Tax Percentage On Overtime Uk

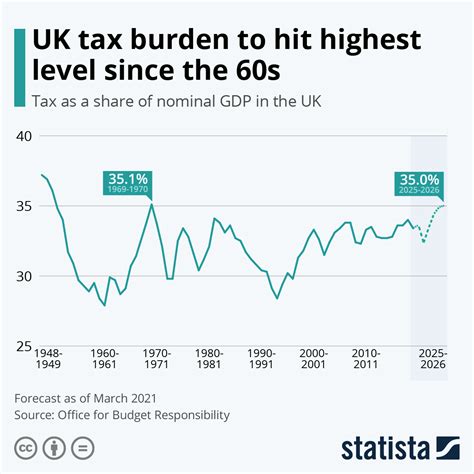

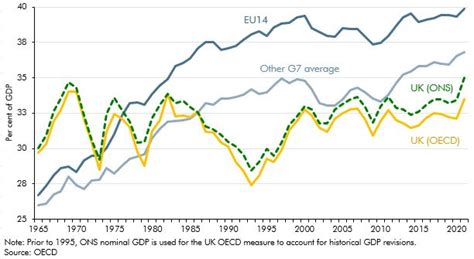

In the United Kingdom, the tax system for overtime pay operates under a complex framework that considers various factors such as income tax brackets, personal allowances, and national insurance contributions. Understanding the tax implications of overtime earnings is crucial for both employees and employers to ensure compliance and accurate financial planning.

The Tax Landscape for Overtime Earnings

Overtime pay in the UK is subject to income tax and national insurance contributions, similar to regular earnings. However, the specific tax treatment can vary depending on the type of overtime worked, the employee’s tax code, and their overall income.

Income Tax on Overtime

The UK uses a progressive income tax system, which means that the tax rate increases as an individual’s income rises. Overtime pay is included in the calculation of taxable income and is taxed according to the applicable tax bracket. As of the 2023-24 tax year, the income tax rates in the UK are as follows:

| Tax Band | Income Range | Tax Rate |

|---|---|---|

| Basic Rate | £12,571 - £50,271 | 20% |

| Higher Rate | £50,271 - £150,000 | 40% |

| Additional Rate | Over £150,000 | 45% |

Overtime pay will be taxed based on the individual's total income, including regular earnings and any other taxable income sources. For example, if an individual's regular income falls within the basic rate tax band but their overtime pay pushes them into the higher rate tax band, the overtime earnings will be taxed at the higher rate of 40%.

National Insurance Contributions

In addition to income tax, employees in the UK also contribute to national insurance (NI) to fund state benefits such as the state pension and unemployment benefits. The amount of NI contributions depends on the employee’s earnings and employment status. The current NI thresholds and rates for the 2023-24 tax year are as follows:

| NI Category | Earnings Range | Employee Rate |

|---|---|---|

| Class 1 Primary Threshold | £9,983 - £50,587 | 13.25% |

| Class 1 Higher Threshold | £50,587 - £50,000 | 3.25% |

| Class 1 Additional Threshold | Over £50,000 | 2% |

It's important to note that the thresholds and rates mentioned above are subject to change each tax year, so it's advisable to refer to the latest guidelines provided by HM Revenue and Customs (HMRC) for accurate and up-to-date information.

Tax Code Considerations

The tax code assigned to an employee by HMRC determines how much tax is deducted from their income. Overtime pay is generally taxed using the same tax code as the individual’s regular earnings. However, if an employee’s overtime earnings are substantial and push them into a higher tax bracket, they may need to request an adjustment to their tax code to ensure they are not overpaying tax.

Calculating Overtime Tax

To calculate the tax on overtime pay, employers or employees can use the following steps:

- Determine the employee's total taxable income, including regular earnings and overtime pay.

- Identify the applicable tax band based on the total income.

- Calculate the tax liability using the appropriate tax rate for the identified tax band.

- Deduct any personal allowances or other tax reliefs applicable to the individual.

- Apply national insurance contributions based on the earnings and the NI thresholds.

- Deduct the tax and NI contributions from the overtime pay to determine the net overtime earnings.

It's important to keep accurate records of overtime hours worked and earnings to facilitate the tax calculation process. Employers may choose to deduct the tax and NI contributions from the employee's pay as they process payroll or opt for a separate arrangement with the employee to settle the tax liability at a later date.

Example Calculation

Let’s consider an example to illustrate the tax calculation process. Suppose an employee has a regular annual income of £35,000 and earns an additional £5,000 in overtime pay. Here’s how the tax calculation would work:

- Total taxable income: £35,000 + £5,000 = £40,000

- Applicable tax band: Basic rate (as the income is within the basic rate tax band)

- Tax liability: £40,000 x 20% = £8,000

- Personal allowance: £12,570 (for the 2023-24 tax year)

- Net tax liability: £8,000 - £12,570 = £0 (no tax due)

In this example, the employee's total income, including overtime pay, falls within the basic rate tax band, and they have not exceeded their personal allowance. Therefore, they would not owe any additional tax on their overtime earnings.

Tax Considerations for Different Overtime Types

The tax treatment of overtime can vary depending on the type of overtime worked. Here are some common scenarios and their tax implications:

Regular Overtime

Regular overtime refers to additional hours worked beyond the standard working week. The tax on regular overtime is calculated based on the employee’s regular pay rate and is subject to the same tax and NI contributions as their regular earnings. The overtime pay is included in the employee’s total taxable income, and the tax is deducted using their tax code.

Shift Work and Night Work

Employees who work shifts or perform night work may be entitled to additional pay known as shift pay or night shift pay. This additional pay is often taxed separately from regular earnings and overtime pay. The tax treatment of shift pay can vary depending on the employer’s arrangement and the employee’s tax code. In some cases, shift pay may be taxed at a flat rate, while in others, it may be subject to the employee’s regular tax code.

Unpaid Overtime

Unpaid overtime, where employees work additional hours without compensation, is not subject to income tax or NI contributions. However, employees should be aware that working unpaid overtime may affect their eligibility for certain benefits and entitlements, such as holiday pay and sick pay.

Overtime Pay Exceeding the Annual Threshold

If an employee’s overtime pay exceeds the annual threshold for national insurance contributions, they may be required to pay additional NI contributions. The annual threshold for the 2023-24 tax year is £50,000. If an employee’s total earnings, including overtime pay, surpass this threshold, they may need to make additional NI contributions at the higher rate of 3.25% on earnings between £50,587 and £200,000.

Employer Responsibilities and Record-Keeping

Employers have a responsibility to ensure accurate tax and NI deductions for their employees’ overtime pay. They must maintain records of overtime hours worked, overtime pay rates, and any applicable deductions. This information is crucial for payroll processing and for reporting to HMRC.

Employers should also provide clear communication to their employees regarding the tax implications of overtime work. This includes explaining how overtime pay is taxed, any applicable tax codes, and the potential impact on their overall tax liability.

Tax Planning and Strategies

For employees who regularly work overtime, tax planning can be an essential aspect of financial management. Here are some strategies to consider:

- Review Tax Codes: Ensure your tax code accurately reflects your circumstances, especially if your overtime earnings are substantial.

- Utilize Tax Reliefs: Take advantage of any applicable tax reliefs, such as pension contributions or charitable donations, to reduce your taxable income.

- Consider Salary Sacrifice Schemes: Some employers offer salary sacrifice schemes, allowing employees to exchange a portion of their salary for non-cash benefits, which can reduce tax liabilities.

- Manage Overtime Earnings: If your overtime earnings fluctuate, consider strategies to manage your tax liability, such as adjusting your tax code or making voluntary payments to HMRC.

Conclusion

Understanding the tax implications of overtime pay in the UK is crucial for both employees and employers. The progressive tax system and national insurance contributions can impact the net earnings from overtime work. By staying informed about the tax landscape, keeping accurate records, and employing effective tax planning strategies, individuals can ensure they maximize their take-home pay from overtime earnings.

How often should I review my tax code if I work overtime regularly?

+It’s recommended to review your tax code annually, especially if your circumstances change significantly. If your overtime earnings are substantial and consistently push you into a higher tax bracket, you may need to request an adjustment to your tax code to avoid overpaying tax.

Are there any tax-efficient ways to receive overtime pay?

+Some employers offer salary sacrifice schemes, where you can exchange a portion of your salary for non-cash benefits, such as pension contributions or childcare vouchers. This can reduce your taxable income and potentially save you money on tax.

Can I claim tax relief for expenses related to overtime work?

+Yes, you may be able to claim tax relief for certain expenses incurred solely for the purpose of performing your job, including overtime work. This could include items like uniform maintenance, tools, or travel expenses. It’s important to keep records of these expenses and consult with an accountant or tax advisor for guidance.