Georgia Tax Ad Valorem

Georgia's tax system, like many other states in the United States, employs various methods to generate revenue and support its operations. One such method is the Ad Valorem tax, which plays a significant role in the state's taxation landscape. This article aims to delve into the intricacies of the Ad Valorem tax in Georgia, exploring its definitions, applications, and implications for individuals and businesses.

Understanding Ad Valorem Tax

Ad Valorem, a Latin term meaning “according to value”, is a type of tax imposed on the value of property or goods. In the context of Georgia’s tax system, Ad Valorem taxes are primarily associated with real estate and personal property assessments. These taxes are a vital source of revenue for local governments, funding essential services such as education, infrastructure, and public safety.

The Ad Valorem tax in Georgia is calculated based on the fair market value of the property, which is determined through a comprehensive assessment process. This value-based taxation ensures that the tax burden is distributed fairly among property owners, taking into account the actual worth of their assets.

Real Estate Ad Valorem Tax

For real estate, the Ad Valorem tax applies to both residential and commercial properties. The assessment process involves an evaluation of the property’s physical characteristics, location, and recent sales data to determine its fair market value. This value is then multiplied by the applicable millage rate, which is set by local taxing authorities, to calculate the annual tax liability.

An example of a real estate Ad Valorem tax calculation can be demonstrated as follows:

| Fair Market Value of Property | $250,000 |

|---|---|

| Millage Rate | 15 mills |

| Ad Valorem Tax | $3,750 (Fair Market Value x Millage Rate) |

In this scenario, the property owner would be responsible for an annual Ad Valorem tax of $3,750.

Personal Property Ad Valorem Tax

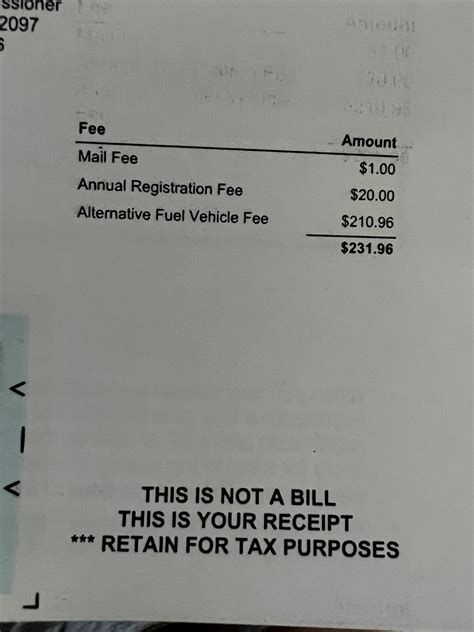

Personal property Ad Valorem taxes in Georgia cover a wide range of assets, including vehicles, boats, aircraft, and business equipment. The valuation process for these assets considers factors such as age, condition, and market value. Unlike real estate, personal property assessments are often conducted using statutory formulas that consider depreciation and other relevant factors.

For instance, the Ad Valorem tax on a vehicle might be calculated based on a percentage of its blue book value, which represents the estimated fair market value. This value is then subject to the applicable millage rate to determine the tax liability.

Tax Assessment and Appeal Process

The Ad Valorem tax assessment process in Georgia is handled by county tax assessors, who are responsible for determining the fair market value of properties within their jurisdiction. This process typically occurs annually, and property owners receive a notice of assessment detailing the calculated value and the corresponding tax liability.

If a property owner disagrees with the assessed value, they have the right to appeal the assessment. The appeal process in Georgia involves several steps, including an informal review with the county tax assessor, a formal hearing with the county board of equalization, and, if necessary, an appeal to the Georgia State Board of Equalization or the courts.

Informal Review

The informal review is an opportunity for property owners to discuss their concerns with the county tax assessor. This step allows for a dialogue to address any potential errors or discrepancies in the assessment. It is often the first and most efficient way to resolve valuation disputes.

Formal Hearing

If the informal review does not lead to a satisfactory resolution, property owners can request a formal hearing before the county board of equalization. During this hearing, the property owner presents their case, providing evidence and arguments to support their claimed value. The board then makes a decision, which can be appealed to a higher authority if the property owner is still dissatisfied.

State and Judicial Appeals

Should the property owner wish to pursue the appeal further, they can file with the Georgia State Board of Equalization, which serves as an independent review board. If the appeal reaches this level, it often indicates a significant dispute over the valuation. The state board’s decision can be final, or it can be appealed to the courts for a judicial review.

Impact and Considerations

The Ad Valorem tax system in Georgia has a profound impact on both individuals and businesses. For homeowners, it represents a significant annual expense that can influence their financial planning and budgeting. The tax liability can vary significantly based on the location and value of the property, making it an essential consideration when purchasing or owning real estate.

Businesses, especially those with substantial real estate holdings or valuable personal property, face unique challenges. They must carefully manage their tax obligations to ensure compliance and minimize financial impact. This often involves a thorough understanding of the tax laws, regular property assessments, and strategic planning to take advantage of available exemptions and relief programs.

Compliance and Penalties

Non-compliance with Ad Valorem tax obligations in Georgia can result in significant penalties, including interest charges and fines. It is crucial for property owners to understand their responsibilities and ensure timely payment of taxes. Late payments can lead to accruing interest and potential legal consequences.

Tax Planning and Strategies

Given the complexity of the Ad Valorem tax system, many property owners and businesses seek professional advice for tax planning. This can involve strategies such as regular property reassessments, ensuring accurate valuations, and taking advantage of available exemptions and deductions. Additionally, staying informed about changes in tax laws and regulations is essential to maintain compliance.

Future Implications and Potential Changes

The Ad Valorem tax system in Georgia, like any taxation policy, is subject to potential changes and reforms. As the state’s economy and population dynamics evolve, the tax system may require adjustments to remain equitable and sustainable.

Some potential future implications and considerations include:

- Revenue Shortfalls: With the state's growing population and changing economic landscape, there may be a need to reevaluate the tax base and ensure sufficient revenue generation to support public services.

- Equity Concerns: As property values fluctuate, there is a risk of unequal tax burdens among property owners. Ongoing assessments and adjustments are necessary to maintain fairness.

- Technological Advancements: The integration of technology into the assessment process could enhance accuracy and efficiency, potentially reducing administrative burdens and improving taxpayer experiences.

- Tax Reform Initiatives: Georgia, like many states, periodically reviews its tax policies. Future reforms may include changes to assessment methods, tax rates, or the introduction of new tax incentives or exemptions.

Staying informed about these potential changes is crucial for property owners and businesses to adapt their tax strategies and ensure compliance with evolving regulations.

How often are property assessments conducted in Georgia for Ad Valorem taxes?

+Property assessments for Ad Valorem taxes in Georgia are typically conducted annually. However, certain counties may have different assessment cycles, so it’s important to check with the local tax assessor’s office for specific details.

Are there any exemptions or relief programs available for Ad Valorem taxes in Georgia?

+Yes, Georgia offers various exemptions and relief programs to reduce the tax burden for certain property owners. These include homestead exemptions for primary residences, agricultural exemptions for farmland, and disability exemptions for qualifying individuals. Additionally, there are relief programs available for low-income seniors and veterans.

What happens if I disagree with my property’s assessed value in Georgia?

+If you disagree with your property’s assessed value, you have the right to appeal. The appeal process in Georgia involves an informal review with the county tax assessor, a formal hearing with the county board of equalization, and, if necessary, an appeal to the Georgia State Board of Equalization or the courts. It is recommended to gather evidence and consult with a tax professional to ensure a successful appeal.