45X Tax Credit

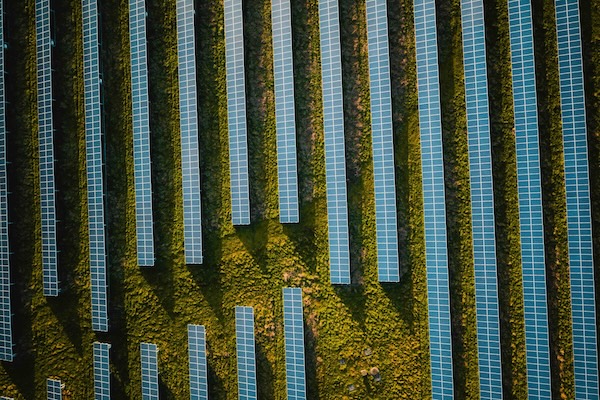

Welcome to a comprehensive guide on the 45X Tax Credit, a crucial financial incentive that has the potential to revolutionize the renewable energy landscape. This tax credit, introduced to encourage investment in sustainable projects, offers a unique opportunity for businesses and individuals alike to not only contribute to a greener future but also to benefit financially from their environmentally conscious decisions.

In an era where climate change is a pressing global concern, the 45X Tax Credit stands as a powerful tool, providing an economic incentive to accelerate the transition towards cleaner energy sources. This guide will delve deep into the intricacies of this credit, exploring its history, eligibility criteria, application process, and the immense benefits it can bring to the table.

Unraveling the 45X Tax Credit: A Detailed Exploration

The 45X Tax Credit, officially known as the Renewable Electricity Production Tax Credit (PTC), is a federal incentive designed to promote the development and utilization of renewable energy technologies. Introduced in the United States, this credit has played a pivotal role in driving the growth of the renewable energy sector, attracting investments, and fostering innovation.

History and Evolution

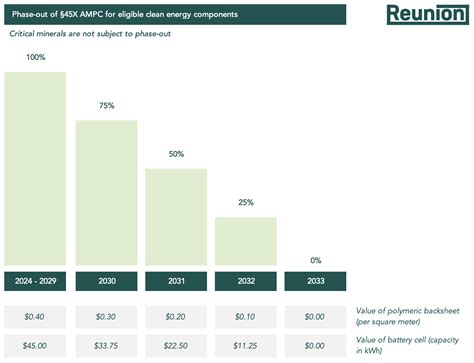

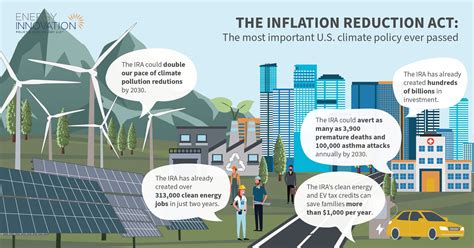

The roots of the 45X Tax Credit can be traced back to the Energy Policy Act of 1992, which initially established the PTC. Over the years, this credit has undergone several extensions and modifications, with the most recent being the Inflation Reduction Act of 2022. This act not only extended the PTC but also expanded its scope, introducing the 45X variant, which offers an increased credit value for specific renewable energy technologies.

The evolution of the 45X Tax Credit reflects the changing landscape of renewable energy and the growing recognition of its importance. With each amendment, the credit has become more tailored to the needs of the industry, providing increased incentives for the development of cutting-edge technologies and the expansion of clean energy infrastructure.

Eligibility and Qualifying Projects

The 45X Tax Credit is not a one-size-fits-all incentive. To be eligible, projects must meet specific criteria and fall under the umbrella of renewable energy. Here’s a breakdown of the key eligibility requirements:

- Renewable Energy Technologies: The credit primarily applies to projects utilizing wind, solar, geothermal, hydropower, and certain types of biomass energy. Each technology has its own set of qualifications, and it's crucial to understand these nuances when considering the 45X Tax Credit.

- Placement and Timing: Projects must be located within the United States or its territories and have a capacity of at least 5 megawatts (MW). Additionally, the credit is time-sensitive, with specific deadlines for when the project must be placed in service to qualify.

- Production Requirements: To claim the credit, projects must generate electricity and meet specific production thresholds. These thresholds vary based on the technology used and the project's capacity.

Understanding these eligibility criteria is essential for anyone considering the 45X Tax Credit. It ensures that projects not only qualify for the incentive but also align with the broader goals of promoting renewable energy and reducing carbon emissions.

Application Process and Calculation

Navigating the application process for the 45X Tax Credit requires a thorough understanding of the rules and regulations. Here’s a step-by-step guide to help you through the process:

- Project Planning: The first step is to ensure your project aligns with the eligibility criteria. This involves detailed planning, considering factors like technology choice, location, and capacity.

- Form Submission: Once your project is ready, you'll need to submit Form 5695 to the Internal Revenue Service (IRS). This form is used to claim the tax credit and must be filed with your tax return for the applicable tax year.

- Calculation: The credit amount is calculated based on the electricity produced by the project. For wind and closed-loop biomass projects, the credit is $26 per megawatt-hour (MWh) of electricity produced. For other qualifying technologies, the credit varies but is generally lower.

- Verification and Audit: The IRS may require additional documentation to verify the eligibility of your project. It's crucial to maintain accurate records and be prepared for potential audits.

The application process, while detailed, is designed to ensure the integrity of the 45X Tax Credit program. By following these steps, project developers can maximize their chances of securing this valuable incentive.

Benefits and Impact of the 45X Tax Credit

The 45X Tax Credit is more than just a financial incentive; it’s a catalyst for positive change in the energy sector. Here’s how this credit is making a difference:

Financial Incentives for Renewable Energy Projects

At its core, the 45X Tax Credit provides a substantial financial boost to renewable energy projects. For project developers, this credit can mean the difference between a feasible and an infeasible venture. The increased credit value, especially for wind and biomass projects, makes these technologies more economically viable, encouraging their widespread adoption.

| Technology | Credit Value ($/MWh) |

|---|---|

| Wind | $26 |

| Solar | $16 |

| Geothermal | $16 |

| Hydropower | $16 |

Accelerating the Transition to Clean Energy

The impact of the 45X Tax Credit extends beyond individual projects. By incentivizing the development of renewable energy, this credit is playing a pivotal role in the transition to a cleaner and more sustainable energy future. The increased credit value has led to a surge in investment in wind and biomass projects, contributing to a significant reduction in carbon emissions.

Job Creation and Economic Growth

The renewable energy sector is a major employer, and the 45X Tax Credit has a direct impact on job creation. As more projects come online, there is a growing demand for skilled workers, from engineers and technicians to construction workers. This not only stimulates local economies but also contributes to a more diverse and resilient job market.

Stimulating Innovation and Technology Advancements

The 45X Tax Credit is not just about supporting existing technologies; it also drives innovation. With increased incentives, project developers are incentivized to explore new and improved technologies, leading to advancements in efficiency, storage, and integration of renewable energy sources. This, in turn, makes renewable energy more competitive and accessible.

Future Implications and Opportunities

As the world moves towards a more sustainable future, the role of the 45X Tax Credit is poised to become even more critical. Here’s a glimpse into the potential future of this incentive and its impact on the renewable energy sector.

Extended Horizons: Long-Term Sustainability

One of the key advantages of the 45X Tax Credit is its long-term sustainability. Unlike some other incentives, which may be subject to annual budget constraints, the 45X Tax Credit has a more stable and predictable funding horizon. This stability provides a reliable foundation for project developers to plan and execute their renewable energy ventures with confidence.

As the credit continues to be extended and refined, it is expected to play a pivotal role in the long-term transition to clean energy. By providing a consistent and reliable incentive, the 45X Tax Credit encourages the development of sustainable energy infrastructure, which is essential for meeting global climate goals.

Expanding Horizons: New Technologies and Applications

The renewable energy landscape is constantly evolving, with new technologies and applications emerging. The 45X Tax Credit is well-positioned to support these innovations, offering incentives for cutting-edge projects that may not have been viable without such support.

For instance, emerging technologies like offshore wind farms, advanced solar storage systems, and next-generation geothermal systems could benefit significantly from the 45X Tax Credit. By encouraging investment in these areas, the credit can drive innovation and help bring these technologies to market faster.

Collaborative Opportunities: Public-Private Partnerships

The 45X Tax Credit presents a unique opportunity for public-private partnerships to thrive. Governments, businesses, and communities can come together to develop and implement renewable energy projects, leveraging the credit to make these ventures economically feasible.

Such partnerships can lead to the development of large-scale renewable energy projects, community-based initiatives, and innovative financing models. By combining resources and expertise, these collaborations can accelerate the adoption of clean energy and drive down costs, making renewable energy accessible to a wider range of stakeholders.

Global Impact: A Catalyst for International Change

The influence of the 45X Tax Credit is not limited to the United States. As a leading example of successful renewable energy incentives, it can inspire and inform policy decisions in other countries. By sharing best practices and lessons learned, the 45X Tax Credit can serve as a model for global climate action, encouraging other nations to adopt similar incentives and accelerate their transition to clean energy.

In conclusion, the 45X Tax Credit is a powerful tool with far-reaching implications. Its ability to drive innovation, stimulate economic growth, and accelerate the transition to clean energy makes it a critical component of the global climate change solution. As the world continues to face the challenges of climate change, the 45X Tax Credit stands as a beacon of hope, offering a tangible way to make a difference and secure a sustainable future for generations to come.

What is the purpose of the 45X Tax Credit?

+The 45X Tax Credit, officially known as the Renewable Electricity Production Tax Credit, aims to promote the development and utilization of renewable energy technologies by providing a financial incentive to project developers. It encourages the adoption of clean energy sources, reduces carbon emissions, and drives innovation in the energy sector.

Who is eligible for the 45X Tax Credit?

+Eligible projects must utilize renewable energy technologies like wind, solar, geothermal, hydropower, or certain types of biomass. They must be located within the United States, have a capacity of at least 5 MW, and meet specific production requirements. The credit is time-sensitive, with deadlines for when the project must be placed in service.

How is the 45X Tax Credit calculated?

+The credit amount is based on the electricity produced by the project. For wind and closed-loop biomass projects, it’s $26 per megawatt-hour (MWh). For other technologies, the credit varies but is generally lower. Project developers must submit Form 5695 to claim the credit, and the IRS may require additional verification.