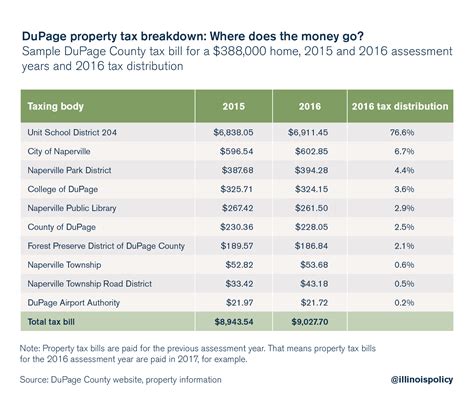

Otsego County Tax Map

The Otsego County Tax Map is an essential tool for property owners, real estate professionals, and government agencies alike. It provides a comprehensive and detailed overview of the county's land parcels, their boundaries, and crucial information related to property taxation. This digital mapping system offers an efficient and accurate way to access and manage property data, ensuring fair and transparent taxation processes. In this article, we will delve into the intricacies of the Otsego County Tax Map, exploring its features, benefits, and impact on the community.

Understanding the Otsego County Tax Map

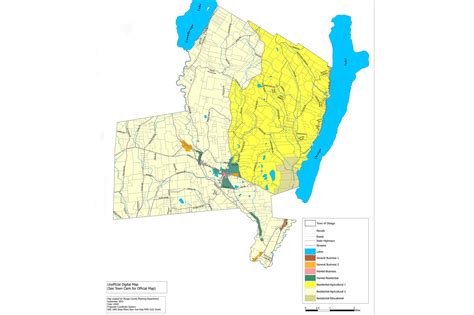

The Otsego County Tax Map is a sophisticated digital platform that serves as a central repository for all property-related data in the county. It integrates various sources of information, including cadastral surveys, deed records, aerial imagery, and tax assessment data, to create a comprehensive map-based interface. This map not only displays the physical boundaries of each property but also provides detailed information about ownership, tax assessment values, zoning classifications, and other relevant attributes.

One of the key advantages of the Otsego County Tax Map is its user-friendly interface. Property owners and professionals can easily navigate through the map, search for specific properties using various criteria, and access detailed information with just a few clicks. The map's interactive features allow users to zoom in on individual parcels, view aerial photographs, and access historical data, making it an invaluable resource for research and decision-making.

Key Features of the Otsego County Tax Map

- Property Search Functionality: Users can search for properties by address, owner’s name, parcel ID, or even geographical coordinates. This feature simplifies the process of locating specific properties and accessing their associated data.

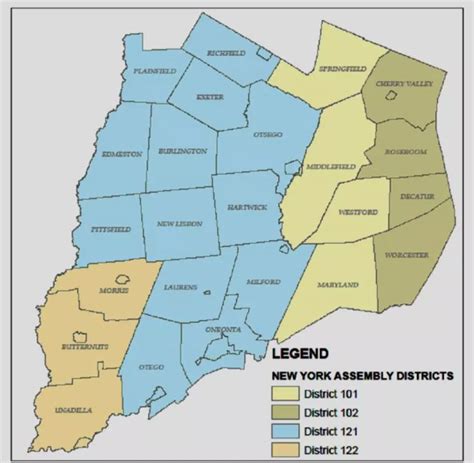

- Detailed Property Information: The map provides a wealth of information about each property, including ownership details, tax assessment values, land use, and any outstanding tax liabilities. This data is regularly updated to ensure accuracy.

- Aerial Imagery and Mapping: High-resolution aerial imagery is integrated into the map, allowing users to visualize the physical characteristics of the land, including topography, neighboring properties, and any recent changes or developments.

- Historical Data: The Otsego County Tax Map maintains a historical record of property transactions, allowing users to trace the ownership and assessment history of a parcel over time. This feature is particularly valuable for research and analysis.

- Interactive Tools: The map offers various interactive tools such as measurement tools, which enable users to calculate the area and perimeter of a property, and comparison tools to analyze the differences between multiple parcels.

| Property Attribute | Available Data |

|---|---|

| Ownership Details | Owner's Name, Address, Contact Information |

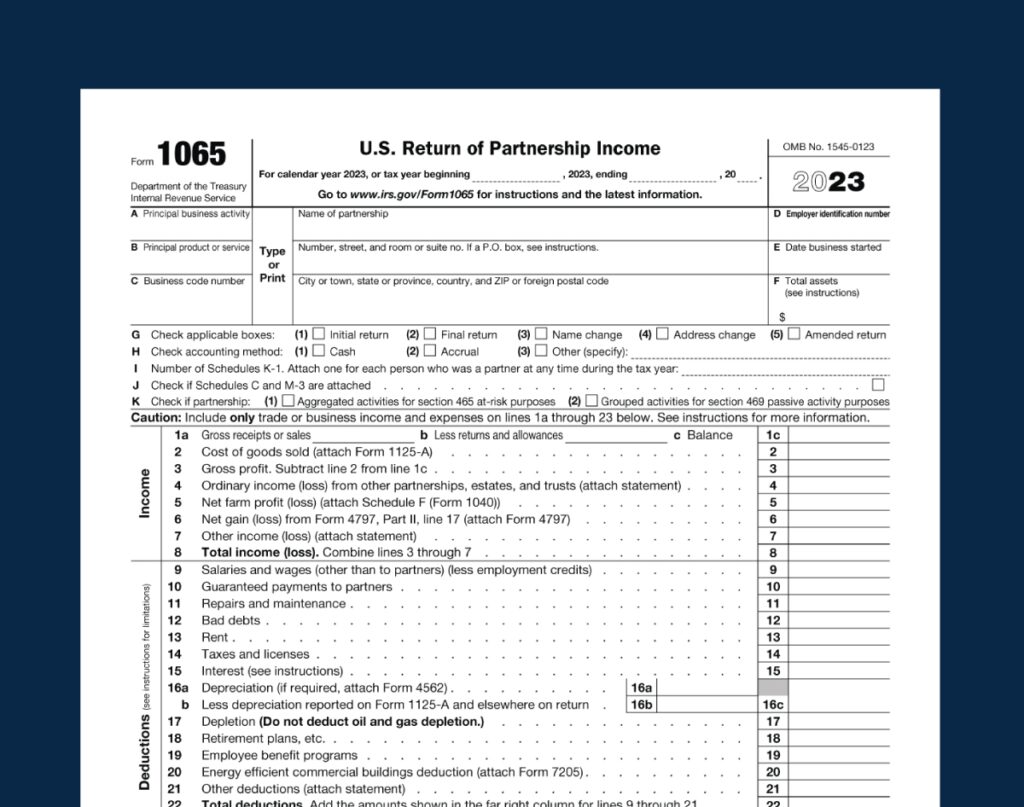

| Tax Assessment | Current and Historical Assessment Values, Tax Rates, and Calculations |

| Land Use and Zoning | Zoning Classifications, Land Use Restrictions, and Permitted Uses |

| Property Improvements | Details about Buildings, Structures, and Improvements on the Property |

Benefits and Impact on the Community

The implementation of the Otsego County Tax Map has brought numerous benefits to the community, enhancing transparency, efficiency, and accessibility in property-related matters.

Transparency and Fair Taxation

The Otsego County Tax Map ensures transparency in the taxation process by providing equal access to property information for all residents. Property owners can easily verify their tax assessments, understand the basis for calculations, and identify any discrepancies. This transparency fosters trust between taxpayers and the government, reducing the likelihood of disputes and promoting fair taxation practices.

Efficiency and Time Savings

The digital nature of the Otsego County Tax Map streamlines various property-related processes, saving time and resources for both property owners and government agencies. Property searches, data retrieval, and record keeping are now faster and more accurate, eliminating the need for manual data entry and reducing administrative burdens.

Enhanced Decision-Making

The comprehensive data available on the Otsego County Tax Map empowers property owners, investors, and developers to make informed decisions. Whether it’s evaluating a property for purchase, assessing the feasibility of a development project, or understanding the local real estate market, the map provides the necessary insights. This leads to more strategic decision-making and reduces the risks associated with property investments.

Community Engagement and Awareness

By making property information easily accessible, the Otsego County Tax Map encourages community engagement and awareness. Residents can explore their neighborhood, learn about nearby properties, and stay informed about local developments. This fosters a sense of community and enables residents to actively participate in local decision-making processes.

Future Implications and Potential Developments

As technology continues to advance, the Otsego County Tax Map is expected to evolve and incorporate new features to meet the changing needs of the community. Some potential future developments include:

- Integration with GIS Systems: Combining the Otsego County Tax Map with Geographic Information Systems (GIS) could provide even more powerful analysis and visualization capabilities, enabling advanced spatial analysis and planning.

- Real-Time Data Updates: Implementing real-time data updates would ensure that the map remains current and accurate, reflecting any changes in property ownership, assessments, or land use immediately.

- Mobile Accessibility: Developing a mobile-friendly version of the map would enhance accessibility, allowing users to access property information on the go and providing valuable tools for field work and inspections.

- Data Visualization Tools: Advanced data visualization techniques could be employed to present complex property data in intuitive and visually appealing ways, making it easier for users to interpret and understand the information.

Conclusion

The Otsego County Tax Map is a powerful tool that revolutionizes the way property data is accessed and managed. Its user-friendly interface, comprehensive data, and interactive features make it an invaluable resource for property owners, professionals, and the community at large. By enhancing transparency, efficiency, and decision-making capabilities, the Otsego County Tax Map plays a vital role in fostering a fair and sustainable property market. As the map continues to evolve, it will undoubtedly remain a cornerstone of Otsego County’s real estate landscape, shaping the future of property management and taxation.

How often is the Otsego County Tax Map updated?

+The Otsego County Tax Map is updated on a regular basis to ensure the accuracy and currency of property information. Updates are typically made annually, incorporating changes in ownership, assessments, and other relevant data. In some cases, special updates may be conducted to reflect significant changes or developments.

Can I access the Otsego County Tax Map online from anywhere?

+Yes, the Otsego County Tax Map is accessible online through the county’s official website. It can be accessed from any device with an internet connection, providing convenient access to property information for residents, professionals, and anyone interested in Otsego County real estate.

Are there any privacy concerns associated with the Otsego County Tax Map?

+Otsego County takes privacy seriously and has implemented measures to protect sensitive information. While the tax map provides detailed property data, personal information such as social security numbers and financial details are not included. The county’s privacy policy ensures that only authorized users can access certain confidential information.