Pierce County Property Tax

Welcome to this comprehensive guide on Pierce County Property Tax. This article aims to provide an in-depth analysis of the property tax system in Pierce County, Washington, offering valuable insights for homeowners, investors, and anyone interested in understanding the intricacies of this crucial aspect of homeownership. With a focus on clarity and specificity, we will delve into the various factors that influence property taxes, the assessment process, payment options, and the implications for residents and the local economy.

Understanding Pierce County Property Taxes

Pierce County, located in the beautiful Pacific Northwest, is home to a diverse range of communities, from bustling urban centers to picturesque rural areas. As with many counties across the United States, property taxes play a significant role in funding essential public services and infrastructure. These taxes contribute to the maintenance of roads, schools, emergency services, and other vital community resources.

The property tax system in Pierce County is designed to ensure a fair and equitable distribution of the tax burden among property owners. The assessment process, which determines the value of each property, is a crucial step in this system. It involves evaluating factors such as the property's location, size, improvements, and recent sales data to arrive at an assessed value.

The Assessment Process

Pierce County employs a team of trained assessors who are responsible for conducting regular property assessments. These assessments typically occur every two years, with the primary goal of maintaining an accurate and up-to-date record of each property’s value. The assessors consider a range of factors, including:

- Property Type: Different types of properties, such as residential, commercial, or agricultural, may have varying assessment methodologies.

- Market Value: The current market value of similar properties in the area is a key consideration. Assessors analyze recent sales data to determine fair market value.

- Improvements: Any improvements made to the property, such as renovations or additions, can impact its assessed value.

- Location: The property’s location within the county can affect its value due to factors like proximity to amenities, schools, and transportation hubs.

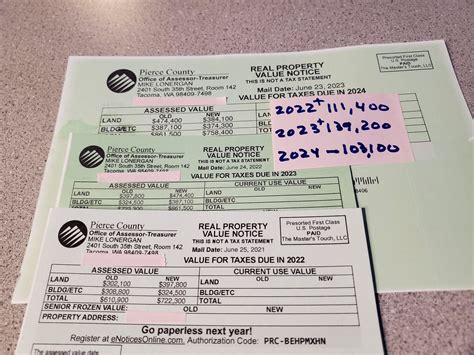

Once the assessment is complete, property owners receive a notice of their assessed value, along with the corresponding tax rate and estimated tax amount. This information serves as the basis for calculating their property tax liability.

| Property Type | Assessment Methodology |

|---|---|

| Residential | Market value-based assessment with adjustments for neighborhood and property characteristics. |

| Commercial | Income-based assessment, considering rental income and operating expenses. |

| Agricultural | Special valuation methods based on the property's use and potential for agricultural production. |

Calculating Property Taxes in Pierce County

The calculation of property taxes in Pierce County involves two main components: the assessed value of the property and the tax rate. The assessed value, as determined by the assessment process, is multiplied by the applicable tax rate to arrive at the property tax liability.

Tax Rates and Levy Limits

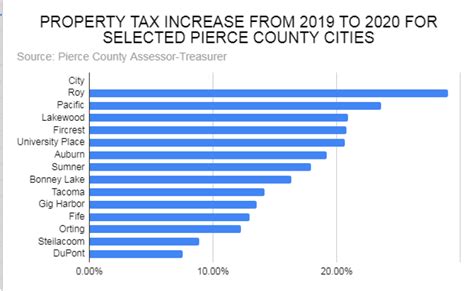

Pierce County, like many other jurisdictions, sets tax rates based on the needs of various public services and the overall budget requirements. These tax rates are established by local governing bodies, such as the Pierce County Council, and are subject to legal levy limits. The levy limits ensure that the tax burden remains within reasonable boundaries and that property owners are not subjected to excessive taxation.

The tax rate is typically expressed as a percentage and can vary depending on the type of property and its location within the county. For instance, residential properties may have a different tax rate compared to commercial or industrial properties.

| Property Type | Average Tax Rate (%) |

|---|---|

| Residential | 1.75 |

| Commercial | 2.25 |

| Industrial | 2.50 |

It's important to note that these tax rates are subject to change annually, as they are influenced by factors such as budget adjustments, voter-approved levies, and changes in the local economy. Property owners can refer to the Pierce County Assessor's Office for the most up-to-date tax rate information.

Tax Exemptions and Relief Programs

Pierce County offers various tax exemptions and relief programs to assist certain property owners, particularly those who may face financial hardships or have specific qualifications. These programs aim to provide relief and ensure fairness in the property tax system.

- Senior Exemption: Property owners who are 61 years or older and meet certain income requirements may be eligible for a property tax exemption. This exemption can significantly reduce the tax liability for qualifying seniors.

- Disabled Veteran Exemption: Veterans with service-connected disabilities may be entitled to an exemption, reducing their property tax burden.

- Low-Income Homeowner Exemption: This program provides relief to low-income homeowners by reducing their property taxes. Eligibility is typically based on income and property value.

- Farm and Agricultural Land Tax Relief: Properties designated as agricultural land may be eligible for reduced tax rates, supporting the local farming community.

To apply for these exemptions or relief programs, property owners should contact the Pierce County Assessor's Office or consult the county's website for detailed information and application processes.

Payment Options and Due Dates

Pierce County offers a range of convenient payment options for property taxes, ensuring flexibility for property owners. The due dates for property tax payments are typically set annually, with penalties incurred for late payments.

Payment Methods

- Online Payment: Property owners can make secure online payments through the Pierce County Treasurer’s Office website. This method offers a quick and convenient way to settle tax liabilities.

- Mail-in Payment: Traditional mail-in payments can be made by sending a check or money order to the designated address provided on the tax notice. This method requires careful attention to ensure timely receipt and processing.

- In-Person Payment: For those who prefer face-to-face transactions, Pierce County Treasurer’s Office provides in-person payment options at their designated locations. This method allows for immediate confirmation of payment.

- Automatic Payment Plans: Property owners can set up automatic payment plans, which deduct the tax amount directly from their bank account on the due date. This option ensures timely payments without the need for manual reminders.

It's important for property owners to review their tax notices carefully to understand the payment due dates and any applicable penalties for late payments. Late payments can incur additional fees and may impact the property owner's credit rating.

Penalty Structure

Pierce County has a structured penalty system for late property tax payments. The penalty amounts increase over time, with the first late payment typically incurring a smaller penalty, and subsequent late payments resulting in higher penalties. It is in the best interest of property owners to make timely payments to avoid these additional costs.

| Late Payment Interval | Penalty Percentage |

|---|---|

| 1-30 days late | 0.5% |

| 31-60 days late | 1% |

| 61-90 days late | 1.5% |

| 91+ days late | 2% |

Property owners should note that these penalty structures may be subject to change, and it is advisable to refer to the official Pierce County Treasurer's Office website for the most accurate and up-to-date information.

The Impact of Property Taxes on Pierce County

Property taxes play a vital role in the economic health and development of Pierce County. The revenue generated from these taxes contributes significantly to the funding of essential public services and infrastructure projects.

Funding Public Services

A substantial portion of property tax revenue is allocated to support various public services, including:

- Education: Property taxes are a primary source of funding for local schools, ensuring that students have access to quality education and resources.

- Public Safety: Police and fire departments rely on property tax revenue to maintain their operations, ensuring the safety and security of residents.

- Health and Social Services: Property taxes contribute to the provision of healthcare services, social welfare programs, and support for vulnerable populations.

- Transportation: Funding for road maintenance, public transit, and infrastructure improvements is often derived from property taxes.

Economic Development and Community Growth

Property taxes also have a direct impact on the economic development and growth of Pierce County. The revenue generated can be invested in initiatives that attract businesses, create jobs, and stimulate the local economy. Additionally, well-maintained public spaces and infrastructure can enhance the quality of life for residents and make the county more appealing to potential investors and businesses.

Moreover, the assessment and taxation of properties can encourage property owners to maintain and improve their properties, leading to increased property values and a more vibrant real estate market. This, in turn, can attract new residents and businesses, further boosting the county's economy.

Future Implications and Considerations

As Pierce County continues to grow and evolve, the property tax system will need to adapt to meet the changing needs of the community. Here are some key considerations for the future:

- Population Growth: With an increasing population, the demand for public services and infrastructure will rise. The property tax system will need to ensure that revenue generation keeps pace with these growing demands.

- Sustainable Development: The county should explore ways to encourage sustainable development practices, such as energy-efficient buildings and environmentally friendly initiatives, while maintaining a fair tax system.

- Community Engagement: Involving residents and stakeholders in the property tax system’s development and decision-making processes can lead to more transparent and equitable policies.

- Technological Advancements: Embracing technology can enhance the efficiency and accuracy of the assessment process, making it more convenient for property owners and reducing administrative burdens.

FAQ

What happens if I disagree with my property’s assessed value?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal. The process typically involves submitting an appeal to the Pierce County Board of Equalization, providing evidence and arguments to support your case. It’s advisable to consult with a professional appraiser or tax advisor for guidance.

Are there any payment plans available for property taxes?

+Yes, Pierce County offers various payment plan options to assist property owners in managing their tax liabilities. These plans can be tailored to individual circumstances and may include monthly installments or other flexible arrangements. Contact the Pierce County Treasurer’s Office for more information.

How often are property assessments conducted in Pierce County?

+Property assessments in Pierce County typically occur every two years. However, certain circumstances, such as significant improvements or changes to the property, may trigger an assessment outside of this regular cycle. It’s essential to keep the assessor’s office informed of any significant changes to your property.

Can I pay my property taxes early, and are there any benefits to doing so?

+Yes, you can pay your property taxes early without any penalties. Early payment may offer some benefits, such as peace of mind and the potential to avoid late payment fees. However, it’s important to ensure that you have accurate and up-to-date information on the tax due dates to avoid overpaying.

Are there any tax relief programs for low-income homeowners in Pierce County?

+Yes, Pierce County offers the Low-Income Homeowner Exemption program, which provides tax relief to eligible low-income homeowners. To qualify, you must meet certain income and property value requirements. Contact the Pierce County Assessor’s Office for details and application procedures.