Va Property Tax

Welcome to this in-depth exploration of Virginia's property tax system, a crucial aspect of the state's economy and an essential component of local government funding. Property taxes are a primary source of revenue for various services and infrastructure, making them a vital topic for homeowners, investors, and anyone interested in Virginia's real estate landscape.

Understanding Virginia’s Property Tax Landscape

The property tax system in Virginia, like many other states, is a complex mechanism that varies across counties and cities. It is a crucial revenue stream for local governments, supporting essential services such as education, public safety, and infrastructure development. This article aims to demystify this system, providing a comprehensive guide to understanding and navigating property taxes in the state.

Virginia's property tax system is based on the assessed value of a property, which is determined by the local government's assessment office. This value is then used to calculate the tax amount, which is paid annually by the property owner. The assessment process, tax rates, and exemptions vary across the state's 95 counties and 38 independent cities, making it a diverse and dynamic landscape.

The Assessment Process: A Deep Dive

Property assessment is a critical step in the property tax process, as it determines the value on which taxes are calculated. In Virginia, assessments are typically conducted every year, with some localities opting for a biennial or triennial cycle. The assessment office in each locality is responsible for determining the fair market value of properties, which is the price for which a property would likely sell in an open and competitive market.

The assessment process involves a combination of methods, including sales comparison, cost approach, and income approach. The sales comparison method, often the primary tool, involves comparing the property to similar properties that have recently sold in the area. The cost approach estimates the property's value based on the cost to replace it, minus depreciation. The income approach is more commonly used for income-producing properties, where the value is derived from the property's potential income.

| Assessment Method | Description |

|---|---|

| Sales Comparison | Compares the property to recent sales of similar properties |

| Cost Approach | Estimates value based on replacement cost minus depreciation |

| Income Approach | Derives value from potential income of the property |

The assessed value is not the sale price of the property, and it might not reflect the actual market value, especially in rapidly changing real estate markets. Property owners have the right to appeal their assessment if they believe it is inaccurate. The appeal process varies by locality but generally involves a review by an independent board and, in some cases, a hearing.

Tax Rates and Exemptions: A County-by-County Breakdown

Virginia’s property tax rates vary widely across the state, with each county and city setting its own rate. These rates are expressed in cents per $100 of assessed value, often referred to as the “tax rate per hundred.”

For instance, Arlington County has one of the highest property tax rates in the state at $1.05 per $100 of assessed value, while Buckingham County has one of the lowest at $0.60 per $100. These rates can significantly impact a property owner's tax liability, with higher rates leading to larger tax bills.

| County/City | Tax Rate per Hundred |

|---|---|

| Arlington County | $1.05 |

| Fairfax County | $1.13 |

| Prince William County | $1.15 |

| Buckingham County | $0.60 |

| Appomattox County | $0.65 |

| Bath County | $0.71 |

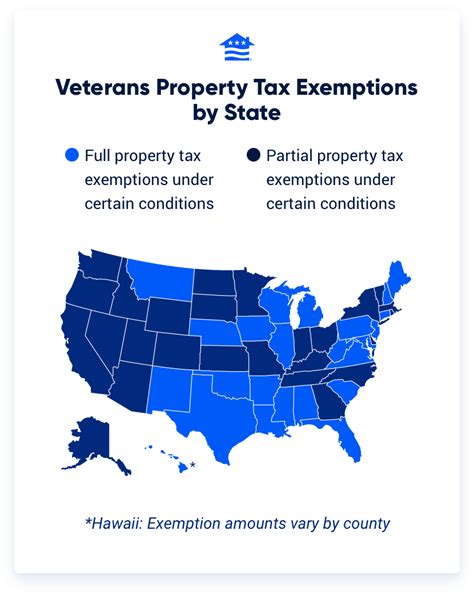

In addition to varying tax rates, Virginia offers several exemptions that can reduce a property owner's tax liability. These include the standard homeowner's exemption, which reduces the assessed value of a primary residence by $250,000, and various other exemptions for seniors, veterans, and disabled individuals.

The Impact of Property Taxes on Virginia’s Economy

Property taxes play a significant role in Virginia’s economy, providing a stable and reliable revenue stream for local governments. These funds are crucial for maintaining and improving public services, including schools, roads, public safety, and other community facilities. The revenue generated through property taxes helps to create a vibrant and thriving community, attracting businesses and residents alike.

However, the impact of property taxes is not uniform across the state. High-growth areas, such as Northern Virginia, experience rapid increases in property values, leading to higher tax revenues. On the other hand, rural areas with slower growth might struggle to generate sufficient revenue, impacting the quality and availability of local services.

Property taxes also influence investment decisions, with investors considering tax rates and potential tax liabilities when evaluating real estate opportunities in Virginia. A well-managed and transparent property tax system can therefore be a significant draw for investors, contributing to the state's economic growth.

Tips for Navigating Virginia’s Property Tax System

Understanding and managing property taxes can be a complex task, but there are several strategies that property owners can employ to navigate this landscape effectively.

- Stay Informed: Keep up-to-date with the latest tax rates and assessment practices in your locality. This information is typically available on the local government's website or through the assessment office.

- Appeal Your Assessment: If you believe your property's assessed value is inaccurate, you have the right to appeal. Gather evidence, such as recent sales of similar properties, to support your case.

- Explore Exemptions: Research the various exemptions available and determine if you qualify for any of them. This can significantly reduce your tax liability.

- Plan for Changes: If you anticipate changes to your property, such as renovations or additions, consider the potential impact on your tax liability. Consult with a tax professional to understand the implications.

- Engage with Local Government: Attend local government meetings and stay involved in community affairs. This can provide insights into the budget process and potential changes to tax rates or assessment practices.

Conclusion

Virginia’s property tax system is a complex but essential component of the state’s economy and local government funding. By understanding this system and staying informed about local practices, property owners can effectively manage their tax liabilities and contribute to the vibrant communities across the state. This guide provides a comprehensive overview, but it is always advisable to consult with local experts and tax professionals for specific advice.

FAQ

When are property taxes due in Virginia?

+

Property taxes in Virginia are typically due in two installments. The first installment is due by October 5th, and the second by March 10th of the following year. However, some localities may have different due dates, so it’s essential to check with your local government or tax office.

How often are properties assessed for tax purposes in Virginia?

+

Properties in Virginia are generally assessed annually. However, some localities may opt for a biennial or triennial assessment cycle. It’s important to check with your local assessment office to understand the assessment schedule in your area.

Can I appeal my property tax assessment in Virginia?

+

Yes, property owners in Virginia have the right to appeal their property tax assessment if they believe it is incorrect or unfair. The appeal process involves submitting an application to the local Board of Equalization or Board of Assessment Appeals. It’s advisable to gather evidence, such as recent sales of similar properties, to support your case.

Are there any exemptions available for property taxes in Virginia?

+

Yes, Virginia offers several exemptions that can reduce a property owner’s tax liability. These include the standard homeowner’s exemption, which reduces the assessed value of a primary residence by $250,000, and various other exemptions for seniors, veterans, and disabled individuals. It’s worth researching these exemptions to determine if you qualify.

How do property taxes impact the real estate market in Virginia?

+

Property taxes can significantly influence investment decisions and the overall real estate market in Virginia. Areas with higher tax rates or rapid increases in property values may be less attractive to investors, while regions with lower tax rates and stable assessments can be more appealing. Property taxes also impact the affordability of housing for residents.