Washington State Business Taxes

Washington State, known for its vibrant economy and diverse industries, offers a unique tax landscape for businesses. Understanding the intricacies of business taxes in this region is crucial for entrepreneurs and business owners seeking to establish and grow their ventures. This comprehensive guide delves into the various tax obligations and considerations for businesses operating within Washington State, providing an in-depth analysis of tax laws, structures, and strategies.

Navigating the Tax Landscape: An Overview

Washington State boasts a robust economy, with a wide range of industries thriving, including technology, aerospace, agriculture, and outdoor recreation. This diversity brings about a complex tax system that businesses must navigate. The state’s tax structure is designed to support economic growth while ensuring equitable contributions from businesses. Let’s explore the key components of Washington State’s business tax system.

Taxation Types and Rates

Washington State operates on a multifaceted tax system, encompassing various types of taxes that businesses may encounter. These include:

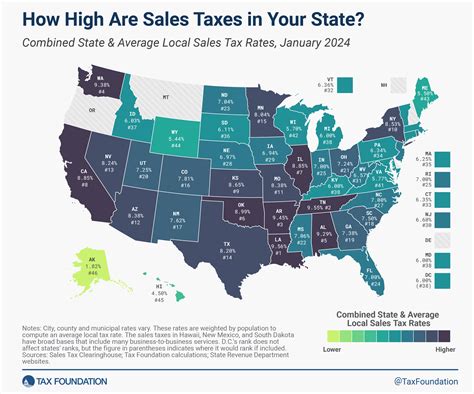

- Sales and Use Tax: A tax levied on the sale of tangible personal property and certain services. The state’s sales tax rate is 6.5%, but local jurisdictions may add additional sales tax, resulting in varying rates across the state.

- Business and Occupation (B&O) Tax: A unique feature of Washington’s tax system, the B&O tax is a gross receipts tax applied to businesses based on their activities. The tax rate varies depending on the business activity, with rates ranging from 0.164% to 1.9%.

- Property Tax: Businesses owning real or personal property in Washington are subject to property taxes, which are determined by the assessed value of the property and the local tax rate.

- Excise Taxes: These taxes are applied to specific activities or goods, such as fuel, tobacco, and alcohol. Excise tax rates vary depending on the product or service.

| Tax Type | Rate | Description |

|---|---|---|

| Sales and Use Tax | 6.5% (State) + Local Rates | Tax on tangible goods and services. |

| Business and Occupation Tax | 0.164% - 1.9% | Gross receipts tax based on business activity. |

| Property Tax | Varies by County | Tax on real and personal property. |

| Excise Taxes | Varies by Product | Taxes on specific goods and activities. |

Tax Registration and Compliance

To operate legally in Washington State, businesses must register with the Washington State Department of Revenue and obtain the necessary tax permits and licenses. The registration process involves providing detailed information about the business, its activities, and its expected tax obligations. Once registered, businesses are responsible for accurate tax reporting and timely payment of taxes.

Business and Occupation (B&O) Tax: A Comprehensive Guide

The Business and Occupation (B&O) tax is a cornerstone of Washington State’s tax system, designed to tax businesses based on their revenue generation activities. Understanding the intricacies of the B&O tax is essential for businesses operating within the state. Let’s explore the key aspects of this tax.

B&O Tax Categories and Rates

The B&O tax is categorized into several classes, each with its own tax rate. The rate applied depends on the primary business activity of the entity. Here are the main B&O tax classes and their corresponding rates:

- Retailers and Wholesalers: 0.471% tax rate on gross income from retail or wholesale sales.

- Manufacturers: 0.484% tax rate on the value of products manufactured in Washington.

- Service and Other Businesses: 1.5% tax rate on gross income from services or other business activities.

- Construction Contractors: 0.962% tax rate on the value of construction contracts.

- Public Utility Companies: Taxed based on gross income, with rates varying depending on the type of utility.

| B&O Tax Class | Tax Rate | Description |

|---|---|---|

| Retailers and Wholesalers | 0.471% | Tax on gross income from sales. |

| Manufacturers | 0.484% | Tax on value of manufactured products. |

| Service and Other Businesses | 1.5% | Tax on gross income from services. |

| Construction Contractors | 0.962% | Tax on value of construction contracts. |

| Public Utility Companies | Varies | Taxed based on gross income. |

Tax Exemptions and Credits

Washington State offers various tax exemptions and credits to support specific industries and promote economic growth. These incentives can significantly reduce a business’s tax liability. Here are some notable exemptions and credits:

- Manufacturing Exemption: Certain manufacturing activities may be exempt from B&O tax, promoting investment in this sector.

- Research and Development Credit: Businesses engaged in research and development activities may be eligible for a tax credit, reducing their B&O tax liability.

- High-Tech Job Creation Tax Credit: Businesses creating high-tech jobs may qualify for a tax credit, encouraging innovation and job growth.

- Small Business Tax Credit: Small businesses with low gross income may be eligible for a tax credit, providing relief for startups and small enterprises.

Sales and Use Tax: Understanding the Essentials

The Sales and Use Tax is a fundamental component of Washington State’s tax system, applicable to a wide range of businesses. Understanding this tax is crucial for accurate tax reporting and compliance. Let’s delve into the key aspects of sales and use tax in Washington.

Sales Tax Basics

The sales tax is a tax levied on the sale of tangible personal property and certain services. It is collected by the seller at the point of sale and remitted to the state. The base sales tax rate in Washington State is 6.5%, but local jurisdictions may add additional sales tax, resulting in a combined state and local sales tax rate. It’s essential for businesses to understand the sales tax rates applicable to their specific locations.

Use Tax and Nexus

The use tax is a complementary tax to the sales tax, applicable when tangible personal property is used, stored, or consumed in Washington State without being subject to sales tax. This often arises in situations where the seller does not have a physical presence in the state but still delivers goods to Washington residents. Businesses must understand their nexus with the state to determine if they are required to collect and remit use tax.

Sales Tax Registration and Compliance

Businesses engaged in taxable sales in Washington State must register with the Washington State Department of Revenue for a sales tax permit. This registration process involves providing detailed information about the business and its sales activities. Once registered, businesses are responsible for collecting and remitting sales tax accurately and timely.

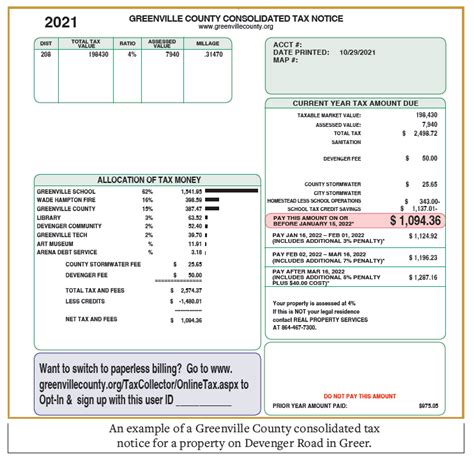

Property Tax: A Localized Perspective

Property tax is a critical component of Washington State’s tax system, as it supports local governments and schools. The property tax landscape in Washington is localized, with tax rates and assessments varying by county. Understanding property tax is essential for businesses owning real or personal property within the state.

Property Tax Assessment and Rates

Property tax in Washington is determined by the assessed value of the property and the local tax rate. The assessed value is typically based on the property’s fair market value, and it is reassessed periodically. The local tax rate is set by the county government and may vary significantly across the state. It’s crucial for businesses to understand the property tax rates and assessment processes in their specific counties.

Property Tax Exemptions

Washington State offers various property tax exemptions to support specific industries and promote economic development. These exemptions can provide significant relief to businesses operating within the state. Here are some notable property tax exemptions:

- Manufacturing Equipment Exemption: Certain manufacturing equipment may be exempt from property tax, encouraging investment in this sector.

- Agricultural Land Exemption: Agricultural lands may be eligible for a reduced property tax assessment, supporting the state’s agricultural industry.

- Historic Property Tax Relief: Properties with historic significance may qualify for property tax relief, promoting the preservation of historic buildings.

Excise Taxes: Targeted Taxation

Excise taxes in Washington State are targeted taxes applied to specific goods and activities. These taxes are designed to generate revenue for specific purposes and to regulate certain industries. Understanding excise taxes is crucial for businesses involved in the production, distribution, or sale of goods subject to these taxes.

Fuel Excise Tax

The fuel excise tax is a tax levied on the sale or use of gasoline, diesel fuel, and other motor vehicle fuels. The tax rate varies depending on the type of fuel and is typically collected by fuel distributors. This tax contributes to the state’s transportation infrastructure and environmental initiatives.

Tobacco and Alcohol Excise Taxes

Washington State imposes excise taxes on the sale and distribution of tobacco products and alcoholic beverages. These taxes are designed to generate revenue and regulate the consumption of these products. The tax rates for tobacco and alcohol vary and are typically collected by distributors or retailers.

Other Excise Taxes

Washington State also imposes excise taxes on various other goods and activities, including:

- Airline Tickets

- Motor Vehicle Sales

- Telephone Services

- Gaming and Gambling Activities

Tax Strategies and Planning

Navigating Washington State’s complex tax landscape requires careful planning and strategy. Businesses can employ various tax strategies to optimize their tax obligations and minimize their tax liability. Here are some key considerations for tax planning:

- Understand Your Tax Profile: Assess your business’s tax obligations, including sales tax, B&O tax, property tax, and excise taxes. Understand the applicable tax rates and any exemptions or credits you may qualify for.

- Optimize Taxable Activities: Review your business activities and consider restructuring to take advantage of lower tax rates or tax exemptions. For example, manufacturing activities may be subject to a lower B&O tax rate than service-based activities.

- Utilize Tax Incentives: Take advantage of the various tax incentives and credits offered by Washington State. These incentives can provide significant tax savings and support your business’s growth.

- Seek Professional Guidance: Engage with tax professionals or accountants who specialize in Washington State taxes. They can provide tailored advice and ensure your tax planning is compliant and effective.

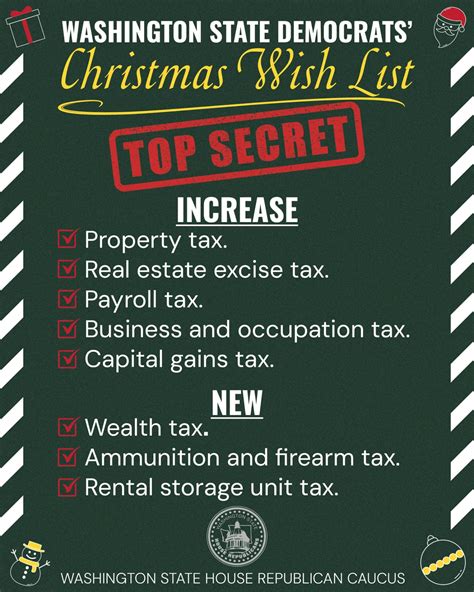

Future Outlook and Considerations

Washington State’s tax landscape is dynamic, with ongoing discussions and potential changes. As the state continues to evolve, businesses must stay informed about tax reforms and policy changes. Here are some key considerations for the future:

- Tax Reform Initiatives: Washington State has explored various tax reform proposals, including potential changes to the B&O tax structure and rates. Stay updated on these initiatives to understand their potential impact on your business.

- Economic Trends and Industry Shifts: Keep an eye on economic trends and industry shifts that may influence tax policies. For example, the growth of e-commerce and remote work may lead to new tax considerations.

- International Trade and Tax Agreements: Washington State’s economy is interconnected with global trade. Stay informed about international tax agreements and their potential impact on your business’s tax obligations.

Conclusion: A Tax-Savvy Approach

Understanding and navigating Washington State’s business tax landscape is essential for successful entrepreneurship and business growth. By comprehending the various tax obligations, rates, and incentives, businesses can make informed decisions and optimize their tax strategies. Stay informed, seek professional guidance, and embrace a tax-savvy approach to ensure your business thrives within Washington State’s dynamic tax environment.

What are the key differences between Washington State’s sales tax and use tax?

+Sales tax is levied on the sale of tangible personal property and certain services, while use tax is applicable when tangible personal property is used, stored, or consumed without being subject to sales tax. Use tax is often relevant for out-of-state purchases or when the seller does not have a physical presence in Washington.

How often do property tax assessments occur in Washington State?

+Property tax assessments typically occur every two years, with the assessed value of the property being determined based on its fair market value. However, certain counties may have different assessment cycles, so it’s essential to check with the local assessor’s office for specific details.

Are there any online resources available for businesses to calculate their tax obligations in Washington State?

+Yes, the Washington State Department of Revenue provides an online tax calculator tool that businesses can use to estimate their tax obligations. This tool takes into account various factors, including sales volume, business activity, and applicable tax rates. It’s a valuable resource for businesses to get a rough estimate of their tax liability.