Arkansas Sales Tax Rate

In the world of business and finance, understanding the intricacies of sales tax rates is crucial, especially when it comes to specific states like Arkansas. Sales tax is a significant source of revenue for states and can impact the financial planning of businesses and consumers alike. This article aims to delve into the topic of Arkansas' sales tax rate, exploring its history, current regulations, and the impact it has on the state's economy and business landscape.

The Evolution of Arkansas Sales Tax

Arkansas, like many other states, has a long history of imposing sales tax to generate revenue for various public services and infrastructure projects. The state’s sales tax journey began in 1931 with the enactment of the Sales and Use Tax Act, which established a 3% sales tax rate. This was a significant step towards modernizing the state’s tax system and ensuring a stable source of income for essential government functions.

Over the years, the sales tax rate in Arkansas has undergone several revisions to adapt to the changing economic landscape and revenue needs. One of the most notable adjustments occurred in 1989 when the state increased the sales tax rate to 5%, a move that aimed to address budget deficits and provide additional funding for education and infrastructure improvements.

The evolution of Arkansas' sales tax structure didn't stop there. In 2013, the state took a significant step towards streamlining its tax code by implementing the Arkansas Comprehensive Tax Reform and Research Act. This act not only reformed the state's income tax structure but also made changes to the sales tax, including the introduction of a 0.5% increase, bringing the total state sales tax rate to 6%. This increase was aimed at providing long-term stability to the state's revenue stream and reducing the reliance on volatile sources of income.

Current Sales Tax Rate in Arkansas

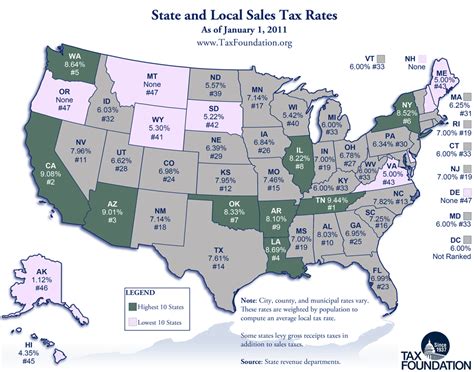

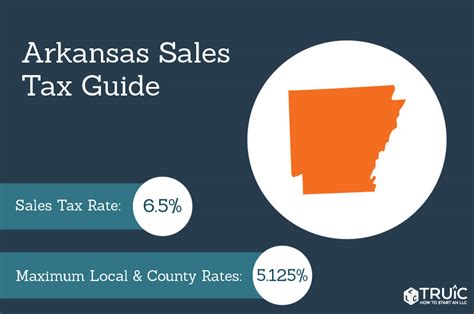

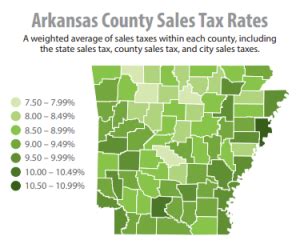

As of my last update in 2023, the general sales tax rate in Arkansas stands at 6%. This state-wide rate is applicable to most goods and services, making it a significant consideration for businesses operating within the state’s borders. However, it’s important to note that Arkansas, like many other states, also allows for local sales taxes to be levied by cities and counties.

Local sales taxes in Arkansas can vary significantly, with some areas imposing additional taxes ranging from 0.5% to 3%. These local variations in sales tax rates can have a substantial impact on businesses, particularly those with multiple locations or those that cater to a wide geographic area. It's essential for businesses to stay updated on these local tax rates to ensure compliance and accurate pricing strategies.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

| Local Sales Tax (Varies) | 0.5% - 3% |

For instance, consider the city of Little Rock, which imposes a 1% local sales tax on top of the state rate, resulting in a total sales tax of 7%. On the other hand, cities like Fayetteville and Fort Smith have opted for a 0.5% local sales tax, making their total sales tax rate 6.5%. These variations can affect the pricing strategies and profitability of businesses operating in different regions of the state.

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in Arkansas applies to most goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the bottom line for certain industries and consumer groups.

One notable exemption is the food exemption, which applies to unprepared food items, including groceries and staple foods. This exemption means that the sales tax rate on these items is zero, providing a significant relief to households and businesses in the food industry. However, it's important to note that this exemption does not extend to prepared foods or restaurant meals, which are subject to the standard sales tax rate.

Additionally, Arkansas offers sales tax holidays during specific periods, usually around back-to-school or disaster preparedness seasons. During these tax-free weekends, certain categories of goods, such as school supplies or emergency preparedness items, are exempt from sales tax. These holidays provide a boost to consumer spending and offer businesses an opportunity to promote their products without the burden of sales tax.

Impact on Businesses and Consumers

The sales tax rate in Arkansas has a profound impact on both businesses and consumers within the state. For businesses, the sales tax rate can influence pricing strategies, profit margins, and even their competitive position in the market. Higher sales tax rates can lead to increased prices for consumers, which, in turn, may affect demand and sales volumes.

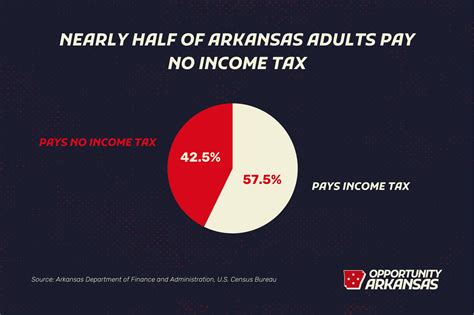

From a consumer perspective, sales tax can significantly impact their purchasing power and overall cost of living. Higher sales tax rates can make certain goods and services more expensive, especially for those on fixed incomes or with limited financial means. This can lead to a shift in consumer behavior, with individuals potentially reducing their spending or opting for cheaper alternatives.

Furthermore, the variation in local sales tax rates can create disparities in the cost of living across different regions of Arkansas. For instance, a consumer in a city with a higher local sales tax rate may find themselves paying more for the same goods or services compared to someone in a neighboring city with a lower tax rate. This can influence consumer choices and even impact population distribution within the state.

Compliance and Administration Challenges

For businesses operating in Arkansas, compliance with the state’s sales tax regulations can be a complex and time-consuming task. With varying local sales tax rates, businesses need to ensure accurate tax calculations and reporting to avoid penalties and legal issues. This often requires sophisticated tax software and a dedicated team to manage these administrative tasks.

Moreover, businesses that operate across multiple states, including Arkansas, face the challenge of navigating different tax laws and regulations. This can be particularly daunting for small and medium-sized enterprises, as they may not have the resources to invest in specialized tax compliance teams. As a result, many businesses turn to tax professionals or outsourcing firms to ensure accurate and timely compliance with Arkansas' sales tax regulations.

Future Outlook and Potential Reforms

As Arkansas continues to evolve and adapt to changing economic conditions, the state’s sales tax rate and structure may also undergo further revisions. The current sales tax rate, while providing a stable revenue stream, may face increasing pressure from changing consumer behaviors and technological advancements.

One potential area of reform is the consideration of a simplified sales tax system. This could involve a uniform sales tax rate across the state, eliminating the complexities associated with varying local sales taxes. A simplified system could make tax administration more efficient for businesses and reduce the compliance burden, especially for smaller enterprises.

Additionally, Arkansas could explore the potential of a value-added tax (VAT) system, similar to what is used in many European countries. A VAT system could provide a more comprehensive and transparent approach to taxation, capturing economic activity at every stage of production and distribution. While a VAT system would be a significant departure from the current sales tax structure, it could offer long-term benefits in terms of revenue stability and administrative efficiency.

Furthermore, as the state looks to attract and retain businesses, especially in the e-commerce and digital sectors, Arkansas may need to reconsider its tax incentives and policies. The current sales tax structure, while providing a steady revenue stream, may not be as attractive to businesses operating in the digital space, where physical location and local sales taxes may be less relevant.

In conclusion, Arkansas' sales tax rate is a critical component of the state's tax system, impacting businesses and consumers alike. As the state navigates economic changes and seeks to remain competitive, the sales tax rate and its structure will continue to evolve, presenting both challenges and opportunities for those operating within the state's borders.

What is the current sales tax rate in Arkansas for 2023?

+

The current state-wide sales tax rate in Arkansas for 2023 is 6%.

Are there any local sales taxes in Arkansas?

+

Yes, local sales taxes are allowed in Arkansas, and they can vary from city to city. These local taxes can range from 0.5% to 3%, in addition to the state sales tax rate.

What are some common sales tax exemptions in Arkansas?

+

Arkansas has a food exemption, meaning unprepared food items are not subject to sales tax. Additionally, there are sales tax holidays during specific periods for certain categories of goods.

How does the sales tax rate in Arkansas affect businesses and consumers?

+

For businesses, the sales tax rate can impact pricing strategies and profit margins. For consumers, it can affect their purchasing power and overall cost of living, potentially influencing their spending behavior.

What challenges do businesses face in terms of sales tax compliance in Arkansas?

+

Businesses need to navigate varying local sales tax rates and ensure accurate tax calculations and reporting. This can be complex and time-consuming, often requiring specialized tax software and dedicated teams.