Rankin County Tax Collector

Welcome to the comprehensive guide on the Rankin County Tax Collector's office, where we will delve into the essential services and responsibilities of this vital governmental entity. As a resident of Rankin County, understanding the role of the tax collector is crucial for maintaining compliance with tax regulations and ensuring a smooth process for all financial obligations.

About Rankin County Tax Collector’s Office

The Rankin County Tax Collector’s office is a cornerstone of local government, responsible for the efficient and effective collection of taxes and fees to support the county’s operations and development. This department plays a critical role in maintaining the financial health and stability of Rankin County, ensuring that vital public services can be provided to its residents.

Located in the heart of Rankin County, the tax collector's office is easily accessible to the public, with friendly and knowledgeable staff dedicated to providing excellent customer service. The office operates under the guidance of the elected Tax Collector, who is responsible for overseeing the administration and collection of various taxes, including property taxes, vehicle registration fees, and other related assessments.

Key Responsibilities and Services

- Property Tax Assessment and Collection: The primary responsibility of the Rankin County Tax Collector’s office is the assessment and collection of property taxes. This includes valuing real estate properties, calculating tax liabilities based on assessed values, and issuing tax bills to property owners. The office also assists residents in understanding their property tax obligations and offers guidance on payment options and deadlines.

- Vehicle Registration and Title Services: Residents of Rankin County rely on the tax collector’s office for vehicle registration and titling services. This includes processing vehicle registration renewals, issuing new titles, and providing assistance with title transfers. The office ensures that all vehicle-related fees and taxes are accurately assessed and collected, promoting safe and compliant vehicle ownership within the county.

- Business Tax and License Administration: For businesses operating in Rankin County, the tax collector’s office is the go-to resource for business tax and license requirements. This includes collecting business privilege taxes, issuing business licenses, and providing guidance on tax obligations for various business activities. The office ensures that businesses comply with local tax regulations, fostering a fair and competitive business environment.

- Special Assessments and Fees: In addition to general tax collection, the tax collector’s office is responsible for administering and collecting special assessments and fees. This may include environmental impact fees, development impact fees, or other specific charges associated with certain activities or services provided by the county. The office ensures that these assessments are fairly distributed and collected, supporting the sustainable development and maintenance of Rankin County.

- Online Services and Payment Options: Recognizing the importance of technological advancements, the Rankin County Tax Collector’s office offers a range of online services to enhance convenience and accessibility. Residents can access their tax accounts online, view and pay bills, and obtain various certificates and documents digitally. This modern approach to tax collection streamlines the process, reduces administrative burdens, and provides greater flexibility for taxpayers.

Office Location and Contact Information

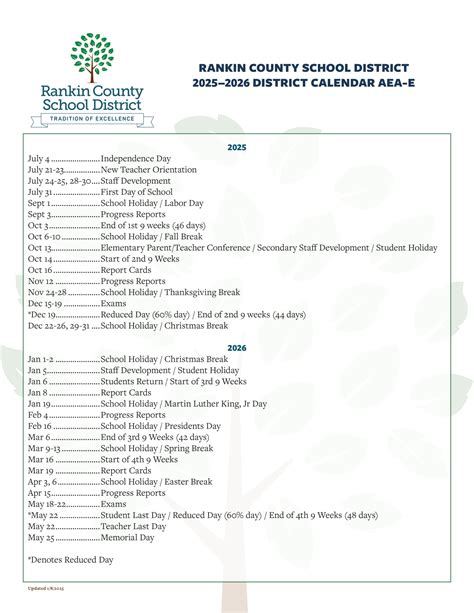

The Rankin County Tax Collector’s office is conveniently located at 213 East Government Street, Brandon, MS 39042. The office is open from 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding public holidays. Residents can visit the office in person to discuss their tax-related matters, obtain assistance, or complete various transactions.

For inquiries or to reach the tax collector's office remotely, residents can utilize the following contact information:

- Phone: (601) 825-1480

- Email: taxcollector@rankin.ms.gov

- Website: www.rankin.ms.gov/tax-collector

Online Services and Resources

To cater to the diverse needs of its residents, the Rankin County Tax Collector's office provides an array of online services and resources. These digital tools aim to simplify the tax payment process, provide real-time account information, and offer convenient access to essential documents.

Online Payment Portal

The online payment portal is a secure and efficient way for residents to pay their taxes and fees remotely. Through this portal, individuals can access their tax accounts, view pending or outstanding balances, and make payments using various methods, including credit cards, debit cards, or electronic checks. The portal provides a user-friendly interface, ensuring a seamless experience for taxpayers.

| Payment Method | Acceptance |

|---|---|

| Credit Card | Visa, MasterCard, Discover, and American Express |

| Debit Card | Visa and MasterCard |

| Electronic Check | ACH Transfers |

Electronic Bill Payment

For those who prefer automatic payments, the tax collector’s office offers an electronic bill payment service. Residents can set up recurring payments for their taxes, ensuring timely payments without the need for manual reminders. This service is particularly beneficial for property taxes, as it automates the payment process for each tax period.

Online Account Management

The online account management system allows taxpayers to access their tax records and transaction history anytime. This feature provides transparency and enables residents to monitor their tax obligations, view payment statuses, and download important documents, such as tax receipts and certificates of registration. It also offers the ability to update personal information, ensuring accurate records are maintained.

Digital Document Access

The tax collector’s office understands the importance of providing easy access to essential documents. Through the online platform, residents can obtain digital copies of tax bills, receipts, and other related documents instantly. This service eliminates the need for in-person visits or waiting for mailed copies, enhancing efficiency and convenience.

Frequently Asked Questions

What are the office hours for the Rankin County Tax Collector’s office?

+The Rankin County Tax Collector’s office is open from 8:00 a.m. to 5:00 p.m., Monday through Friday. Please note that the office is closed on public holidays.

How can I pay my property taxes in Rankin County?

+You can pay your property taxes through the online payment portal, by mail, or in person at the tax collector’s office. The office accepts various payment methods, including credit cards, debit cards, electronic checks, and cash.

What documents do I need to bring when registering a vehicle in Rankin County?

+When registering a vehicle, you will need the following documents: a valid driver’s license, proof of insurance, the vehicle’s title or registration certificate, and the required fees. It’s recommended to contact the tax collector’s office beforehand to ensure you have all the necessary documentation.

How can I obtain a business license in Rankin County?

+To obtain a business license, you can visit the Rankin County Tax Collector’s office or apply online through their website. The process typically involves completing an application form, providing business information, and paying the required license fee.

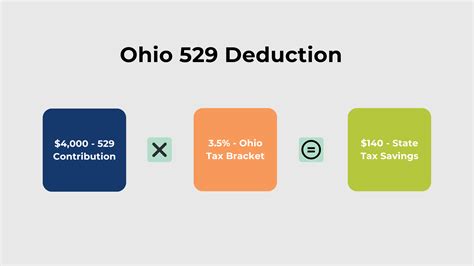

Are there any discounts or exemptions for property taxes in Rankin County?

+Rankin County offers various tax exemptions and discounts to eligible residents. These may include homestead exemptions, senior citizen discounts, or exemptions for certain types of properties. It’s advisable to consult with the tax collector’s office or review the county’s tax guidelines to understand the specific requirements and qualifications.

The Rankin County Tax Collector’s office remains dedicated to providing exceptional service and support to its residents. By staying informed and utilizing the available resources, taxpayers can navigate their financial obligations with ease and contribute to the continued development and prosperity of Rankin County.