Sales Tax Rates For Connecticut

Connecticut's sales tax rates play a crucial role in the state's economy, influencing the purchasing behavior of residents and businesses alike. Understanding these rates is essential for anyone looking to navigate the state's tax landscape effectively. This comprehensive guide delves into the intricacies of Connecticut's sales tax structure, offering insights into its application, variations, and implications.

The Basics of Connecticut Sales Tax

Connecticut imposes a state sales and use tax on retail sales, leases, and rentals of most goods, as well as certain services. The tax is collected by the seller and remitted to the Connecticut Department of Revenue Services (DRS). As of my last update in January 2023, the statewide sales tax rate in Connecticut stands at 6.35%, which is applied to the total purchase price, including any applicable discounts or coupons.

Taxable Items and Services

The state sales tax applies to a broad range of goods and services, including:

- Clothing and footwear

- Electronics and appliances

- Furniture and home goods

- Vehicles and automotive parts

- Sporting goods

- Jewelry and accessories

- Restaurant meals and prepared food

- Admissions to entertainment events

- Certain services like repairs and installations

Exemptions and Special Rates

While the 6.35% rate is the standard, there are specific exemptions and special tax rates for certain goods and services in Connecticut. For instance:

- Prescription and non-prescription drugs are exempt from sales tax.

- Groceries, including food for home consumption, are taxed at a reduced rate of 3%.

- Certain manufacturing equipment and supplies may be eligible for a partial exemption or a reduced tax rate of 0.875%.

- Sales of pre-owned residential real estate are subject to a conveyance tax, which varies based on the sale price.

| Item Category | Tax Rate |

|---|---|

| Standard Taxable Goods | 6.35% |

| Groceries | 3% |

| Manufacturing Equipment (Partial Exemption) | 0.875% |

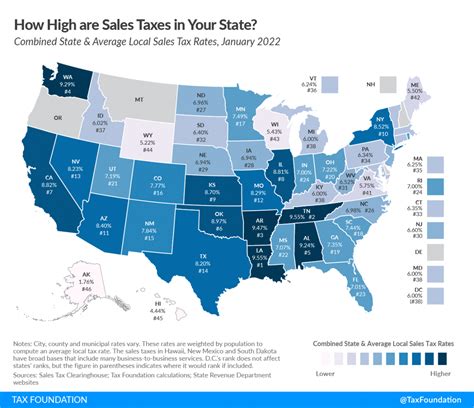

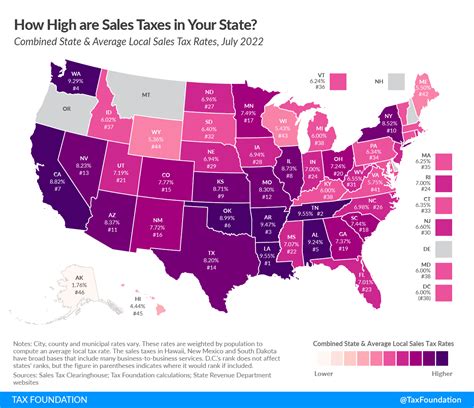

Local Sales Tax Rates in Connecticut

In addition to the state sales tax, Connecticut allows municipalities to levy their own sales and use taxes, creating a two-tiered tax structure. These local taxes are added to the state rate, resulting in varying total sales tax rates across the state.

Local Tax Rates by Municipality

As of my knowledge cutoff in January 2023, here are some examples of local sales tax rates in various Connecticut towns:

- Hartford: 1.5%

- Bridgeport: 0.5%

- New Haven: 1%

- Stamford: 1%

- Waterbury: 0.75%

These local rates can significantly impact the total sales tax a consumer pays, especially for larger purchases.

Variations and Implications

The two-tiered tax structure can lead to variations in pricing for similar goods and services across the state. For instance, a product purchased in Hartford would have a higher sales tax rate compared to a similar purchase in Bridgeport.

This geographic pricing difference can influence consumer behavior, with some residents choosing to shop in municipalities with lower tax rates. It also impacts business strategies, particularly for retailers with multiple locations or those considering expansion, as they must account for these variations when setting prices and strategies.

| Municipality | Local Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Hartford | 1.5% | 7.85% |

| Bridgeport | 0.5% | 6.85% |

| New Haven | 1% | 7.35% |

Sales Tax Holidays in Connecticut

Connecticut occasionally observes sales tax holidays, during which specific categories of goods are exempt from sales tax for a limited time. These holidays are designed to stimulate consumer spending and provide a tax break for shoppers.

Recent Sales Tax Holidays

In recent years, Connecticut has hosted sales tax holidays for:

- Energy Star Appliances: Appliances meeting Energy Star standards were exempt during a specific period.

- Clothing and Footwear: Items under a certain price threshold were tax-free during a designated weekend.

The dates and categories for these holidays vary annually and are announced by the DRS.

Benefits and Considerations

Sales tax holidays can be a boon for consumers, offering significant savings on large-ticket items. For retailers, these holidays can drive foot traffic and increase sales, particularly for stores offering competitive pricing.

However, businesses must plan and prepare for these events, ensuring they have adequate stock and staff to manage the increased demand. They also need to stay updated on the specific rules and dates for each holiday to ensure compliance.

Compliance and Remittance

Ensuring compliance with Connecticut’s sales tax regulations is critical for businesses operating in the state. This includes accurately calculating sales tax, collecting the correct amount, and remitting it to the DRS on time.

Registration and Filing

Businesses that make taxable sales in Connecticut must register with the DRS and obtain a Connecticut Sales and Use Tax Permit. This process involves completing the DR-1 Application for Registration and providing relevant business information.

Once registered, businesses are required to file sales tax returns periodically, typically on a monthly or quarterly basis. These returns must be filed by the 20th day of the month following the reporting period.

Remittance Methods

The DRS offers several methods for remitting sales tax payments, including:

- Online Payment through the DRS website

- EFT (Electronic Funds Transfer) for businesses with high sales tax liabilities

- Check or Money Order by mail

Businesses can choose the method that best suits their needs and payment preferences.

Conclusion: Navigating Connecticut’s Sales Tax Landscape

Connecticut’s sales tax structure, with its statewide rate, local variations, and occasional sales tax holidays, presents a dynamic landscape for businesses and consumers. Understanding these rates and their implications is essential for effective financial planning and tax compliance.

By staying informed about the latest tax rates, exemptions, and regulations, businesses can make informed decisions about pricing, expansion, and sales strategies. Consumers, too, can benefit from understanding these rates to make informed purchasing decisions and take advantage of tax savings opportunities.

As the tax landscape continues to evolve, staying abreast of changes and seeking professional guidance when needed will be key to navigating Connecticut’s sales tax system successfully.

How often do sales tax rates change in Connecticut?

+Sales tax rates in Connecticut can change annually, typically as part of the state’s budgeting process. However, significant changes are relatively rare, and the state aims for stability in its tax rates.

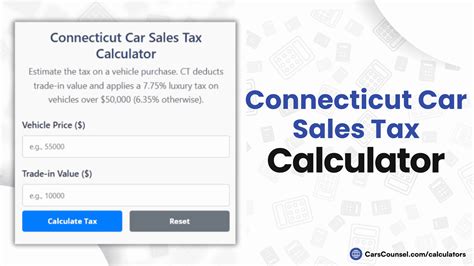

Are there any online tools to calculate sales tax in Connecticut?

+Yes, the Connecticut Department of Revenue Services (DRS) provides an online Sales Tax Calculator on its website. This tool allows users to input the purchase price and applicable exemptions to calculate the total sales tax.

What happens if a business fails to remit sales tax on time?

+Late remittance of sales tax can result in penalties and interest charges. The DRS may also take enforcement actions, including audits and the revocation of the business’s sales tax permit.

Are there any plans for simplifying Connecticut’s sales tax structure?

+While there have been discussions about simplifying the sales tax structure, no major reforms have been implemented recently. The current two-tiered system, with state and local taxes, is likely to remain in place for the foreseeable future.