State Of Missouri Sales Tax

The State of Missouri imposes a sales tax on the sale of tangible personal property and certain services. This tax is an essential revenue source for the state, contributing to various public services and infrastructure development. Understanding the intricacies of Missouri's sales tax system is crucial for businesses and individuals alike, as it impacts their financial obligations and planning.

Sales Tax in Missouri: An Overview

Missouri’s sales tax is a consumption tax, meaning it is applied to the sale of goods and certain services at the point of purchase. The state sets a base sales tax rate, but local jurisdictions can also levy additional taxes, creating a composite rate that varies across the state. This unique structure adds complexity to tax compliance, as businesses must navigate multiple tax rates depending on their location and the location of their customers.

The state's sales tax is administered by the Missouri Department of Revenue (DOR), which provides guidance, collects taxes, and enforces compliance. The DOR's role is vital in ensuring that businesses understand their tax obligations and that the state's revenue streams are protected.

Key Features of Missouri’s Sales Tax System

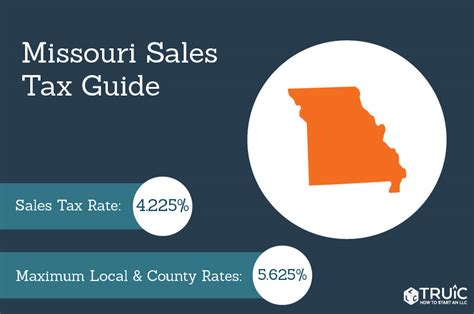

- The state’s base sales tax rate is set at 4.225%, which includes both the state and local taxes. This rate is applied uniformly across the state, serving as the foundation for local additions.

- Local taxing jurisdictions, including cities and counties, have the authority to levy additional sales taxes. These local taxes can vary significantly, leading to a range of composite rates across Missouri.

- Missouri’s sales tax applies to most tangible personal property and certain services. This includes items like clothing, electronics, and furniture, as well as services like repairs and rentals.

- There are exemptions and special provisions for certain goods and services. For instance, some food items, prescription drugs, and certain manufacturing inputs are exempt from sales tax.

- The state offers simplified tax rates for specific areas, known as Tax Rate Zones. These zones aim to provide a more uniform tax experience for certain regions, simplifying tax compliance for businesses and consumers.

| Sales Tax Rate Type | Rate (%) |

|---|---|

| State Base Rate | 4.225 |

| Average Local Rate | 1.785 |

| Highest Composite Rate | 10.425 |

Compliance and Registration

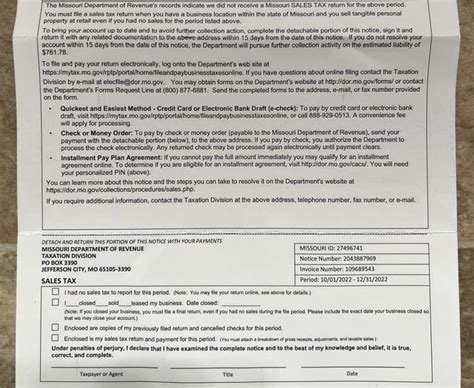

Businesses operating in Missouri must register with the DOR to obtain a sales tax permit. This permit authorizes them to collect and remit sales tax on behalf of the state. The registration process involves providing detailed information about the business, its location, and the nature of its operations.

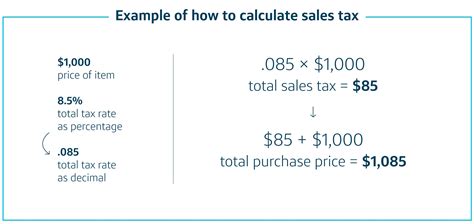

Once registered, businesses are responsible for calculating the applicable tax rate for each transaction, based on the location of the sale and the specific goods or services involved. They must then collect the tax from customers at the point of sale and remit it to the DOR on a regular basis, typically monthly or quarterly.

Challenges in Compliance

The complexity of Missouri’s sales tax system, with its varying local rates and specific exemptions, presents challenges for businesses. Accurate tax calculation and compliance can be a daunting task, especially for businesses with multiple locations or those selling online, where tax rates can differ based on the customer’s shipping address.

To address these challenges, businesses often utilize sales tax software and outsourced tax compliance services. These tools and services help ensure accurate tax calculations, proper filing, and timely remittance, reducing the risk of non-compliance and associated penalties.

Impact on Businesses and Consumers

Missouri’s sales tax has a significant impact on both businesses and consumers. For businesses, the tax affects their pricing strategies, profit margins, and cash flow. It also adds administrative burdens, particularly for smaller businesses that may not have dedicated tax professionals on staff.

From a consumer perspective, sales tax adds to the cost of goods and services. While it is an expected part of doing business in Missouri, it can influence purchasing decisions, especially for higher-value items. Consumers often consider the total cost, including tax, when making purchases, which can impact the demand for certain products or services.

Strategic Considerations for Businesses

Businesses operating in Missouri need to carefully consider the impact of sales tax on their operations. They must ensure that their pricing strategies account for the applicable tax rates, especially when selling to multiple locations or online. This may involve offering competitive pricing or providing clear tax information to customers during the purchasing process.

Additionally, businesses should stay informed about tax rate changes and potential exemptions that could impact their operations. This proactive approach can help them optimize their tax obligations and potentially reduce their tax liability.

Future Trends and Potential Changes

The landscape of sales tax in Missouri is subject to change, influenced by economic conditions, political decisions, and technological advancements. While the state’s current sales tax system is well-established, there are ongoing discussions and proposals for reforms that could impact businesses and consumers.

Proposed Reforms and Their Implications

One notable proposal is the streamlining of sales tax rates across the state. This reform aims to simplify the tax system by reducing the number of varying local rates and potentially standardizing the tax structure. If implemented, it could significantly reduce the compliance burden for businesses, making tax calculations and filings more straightforward.

Another potential reform involves expanding the sales tax base to include certain services that are currently exempt. This could increase the state's revenue but may also impact the pricing and competitiveness of affected industries. Businesses would need to adapt their pricing models and strategies to accommodate these changes.

Additionally, with the rise of e-commerce, there is a growing focus on online sales tax collection. Missouri, like many other states, is considering ways to ensure that online retailers collect and remit sales tax on transactions conducted within the state. This shift could impact the operations of both online retailers and traditional brick-and-mortar businesses, particularly those with an online presence.

| Potential Reform | Implications |

|---|---|

| Rate Streamlining | Simplified tax compliance for businesses; reduced administrative burden. |

| Sales Tax Base Expansion | Increased revenue for the state; potential price adjustments for affected industries. |

| Online Sales Tax Collection | Impact on e-commerce businesses; potential compliance challenges for online retailers. |

Conclusion

Missouri’s sales tax system is a critical component of the state’s revenue generation, impacting businesses and consumers alike. With its unique structure and varying rates, it presents both opportunities and challenges. Businesses must navigate this complex landscape to ensure compliance and optimize their operations, while consumers make purchasing decisions with an awareness of the tax implications.

As the state considers reforms and adapts to evolving economic and technological landscapes, the sales tax system will likely undergo changes. Staying informed and proactive in understanding these changes will be essential for all stakeholders in Missouri's business and economic community.

FAQ

What is the current base sales tax rate in Missouri?

+

The current base sales tax rate in Missouri is 4.225%.

Can local jurisdictions add sales tax on top of the state rate?

+

Yes, local jurisdictions, including cities and counties, have the authority to levy additional sales taxes on top of the state rate.

Are there any items or services exempt from sales tax in Missouri?

+

Yes, there are exemptions for certain items and services, including some food items, prescription drugs, and certain manufacturing inputs.

How often do businesses need to remit sales tax to the Missouri Department of Revenue?

+

Businesses typically remit sales tax on a monthly or quarterly basis, depending on their tax liability and registration status.

What happens if a business fails to collect and remit sales tax correctly?

+

Failure to comply with sales tax obligations can result in penalties, interest charges, and potential legal consequences. It’s crucial for businesses to stay informed and ensure accurate tax collection and remittance.