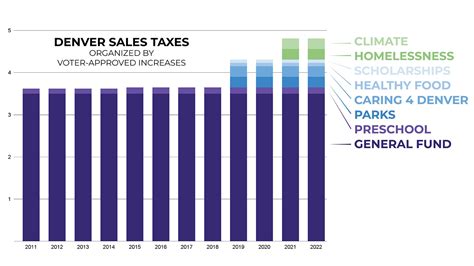

Denver City Sales Tax

Denver, Colorado, is a vibrant city known for its vibrant culture, beautiful mountain backdrop, and thriving business environment. One aspect that sets the city apart is its sales tax system, which plays a crucial role in funding various public services and initiatives. In this comprehensive article, we will delve into the world of Denver's sales tax, exploring its rates, implications, and the impact it has on both residents and businesses.

Understanding Denver's Sales Tax Structure

Denver's sales tax is a consumption tax imposed on the purchase of goods and services within the city limits. It is a vital revenue stream for the city, contributing to the development and maintenance of essential infrastructure, public transportation, and community programs. The sales tax rate in Denver consists of a combination of state, county, and municipal taxes, each serving a specific purpose.

State Sales Tax

The state of Colorado levies a base sales tax rate of 2.9%, which forms the foundation of the overall sales tax. This rate is consistent across the state and applies to a wide range of taxable goods and services.

Denver's Municipal Sales Tax

On top of the state sales tax, Denver imposes its own municipal sales tax rate, which is currently set at 4.62%. This additional tax is specifically allocated to fund various city-wide projects and initiatives. Some of the key areas where these funds are directed include:

- Maintenance and expansion of public transportation systems like buses and light rail.

- Support for local arts, culture, and tourism initiatives.

- Development and upkeep of parks, trails, and recreational facilities.

- Enhancing public safety measures and emergency response services.

- Funding for affordable housing programs and community development.

Regional Sales Tax

In addition to the state and municipal taxes, Denver is part of the Scientific and Cultural Facilities District (SCFD), which imposes an extra sales tax of 0.1%. This tax is dedicated to supporting scientific and cultural institutions within the district, promoting education and enrichment for the community.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 2.9% |

| Denver Municipal Sales Tax | 4.62% |

| SCFD Sales Tax | 0.1% |

The total sales tax rate in Denver, therefore, adds up to 7.62%, making it one of the higher sales tax rates in the state. This comprehensive tax system ensures that the city can effectively manage its finances and provide essential services to its residents and visitors.

Impact on Residents and Businesses

Denver's sales tax structure has a significant impact on both the residents and businesses operating within the city. Let's explore how it affects each group.

Residents

For residents of Denver, the sales tax directly influences their purchasing power and overall cost of living. While the higher tax rate may result in slightly increased prices for goods and services, it is important to note that the tax funds crucial public services and infrastructure projects. Here are some key points to consider:

- Public Transportation: The sales tax contributes to maintaining an efficient and reliable public transportation system, making it more accessible and affordable for residents. This encourages a more sustainable and environmentally friendly commute.

- Community Initiatives: The tax revenue supports various community programs, such as youth development initiatives, arts and cultural events, and recreational activities. These programs enhance the overall quality of life and create a sense of community.

- Infrastructure Development: The funds generated from sales tax help improve and expand essential infrastructure, including roads, bridges, and public spaces. This ensures that the city remains well-maintained and continues to attract businesses and residents.

- Affordable Housing: Denver's sales tax supports initiatives aimed at providing affordable housing options for residents, addressing the growing need for accessible and reasonably priced accommodations.

Businesses

Businesses operating in Denver are subject to the city's sales tax and must comply with the tax regulations. While the sales tax adds an additional cost to their operations, it also presents certain advantages and opportunities.

- Infrastructure and Services: The sales tax funds contribute to the development and maintenance of infrastructure, ensuring a well-connected and efficient city. This benefits businesses by providing better access to resources and customers, fostering a more conducive business environment.

- Community Engagement: Businesses can actively participate in and support community initiatives funded by the sales tax. This involvement enhances their reputation, strengthens community ties, and attracts customers who value social responsibility.

- Economic Growth: A well-funded and well-managed city attracts investments and encourages economic growth. Businesses can benefit from a thriving local economy, increased consumer spending, and a skilled workforce, leading to potential expansion opportunities.

- Sales Tax Compliance: Businesses must navigate the sales tax regulations and ensure compliance. While this adds administrative tasks, it is essential for maintaining a positive relationship with the city and avoiding penalties. Consulting with tax professionals can streamline this process.

Sales Tax Exemptions and Considerations

While Denver's sales tax applies to a wide range of goods and services, there are certain exemptions and considerations that are important to note. These exemptions vary based on the nature of the transaction and the items being purchased.

Food and Groceries

A notable exemption in Denver's sales tax system is the zero sales tax on food and groceries. This means that when purchasing essential food items and groceries, residents and visitors do not have to pay any additional sales tax. This exemption aims to alleviate the financial burden on households and promote accessibility to basic necessities.

Manufacturing and Wholesale Sales

Denver offers a sales tax exemption for manufacturing and wholesale sales, which is a significant incentive for businesses operating in these sectors. This exemption encourages economic growth and the development of manufacturing hubs within the city. It allows businesses to save on sales tax costs, making Denver an attractive location for manufacturing and wholesale operations.

Tourism and Entertainment

The city of Denver actively promotes tourism and entertainment industries, which are vital contributors to its economy. As such, certain sales tax exemptions and incentives are in place to support these sectors. For example, tickets for concerts, sporting events, and cultural performances are often exempt from sales tax, making them more affordable for visitors and residents alike.

Online Sales

With the rise of e-commerce, it is important to understand the sales tax implications for online purchases. In Denver, online sales are subject to the same sales tax rates as in-store purchases. This means that when buying goods online, the applicable sales tax is calculated and included in the total cost. Businesses must ensure they have systems in place to accurately collect and remit sales tax for online transactions.

Future Outlook and Implications

Denver's sales tax system is a dynamic and evolving component of the city's fiscal policy. As the city continues to grow and adapt to changing economic landscapes, the sales tax structure may undergo modifications to address emerging needs and priorities. Here are some potential future implications and considerations:

Economic Growth and Development

As Denver's economy flourishes, the city may experience increased demand for public services and infrastructure upgrades. This could lead to potential adjustments in the sales tax rates to accommodate the growing needs of the community. Additionally, as new industries emerge and thrive, the sales tax system may be refined to support these sectors effectively.

Sustainable Initiatives

With a growing focus on sustainability and environmental consciousness, Denver may explore ways to utilize sales tax revenue to fund green initiatives. This could include investments in renewable energy projects, waste management programs, and initiatives to reduce the city's carbon footprint. Such efforts would not only benefit the environment but also attract environmentally conscious businesses and residents.

Community Engagement

Denver's sales tax system has a direct impact on the community's well-being and engagement. As the city continues to prioritize community initiatives, the sales tax revenue may be allocated to support more diverse and inclusive programs. This could involve funding for community centers, after-school programs, and initiatives that promote social cohesion and address social inequalities.

Technological Advancements

The future of Denver's sales tax system may also be influenced by technological advancements. As e-commerce continues to gain traction, the city may explore innovative ways to streamline sales tax collection and compliance processes. This could involve implementing advanced software and systems to ensure accurate tax calculations and efficient remittance.

Collaboration and Partnerships

Denver's sales tax structure could also evolve through collaborative efforts and partnerships. The city may engage with neighboring municipalities and counties to develop regional tax initiatives that benefit a broader area. Such collaborations could lead to more efficient allocation of resources and improved services for residents and businesses across the region.

Frequently Asked Questions (FAQ)

How does Denver’s sales tax compare to other major cities in Colorado?

+Denver’s sales tax rate of 7.62% is slightly higher compared to some other major cities in Colorado. For example, Colorado Springs has a total sales tax rate of 7.20%, while Boulder’s sales tax rate is 8.20%. Each city’s sales tax structure varies, with different allocations for state, county, and municipal taxes.

Are there any plans to reduce or increase Denver’s sales tax rate in the near future?

+Currently, there are no announced plans to reduce or increase Denver’s sales tax rate in the immediate future. However, as with any tax policy, it is subject to ongoing discussions and evaluations by city officials. Any changes would likely be proposed through public hearings and require approval from the appropriate governing bodies.

How does Denver’s sales tax revenue contribute to public transportation improvements?

+A significant portion of Denver’s sales tax revenue is dedicated to funding public transportation projects and maintenance. This includes investments in bus rapid transit systems, light rail expansions, and improvements to existing infrastructure. The sales tax provides a stable source of funding, ensuring the city can maintain and enhance its transportation network.

Are there any sales tax incentives or exemptions for small businesses in Denver?

+Yes, Denver offers certain sales tax incentives and exemptions for small businesses. For example, there is a sales tax exemption for manufacturing and wholesale sales, which can significantly benefit small businesses operating in these sectors. Additionally, there are resources and support programs available to help small businesses navigate the sales tax regulations and compliance processes.

How does Denver’s sales tax revenue support community initiatives and cultural events?

+Denver’s sales tax revenue is allocated to support a wide range of community initiatives and cultural events. This includes funding for arts organizations, museums, theaters, and cultural festivals. The sales tax also contributes to youth development programs, recreational activities, and initiatives that promote social cohesion and inclusivity within the community.