Sales Tax In Florida

Sales tax is an essential component of the revenue system in the United States, with each state implementing its own set of regulations and rates. Florida, known for its vibrant economy and diverse industries, has a unique approach to sales taxation that influences both residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of sales tax in Florida, exploring its structure, impact, and implications for various sectors.

Understanding Florida’s Sales Tax Landscape

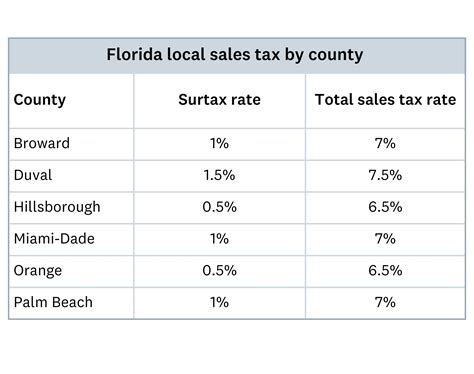

Florida’s sales tax system is a vital source of revenue for the state, funding essential services and infrastructure projects. The tax is levied on the sale or lease of tangible personal property and certain services within the state’s borders. While the state sets the base sales tax rate, individual counties and municipalities may also impose additional taxes, resulting in varying rates across Florida.

The current statewide sales tax rate in Florida is 6%, making it relatively moderate compared to other states. However, when combined with local taxes, the total sales tax rate can fluctuate significantly. For instance, in Miami-Dade County, the total sales tax rate is 7.5%, consisting of the state tax and an additional 1.5% county tax. These variations in rates highlight the complex nature of sales taxation in Florida, requiring careful consideration for businesses and consumers alike.

Taxable Goods and Services

Florida’s sales tax applies to a wide range of goods and services, encompassing most retail transactions. This includes tangible items like clothing, electronics, furniture, and groceries. Additionally, certain services such as repairs, installations, and rentals are also subject to sales tax. However, there are notable exemptions, particularly in the area of grocery items, which are taxed at a lower rate or even exempted in some counties.

| Tax Category | Rate |

|---|---|

| Tangible Personal Property | 6% (State) + Local Taxes |

| Grocery Items | Varies by County (0% - 6%) |

| Services | 6% (State) + Local Taxes |

The varying tax rates on grocery items across Florida's counties reflect the state's commitment to supporting essential services and infrastructure while also ensuring that residents have access to affordable necessities. This nuanced approach to sales taxation showcases Florida's dedication to balancing economic growth with the well-being of its citizens.

Impact on Businesses and Consumers

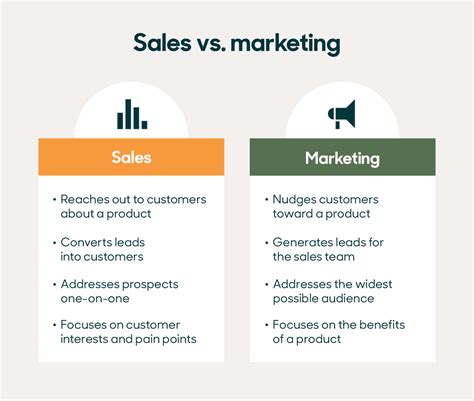

The sales tax structure in Florida has a profound impact on both businesses and consumers. For businesses, particularly those with physical stores, the varying tax rates across counties can present challenges in tax compliance and pricing strategies. On the other hand, online retailers face the task of accurately calculating and collecting sales tax based on the customer’s shipping address, adding complexity to their operations.

From a consumer perspective, the fluctuating sales tax rates can affect purchasing decisions and overall spending habits. Residents in areas with higher sales tax rates may seek opportunities to shop in neighboring counties with lower rates, leading to potential revenue losses for local businesses. Additionally, the variability in tax rates can create confusion and impact the overall shopping experience.

Sales Tax Compliance and Enforcement

The Florida Department of Revenue is responsible for enforcing sales tax regulations and ensuring compliance among businesses. They provide resources and guidelines to assist businesses in understanding their tax obligations and registering for sales tax permits. Businesses are required to collect, report, and remit sales tax on a regular basis, typically on a monthly or quarterly basis.

To facilitate compliance, the Department of Revenue offers various tools and resources, including online tax calculators, tax rate lookup tools, and educational materials. Additionally, they conduct audits and investigations to ensure businesses are adhering to sales tax regulations. Non-compliance can result in penalties, interest, and even legal consequences, emphasizing the importance of accurate tax reporting and collection.

Registration and Permit Requirements

Businesses engaged in taxable activities in Florida are required to obtain a sales tax permit from the Department of Revenue. The permit authorizes businesses to collect and remit sales tax on behalf of the state. The registration process typically involves completing an online application, providing business details, and agreeing to comply with sales tax regulations.

Once registered, businesses must display their sales tax permit at their place of business and include the applicable sales tax on all taxable transactions. Failure to obtain a permit or comply with tax regulations can lead to penalties and legal action, highlighting the critical importance of proper registration and compliance.

Sales Tax Audits and Investigations

The Florida Department of Revenue conducts sales tax audits to verify that businesses are accurately reporting and remitting sales tax. Audits may be triggered by various factors, including random selection, risk assessment, or specific complaints or concerns. During an audit, tax examiners review a business’s records, including sales receipts, invoices, and financial statements, to ensure compliance with tax regulations.

In cases where non-compliance is identified, the Department of Revenue may impose penalties and interest on the outstanding tax liabilities. The severity of penalties depends on the nature and extent of the violation, with repeated or intentional non-compliance resulting in more severe consequences. Businesses facing audits or investigations are encouraged to cooperate fully and seek professional advice to navigate the process effectively.

Sales Tax for Remote Sellers

With the rise of e-commerce, Florida has implemented regulations for remote sellers, which are businesses that sell goods or services into the state without a physical presence there. These regulations aim to ensure that remote sellers collect and remit sales tax on transactions with Florida customers, contributing to the state’s revenue stream.

Under Florida's sales tax laws, remote sellers are required to register for a sales tax permit and collect sales tax on transactions with Florida customers if they meet certain criteria. These criteria include exceeding a specified economic threshold, such as a minimum number of transactions or a minimum gross revenue threshold within the state.

Economic Nexus and Remote Seller Obligations

Florida’s economic nexus laws establish a connection between remote sellers and the state based on their economic activity. This means that remote sellers who exceed a certain level of economic activity in Florida are considered to have a substantial enough presence to be required to collect and remit sales tax.

Remote sellers who meet the economic nexus criteria must register for a sales tax permit, collect sales tax from Florida customers, and remit the collected tax to the Department of Revenue. Failure to comply with these obligations can result in penalties and interest, emphasizing the importance of remote sellers staying informed about their tax obligations.

Marketplace Facilitator Rules

Florida has also implemented marketplace facilitator rules, which apply to online marketplaces and platforms that facilitate the sale of goods or services by third-party sellers. These rules hold marketplace facilitators responsible for collecting and remitting sales tax on behalf of their third-party sellers, ensuring compliance with sales tax regulations.

Marketplace facilitators that meet certain criteria, such as facilitating a minimum number of transactions or generating a minimum amount of gross revenue in Florida, are required to register for a sales tax permit and collect sales tax from their third-party sellers' transactions with Florida customers. By holding marketplace facilitators accountable, Florida aims to streamline sales tax compliance for both the state and the businesses operating within its borders.

Future Implications and Policy Considerations

The sales tax landscape in Florida is subject to ongoing policy discussions and potential reforms. As the state’s economy evolves and new technologies shape the retail landscape, sales tax regulations may need to adapt to ensure fairness, efficiency, and compliance.

One area of focus is the treatment of online sales and the impact of e-commerce on traditional brick-and-mortar businesses. With the rise of online shopping, there is a growing need to address the issue of remote sellers and their tax obligations. Florida's economic nexus laws and marketplace facilitator rules are steps towards ensuring a level playing field for all businesses, both online and offline.

Addressing Tax Inequities

The varying sales tax rates across Florida’s counties can lead to tax inequities, particularly for businesses operating in areas with higher tax rates. These businesses may face challenges in remaining competitive, as consumers have the option to shop in neighboring counties with lower tax rates. Addressing these inequities could involve a comprehensive review of sales tax rates and potential reforms to create a more uniform and fair tax structure.

Simplifying Tax Administration

The complexity of Florida’s sales tax system, with its varying rates and local taxes, presents challenges for both businesses and tax administrators. Simplifying the tax administration process could involve standardizing rates across the state or implementing a more streamlined tax collection and remittance system. Such reforms could reduce compliance burdens and improve efficiency for businesses and tax authorities alike.

Tax Policy and Economic Development

Sales tax revenue plays a significant role in funding essential services and infrastructure projects in Florida. As the state continues to prioritize economic development and attract businesses, the sales tax system will remain a critical component of its revenue strategy. Striking the right balance between tax rates, compliance, and economic growth will be essential to ensure Florida’s long-term prosperity.

Conclusion

Florida’s sales tax system is a dynamic and complex component of its economic landscape, impacting businesses and consumers across the state. With varying rates and regulations, understanding and navigating sales taxation is essential for both compliance and strategic decision-making. As the state continues to adapt to changing economic conditions and technological advancements, the sales tax landscape will remain a key focus for policymakers, businesses, and residents alike.

By staying informed, seeking professional guidance, and embracing innovative tax solutions, businesses and individuals can effectively navigate Florida's sales tax system, contributing to the state's vibrant economy and ensuring a bright future for all.

Frequently Asked Questions

What is the current sales tax rate in Florida for tangible personal property and services?

+The current statewide sales tax rate in Florida for tangible personal property and services is 6%. However, individual counties and municipalities may impose additional taxes, resulting in varying total sales tax rates across the state.

Are there any sales tax exemptions in Florida?

+Yes, there are certain sales tax exemptions in Florida. For example, some counties exempt or tax grocery items at a lower rate. Additionally, specific services, such as certain professional services, may also be exempt from sales tax. It’s important to check with the Florida Department of Revenue for a complete list of exemptions.

How often do businesses need to report and remit sales tax in Florida?

+The frequency of sales tax reporting and remittance in Florida depends on the business’s sales volume. Generally, businesses with higher sales volumes are required to report and remit sales tax on a monthly basis. Those with lower sales volumes may be allowed to report and remit quarterly. It’s best to consult with the Florida Department of Revenue for specific guidelines.

What are the consequences of non-compliance with sales tax regulations in Florida?

+Non-compliance with sales tax regulations in Florida can result in penalties, interest, and even legal consequences. The severity of penalties depends on the nature and extent of the violation. It’s crucial for businesses to stay informed about their tax obligations and seek professional guidance to ensure compliance.

How can businesses effectively manage sales tax compliance in Florida?

+Businesses can effectively manage sales tax compliance in Florida by staying informed about sales tax regulations, utilizing tax software for accurate calculations and reporting, and consulting with tax professionals for guidance. Regularly reviewing sales tax rates and staying updated on any changes or reforms is also essential.