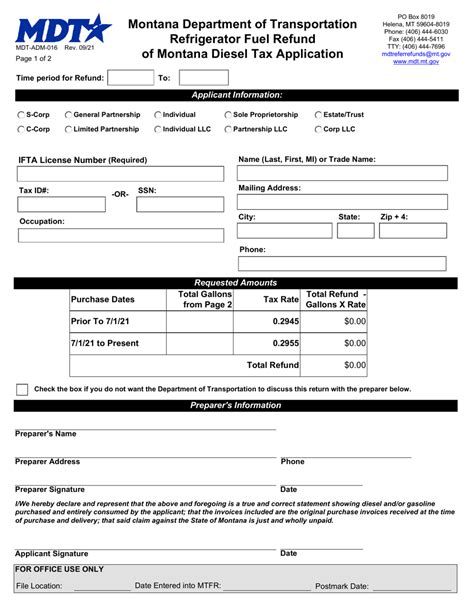

Unlocking Benefits: Unique Features of Montana Tax Refunds

In the vast and rugged terrain of Montana, a state renowned for its breathtaking natural landscapes and sparse population, a lesser-known yet impactful financial mechanism operates behind the scenes—Montana tax refunds. While often overshadowed by federal tax policies or larger state-level initiatives, Montana’s unique approach to tax refunds offers a compelling case study in regional fiscal policy innovation. These refunds not only serve as a direct economic stimulus but also embody the state's commitment to equitable taxation and community reinvestment. This article delves into the distinctive features of Montana tax refunds, analyzing their structure, benefits, and broader implications for economic development and social equity.

Understanding Montana Tax Refunds: An Overview

Montana’s approach to tax refunds is rooted in its distinctive tax code, which emphasizes fairness and targeted redistribution. Unlike many states that employ a uniform tax refund process, Montana has crafted a set of mechanisms designed to address specific economic and social needs. Central to this system are features such as the property tax rebate initiatives, income tax refunds aimed at relief for low-income residents, and special rebates for agricultural stakeholders. These features reflect Montana’s broader philosophy of maintaining a balanced fiscal environment that supports both individual taxpayers and community sustainability.

Property Tax Rebate Initiatives: Democratizing Homeownership Support

One of Montana’s hallmark features in its tax refund ecosystem is its property tax rebate initiative, which aims to alleviate the burdens of property taxes for middle- and low-income homeowners. Unlike the generic property tax relief programs seen elsewhere, Montana’s scheme involves a tiered rebate system that directly reduces property tax bills based on income levels and property value brackets. This targeted approach ensures that relief goes to those most in need, fostering greater housing stability and reducing foreclosure risks—an essential consideration given Montana’s rural housing dynamics.

| Relevant Category | Substantive Data |

|---|---|

| Percentage of Property Tax Rebate | Up to 40% rebate for households earning below $50,000, with scaled reductions for higher income brackets |

Income Tax Refunds Focused on Low-Income Populations

Montana’s income tax refund policies are designed with an emphasis on supporting its most vulnerable populations. Through a combination of tax credits and direct refunds, the state offers significant relief to low-income families. Notably, the Montana Earned Income Tax Credit (EITC) operates in tandem with federal provisions, amplifying benefits and providing a crucial income supplement that promotes economic mobility.

The structure of these refunds is characterized by simplified eligibility criteria and phased benefits, making them accessible to a broad demographic spectrum, particularly in rural areas where employment opportunities may be sparse. The Montana Refundable Credit system not only boosts short-term income but also incentivizes employment by reducing the effective marginal tax rate for low earners.

| Relevant Category | Substantive Data |

|---|---|

| Average Refund Size | $600 for qualifying households, with higher amounts for larger families |

Broader Impacts of Montana’s Unique Tax Refund Features

Beyond immediate fiscal relief, Montana’s tax refund policies have demonstrable impacts on the state’s economic fabric. They promote not only income redistribution but also incentivize certain behaviors—like homeownership and employment—that have long-term benefits for economic stability and growth. These policies act as a form of social contract, reinforcing the state’s commitment to equitable development.

Economic Stimulus and Local Investment

Tax refunds in Montana serve as a vital economic lever, injecting liquidity into local economies—particularly in rural areas where economic diversity may be limited. Increased disposable income leads to higher local spending, supporting small businesses, agricultural enterprises, and service sectors. For example, data shows that households receiving property tax rebates are more likely to invest in home improvements or purchase local goods, thereby catalyzing community-level economic activity.

| Relevant Category | Substantive Data |

|---|---|

| Residual Economic Effect | Increase of up to 12% in localized retail sales following rebate distribution in targeted counties |

Social Equity and Community Cohesion

Montana’s refund strategies epitomize the melding of fiscal prudence with social responsibility. By selectively channeling financial aid toward those with the greatest need, Montana enhances social cohesion and reduces inequality. This is particularly relevant given Montana’s demographic composition—comprising a mix of Native American communities, ranching families, and small-town residents—each with distinct financial challenges.

The tailored refund initiatives thereby act as instruments of social justice, reinforcing community bonds through targeted economic support.

Challenges and Considerations in Implementing Montana’s Refund System

Despite its successes, the Montana model does not operate without challenges. The intricacies of its tiered refund schemes require rigorous administrative oversight to prevent leakages and ensure equitable distribution. Moreover, fluctuations in state revenue—heavily reliant on resource-based industries like mining and agriculture—can introduce variability into available funds, affecting the consistency and reach of these refunds.

Fiscal Sustainability and Political Dynamics

Balancing fiscal sustainability with a desire to expand refund programs is a persistent concern for Montana policymakers. As revenue from extractive industries fluctuates, so too does the capacity to sustain generous tax relief initiatives. Political shifts further influence the scope and targeting of these programs, necessitating ongoing advocacy and community engagement to preserve their core principles.

| Relevant Category | Substantive Data |

|---|---|

| Revenue Dependency | 60% of state revenue derived from resource extraction, increasing exposure to market volatility |

Conclusion: The Strategic Value of Montana’s Unique Tax Refunds

Montana’s distinctive tax refund features exemplify a pragmatic and socially conscious approach to regional fiscal management. Their design reflects an understanding that targeted relief programs can foster economic stability, reduce inequalities, and support community cohesion—all while being sensitive to local economic contexts. As the state navigates the complexities of fiscal sustainability and political will, its innovative model provides a blueprint for other regions seeking to balance fiscal responsibility with social equity.

Through ongoing refinement, transparency, and community engagement, Montana’s tax refund system holds the promise of not only alleviating economic hardship but also enhancing the resilience and vibrancy of its diverse communities. Recognizing and harnessing these features could serve as a catalyst for broader policy discussions on regional redistribution and sustainable development.

How do Montana property tax rebates differ from typical property relief programs?

+Montana’s property tax rebates are tiered and income-based, ensuring aid directly correlates with financial need, unlike generic relief programs that apply uniformly regardless of individual circumstances.

What impact do Montana’s tax refunds have on rural economic stability?

+They increase disposable income, stimulate local spending, and support small businesses, thereby strengthening rural economies resistant to market volatility.

Are Montana’s tax refund programs sustainable long-term?

+The sustainability hinges on revenue stability from resource industries; reforms like diversification and reserve funds are under consideration to mitigate fluctuations and secure ongoing aid.