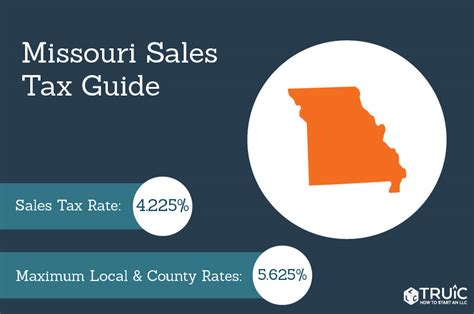

Sales tax is a significant revenue generator for the county. The current sales tax rate in Orangeburg County is 6%, which includes the state sales tax of 6% and the local sales tax of 0%. This rate is applicable to most tangible personal property and certain services.

Businesses must also obtain a business license, the cost of which varies depending on the type and size of the business. Additionally, certain professions require an occupational license, the fees for which are set by the county.

To encourage economic development, Orangeburg County offers tax incentives to qualifying businesses. These incentives may include tax abatements, tax credits, or reduced tax rates for a specific period. The county's Economic Development Office works closely with businesses to tailor incentives that support their growth and expansion plans.

Tax Incentives and Relief Programs: Boosting Business and Community Development

Orangeburg County recognizes the importance of attracting and retaining businesses, and as such, has implemented a range of tax incentives and relief programs. These initiatives aim to stimulate economic growth, create jobs, and enhance the overall quality of life in the region.

One notable program is the County's Job Tax Credit, which offers a tax credit of up to $2,500 per new job created. This incentive is designed to encourage businesses to expand their operations and create additional employment opportunities for local residents.

The county also provides tax abatements for certain types of development, such as the construction of affordable housing or the rehabilitation of historic properties. These abatements can significantly reduce the tax burden for qualifying projects, making them more financially viable.

For small businesses, Orangeburg County offers a Small Business Tax Credit, which provides a tax credit of up to $5,000 for eligible expenses related to business start-up or expansion. This credit aims to support entrepreneurship and help small businesses overcome initial financial hurdles.

Furthermore, the county actively participates in state-level incentive programs, such as the South Carolina Jobs-Economic Development Act (JEDA), which offers a range of incentives for qualifying businesses, including tax credits, exemptions, and grants. These incentives can be particularly attractive for businesses looking to establish a significant presence in the region.

Navigating the Tax Landscape: A Comprehensive Guide for Residents and Businesses

Understanding the tax system in Orangeburg County is a crucial step towards financial planning and compliance. Whether you’re a homeowner looking to minimize your tax liability or a business owner seeking to maximize incentives, this guide provides a solid foundation. By staying informed about tax rates, exemptions, and incentives, individuals and businesses can make more strategic decisions that benefit both their financial well-being and the community as a whole.

Remember, the tax landscape is subject to change, and it's essential to stay updated with any new developments or amendments to tax laws. Consult with tax professionals or reach out to the Orangeburg County Tax Assessor's Office for the most accurate and up-to-date information.

How often are property tax assessments conducted in Orangeburg County?

+Property tax assessments in Orangeburg County are conducted every five years. However, if there are significant improvements or changes to a property, an assessment may be triggered earlier.

Are there any tax relief programs for senior citizens in Orangeburg County?

+Yes, Orangeburg County offers the Senior Citizens Exemption Program, which provides a tax exemption of up to 10,000 on the assessed value of a primary residence for qualifying senior citizens.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What are the eligibility criteria for the County's Job Tax Credit?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>To be eligible for the Job Tax Credit, businesses must create new, full-time jobs with a minimum annual salary of 35,000. The credit is available for up to five years and is based on the number of new jobs created.

How can businesses stay updated with the latest tax incentives and changes in Orangeburg County?

+Businesses can subscribe to the Orangeburg County Economic Development Office’s newsletter, which provides regular updates on tax incentives, changes in tax laws, and other economic development news.

Are there any tax incentives for renewable energy projects in Orangeburg County?

+Yes, the county offers a Renewable Energy Tax Credit, which provides a tax credit for the installation of renewable energy systems, such as solar panels or wind turbines. The credit can be up to 25% of the cost of the system, with a maximum credit of $2,500.