Is A Tax Id The Same As An Ein

An Employer Identification Number (EIN), also known as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number, is a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) in the United States. It serves as a crucial identifier for businesses and organizations for tax purposes and is often referred to as a Tax ID or Tax Identification Number (TIN) in common parlance.

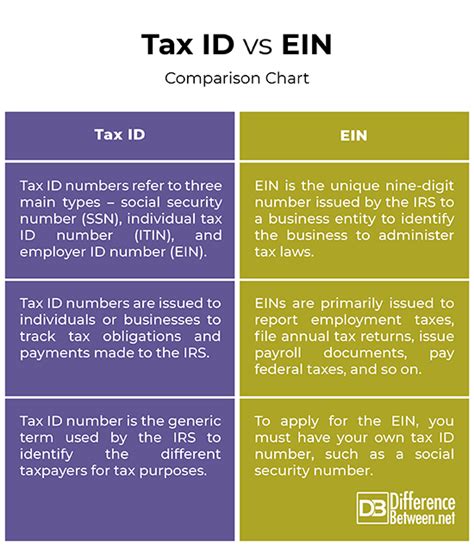

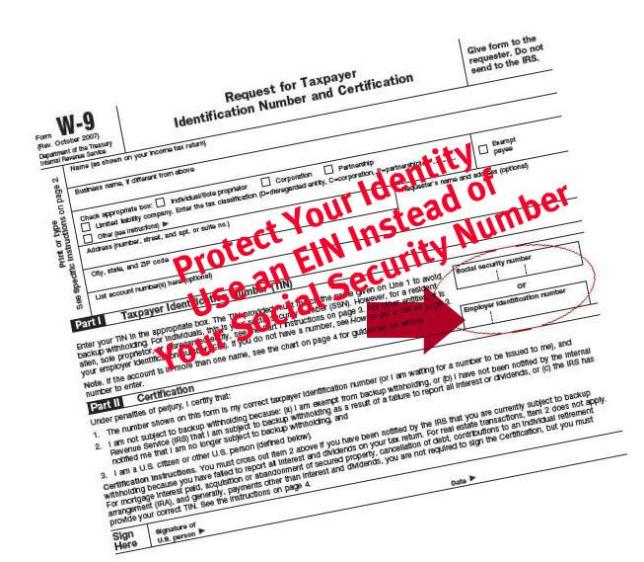

While the terms Tax ID and EIN are frequently used interchangeably in everyday conversations, it's important to clarify their technical distinctions. An EIN is specifically designated for tax purposes and is not the same as other types of identification numbers, such as Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs), which are used for personal identification and taxation.

Understanding the Purpose and Function of EINs

EINs are primarily assigned to businesses and organizations, including corporations, partnerships, trusts, estates, and government agencies. They are used to identify the tax accounts of these entities and are required for various tax-related activities, such as filing tax returns, opening a business bank account, hiring employees, and applying for loans or permits.

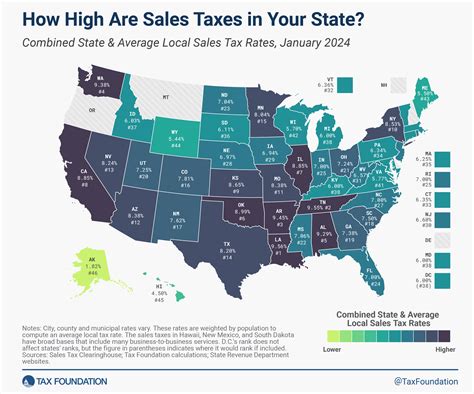

EINs are essential for businesses to comply with tax laws and regulations. They enable the IRS to track and manage tax obligations, including income tax, employment tax, and excise tax. Additionally, EINs are used for reporting and paying other taxes, such as payroll taxes and sales taxes, depending on the specific business activities and jurisdictions involved.

The Application Process and Requirements for EINs

To obtain an EIN, businesses typically submit an application to the IRS. The application process can be completed online, by fax, or by mail. The IRS provides an online tool called the EIN Assistant, which guides applicants through the process and ensures they provide the necessary information. The required details include the legal name and address of the business, the business structure (e.g., corporation, partnership, sole proprietorship), and the responsible party’s information (the person authorized to act on behalf of the business).

It's important to note that the IRS does not charge a fee for assigning an EIN. However, third-party services may offer EIN application assistance for a fee, which is not necessary or required by the IRS. Businesses should be cautious of such services and ensure they are dealing directly with the IRS to avoid potential scams or unnecessary expenses.

Using EINs for Business Operations

Once an EIN is obtained, it becomes a critical component of a business’s identity and operations. It is used on various official documents and forms, including tax returns, employment tax forms, and business licenses. EINs are also required when opening business bank accounts, applying for business permits and licenses, and engaging in transactions with government agencies.

Businesses must safeguard their EINs and ensure they are not misused or shared without authorization. Just like personal identification numbers, EINs should be protected to prevent fraud and maintain the integrity of the business's tax and financial records.

The Distinction Between EINs and Other Identification Numbers

While EINs are specifically assigned to businesses and organizations, other identification numbers serve different purposes. Here’s a brief overview of some common types of identification numbers and how they differ from EINs:

Social Security Number (SSN)

An SSN is a nine-digit number issued by the Social Security Administration to individuals, primarily for social security and tax purposes. It is used to track an individual’s earnings and benefits and is required for personal tax filings and various financial activities. SSNs are not assigned to businesses or organizations and are exclusively used for personal identification.

Individual Taxpayer Identification Number (ITIN)

An ITIN is a nine-digit number issued by the IRS to individuals who are required to have a U.S. taxpayer identification number but are not eligible for an SSN. This includes non-resident aliens, foreign nationals, and certain other individuals who need to file U.S. tax returns. ITINs are used specifically for tax purposes and do not confer work authorization or eligibility for Social Security benefits.

Business Tax Registration Number (BTRN)

A BTRN is a unique identifier assigned to businesses by state or local tax authorities for tax registration purposes. It is used to identify a business’s tax account within a specific jurisdiction and is required for reporting and paying state or local taxes, such as sales tax or franchise tax. BTRNs may have different formats and requirements depending on the state or locality.

Other Business Identification Numbers

In addition to EINs and BTRNs, businesses may encounter other identification numbers depending on their industry and location. For example, the Department of Transportation (DOT) assigns unique numbers to motor carriers for regulatory purposes, and the Drug Enforcement Administration (DEA) assigns registration numbers to businesses involved in controlled substances.

It's crucial for businesses to understand the specific identification numbers required for their operations and to ensure they are using the correct identifiers for the appropriate purposes. Misusing or misrepresenting identification numbers can lead to legal and financial consequences, so accurate and informed use of these numbers is essential.

The Future of EINs and Tax Identification

As technology advances and tax systems evolve, the use of EINs and other tax identification numbers is likely to undergo changes and improvements. The IRS and other government agencies are continuously working to enhance security measures, streamline processes, and provide better services to businesses and taxpayers.

One notable development is the IRS's transition to a modernized e-File system, which aims to improve the efficiency and security of tax filing and payment processes. The system, known as MeF (Modernized e-File), provides a more user-friendly and secure platform for businesses to transmit tax information electronically. This transition is part of the IRS's broader effort to modernize its systems and enhance taxpayer services.

Additionally, the IRS is exploring the use of advanced technologies, such as blockchain and artificial intelligence, to enhance tax administration and compliance. These technologies have the potential to improve data security, streamline processes, and reduce the burden on taxpayers and businesses. For example, blockchain technology could enhance the security and transparency of tax data, while artificial intelligence could assist in tax return processing and audit selection.

Conclusion

EINs, or Tax IDs, play a vital role in the tax and business operations of organizations in the United States. They serve as unique identifiers, enabling the IRS and other government agencies to track and manage tax obligations effectively. While the terms Tax ID and EIN are often used interchangeably, it’s important to understand their specific purposes and distinctions to ensure accurate and compliant use.

As technology continues to advance, the future of tax identification and administration holds promise for increased efficiency, security, and convenience. Businesses and taxpayers can expect continued improvements and innovations from the IRS and other government entities, aimed at streamlining processes and enhancing the overall tax experience.

Can an individual have an EIN?

+While EINs are primarily assigned to businesses and organizations, there are certain situations where individuals may need an EIN. For example, sole proprietors who have employees or certain types of trusts or estates may require an EIN for tax purposes. However, in most cases, individuals use their Social Security Number (SSN) for personal tax filings.

How long does it take to get an EIN?

+The time it takes to receive an EIN can vary depending on the application method and the IRS’s workload. When applying online through the EIN Assistant, businesses can typically receive their EIN immediately. However, applications submitted by fax or mail may take several days or weeks to process.

Can an EIN be used for personal tax filings?

+No, an EIN should not be used for personal tax filings. EINs are specifically assigned to businesses and organizations for tax purposes. Individuals should use their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for personal tax filings.

Are there any fees associated with obtaining an EIN?

+No, the IRS does not charge a fee for assigning an EIN. However, be cautious of third-party services that offer EIN application assistance for a fee. These services are not necessary and may lead to unnecessary expenses. The official process for obtaining an EIN is provided directly by the IRS at no cost.