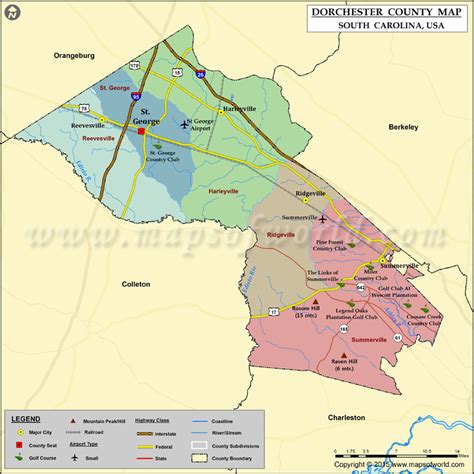

Dorchester County Tax

Understanding Dorchester County taxes is crucial for both residents and businesses operating within this vibrant South Carolina county. With its diverse economy, historic charm, and growing communities, Dorchester County offers a unique tax landscape that requires careful navigation. This comprehensive guide aims to demystify the tax structure, providing an in-depth analysis of the various tax types, rates, and exemptions specific to Dorchester County.

Navigating the Dorchester County Tax System

The tax system in Dorchester County, like any other county, is a complex network of regulations and policies designed to generate revenue for essential public services. This section provides an overview of the county’s tax structure, highlighting the key tax types and their significance.

Property Taxes: The Backbone of County Revenue

Property taxes are a fundamental component of Dorchester County’s tax system. These taxes are levied on both real estate and personal property, with rates varying based on the property’s location and assessed value. The revenue generated from property taxes funds a range of critical services, including schools, public safety, infrastructure development, and more.

| Tax Type | Rate | Exemptions |

|---|---|---|

| Residential Property Tax | 10.4 mills (as of 2023) | Homestead exemption for primary residences |

| Commercial Property Tax | 11.6 mills (as of 2023) | None specified |

| Agricultural Property Tax | 4% assessment ratio | Farmland preservation program benefits |

The Dorchester County Assessor's Office plays a crucial role in determining property values, which directly influence the tax amount. Property owners can appeal their assessments if they believe the value is inaccurate. Additionally, the county offers various tax relief programs to assist senior citizens and disabled individuals.

Sales and Use Taxes: Impact on Businesses and Consumers

Dorchester County, like the rest of South Carolina, imposes a sales and use tax on the retail sale, lease, or rental of tangible personal property, as well as certain services. This tax is collected by businesses and remitted to the state and county governments.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% (as of 2023) |

| Dorchester County Sales Tax | 1% (as of 2023) |

| Accommodations Tax | 3% on hotel and motel stays |

Businesses operating in Dorchester County are responsible for registering for sales tax permits and filing regular tax returns. Failure to comply can result in penalties and interest charges. It's important to note that certain goods and services are exempt from sales tax, such as most groceries and prescription drugs.

Personal Income Taxes: Individual Contributions to County Finances

Dorchester County residents, like all South Carolina residents, are subject to state income tax. The county also imposes a local income tax, which is collected alongside the state income tax. The revenue generated from income taxes contributes to various county services and initiatives.

| Tax Type | Rate |

|---|---|

| State Income Tax | Top rate of 7% (as of 2023) |

| Dorchester County Income Tax | 0.5% (as of 2023) |

Dorchester County residents are required to file state and local income tax returns annually, declaring their earnings and claiming any applicable deductions and credits. Proper tax planning and compliance are essential to avoid penalties and ensure accurate reporting.

Vehicle Taxes: Owning and Operating Vehicles in Dorchester County

Vehicle taxes in Dorchester County are assessed based on the vehicle’s value and the type of registration. These taxes fund road maintenance, public transportation, and other transportation-related initiatives.

| Tax Type | Rate |

|---|---|

| Vehicle Property Tax | 6% of assessed value |

| Vehicle Registration Fee | $62 for standard registration |

Vehicle owners in Dorchester County are responsible for paying these taxes and fees annually or biennially, depending on their registration type. Late payments may incur penalties and interest charges. It's important to keep accurate records of vehicle purchases, sales, and registration to ensure compliance.

Estate and Inheritance Taxes: Transferring Wealth within the County

Dorchester County, like the rest of South Carolina, does not impose an estate or inheritance tax. However, residents should be aware of the federal estate tax, which may apply to large estates. Understanding these taxes is crucial for effective estate planning and wealth transfer.

Other Taxes and Fees: A Comprehensive Overview

Dorchester County, like many other counties, imposes various other taxes and fees to fund specific services and initiatives. These include:

- Dog License Fee: Required for all dogs over the age of 6 months.

- Business License Tax: Varies based on the type of business and its location.

- Meal Tax: A small percentage added to restaurant bills to fund tourism initiatives.

- Special Assessment Taxes: Levied for specific community projects or improvements.

Tax Relief and Incentives: Supporting Residents and Businesses

Dorchester County recognizes the importance of providing tax relief and incentives to support its residents and businesses. These initiatives aim to ease the tax burden and encourage economic growth and development.

Senior Citizen and Disability Tax Relief

Dorchester County offers tax relief programs for senior citizens and individuals with disabilities. These programs provide reduced property tax rates and other benefits to eligible residents. The county’s Assessor’s Office provides detailed information on qualification criteria and the application process.

Business Incentives and Tax Credits

The county actively promotes economic development by offering various business incentives and tax credits. These include:

- Job Tax Credits: Incentives for businesses creating new jobs within the county.

- Investment Tax Credits: Credits for businesses investing in new equipment or infrastructure.

- Research and Development Credits: Tax benefits for companies engaged in research and development activities.

Tax Exemptions for Non-Profits and Religious Organizations

Dorchester County exempts certain properties owned by non-profit organizations and religious institutions from property taxes. This exemption supports the vital services provided by these entities within the community.

Tax Compliance and Enforcement: Ensuring Fairness and Accountability

Dorchester County takes tax compliance seriously, implementing measures to ensure that all taxpayers meet their obligations. The county’s tax authorities work diligently to maintain a fair and equitable tax system.

Audit and Collection Processes

The Dorchester County Tax Collector’s Office conducts regular audits to verify tax compliance. These audits ensure that businesses and individuals are accurately reporting their taxable income, sales, and property values. Non-compliance can result in penalties, interest charges, and even legal action.

Taxpayer Rights and Appeals

Dorchester County recognizes the importance of taxpayer rights and provides mechanisms for appeals and disputes. Taxpayers who believe they have been incorrectly assessed or taxed can file appeals with the county’s Board of Assessment Appeals. This process ensures that taxpayers have a voice in the tax assessment and collection process.

Tax Relief for Disaster Victims

In the event of natural disasters or other emergencies, Dorchester County may offer tax relief to affected residents and businesses. This relief can include property tax deferrals, waivers, or abatements to help communities recover and rebuild.

Conclusion: A Comprehensive Tax Strategy for Dorchester County Residents

Understanding the intricacies of Dorchester County’s tax system is essential for both individuals and businesses. By familiarizing themselves with the various tax types, rates, and exemptions, residents can make informed financial decisions and plan their tax strategies effectively.

This guide has provided a comprehensive overview of the county's tax landscape, offering insights into property, sales, income, and other taxes. It's important for taxpayers to stay informed about any changes or updates to the tax code and to seek professional advice when needed. With careful planning and compliance, Dorchester County residents can navigate the tax system successfully and contribute to the county's vibrant economy.

How often do property tax rates change in Dorchester County?

+Property tax rates in Dorchester County can change annually, based on the county’s budget and financial needs. The county council reviews and approves these rates each year.

Are there any tax incentives for green energy initiatives in Dorchester County?

+Yes, Dorchester County offers tax credits for the installation of renewable energy systems, such as solar panels. These credits can significantly reduce the overall cost of these initiatives.

How can I apply for the senior citizen tax relief program?

+To apply for the senior citizen tax relief program, you can contact the Dorchester County Assessor’s Office. They will provide you with the necessary forms and guidelines for eligibility.

What happens if I miss the deadline for paying my property taxes?

+If you miss the deadline for paying your property taxes, you may incur late fees and interest charges. It’s important to stay informed about payment due dates and make timely payments to avoid penalties.

Are there any resources available for tax preparation and filing in Dorchester County?

+Yes, Dorchester County offers tax preparation assistance through various community programs and organizations. You can also seek professional tax preparation services to ensure accurate and timely filing.