Waterbury Ct Tax Collector

The Waterbury Tax Collector's Office is an essential entity within the city of Waterbury, Connecticut, responsible for a critical function that impacts every resident and business owner in the area. This office is tasked with the collection and management of taxes, which are a vital source of revenue for the local government, funding various public services and infrastructure projects.

The role of the Tax Collector goes beyond mere revenue collection. It involves a delicate balance of ensuring the city receives the necessary funds while also maintaining a positive relationship with taxpayers and offering efficient, transparent services. The office's operations have a direct impact on the financial health and stability of the city, influencing its ability to provide essential services and maintain its infrastructure.

The Waterbury Tax Collector's Office: An Overview

The Waterbury Tax Collector's Office is headed by an appointed official, who is responsible for overseeing the collection of taxes, maintaining accurate records, and ensuring compliance with state and local tax laws. The office handles a variety of taxes, including property taxes, which are a significant source of revenue for the city.

Waterbury's property tax system is designed to ensure fairness and transparency. Property owners are assessed based on the value of their properties, with the tax rate determined by the city's budget requirements and the need to provide essential services to residents. The Tax Collector's Office ensures that these assessments are accurate and that property owners are aware of their tax obligations.

In addition to property taxes, the office also handles other tax types, such as motor vehicle taxes and taxes on business operations. Each of these tax streams plays a crucial role in the city's financial health, contributing to the overall revenue pool that funds vital services like education, public safety, and infrastructure maintenance.

Key Responsibilities of the Tax Collector

The responsibilities of the Waterbury Tax Collector are multifaceted and critical to the city's functioning. Here are some of the key duties that the office undertakes:

- Tax Assessment and Collection: The primary role of the Tax Collector is to assess and collect taxes from property owners, businesses, and vehicle owners within the city limits. This involves a complex process of calculating tax liabilities, issuing tax bills, and collecting payments in a timely manner.

- Delinquent Tax Enforcement: When taxpayers fail to meet their tax obligations, the Tax Collector's Office is responsible for enforcing collection through various means, including liens, levies, and seizure of assets. This ensures that the city receives the revenue it is owed and discourages non-compliance.

- Taxpayer Assistance: The office also provides support and assistance to taxpayers, offering guidance on tax payments, answering queries, and providing information on tax exemptions and discounts. This proactive approach helps to build a positive relationship with taxpayers and ensures a smoother tax collection process.

- Record Maintenance: Accurate record-keeping is crucial for the Tax Collector's Office. This involves maintaining up-to-date property ownership records, tracking tax payments, and managing tax account information. These records are vital for auditing purposes and ensuring the integrity of the tax system.

- Budget Management: The Tax Collector plays a role in the city's budget process by providing revenue projections and ensuring that tax collection efforts align with the city's financial goals. This involves a careful analysis of tax trends and potential revenue sources to inform the budgeting process.

The Waterbury Tax Collector's Office operates with a commitment to transparency and accountability, striving to ensure that the tax collection process is fair, efficient, and accessible to all taxpayers. By effectively managing these critical responsibilities, the office contributes significantly to the financial stability and overall prosperity of the city.

Tax Collection Process in Waterbury

The tax collection process in Waterbury is a well-organized and streamlined system, designed to ensure the city receives the revenue it needs to function effectively while providing a seamless experience for taxpayers. This process involves several key stages, each of which is carefully managed by the Tax Collector's Office to ensure efficiency and compliance.

Property Tax Assessment

The first step in the tax collection process is the assessment of property values. The city's tax assessors evaluate each property within Waterbury, considering factors such as size, location, and recent sales of comparable properties. This process ensures that each property owner is taxed fairly based on the actual value of their property.

The assessed value of a property is then used to calculate the tax liability. The tax rate, which is set annually by the city's governing body, is applied to the assessed value to determine the amount due. This information is made available to property owners through tax bills, which are typically sent out twice a year.

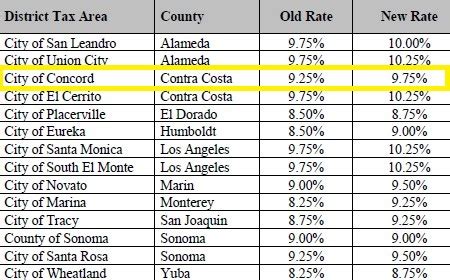

| Property Type | Average Assessed Value | Average Tax Rate | Average Annual Tax |

|---|---|---|---|

| Residential | $150,000 | 1.75% | $2,625 |

| Commercial | $300,000 | 2.25% | $6,750 |

| Industrial | $500,000 | 2.5% | $12,500 |

The table above provides an example of average assessed values, tax rates, and resulting annual taxes for different property types in Waterbury. These figures can vary based on individual property characteristics and the city's budgetary needs.

Tax Payment Options

The Waterbury Tax Collector's Office offers a range of payment options to accommodate different taxpayer preferences and needs. Taxpayers can choose to pay their taxes in full upon receipt of their tax bill, or they can opt for installment plans, which allow for payments to be spread out over a period of time.

The office accepts various payment methods, including cash, checks, money orders, and online payments through secure payment portals. This flexibility ensures that taxpayers can choose the method that is most convenient and secure for them.

Late Payment and Enforcement

While the Tax Collector's Office strives to provide a smooth tax collection process, there are consequences for late payments or non-payment of taxes. When a tax bill is not paid by the due date, the office sends out reminder notices. If the payment remains outstanding, the office may initiate enforcement actions, which can include:

- Late Payment Fees: The office may charge a penalty for late payments, typically a percentage of the outstanding tax amount.

- Lien Placement: In cases of prolonged non-payment, the office may place a lien on the property, which can affect the property owner's ability to sell or refinance the property until the taxes are paid.

- Property Seizure: As a last resort, the office may seize the property and sell it to recoup the unpaid taxes. This is a rare occurrence and is typically reserved for cases of significant and prolonged non-payment.

These enforcement actions are designed to ensure that the city receives the revenue it is owed while also serving as a deterrent for non-compliance. The Tax Collector's Office aims to balance these enforcement measures with a commitment to taxpayer assistance and education, striving to resolve tax issues before they escalate to more severe consequences.

Taxpayer Resources and Support

The Waterbury Tax Collector's Office recognizes that tax obligations can be complex and sometimes overwhelming for taxpayers. To address these challenges, the office provides a range of resources and support services to ensure that taxpayers have the information and assistance they need to navigate the tax collection process successfully.

Online Services

The office's website serves as a valuable resource for taxpayers, offering a wealth of information and tools to simplify the tax payment process. Taxpayers can access their account information, view their tax bills, and make payments online through a secure portal. This online platform also provides access to important tax documents, such as assessment notices and payment receipts.

Additionally, the website offers a range of educational materials, including guides on tax payment options, explanations of tax exemptions, and answers to frequently asked questions. This resource ensures that taxpayers have the information they need to understand their tax obligations and make informed decisions about their payments.

Taxpayer Assistance Programs

The Tax Collector's Office understands that unforeseen circumstances can impact a taxpayer's ability to pay their taxes on time. To provide support in such situations, the office offers various assistance programs, including:

- Payment Plans: Taxpayers who are facing financial challenges can apply for payment plans, which allow them to pay their taxes in installments over an extended period. These plans are tailored to the taxpayer's financial situation and can provide much-needed flexibility.

- Hardship Exemptions: In cases where taxpayers are experiencing severe financial hardship, the office may grant exemptions from certain taxes or penalties. This is typically a last resort measure and requires thorough documentation of the taxpayer's financial situation.

- Senior Citizen Discounts: Waterbury offers discounts on property taxes for senior citizens who meet certain age and income requirements. This program helps to ease the tax burden for elderly residents who may be on fixed incomes.

These assistance programs demonstrate the Tax Collector's Office's commitment to fairness and support for taxpayers. By offering these options, the office ensures that taxpayers have the opportunity to fulfill their tax obligations, even in challenging circumstances, without facing undue hardship.

Community Outreach and Education

The Tax Collector's Office actively engages with the Waterbury community to promote tax awareness and understanding. This includes hosting informational sessions and workshops to educate taxpayers about their rights and responsibilities, as well as providing guidance on tax payment options and assistance programs.

The office also participates in community events and forums, offering opportunities for taxpayers to ask questions and seek clarification on tax-related matters. By fostering open communication and providing accessible resources, the Tax Collector's Office strives to build a culture of tax compliance and understanding within the community.

The Impact of Effective Tax Collection

The role of the Waterbury Tax Collector's Office extends beyond the mere collection of taxes. Effective tax collection has a profound impact on the city's overall well-being and future prosperity. It ensures that the city has the financial resources it needs to provide essential services, maintain infrastructure, and invest in initiatives that enhance the quality of life for residents.

Funding Essential Services

Tax revenue is a primary source of funding for a wide range of public services in Waterbury. These services include:

- Education: Tax revenue supports the city's schools, ensuring that students have access to quality education and necessary resources.

- Public Safety: Taxes fund police and fire departments, ensuring the safety and security of residents and businesses.

- Health Services: Tax revenue contributes to the operation of public health clinics and emergency medical services.

- Parks and Recreation: Taxes help maintain public parks, recreational facilities, and community centers, providing residents with opportunities for leisure and social interaction.

By effectively collecting taxes, the Waterbury Tax Collector's Office ensures that these vital services are adequately funded, allowing the city to fulfill its responsibilities to its residents.

Infrastructure Development and Maintenance

Tax revenue also plays a crucial role in the development and maintenance of Waterbury's infrastructure. This includes:

- Road and Bridge Maintenance: Taxes fund the repair and upkeep of roads, bridges, and other transportation infrastructure, ensuring safe and efficient travel for residents and businesses.

- Water and Sewer Systems: The city's water and sewer systems are maintained and upgraded using tax revenue, ensuring clean and reliable water supply and waste management.

- Public Buildings and Facilities: Taxes contribute to the construction and maintenance of public buildings like libraries, government offices, and community centers, ensuring they remain functional and accessible to the public.

Without effective tax collection, the city would struggle to maintain and improve its infrastructure, which is essential for economic growth, public health, and overall quality of life.

Economic Growth and Development

The tax revenue collected by the Waterbury Tax Collector's Office also contributes to the city's economic growth and development. It provides the financial foundation for initiatives aimed at attracting businesses and investors, creating jobs, and stimulating economic activity.

For example, tax revenue can be used to fund:

- Economic development incentives, such as tax abatements or grants, to encourage businesses to locate in Waterbury.

- Infrastructure improvements that make the city more attractive to businesses and investors, such as upgrades to transportation networks or the development of business parks.

- Initiatives to support local businesses, such as small business loan programs or marketing campaigns to promote Waterbury as a business-friendly destination.

By facilitating economic growth, the Tax Collector's Office indirectly contributes to job creation, increased tax revenue over time, and a more prosperous and vibrant community.

Future Prospects and Challenges

As Waterbury looks toward the future, the role of the Tax Collector's Office will continue to evolve to meet new challenges and opportunities. The city's changing demographics, economic landscape, and technological advancements will shape the tax collection process and the strategies employed by the office.

Changing Demographics and Economic Trends

Waterbury, like many cities, is experiencing demographic shifts and economic transformations that impact its tax base. As the population ages and the economic landscape changes, the Tax Collector's Office will need to adapt its strategies to ensure a stable and sustainable revenue stream.

For instance, as the city's population ages, there may be a greater demand for services like senior citizen discounts and payment plan options. At the same time, economic shifts may lead to changes in the tax base, with businesses and industries rising and falling in prominence. The Tax Collector's Office will need to stay agile to accommodate these changes and ensure that the city's tax revenue remains robust.

Technological Advancements

The Tax Collector's Office is also poised to leverage technological advancements to enhance its operations. Digital tools and platforms can streamline the tax collection process, making it more efficient and convenient for taxpayers. Online payment systems, mobile apps, and digital record-keeping can reduce administrative burdens and improve taxpayer engagement.

Additionally, technological advancements can aid in data analysis and tax forecasting, helping the office to anticipate revenue trends and plan for the city's financial needs. These tools can also improve the accuracy of tax assessments, ensuring that taxpayers are charged fairly and accurately.

Community Engagement and Education

While technological advancements can enhance the tax collection process, the Tax Collector's Office will continue to prioritize community engagement and education. By fostering a culture of tax awareness and understanding, the office can encourage voluntary compliance and build trust with taxpayers.

This includes continuing to offer taxpayer assistance programs, providing accessible resources and information, and actively engaging with the community through outreach initiatives. By empowering taxpayers with knowledge and support, the office can ensure that tax collection remains fair, efficient, and aligned with the city's values and goals.

Conclusion

The Waterbury Tax Collector's Office is an integral part of the city's financial infrastructure, playing a crucial role in ensuring the city's fiscal health and stability. Through its commitment to transparency, fairness, and efficiency, the office ensures that taxpayers can fulfill their obligations while also supporting the city's essential services, infrastructure, and economic growth.

As Waterbury looks to the future, the Tax Collector's Office will continue to adapt and innovate, leveraging technology and community engagement to enhance the tax collection process. By staying agile and responsive to changing circumstances, the office will ensure that Waterbury remains a vibrant, thriving community, supported by a robust and sustainable tax system.