How Much Is Sales Tax In California

California, the Golden State, is renowned for its diverse landscapes, thriving cities, and vibrant culture. While the state boasts numerous attractions and opportunities, one aspect that often comes into play when making purchases is sales tax. Understanding the sales tax landscape in California is essential for both residents and businesses alike. This article aims to provide an in-depth exploration of sales tax in California, covering its rates, applications, and implications.

Understanding Sales Tax in California

Sales tax in California is a state-level tax imposed on the sale or lease of tangible personal property, as well as certain services. It is an essential revenue source for the state, contributing significantly to California’s budget and funding various public services and infrastructure projects.

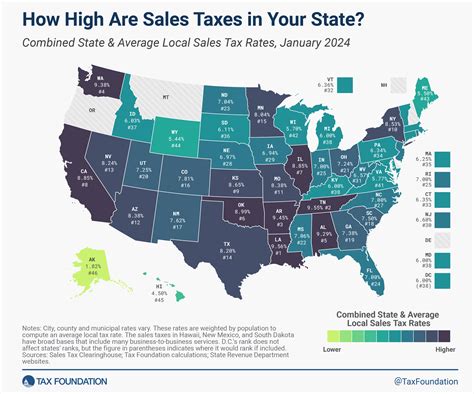

The sales tax system in California is complex, involving not only the state-level tax but also local taxes imposed by counties, cities, and special districts. This multi-layered tax structure results in varying rates across the state, with some areas having higher tax rates than others.

State Sales Tax Rate

As of my last update in January 2023, the state-level sales tax rate in California stands at 7.25%. This rate is applied uniformly across the state and is added to the purchase price of most goods and certain services.

However, it's important to note that this is the base rate, and additional local taxes can increase the overall sales tax rate significantly. These local taxes, known as district taxes, are levied by various local governments to fund specific projects or services within their jurisdictions.

Local Sales Tax Rates

California’s local sales tax rates can vary widely, ranging from approximately 7.25% to over 10%, depending on the specific location. These additional taxes are imposed on top of the state-level sales tax, resulting in a combined rate that consumers must pay.

| County | City | Sales Tax Rate |

|---|---|---|

| Los Angeles County | Los Angeles | 10.25% |

| Orange County | Santa Ana | 8.75% |

| San Diego County | San Diego | 8.75% |

| San Francisco County | San Francisco | 9.50% |

| Alameda County | Oakland | 9.25% |

The table above provides a glimpse into the diverse local sales tax rates across California. These rates are subject to change, as local governments can adjust their tax structures periodically to meet their funding needs.

Sales Tax Exemptions and Special Cases

While most tangible goods and certain services are subject to sales tax in California, there are specific exemptions and special cases to be aware of. Some of the notable exemptions include:

- Groceries: Most food items purchased for home consumption are exempt from sales tax in California.

- Prescription Drugs: Sales of prescription medications are exempt from sales tax.

- Clothing: Clothing items under $100 are exempt from sales tax, providing a much-needed break for budget-conscious shoppers.

- Certain Services: Services such as legal, accounting, and medical services are generally not subject to sales tax.

It's important to note that these exemptions can vary depending on specific circumstances and local regulations. Always consult with a tax professional or refer to official tax guidelines for accurate information regarding sales tax exemptions in California.

Impact of Sales Tax on Consumers and Businesses

Sales tax in California has a significant impact on both consumers and businesses operating within the state.

Consumer Perspective

For consumers, sales tax adds to the overall cost of purchases. The varying local tax rates across the state can result in significant differences in the total price of goods and services. This can impact consumers’ purchasing decisions, especially when considering larger purchases or frequent shopping in areas with higher sales tax rates.

Additionally, sales tax can influence consumers' shopping behavior. Some individuals may choose to shop across county lines or in neighboring states with lower sales tax rates to save money. This phenomenon, known as border shopping, can impact local businesses and the overall economy.

Business Perspective

Businesses operating in California must navigate the complex sales tax landscape to ensure compliance with state and local regulations. This involves accurately calculating and collecting sales tax on transactions, as well as remitting the collected tax to the appropriate tax authorities.

For businesses with multiple locations or online sales, managing sales tax compliance can be particularly challenging. They must stay up-to-date with the latest tax rates and regulations in each jurisdiction they operate in, ensuring accurate tax collection and reporting.

Moreover, businesses may need to consider the impact of sales tax on their pricing strategies. While sales tax is an additional cost for consumers, businesses must decide whether to absorb this cost or pass it on to customers through higher prices. This decision can influence their competitive positioning and customer perception.

Sales Tax Compliance and Enforcement

Ensuring compliance with sales tax regulations is crucial for both consumers and businesses in California. The California Department of Tax and Fee Administration (CDTFA) is responsible for administering and enforcing sales tax laws within the state.

The CDTFA provides resources and guidance to help businesses understand their sales tax obligations. This includes registering for a seller's permit, accurately calculating and collecting sales tax, and filing timely tax returns. Businesses that fail to comply with sales tax regulations may face penalties and interest charges, as well as potential legal consequences.

For consumers, understanding their rights and responsibilities regarding sales tax is essential. They should be aware of the applicable sales tax rates in their area and ensure that businesses are charging the correct tax on their purchases. Consumers can also take advantage of sales tax holidays, during which certain items are exempt from sales tax, to save on their purchases.

Future Implications and Considerations

The sales tax landscape in California is dynamic and subject to change. As the state’s needs and priorities evolve, so too may its tax structure. Here are some future implications and considerations regarding sales tax in California:

- Tax Rate Changes: Local governments may propose changes to their sales tax rates to fund specific projects or address budget shortfalls. These changes can impact the overall sales tax rate in certain areas, affecting consumers and businesses alike.

- Online Sales Tax: With the growth of e-commerce, the collection and enforcement of sales tax on online transactions have become increasingly important. California has implemented measures to ensure online sellers collect and remit sales tax, and this trend is likely to continue as online shopping becomes more prevalent.

- Sales Tax Holidays: California has designated certain sales tax holidays, during which specific items are exempt from sales tax. These holidays provide consumers with an opportunity to save on their purchases and can stimulate economic activity. The state may continue to promote these holidays or expand their scope in the future.

- Tax Reform: As California's economy and tax landscape evolve, there may be calls for tax reform to address issues such as tax fairness, simplicity, and revenue generation. This could lead to changes in the sales tax structure, including potential modifications to rates or exemptions.

Staying informed about sales tax developments in California is crucial for both consumers and businesses. By understanding the current sales tax rates, exemptions, and compliance requirements, individuals and businesses can make informed decisions and navigate the sales tax landscape effectively.

How often do sales tax rates change in California?

+Sales tax rates in California can change periodically, typically due to local government decisions. While the state-level sales tax rate has remained stable, local governments may adjust their district tax rates to meet funding needs. These changes can occur annually or at specific intervals determined by local regulations.

Are there any sales tax holidays in California?

+Yes, California has designated sales tax holidays for specific items, typically occurring during certain months. These holidays provide an opportunity for consumers to save on their purchases. It’s important to stay updated on the dates and eligible items for these holidays to take advantage of the tax-free shopping.

How can businesses stay updated on sales tax regulations in California?

+Businesses can stay informed about sales tax regulations in California by regularly checking the California Department of Tax and Fee Administration’s website. The CDTFA provides resources, guidelines, and updates on tax rates and compliance requirements. Additionally, businesses can subscribe to tax newsletters or consult tax professionals for the latest information.