Taxes In Puerto Rico

Welcome to a comprehensive exploration of the tax system in Puerto Rico, a fascinating and unique jurisdiction with a complex tax landscape. As an island territory of the United States, Puerto Rico has a distinct tax structure that has evolved over time, offering a range of opportunities and considerations for residents, businesses, and investors alike. In this article, we will delve into the intricacies of Puerto Rico's tax system, providing an in-depth analysis of its key components, recent developments, and the potential implications for various stakeholders.

Understanding Puerto Rico's Tax System: An Overview

Puerto Rico's tax system is a blend of federal and local regulations, creating a unique fiscal environment. The island's relationship with the United States influences its tax laws, yet it maintains a significant level of autonomy, particularly in areas like corporate and individual taxation.

One of the most notable features of Puerto Rico's tax system is its Internal Revenue Code of Puerto Rico, which mirrors many aspects of the U.S. Internal Revenue Code but also incorporates unique provisions and rates. This code forms the backbone of the island's tax structure, governing personal income taxes, corporate taxes, and a variety of other levies.

Key Tax Categories in Puerto Rico

To understand the tax landscape in Puerto Rico, it's essential to examine the primary tax categories that impact residents and businesses:

- Personal Income Tax: Puerto Rico has its own income tax system, distinct from federal U.S. taxes. The island's Departamento de Hacienda administers this tax, which applies to individuals earning income within Puerto Rico. The tax rates and brackets are specific to the island, and there are also various deductions and credits available.

- Corporate Tax: Businesses operating in Puerto Rico are subject to corporate tax, which is levied on their profits. The corporate tax system offers certain incentives and benefits, particularly for companies that meet specific criteria and contribute to the island's economic development.

- Sales and Use Tax (IVU): Puerto Rico imposes a sales tax on goods and services, similar to many U.S. states. The Impuesto sobre Ventas y Uso (IVU) is a consumption tax that applies to most transactions. There are certain exemptions and special rates for essential items.

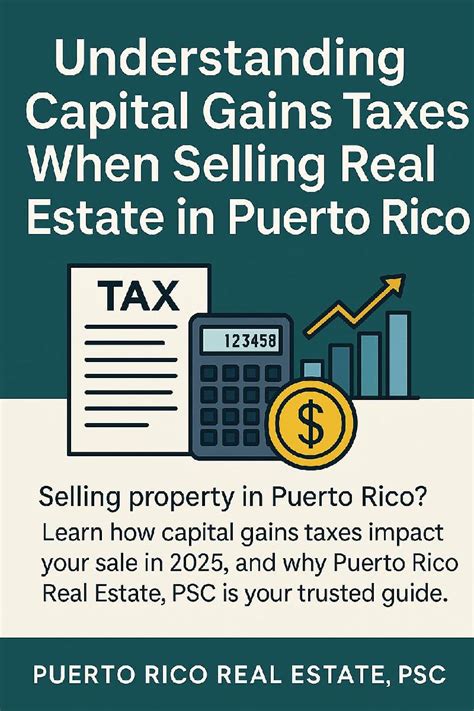

- Property Tax: Real estate and property ownership in Puerto Rico are subject to property taxes. These taxes are collected by local municipalities and contribute to the funding of public services and infrastructure.

- Excise Taxes: Puerto Rico levies excise taxes on specific goods and services, including tobacco, alcohol, and certain luxury items. These taxes are often used to generate revenue for targeted public health and welfare initiatives.

Recent Developments and Reforms

The tax landscape in Puerto Rico is not static, and recent years have seen significant developments and reforms. One of the most notable changes is the introduction of the Puerto Rico Incentives Code, which aims to attract new businesses and investments to the island.

The Incentives Code offers a range of tax benefits and incentives, including tax credits, exemptions, and reduced tax rates. These incentives are designed to encourage economic growth, job creation, and innovation. The code specifically targets industries such as manufacturing, research and development, and certain service sectors.

Another key development is the island's ongoing efforts to simplify and streamline its tax system. Puerto Rico has implemented measures to reduce compliance burdens, improve tax administration, and enhance transparency. These initiatives aim to make the tax system more efficient and attractive to businesses and investors.

| Tax Category | Recent Changes |

|---|---|

| Personal Income Tax | Introduction of new tax brackets and an increased standard deduction. |

| Corporate Tax | Reduction in corporate tax rates for qualifying businesses under the Incentives Code. |

| Sales Tax (IVU) | Implementation of a simplified tax structure with fewer tax rates. |

| Property Tax | Introduction of online filing and payment systems to enhance convenience and compliance. |

The Impact of Tax Policies on Residents and Businesses

Puerto Rico's tax policies have a significant influence on the lives of residents and the operations of businesses. Let's explore how these tax measures impact different stakeholders.

Benefits for Individuals

For individuals, Puerto Rico's tax system offers several advantages. The personal income tax rates are generally lower compared to many U.S. states, providing residents with more disposable income. Additionally, the availability of tax credits and deductions can further reduce the tax burden.

Furthermore, Puerto Rico's unique tax status as a U.S. territory means that individuals can access many of the same benefits and protections offered by the federal government. This includes access to Social Security, Medicare, and other federal programs.

Advantages for Businesses

Businesses operating in Puerto Rico can take advantage of the island's tax incentives and a generally business-friendly environment. The Incentives Code, in particular, offers significant tax breaks for companies that meet specific criteria.

For example, manufacturing companies can benefit from reduced tax rates and tax holidays. This can significantly lower their tax liabilities and make Puerto Rico an attractive location for manufacturing operations. Additionally, businesses can access a skilled workforce and a strategic geographic location, further enhancing their competitiveness.

Challenges and Considerations

While Puerto Rico's tax system offers many benefits, there are also some challenges and considerations that residents and businesses should be aware of:

- Compliance: The tax system can be complex, and compliance requirements can be stringent. Both individuals and businesses must ensure they understand and adhere to all applicable tax laws and regulations.

- Limited Deductions: While there are tax credits and incentives, the range of deductions available to individuals is more limited compared to some U.S. states.

- Economic Uncertainty: Puerto Rico's economy has faced significant challenges in recent years, including the aftermath of natural disasters and a high debt burden. This can create economic uncertainty for businesses and investors.

Puerto Rico's Tax System: A Comparative Analysis

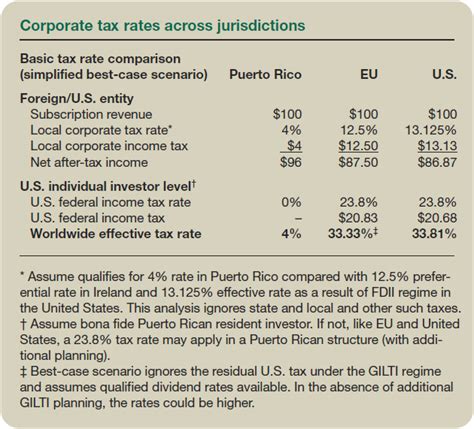

To gain a deeper understanding of Puerto Rico's tax system, it's beneficial to compare it with other jurisdictions, particularly within the United States.

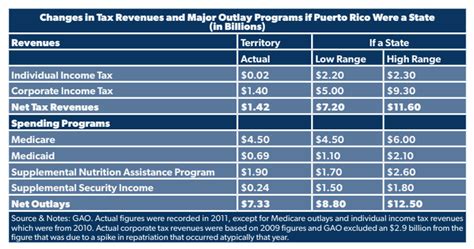

Comparison with U.S. States

When compared to U.S. states, Puerto Rico's tax system offers both similarities and differences. One of the most notable differences is the absence of federal income tax for Puerto Rican residents. While U.S. citizens living in the states pay federal income tax, residents of Puerto Rico are exempt from this levy.

However, Puerto Rico does have its own personal income tax system, which is similar in structure to many U.S. states. The tax rates and brackets vary, but the basic principles of progressive taxation are often shared. Both jurisdictions also impose sales taxes, although the rates and specific goods taxed may differ.

Comparison with Other U.S. Territories

Puerto Rico's tax system is unique among U.S. territories. Unlike territories like Guam or the U.S. Virgin Islands, Puerto Rico has a more developed and sophisticated tax structure. This is due, in part, to its larger population and more diverse economy.

Other U.S. territories often have simpler tax systems, with fewer taxes and less complexity. For example, Guam has a single income tax rate, while the U.S. Virgin Islands has a more straightforward sales tax structure. In contrast, Puerto Rico's tax system is more comprehensive and offers a wider range of tax incentives and benefits.

Global Comparison

On a global scale, Puerto Rico's tax system can be compared to other island nations and jurisdictions with similar economic profiles. For instance, the Caribbean island of Bermuda has a zero-tax policy for individuals, which makes it a popular destination for high-net-worth individuals seeking tax efficiency.

In contrast, Puerto Rico's tax system is more nuanced, with a mix of taxes and incentives. This approach is designed to encourage economic growth and development while also generating sufficient revenue to support public services and infrastructure.

The Future of Puerto Rico's Tax System

Looking ahead, Puerto Rico's tax system is likely to continue evolving to meet the changing needs of the island's economy and its residents. Here are some potential future developments and their implications:

Continued Economic Recovery

Puerto Rico is in the midst of a challenging economic recovery phase following the devastation caused by Hurricane Maria in 2017. The tax system will play a crucial role in this recovery, with incentives and tax reforms aimed at attracting new businesses and investments. As the economy strengthens, the tax system will need to adapt to support sustainable growth.

Embracing Digital Transformation

The COVID-19 pandemic has accelerated the digital transformation of many economies, including Puerto Rico's. The island's tax system is likely to evolve to accommodate the increasing importance of digital businesses and remote work. This may involve the introduction of new taxes or adjustments to existing ones to ensure a fair and sustainable revenue stream.

Addressing Climate Change

Climate change is a pressing issue for island nations like Puerto Rico. The tax system may play a role in addressing this challenge by incentivizing sustainable practices and investments. For example, the government could introduce tax credits for renewable energy projects or offer incentives for businesses to adopt eco-friendly practices.

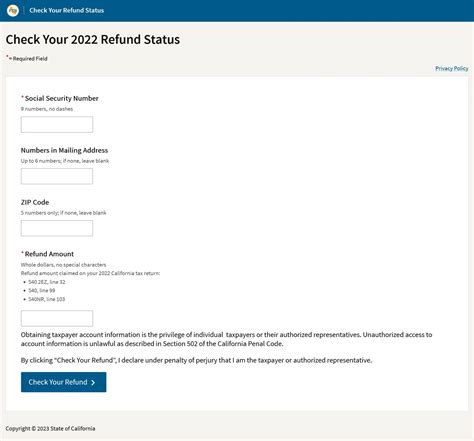

Enhancing Tax Administration

Efforts to simplify and streamline the tax system are likely to continue. The government may focus on further improving tax administration, including the use of technology to enhance compliance and reduce the tax gap. This could involve the implementation of more efficient tax collection methods and the expansion of online filing and payment systems.

Frequently Asked Questions

How does Puerto Rico's tax system compare to the U.S. federal tax system?

+Puerto Rico has its own tax system that operates separately from the U.S. federal tax system. While it has similarities, such as a progressive income tax structure, there are key differences. Puerto Rican residents are not subject to federal income tax, and the island has its own tax rates and regulations. However, Puerto Rico does follow some federal tax laws, such as those related to corporate taxes.

What are the main tax incentives for businesses in Puerto Rico?

+Puerto Rico offers a range of tax incentives to attract businesses, particularly those that contribute to economic development. These incentives include reduced corporate tax rates, tax holidays, and tax credits for research and development activities. Additionally, there are incentives for specific industries like manufacturing and international business centers.

Are there any special tax considerations for residents of Puerto Rico?

+Yes, Puerto Rico has its own personal income tax system, which means residents are subject to local income taxes. However, they are exempt from federal income tax. There are also tax benefits for certain groups, such as senior citizens and veterans, who may be eligible for tax exemptions or reduced rates.

How does Puerto Rico's tax system support economic growth and development?

+Puerto Rico's tax system is designed to encourage economic growth by offering a range of tax incentives and benefits. These incentives attract new businesses, create jobs, and promote investment. Additionally, the tax system supports local industries and infrastructure development through the collection of various taxes, ensuring the island has the resources to support its economy.

What are the main challenges for tax compliance in Puerto Rico?

+Tax compliance in Puerto Rico can be challenging due to the complexity of the tax system and the need to adhere to both local and federal tax laws. Additionally, the island's unique economic and fiscal status can create uncertainty for taxpayers. However, recent reforms and the implementation of digital tax administration tools are aimed at simplifying the process and enhancing compliance.

In conclusion, Puerto Rico's tax system is a dynamic and evolving landscape that plays a crucial role in the island's economy and the lives of its residents. From personal income taxes to corporate incentives, each aspect of the system has a unique impact. As Puerto Rico continues to recover and rebuild, its tax policies will be instrumental in shaping the island's future.

For those interested in learning more about Puerto Rico’s tax system, further resources and expert insights are available. Stay informed and explore the opportunities and challenges that this unique jurisdiction presents.