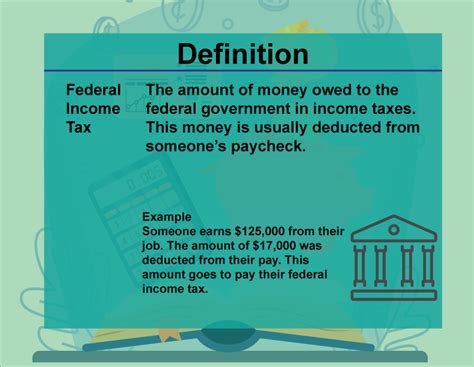

Meaning Of Federal Income Tax

Federal income tax is a vital component of the United States' taxation system, playing a significant role in funding government operations and various public services. This article delves into the intricacies of federal income tax, exploring its historical context, its role in the modern economy, and its impact on individuals and businesses.

A Historical Perspective on Federal Income Tax

The origins of federal income tax can be traced back to the early 20th century. The 16th Amendment to the U.S. Constitution, ratified in 1913, granted Congress the authority to levy an income tax without apportioning it among the states or basing it on census results. This amendment paved the way for a more progressive tax system, allowing the government to collect revenues based on an individual’s or entity’s ability to pay.

The initial implementation of federal income tax aimed to address the nation's growing financial needs, particularly in funding military efforts during times of war. Over the years, the tax system has evolved, adapting to changing economic landscapes and societal needs. Today, federal income tax remains a cornerstone of the U.S. fiscal policy, providing a significant portion of the government's revenue.

The Role of Federal Income Tax in Modern Society

Federal income tax is a critical mechanism for redistributing wealth and addressing societal inequalities. It forms the backbone of the nation’s social safety net, funding vital programs such as Social Security, Medicare, and Medicaid. These programs provide essential support to millions of Americans, ensuring access to healthcare, financial security in retirement, and assistance for those facing economic hardships.

Beyond its role in social welfare, federal income tax is instrumental in financing public infrastructure and services. Tax revenues contribute to the development and maintenance of roads, bridges, public transportation, and educational institutions. They also support law enforcement, national defense, and various federal agencies tasked with protecting public health, safety, and the environment.

Taxation as an Economic Tool

Federal income tax serves as a powerful economic tool, influencing consumer behavior and business decisions. Through progressive tax rates, the government incentivizes certain behaviors, such as investment in research and development or the creation of jobs. Tax incentives can also promote environmental sustainability, encourage entrepreneurship, and support specific industries deemed crucial to the nation’s economic growth.

Additionally, federal income tax plays a vital role in maintaining economic stability. By collecting taxes during periods of prosperity and redistributing them during economic downturns, the government helps stabilize the economy, providing a safety net for vulnerable populations and supporting overall economic recovery.

Understanding Federal Income Tax for Individuals

For individuals, federal income tax is a complex yet essential aspect of financial planning. Taxpayers must navigate a myriad of tax forms, deductions, and credits to ensure they fulfill their legal obligations while optimizing their financial outcomes.

Tax Filing and Compliance

Individuals are required to file annual tax returns, reporting their income and calculating their tax liability. The Internal Revenue Service (IRS) provides guidelines and forms to assist taxpayers in this process. Failure to comply with tax laws can result in penalties and legal repercussions.

To ease the burden of tax compliance, the IRS offers various resources, including online tools, tax guides, and assistance programs. Additionally, many individuals seek the expertise of tax professionals to ensure accurate and timely filing.

Tax Strategies for Individuals

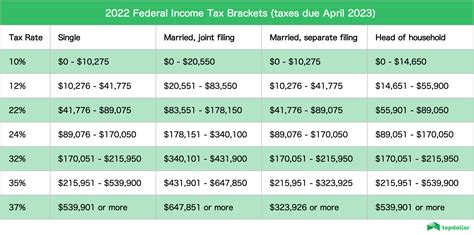

Optimizing tax strategies can help individuals minimize their tax liability and maximize their after-tax income. This involves understanding tax brackets, deductions, and credits available to them. For instance, taxpayers can benefit from deductions for mortgage interest, charitable contributions, and certain business expenses.

Additionally, individuals can take advantage of tax-advantaged savings and investment vehicles, such as 401(k) plans and Individual Retirement Accounts (IRAs), which offer tax benefits to encourage long-term savings and retirement planning.

Federal Income Tax for Businesses

For businesses, federal income tax is a critical consideration in their financial planning and strategy. It influences investment decisions, operational costs, and the overall financial health of the enterprise.

Corporate Tax Structure

Businesses, whether sole proprietorships, partnerships, or corporations, are subject to federal income tax. The tax liability for each entity type varies, with corporations facing a different tax structure than pass-through entities like sole proprietorships and partnerships.

Corporate tax rates are generally higher than individual tax rates, reflecting the potential for greater profitability. However, corporations can benefit from various tax deductions and credits, such as those related to research and development, capital investments, and employee benefits.

Tax Planning and Compliance for Businesses

Effective tax planning is essential for businesses to minimize their tax burden and maximize their profits. This involves understanding tax laws, regulations, and the specific tax implications of their industry. Businesses often employ tax professionals or consult tax experts to ensure compliance and optimize their tax strategies.

Proper tax planning can help businesses identify opportunities for tax savings, such as through cost segregation, tax-efficient financing, or strategic use of tax credits and incentives. It also ensures that businesses are aware of and comply with changing tax laws, avoiding potential penalties and legal issues.

Future Implications and Potential Reforms

The federal income tax system is constantly evolving, driven by changing economic conditions, societal needs, and political ideologies. As such, proposals for tax reforms are a regular feature of political discourse.

Potential reforms could include adjustments to tax rates, modifications to the tax code to address specific societal issues, or simplifications to make the tax system more efficient and understandable for taxpayers. The debate over tax reform often centers on striking a balance between progressive taxation, economic growth, and fairness.

Moreover, technological advancements and the digital economy present new challenges and opportunities for the tax system. The rise of the gig economy, remote work, and cryptocurrency transactions necessitates ongoing adaptation of tax laws and enforcement mechanisms to ensure effective tax collection and compliance.

Global Tax Considerations

In an increasingly globalized economy, international tax considerations become crucial. Businesses operating across borders must navigate complex tax regulations in multiple jurisdictions. This includes understanding transfer pricing, tax treaties, and the potential for double taxation. International tax planning is essential for businesses to minimize their global tax liability while remaining compliant with various national tax laws.

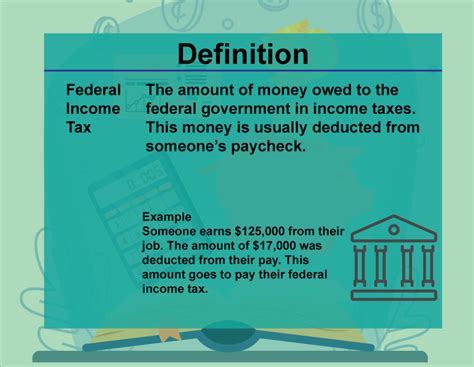

How does federal income tax affect my take-home pay?

+

Federal income tax is deducted from your earnings before you receive your paycheck. The amount deducted depends on your tax bracket, filing status, and the number of allowances you claim. Understanding your tax liability can help you budget effectively and plan for tax payments or refunds.

What are some common tax deductions and credits for individuals?

+

Common tax deductions include mortgage interest, state and local taxes, charitable contributions, and certain medical expenses. Tax credits, on the other hand, directly reduce your tax liability. Some popular credits include the Child Tax Credit, Earned Income Tax Credit, and the Credit for the Elderly or Disabled.

How does federal income tax impact businesses’ profitability?

+

Federal income tax is a significant expense for businesses, impacting their bottom line. By understanding tax laws and implementing effective tax planning strategies, businesses can minimize their tax burden, optimize their cash flow, and improve their overall profitability.